An insurance carrier is a company that creates and manages insurance policies and is typically the financial resource behind them. Insurance carriers are also known as insurance companies or insurers. They sell and fulfil insurance contracts, and underwrite insurance plans and issue payments for claims.

| Characteristics | Values |

|---|---|

| Definition | A company that sells and fulfills insurance contracts |

| Synonyms | Insurer, insurance company, insurance provider |

| Not Synonyms | Insurance agency, insurance agent, insurance broker |

| Responsibility | Underwriting insurance plans, issuing payments for claims |

| Credit Ratings | Graded on a letter scale of A++ to F |

| Types | Admitted, non-admitted |

What You'll Learn

- Insurance carriers are insurance companies that create and manage policies

- Carriers are financially responsible for underwriting plans and issuing claim payments

- Insurance carriers are also referred to as insurance providers

- Carriers are responsible for claims, pricing, and overall management of policies

- Insurance carriers are part of the finance and insurance sector

Insurance carriers are insurance companies that create and manage policies

An insurance carrier is a company that creates and manages insurance policies. They are also the financial resource behind them. Insurance carriers are also known as insurance companies, insurers, or providers.

Insurance carriers are responsible for underwriting insurance plans and issuing payments for claims. They sell and fulfill insurance contracts, providing customers with policies and fulfilling the contract when a claim is made.

Insurance carriers offer a variety of policies that customers can choose from to fit their particular needs. Once a customer purchases a policy, they pay a premium, or monthly fee, to keep their contract with the insurance carrier active. When a customer needs to file a claim, the carrier reviews it, processes it, and pays it out once it’s approved.

Insurance carriers are distinct from insurance agencies or agents, which sell policies. Insurance carriers hire and contract independent agencies to sell their insurance products. Insurance agents work on commission and have a deep understanding of the insurance coverage that the carriers they represent provide.

Insurance carriers are also distinct from insurance brokers, who are third parties that help facilitate insurance policy sales. They collaborate with insurance carriers but don't work for them. Insurance brokers are often experts in risk management who can help clients explore coverage options.

Insurance Paper: Must-Have or No?

You may want to see also

Carriers are financially responsible for underwriting plans and issuing claim payments

An insurance carrier is a company that creates and manages insurance policies and is typically the financial resource behind them. Carriers are financially responsible for underwriting plans and issuing claim payments. This means that they evaluate the risks involved in insuring people and assets, establish pricing, and pay out claims when necessary.

Insurance underwriting is a complex process that involves assessing the likelihood and magnitude of risks. It is a critical function for insurance companies to maintain a healthy loss ratio and drive financial performance. Underwriters use specialised software, data analytics, and artificial intelligence to determine the risks and set the pricing for insurance policies. They consider various factors, such as an applicant's credit rating, property conditions, and hazards that may trigger liability claims.

While insurance carriers are typically financially responsible, there are cases where they serve as administrators of insurance policies. In these instances, the employer offering the coverage manages claims. It is important to note that insurance agencies and brokers are not the same as carriers, although they play important roles in the insurance industry. Insurance agencies and agents sell policies, while brokers are third-party experts in risk management who facilitate policy sales.

When choosing an insurance carrier, it is essential to consider their financial stability and ability to pay out claims. Information about a carrier's financial health and credit rating can be found on rating websites, such as AM Best. This information can help individuals make informed decisions about their insurance coverage and choose a carrier that suits their unique needs.

By understanding the role of insurance carriers and the importance of underwriting in the insurance industry, individuals can navigate the insurance landscape more confidently and ensure they have the necessary protection for their health, assets, and liabilities.

Carry Guard Insurance: Attorney Provision?

You may want to see also

Insurance carriers are also referred to as insurance providers

An insurance carrier is a company that creates and manages insurance policies and is typically the financial resource behind them. They are also referred to as insurance providers. Insurance carriers are responsible for underwriting insurance plans and issuing payments for claims.

Insurance carriers are also known as insurance companies and are responsible for creating the insurance policies that agents then offer to consumers. Agents work for insurance carriers and are responsible for selling the policies and aiding policyholders with questions and concerns.

Insurance carriers provide a variety of policies that consumers can choose from to fit their particular needs. Once a consumer has purchased a policy, they will pay a premium, or monthly fee, to keep their contract with the insurance carrier active. When a consumer needs to file a claim, the carrier will review it, process it, and pay it out once it’s approved.

Insurance carriers are typically the financial resource behind the policies they create and manage. However, there are cases in which a carrier may not be financially responsible but instead serves as an administrator of insurance policies. In these instances, the employer offering the coverage manages claims.

Next Insurance: Admitted Carrier Status

You may want to see also

Carriers are responsible for claims, pricing, and overall management of policies

An insurance carrier is a company that creates and manages insurance policies. They are typically the financial resource behind insurance policies and are responsible for claims, pricing, and the overall management of policies.

Insurance carriers underwrite insurance plans and issue payments for claims. They are responsible for fulfilling the contract when a claim is made. When an individual purchases an insurance policy, they pay a premium, or a monthly fee, to keep their contract with the insurance carrier active. When a claim needs to be filed, the carrier reviews it, processes it, and pays it out once it is approved.

Insurance carriers are also responsible for creating the insurance policies that agents then offer to their clients. Insurance agencies or agents are responsible for distributing and selling insurance policies to businesses or individuals. They work for either a specific insurance carrier or are independent, selling insurance plans from a variety of carriers. Agencies are also responsible for aiding policyholders with any questions or concerns.

It is important to note that insurance carriers, insurance companies, and insurance providers are interchangeable terms.

Insurance Carrier and Underwriter: What's the Difference?

You may want to see also

Insurance carriers are part of the finance and insurance sector

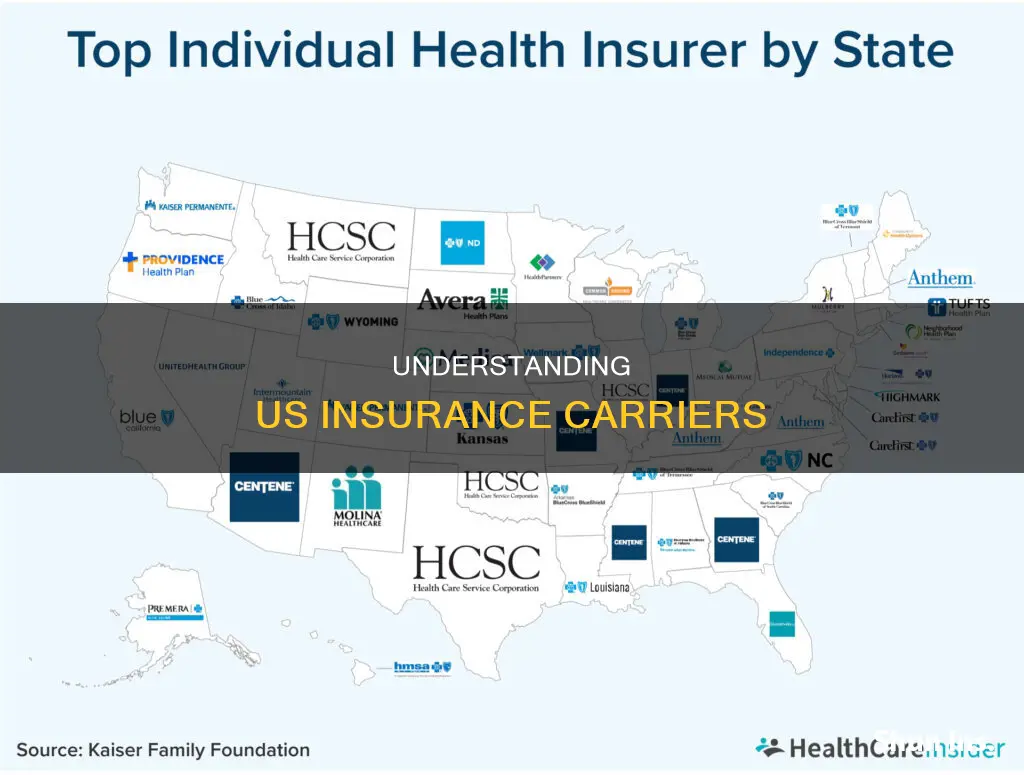

Insurance carriers are companies that create and manage insurance policies, and are typically the financial resource behind them. They are responsible for underwriting insurance plans and issuing payments for claims. In the US, insurance carriers are part of the finance and insurance sector, which consists of about 475,000 establishments with a combined annual revenue of about $4.5 trillion.

The finance and insurance sector is part of the financial activities supersector. It comprises establishments primarily engaged in financial transactions and/or facilitating financial transactions. The three principal types of activities are:

- Raising funds by taking deposits and/or issuing securities, and in the process, incurring liabilities.

- Pooling risk by underwriting insurance and annuities.

- Providing specialized services to facilitate or support financial intermediation, insurance, and employee benefit programs.

The finance and insurance sector is one of the most important and influential sectors of the economy. It provides financial services to people and corporations, including banking, investing, and insurance. It is the primary driver of a nation's economy, enabling the free flow of capital and liquidity in the marketplace. When the sector is strong, the economy grows, and companies in this industry are better able to manage risk.

Insurance carriers are a key part of this sector, providing consumers with insurance services and products. They create and manage insurance policies, and are responsible for underwriting these policies and processing and paying out claims. Insurance carriers can be large companies that offer multiple types of insurance or smaller, more specialized carriers that focus on a specific type of insurance.

Geico Insurance: Always on Your Person?

You may want to see also

Frequently asked questions

An insurance carrier is a company that creates and manages insurance policies and is typically the financial resource behind them. They are also referred to as insurance companies or insurers.

Insurance carriers are responsible for underwriting insurance plans and issuing payments for claims. They also create the insurance policies that agents then sell.

An insurance agency is responsible for distributing and selling insurance to businesses or individuals. They also answer questions and help customers choose a plan that fits their needs. Insurance carriers, on the other hand, hold and manage the insurance policies that agencies then distribute.

Admitted insurance carriers are backed by the state's Department of Insurance and must adhere to certain regulations. Non-admitted insurance carriers are not approved by the state and may not comply with insurance regulations.