Variable annuity life insurance is a type of financial product that combines the features of an annuity and life insurance. It offers a way for individuals to secure their financial future while also providing a means to grow their money through investment options. With this product, policyholders can enjoy the benefits of both immediate income (through the annuity component) and long-term financial protection (through the life insurance aspect). This unique combination allows individuals to potentially build a substantial cash value over time, which can be used for various purposes, such as retirement planning, education funding, or as a legacy for beneficiaries. Understanding the intricacies of variable annuity life insurance is essential for anyone looking to make informed decisions about their financial security and investment strategies.

What You'll Learn

- Definition: Variable annuity life insurance combines life coverage with investment options, offering flexibility and potential for growth

- Investment Options: Policyholders can choose from a range of investment sub-accounts to customize their death benefit and cash value

- Flexibility: Annuities allow policyholders to adjust their investment strategy over time, providing control and adaptability

- Tax Advantages: Tax-deferred growth and potential tax-free withdrawals can make variable annuities an attractive financial tool

- Guaranteed Death Benefit: The policy guarantees a specified death benefit, providing financial security for beneficiaries

Definition: Variable annuity life insurance combines life coverage with investment options, offering flexibility and potential for growth

Variable annuity life insurance is a financial product that provides a unique blend of life insurance and investment opportunities. It is designed to offer individuals a way to secure their loved ones' financial future while also allowing them to potentially grow their money over time. This type of annuity is a long-term commitment, providing both a death benefit and an investment component.

When an individual purchases a variable annuity life policy, they essentially buy a life insurance contract with an added layer of investment features. The primary purpose of the life insurance aspect is to ensure that a predetermined amount of money is paid out to the policy's beneficiaries upon the insured's death. This provides financial security and peace of mind, knowing that a loved one will receive a specified sum regardless of future economic conditions.

The 'variable' in the name refers to the investment options available within the annuity. Policyholders can choose from a variety of investment accounts, often including stocks, bonds, and mutual funds. These investments are designed to offer the potential for growth, allowing the policy's value to increase over time. The performance of these investments directly impacts the overall value of the annuity, providing an opportunity for the insured to potentially accumulate wealth.

One of the key advantages of variable annuity life insurance is the flexibility it offers. Policyholders can typically adjust their investment allocations according to their risk tolerance and financial goals. This adaptability is particularly beneficial for those who want to actively manage their investments and potentially benefit from market growth. Additionally, the death benefit provided by the life insurance component ensures that the policy remains a valuable asset even if the investments underperform.

In summary, variable annuity life insurance is a comprehensive financial tool that combines the security of life coverage with the potential for investment growth. It offers individuals a way to plan for the future, providing both financial protection and the opportunity to build wealth over the long term. Understanding the features and benefits of this type of annuity can help individuals make informed decisions about their financial strategies.

Life Insurance Types: A Comprehensive Comparison Guide

You may want to see also

Investment Options: Policyholders can choose from a range of investment sub-accounts to customize their death benefit and cash value

Variable annuity life insurance offers policyholders a unique investment opportunity within the insurance industry. This type of annuity provides a way to combine insurance protection with a customizable investment strategy. One of the key features that sets it apart is the ability to choose from various investment sub-accounts, which are essentially different investment options within the annuity contract.

When purchasing a variable annuity life insurance policy, policyholders are presented with a menu of investment choices. These investment sub-accounts can vary widely, often including a selection of mutual funds, index funds, and even stocks. The idea is to provide investors with a diverse range of options to tailor their annuity to their specific financial goals and risk tolerance. By selecting different sub-accounts, policyholders can customize the investment strategy, allowing for a more personalized approach to growing their cash value and ensuring a customized death benefit.

Each investment sub-account has its own unique characteristics and associated risks. Some may offer higher potential returns but come with greater volatility, while others might provide more stable growth over time. Policyholders need to carefully consider their financial objectives and risk preferences when choosing these investment options. For instance, someone seeking long-term growth might opt for a mix of equity and fixed-income funds, while a more conservative investor could prefer bond-based sub-accounts.

The beauty of this investment flexibility lies in its ability to adapt to changing market conditions and individual circumstances. Policyholders can adjust their investment choices periodically, rebalancing their portfolio to align with their evolving financial strategies. This level of customization is particularly appealing to those who want to actively manage their investments within the framework of an insurance product.

In summary, variable annuity life insurance provides policyholders with a powerful tool to customize their financial future. Through the selection of various investment sub-accounts, individuals can tailor their death benefit and cash value accumulation to match their unique needs and preferences. This investment option within an insurance product offers a flexible and comprehensive approach to financial planning.

Covid Vaccines: UK Life Insurance Invalidation Concerns

You may want to see also

Flexibility: Annuities allow policyholders to adjust their investment strategy over time, providing control and adaptability

Variable annuity life insurance offers a unique and flexible financial product that empowers policyholders with a degree of control over their investment decisions. This type of annuity provides an opportunity to adapt and adjust the investment strategy as the policyholder's financial goals and circumstances evolve.

One of the key advantages of variable annuities is the ability to customize the investment options. Policyholders can choose from a variety of investment sub-accounts, each with its own set of underlying investments, such as stocks, bonds, or mutual funds. This flexibility allows individuals to align their annuity with their risk tolerance and financial objectives. For instance, a conservative investor might opt for fixed-income sub-accounts, while a more aggressive investor could select equity-focused options.

Over time, as the policyholder's financial situation changes, they can make adjustments to their annuity's investment strategy. This adaptability is particularly beneficial for those who want to stay invested but also seek a level of protection against market volatility. Policyholders can rebalance their portfolio by transferring funds between different investment options, ensuring that their annuity remains aligned with their current financial goals.

The flexibility of variable annuities also extends to the potential for tax-deferred growth. Policyholders can benefit from tax-deferred accumulation, where earnings can grow without being taxed until withdrawals are made. This feature provides a long-term investment strategy, allowing individuals to potentially accumulate a substantial amount of wealth over time. Additionally, policyholders can access their funds through periodic withdrawals or a guaranteed income stream, offering further customization to suit individual needs.

In summary, variable annuity life insurance provides policyholders with the flexibility to tailor their investment approach, adapt to changing financial circumstances, and potentially build a substantial financial portfolio. This level of control and adaptability is a significant advantage, allowing individuals to make informed decisions that align with their unique financial goals and risk preferences.

Top Life Insurance Companies: Finding the Best Fit for You

You may want to see also

Tax Advantages: Tax-deferred growth and potential tax-free withdrawals can make variable annuities an attractive financial tool

Variable annuities offer a unique tax advantage that can significantly benefit investors and those seeking long-term financial planning. One of the key features is the tax-deferred growth of the investment. Unlike traditional savings accounts or retirement plans, variable annuities allow your money to grow tax-free until it is withdrawn. This means that any earnings or interest accrued within the annuity are not subject to annual income tax, providing a significant advantage over other investment vehicles. As a result, your money can accumulate and grow more efficiently over time.

The tax-deferred nature of variable annuities allows investors to benefit from compound interest, where earnings are reinvested and earn interest, leading to exponential growth. This growth potential is particularly attractive for long-term financial goals, such as retirement planning. By deferring taxes, variable annuities enable investors to potentially build a substantial nest egg that can be used for various purposes in the future.

Additionally, variable annuities offer the possibility of tax-free withdrawals. When you reach a certain age or meet specific conditions, you can withdraw funds from your annuity without incurring immediate taxes. This flexibility allows for more strategic financial planning, as you can access your money when you need it without the burden of high tax liabilities. Tax-free withdrawals can be especially beneficial for retirees or those seeking to access their funds without disrupting their long-term financial strategy.

The tax advantages of variable annuities make them an attractive option for individuals who want to optimize their investment returns and manage their tax obligations effectively. It provides a structured way to grow wealth while minimizing the impact of taxes, which can be a significant factor in financial planning and retirement savings. Understanding these tax benefits is essential for anyone considering variable annuity life insurance as a part of their financial portfolio.

Get a Life Insurance License: Missouri Requirements

You may want to see also

Guaranteed Death Benefit: The policy guarantees a specified death benefit, providing financial security for beneficiaries

Variable annuity life insurance is a financial product that combines the features of an annuity and a life insurance policy. It offers investors a way to grow their money while also providing a death benefit to beneficiaries. One of the key features of variable annuity life insurance is the guaranteed death benefit.

The guaranteed death benefit is a specified amount that the insurance company promises to pay out upon the death of the policyholder. This guarantee provides financial security for the beneficiaries, ensuring that they receive a predetermined sum regardless of the policy's investment performance. In other words, the guaranteed death benefit acts as a safety net, offering peace of mind to both the policyholder and their loved ones.

When purchasing a variable annuity life insurance policy, the policyholder selects a guaranteed death benefit amount. This amount is typically a percentage of the policy's total value or a fixed sum. For example, a policy might guarantee a death benefit equal to 100% of the policy's cash value or a specific dollar amount, such as $500,000. This guarantee is particularly important for individuals who want to ensure that their family is financially protected in the event of their passing.

The guaranteed death benefit is funded through the policy's investment performance. The insurance company invests the policyholder's premiums in various investment options, such as stocks, bonds, and mutual funds. The growth or decline of these investments directly impacts the policy's cash value. However, the insurance company guarantees that the death benefit will be paid out, even if the investments underperform or result in a loss. This feature provides a level of security that is often lacking in other investment vehicles.

In summary, the guaranteed death benefit is a critical aspect of variable annuity life insurance, offering financial security and peace of mind. It ensures that beneficiaries receive a specified amount upon the policyholder's death, regardless of the investment performance. This feature makes variable annuity life insurance an attractive option for individuals seeking both investment growth and a reliable death benefit.

Life Insurance After 85: Is It Possible?

You may want to see also

Frequently asked questions

Variable Annuity Life Insurance is a type of life insurance that combines the features of an annuity and a variable investment account. It offers a way to secure a death benefit while also providing the potential for investment growth and tax-deferred accumulation. This product is designed for individuals seeking both insurance protection and investment opportunities.

When you purchase a variable annuity life policy, you typically pay an initial premium. A portion of this premium goes towards funding a death benefit, ensuring that your beneficiaries receive a payout upon your passing. The remaining amount is invested in a variable account, which offers a range of investment options similar to mutual funds. These investments can include stocks, bonds, and money market instruments, allowing your money to grow over time.

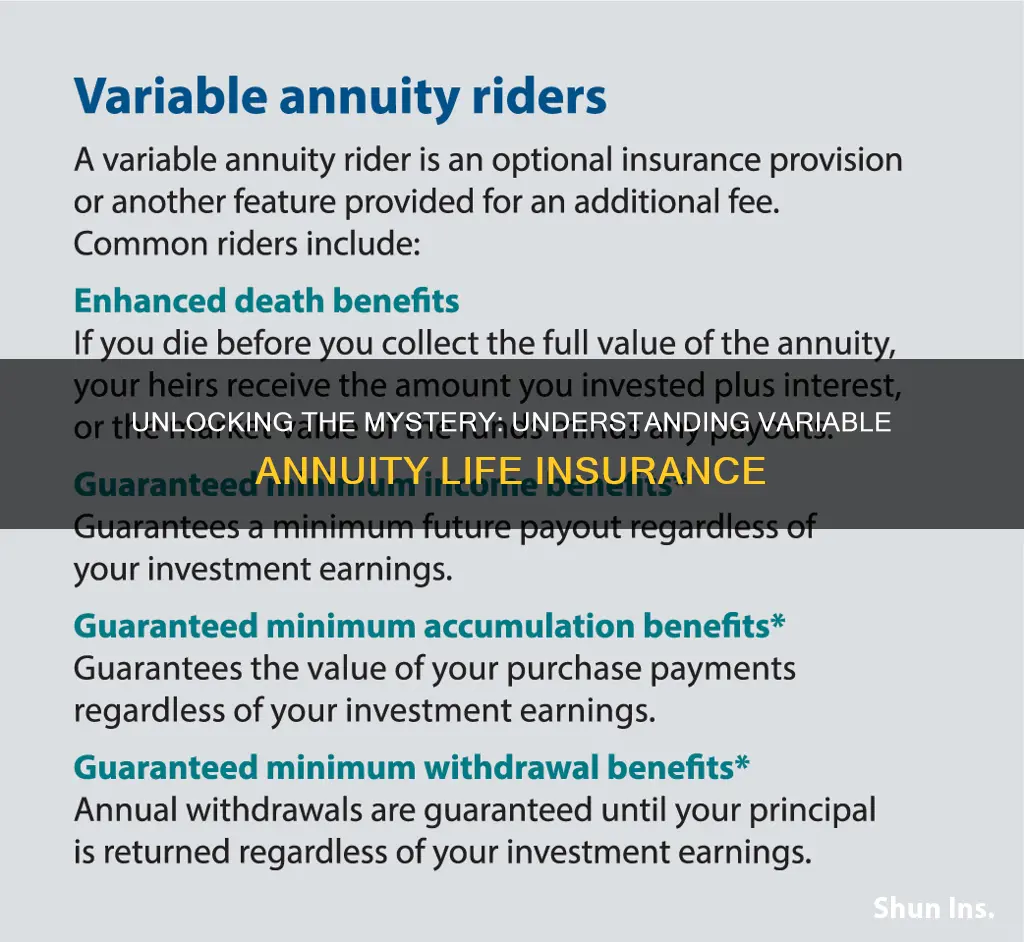

Variable Annuity Life Insurance provides several advantages. Firstly, it offers guaranteed income for life, ensuring a steady stream of payments to you or your designated beneficiaries. Secondly, the variable investment component allows for the potential of higher returns compared to traditional fixed-income investments. Additionally, it provides tax-deferred growth, meaning the investment earnings can accumulate without being taxed until withdrawals are made. This product also offers flexibility in terms of investment choices and the ability to customize the policy to fit individual financial goals.

While Variable Annuity Life Insurance has its benefits, there are a few points to consider. The fees associated with this product can be higher compared to traditional life insurance due to the investment management and administrative costs. Additionally, the investment performance is not guaranteed, and there is a risk of losing some or all of the investment value if the market performs poorly. It's important to carefully review the policy terms, understand the investment options, and consider consulting a financial advisor to ensure it aligns with your financial objectives and risk tolerance.