Vesting is a process in which employees are granted rights to benefits such as stock options, retirement plans, or profit-sharing schemes after working for a company for a certain number of years. It is an incentive program that encourages employees to stay with the company and perform well. In the context of insurance, vesting refers to the age at which the insured starts receiving pension or annuity benefits, known as the vesting age. This age is customizable and typically falls between 30 and 80 years. Once the vesting age is reached, the policyholder begins receiving regular payouts as specified in their plan.

What You'll Learn

- Full vesting grants absolute rights to a claim or benefits to the entitled person

- Vesting schedules are an incentive for employees to perform well and stay with a company

- Vesting age is the age when the policyholder begins receiving their pension

- Vesting is a way for employers to retain top-performing employees

- Vesting is also used in inheritance law and real estate

Full vesting grants absolute rights to a claim or benefits to the entitled person

Vesting is a process in which employees receive rights to benefits such as stock options, retirement plans, or profit-sharing schemes after working for a company for a specific number of years. Full vesting grants absolute rights to a claim or benefits to the entitled person. This means that the employee has fulfilled the conditions required to receive the full, instead of a partial, benefit.

Full vesting is commonly used in employment benefits, where an employer and employee enter into a plan that offers benefits such as pensions. The employer may grant full benefits or only a portion, and this transfer is sometimes subject to conditions. In the case of full vesting, the employer grants the employee absolute rights to claim the entire amount in the account. The vested right is absolute, and no third party, including the employer or their creditors, can reduce the amount.

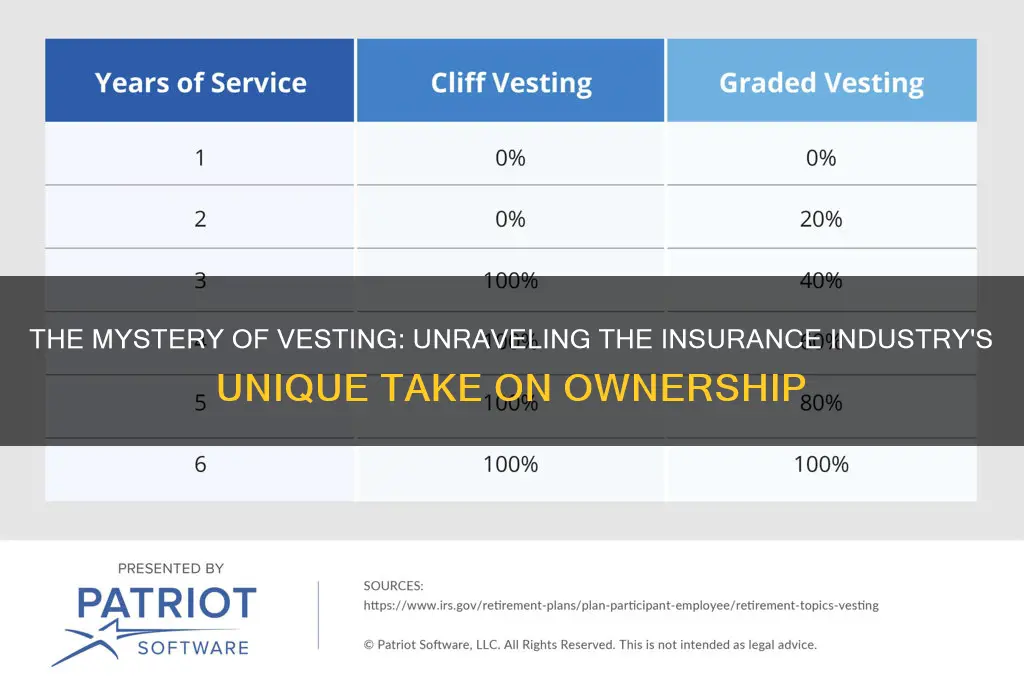

Full vesting is beneficial for employers as it helps retain talented employees by offering them lucrative benefits if they stay with the company for a specified period. Vesting schedules can be gradual, such as 25% per year, or immediate, with 100% of benefits vesting at a set time, like four years after the award date.

The vesting age is the age at which the insured starts receiving their pension. This age is customizable and can generally be set between 30 and 80 years. Once the vesting age is reached, the policy begins to release the annuity payout as per the frequency mentioned in the plan.

Understanding Bite Splints: Navigating Insurance Coverage for This Dental Appliance

You may want to see also

Vesting schedules are an incentive for employees to perform well and stay with a company

Vesting schedules are a type of incentive program that gives employees increasing levels of ownership over employer-contributed funds and assets. They are often used to encourage employees to remain with a company for a long term of employment. Vesting schedules define periods of time and amounts of employer-contributed funds or assets that become available to employees over time.

For example, an employee might be granted 100 restricted stock units as part of an annual bonus. To encourage this valued employee to remain with the company for the next five years, the stock vests according to the following schedule: 25 units in the second year after the bonus, 25 units in year three, 25 units in year four, and 25 units in year five. If the employee leaves the company after year three, only 50 units would be vested, and the other 50 would be forfeited.

Vesting schedules can also be used to allocate profits, equity, and stock options to employees. They are commonly used in stock option plans, retirement plans, and other forms of compensation to align the interests of employees with the long-term success of the company.

In the context of insurance, vesting refers to the granting of absolute rights to a claim or benefits to the person entitled to them. It is a process where employees are granted full rights to the benefits of a stock option, retirement plan, or profit-sharing scheme after working for a company for a particular number of years.

Understanding the Benefits: Unlocking the Power of Cash Value in Insurance Policies

You may want to see also

Vesting age is the age when the policyholder begins receiving their pension

Vesting age is the age at which a policyholder begins receiving their pension. It is the age at which an individual becomes eligible to receive pension benefits in an insurance-cum-retirement or pension plan.

The vesting age is flexible, allowing the policyholder to decide when they want to start receiving the benefits of the investment plan when they initiate the policy. The minimum vesting age is usually 30 years, while the maximum vesting age is 80 years. This means that the policyholder can choose to retire early if they wish, or they can opt for the standard retirement age of 60.

For example, if the standard retirement age is 60, then once an individual reaches this age, they will begin receiving their pension as per the decided frequency of the plan.

Vesting age is an important concept in retirement planning, as it determines when an individual can access their retirement benefits. It is also important to note that vesting is automatic and does not require any paperwork. Once an individual is vested, their previously earned pension credit cannot be cancelled.

The benefits of vesting in retirement plans include financial security, a guaranteed income, and curbing future insecurities. However, there are also downsides to vesting in retirement plans, such as long-term commitment, lack of liquidity, and lower interest rates compared to traditional bonds.

The Unspoken Truths: Term Insurance's Limitations Revealed

You may want to see also

Vesting is a way for employers to retain top-performing employees

Vesting is a way for employers to incentivize and retain top-performing employees. It is a process where employees receive rights to benefits, such as stock options, retirement plans, or profit-sharing schemes, after working for a company for a specific period. This encourages employees to stay with the company and perform well to receive these benefits.

Vesting schedules are commonly used by employers to determine when employees acquire full ownership of their benefits. These schedules can vary, but a common vesting period is three to five years. During this time, employees gradually increase their vested amount until they are 100% vested. For example, an employee might receive 100 restricted stock units as an annual bonus, with 25 units vesting in each of the four years following the bonus. If the employee leaves after the third year, they would only be vested in 50 units, and the remaining 50 would be forfeited.

Vesting is particularly useful for employers to retain talent while also offering lucrative benefits if employees stay for a specified period. It is a strategy to improve employee retention and increase the company's bottom line. Vesting schedules also help employers by postponing payouts, providing more short-term cash for the company.

In the context of retirement plans, "vesting" means ownership. Employees will vest or own a certain percentage of their account in the plan each year. An employee who is 100% vested owns their entire account balance, and the employer cannot take it back for any reason. While vesting schedules can be used to retain employees, it's important to note that employees who leave before full vesting may incur surrender costs or penalties.

Vesting schedules can also be applied to employee stock options or company shares. In this case, employees are given the right to exercise stock options, meaning they can buy a certain number of shares at a fixed price in the future. Alternatively, employees can be granted restricted stock units, where they receive actual shares of stock that they can sell later, but only after the vesting period.

Understanding Term Insurance Compatibility with Islamic Principles

You may want to see also

Vesting is also used in inheritance law and real estate

Vesting is a term used in real estate to describe how people take title to their property. It refers to how owners hold title to the property. While the title refers to the actual ownership of the property, vesting determines what an owner can do with their property in their lifetime and after. For example, vesting can mean the difference between going through probate or not when the owner dies.

There are several ways in which vesting can be held. The most common are:

- Sole Owner: For when there is a single owner of the property. No vesting is required.

- Tenants by the Entirety: A special form of tenancy for married couples, based on the legal belief that a married couple creates a “whole”. Both owners have an undivided interest in the property. The right of survivorship typically entails that the surviving spouse inherits the deceased’s portion.

- Joint Tenants: For when two or more people have an undivided interest in the property. Joint tenancy can be severed if one owner decides to convey their interest in the property to another.

- Tenants in Common: For when two or more owners share equal or unequal interests in a single property. There is no right of survivorship, and each deceased owner’s portion will be passed to their heirs unless stated otherwise in their will.

Vesting is also used in inheritance law. It often takes the form of a set waiting period to finalize bequests following the death of the testator. This helps to reduce conflicts that could arise over the precise time of death and the possibility of double taxation if multiple heirs die after a disaster.

In the context of insurance, vesting refers to the age when the policyholder begins receiving their pension. Once an individual reaches this age, they receive an annuity payout as per the decided frequency of the plan.

Prepaid Insurance or Short-Term Debt: Navigating Liquidation Options

You may want to see also

Frequently asked questions

Vesting in insurance terms refers to the process of granting employees rights to claim benefits, such as stock options, retirement plans, or profit-sharing schemes, after they have worked for a company for a specific number of years.

Vesting is a way for employers to incentivize and retain top-performing employees by offering them lucrative benefits if they stay with the company for a specified period.

Vesting often refers to a gradual process where the amount the employee is vested in increases over a period of years until they are 100% vested. Full vesting, on the other hand, grants absolute rights to the entire amount in the account immediately upon vesting.

A common vesting schedule is between three and seven years. For example, an employee might receive 25 restricted stock units in the second, third, fourth, and fifth years after the initial bonus. If the employee leaves the company after the third year, they would have vested 50 units, and the remaining 50 would be forfeited.