Life insurance is a contract between the policyholder and the insurance company, where the insurer provides a death benefit payout to the policyholder's beneficiaries in the event of their death while the policy is active. The average cost of life insurance is $26 a month, but rates can vary depending on factors such as age, gender, health, occupation, and lifestyle choices. Term life insurance, which covers a fixed period, is generally more affordable than permanent life insurance, which lasts a lifetime and includes a cash value component. To get the best rates, it's recommended to compare quotes from multiple insurers and maintain a healthy lifestyle.

| Characteristics | Values |

|---|---|

| Average cost of life insurance | $26 a month |

| Average cost of a 10-year, $250,000 term life insurance policy for a healthy 20-40-year-old | $24-$29 per month |

| Average cost of a 20-year, $500,000 term life insurance policy for a 40-year-old | $26 a month |

| Average cost of a $500,000 whole life insurance policy for a 30-year-old | $451 a month |

| Average cost of a 20-year, $500,000 term life insurance policy for a 30-year-old male | $30 a month |

| Average cost of a 20-year, $500,000 term life insurance policy for a 30-year-old female | $23 a month |

| Average cost of a $20,000 term life insurance policy for a 30-year-old woman | $8 a month |

| Average cost of a $20,000 term life insurance policy for a 55-year-old woman | $25.50 a month |

| Average cost of a $50,000 term life insurance policy for a 25-year-old woman | $14 a month |

| Average cost of a $50,000 term life insurance policy for a 25-year-old man | $22.50 a month |

| Average cost of a $50,000 term life insurance policy for a 55-year-old woman | $60 a month |

| Average cost of a $50,000 term life insurance policy for a 55-year-old man | $86.50 a month |

What You'll Learn

How much is life insurance for a 30-year-old?

The cost of life insurance is determined by several factors, including age, gender, health, and lifestyle choices. While life insurance is available at any age, it is generally recommended to purchase a policy as early as possible, as premiums tend to increase with age.

For a 30-year-old non-smoker in good health, the average cost of a $500,000 whole life insurance policy is around $440 to $451 per month. Whole life insurance is a type of permanent life insurance that provides coverage for the entire life of the policyholder and often includes a savings component called cash value, which can be accessed while the insured person is still alive. The cash value grows tax-free and can be borrowed against or partially withdrawn.

The cost of life insurance also varies depending on the type of policy chosen. Term life insurance is typically more affordable than whole life insurance because it only covers a specific period and does not build cash value. On the other hand, whole life insurance provides permanent coverage and is more expensive due to the longer coverage period and the inclusion of the cash value component.

When considering life insurance, it is important to evaluate your needs and budget to determine the appropriate coverage amount and policy type. Additionally, it is recommended to shop around and compare quotes from multiple insurers, as rates can vary across different companies.

While age is a significant factor in determining life insurance rates, other factors such as gender, health, smoking status, family medical history, occupation, and lifestyle can also impact the cost of coverage. By considering these factors and seeking advice from independent financial advisers, individuals can make informed decisions about the type and amount of life insurance coverage that best suits their needs.

Chubb Life Insurance: Quality Coverage, Peace of Mind

You may want to see also

How much is life insurance for a family?

The cost of life insurance for a family depends on several factors, including the age, gender, and health of the policyholder, as well as the type and amount of coverage. Here's a breakdown to help you understand the costs:

Age and Gender

Life insurance rates increase with age as the likelihood of the insurer having to pay out the policy goes up. Generally, younger people pay less for life insurance because they are less likely to have health problems. The average cost of life insurance is $31 per month at age 25 and increases to about $593 per month at age 65. Men also tend to pay more for life insurance than women, as they have shorter life expectancies.

Health Status

Insurers evaluate your health status, including height, weight, and medical history, and smoking status. Life insurance for smokers is typically more expensive due to the higher risk of developing health issues. Pre-existing conditions, blood pressure, and cholesterol levels can also impact your rates.

Type of Policy

Term life insurance is generally the most affordable option, as it covers a set number of years without building cash value. Permanent life insurance, on the other hand, lasts a lifetime and includes a cash value component, making it more expensive. Whole life insurance and universal life insurance are two types of permanent life insurance policies with different features and costs.

Coverage Amount

The coverage amount, also known as the death benefit, is the sum of money that will be paid out to your beneficiaries after your death. The cost of life insurance increases with the amount of coverage you select. A higher coverage amount means higher insurance rates.

Family Situation and Financial Obligations

When determining the cost of life insurance for a family, it's important to consider your financial obligations, such as mortgage payments, college fees, and funeral costs. You should also factor in the income replacement needed for your family, especially if you are the primary breadwinner. The number of children and their education expenses should be taken into account as well.

Lifestyle and Occupation

Your occupation and lifestyle choices can impact your life insurance rates. If you have a hazardous job or engage in risky activities, you may pay more for life insurance. Your driving record and criminal history can also affect your rates or even disqualify you from coverage with certain insurers.

To estimate the cost of life insurance for your family, you can use online calculators or consult with insurance providers to get personalized quotes based on your specific circumstances.

Beneficiary Statements: Understanding Your Life Insurance Payouts

You may want to see also

How much is life insurance for a smoker?

Smokers can expect to pay a higher premium for life insurance than non-smokers. This is because smoking is considered a health risk that can reduce life expectancy, and life insurance companies reserve higher rates for those who are expected to live shorter lives.

Types of Life Insurance for Smokers

There are two main types of life insurance available to smokers: whole life insurance and term life insurance. Whole life insurance is a permanent policy that provides coverage for the entirety of the insured's life and often includes a death benefit and a cash value component. Term life insurance offers coverage for a set period, typically between 10 and 30 years, and the premiums may remain the same over the entire term.

Cost of Life Insurance for Smokers

The cost of life insurance for smokers is typically double or triple the rates for non-smokers. For example, a 30-year-old female smoker could pay an extra $10,200 over the course of a 20-year term life insurance policy compared to a non-smoker. A 40-year-old male smoker could expect to pay more than four times what a non-smoker would pay for the same policy.

Factors Affecting the Cost of Life Insurance for Smokers

The frequency and type of tobacco use can impact the cost of life insurance for smokers. Life insurance companies may also take into account the results of a medical exam, including nicotine and cotinine levels in the blood and urine. Some companies offer non-smoker rates to occasional cigar or tobacco chewers, while others classify infrequent users in the same category as regular smokers.

Reducing the Cost of Life Insurance for Smokers

Quitting smoking can help lower the cost of life insurance for smokers. Most life insurance companies require individuals to be nicotine-free for at least a year to qualify for non-smoker rates, and rates may decrease further within three to five years if the individual is in excellent health. Being honest during the application process and medical examination is crucial, as lying about smoking habits may result in the insurance company denying the policy or refusing to pay the death benefit.

Cancer Testing and Life Insurance: What's the Link?

You may want to see also

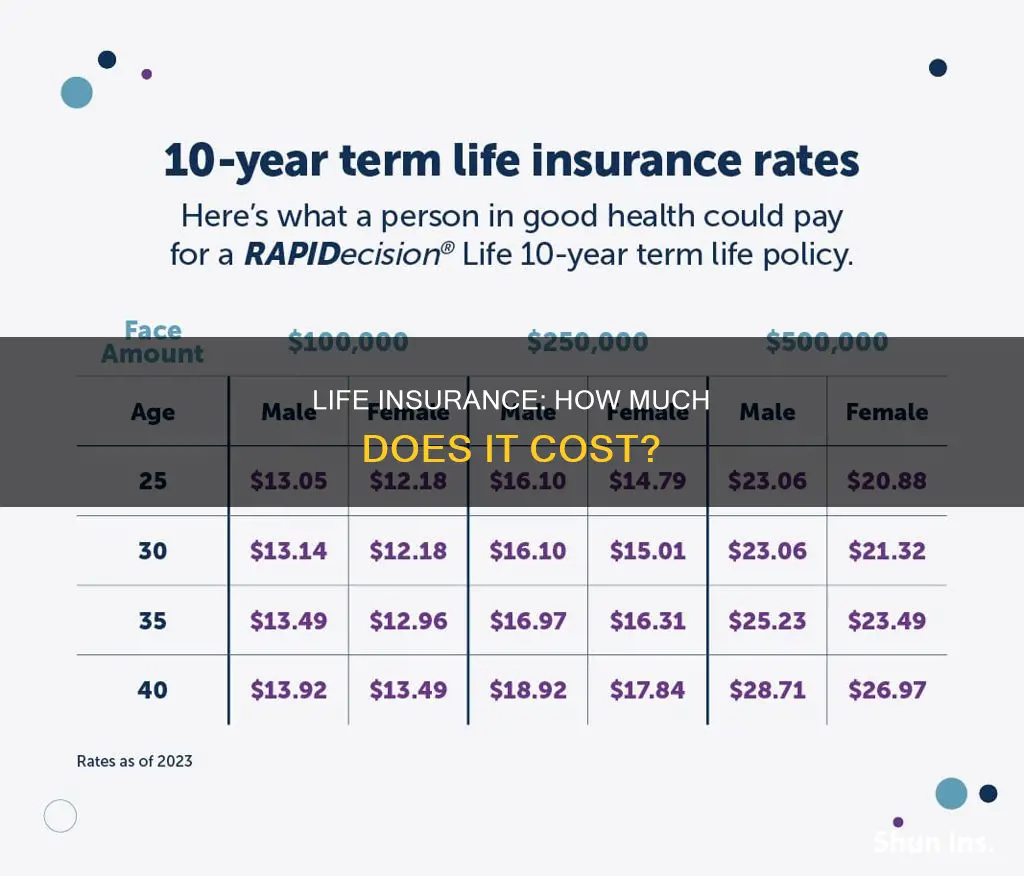

How much is life insurance for 10 years?

The cost of life insurance depends on several factors, including age, gender, health, and smoking status. A 10-year term life insurance policy is a popular option for those seeking simple and inexpensive coverage. Here's what you need to know about the cost of a 10-year term life insurance policy:

Cost Factors for 10-Year Term Life Insurance

The cost of a 10-year term life insurance policy can vary depending on several factors. Here are the key factors that influence the price:

- Age: The younger you are, the lower your premiums will be. Age is a significant factor because younger individuals generally have a longer life expectancy, resulting in lower premiums.

- Gender: Women typically pay less for life insurance than men of the same age and health. This is because women tend to have longer life expectancies.

- Health: Your health status can also impact your premiums. Insurers may require a medical exam and consider factors such as pre-existing conditions, blood pressure, and cholesterol levels.

- Smoking Status: Smokers often pay higher premiums than non-smokers due to the increased risk of health issues associated with smoking.

- Family Medical History: Insurers may inquire about your family's medical history, particularly regarding serious illnesses. A history of chronic diseases in your family may result in higher premiums.

- Occupation and Lifestyle: High-risk jobs or dangerous hobbies can affect your premiums. Occupations like police officers or hazardous hobbies like skydiving may result in higher rates.

Average Cost of 10-Year Term Life Insurance

The average cost of a 10-year term life insurance policy can vary depending on the coverage amount and the insured's age and gender. Here are some estimates to give you an idea:

- According to Forbes Advisor's analysis, the average cost for a 30-year-old female to obtain $500,000 in coverage for 10 years is $180 per year.

- EFinancial estimates that a healthy 20 to 40-year-old can expect to pay between $24 and $29 per month for a $250,000 10-year term life insurance policy.

- Aflac provides sample rates for 10-year term life insurance policies, with monthly premiums ranging from $16 to $77 for a 20-year-old and $35 to $77 for a 40-year-old, depending on the coverage amount.

Tips for Lowering the Cost

To obtain the best rates for a 10-year term life insurance policy, consider the following tips:

- Choose the Right Policy Type: Opt for term life insurance if you only need coverage for a specific period. Term life insurance is generally more affordable than permanent policies.

- Compare Quotes: Shop around and compare quotes from multiple insurers, as rates can vary significantly.

- Buy Early: Purchase life insurance while you're young to lock in lower premiums for the duration of the policy.

- Maintain a Healthy Lifestyle: Staying healthy, avoiding smoking, and keeping a healthy weight can help you qualify for lower premiums.

Life Insurance Licenses for Felons in Connecticut: What's Possible?

You may want to see also

How much is life insurance for a 40-year-old?

Life insurance rates vary depending on several factors, including age, gender, health, lifestyle, and the type of policy chosen. Generally, the younger and healthier you are, the cheaper your premiums.

The average cost of life insurance is $26 a month, based on data for a 40-year-old buying a 20-year, $500,000 term life policy. However, for a 40-year-old non-smoker, the monthly cost of a 40-year term life insurance policy with $250,000 in coverage is under $38. The same policy for a 35-year-old is approximately $33 per month.

The type of life insurance you choose will also affect the average cost. Term life insurance is the least expensive because it only covers a set number of years and does not build cash value. Permanent life insurance, on the other hand, typically lasts a lifetime and includes a cash value component, making it substantially more expensive than term life insurance.

Additionally, certain factors like your gender and occupation can influence your premium. Women tend to pay less than men of the same age and health due to their longer life expectancy. Similarly, if you have a hazardous or high-risk job, such as a police officer or race car driver, you will likely pay more for life insurance than someone with a desk job.

Life Insurance: Ongoing Payments for Peace of Mind

You may want to see also

Frequently asked questions

The average cost of life insurance is $26 per month. However, this can vary depending on the type of plan, the coverage amount, and personal factors.

The biggest factors affecting the cost of life insurance are age and gender. Generally, younger people pay less than older people, and women pay less than men. Other factors include health, smoking status, occupation, and lifestyle.

Yes, term life insurance is usually cheaper than whole life insurance. Term life insurance is a temporary policy with a fixed term, such as 10, 20, or 30 years. Whole life insurance is permanent and typically more expensive.

The cost of term life insurance depends on various factors, including age, gender, and the coverage amount. For example, a $50,000 policy for a healthy 25-year-old woman may cost around $14 per month, while the same policy for a 55-year-old woman may cost around $60 per month.

There are several ways to lower your life insurance rate, such as maintaining a healthy weight, managing any medical conditions, quitting smoking, avoiding high-risk hobbies, and applying for insurance at a younger age.