Voya Life Insurance is a comprehensive financial product designed to provide individuals and families with a sense of security and peace of mind. It offers a range of life insurance policies tailored to meet diverse needs, including term life, permanent life, and universal life insurance. With Voya, policyholders can choose coverage options that align with their financial goals, ensuring that their loved ones are protected in the event of unforeseen circumstances. This insurance company emphasizes transparency, offering clear policy terms and competitive rates, allowing customers to make informed decisions about their insurance needs. Whether it's securing a family's future or providing financial support during challenging times, Voya Life Insurance aims to deliver reliable coverage and exceptional customer service.

What You'll Learn

- Definition: Voya Life Insurance offers financial protection and coverage for individuals and families

- Benefits: Provides death benefit, income replacement, and long-term care options

- Features: Customizable policies, flexible payment options, and digital tools for easy management

- Eligibility: Available to individuals based on age, health, and other factors

- Claims Process: Simplified claims process for quick and efficient payouts upon policyholder's death

Definition: Voya Life Insurance offers financial protection and coverage for individuals and families

Voya Life Insurance is a comprehensive financial protection plan designed to safeguard individuals and their families from the financial impact of unexpected life events. It provides a safety net that ensures financial stability and peace of mind during challenging times. This type of insurance is a valuable tool for anyone seeking to secure their loved ones' future and manage potential risks associated with life's uncertainties.

The primary purpose of Voya Life Insurance is to offer financial coverage and support when it matters most. It is a long-term commitment that ensures a steady income or a lump sum payment to beneficiaries in the event of the insured individual's death. This financial protection can help cover essential expenses, such as mortgage payments, education costs, or daily living expenses, providing a sense of security for the family. With Voya, individuals can choose from various coverage options, including term life insurance, which provides coverage for a specified period, and permanent life insurance, offering lifelong protection.

One of the key advantages of Voya Life Insurance is its flexibility. Policyholders can customize their plans to fit their unique needs and financial goals. This includes selecting the appropriate coverage amount, which can be adjusted over time as circumstances change. Additionally, Voya offers various riders and add-ons, allowing policyholders to enhance their coverage and tailor it to specific requirements, such as critical illness coverage or accidental death benefits.

By purchasing Voya Life Insurance, individuals take a proactive approach to financial planning. It enables them to prepare for the future, ensuring that their loved ones are protected even if they are no longer around. This type of insurance provides a sense of security, knowing that financial obligations will be met, and the family's well-being will be cared for. Moreover, Voya's comprehensive approach to coverage and its ability to adapt to individual needs make it a reliable choice for long-term financial protection.

In summary, Voya Life Insurance is a powerful tool for individuals and families seeking financial security. It offers a range of coverage options, allowing policyholders to create a personalized plan. With Voya, individuals can address potential risks and ensure their loved ones' financial future, providing a valuable layer of protection in an uncertain world.

Stranger-Originated Life Insurance: Legal or Not?

You may want to see also

Benefits: Provides death benefit, income replacement, and long-term care options

Voya Life Insurance offers a comprehensive suite of benefits designed to provide financial security and peace of mind to its policyholders. One of the primary advantages of Voya life insurance is the death benefit it provides. This benefit ensures that your loved ones receive a lump sum payment in the event of your passing, which can help cover essential expenses such as funeral costs, outstanding debts, and daily living expenses. The death benefit is a critical component of financial planning, especially for those with dependents or significant financial obligations.

In addition to the death benefit, Voya life insurance also offers income replacement benefits. This feature is particularly valuable for individuals who rely on a steady income to maintain their standard of living. If you become unable to work due to illness or injury, the income replacement benefit will provide a regular income stream to help cover your living expenses and maintain your financial stability. This can be a significant advantage, especially for those who have recently started their careers or have dependents relying on their income.

Furthermore, Voya life insurance provides long-term care options, which are essential for individuals who may require assistance with daily activities as they age. Long-term care can include services such as nursing home care, assisted living, or even in-home care. The cost of long-term care can be substantial, and having a Voya policy with this benefit can help cover these expenses, ensuring that you or your loved ones are provided for during challenging times. Long-term care options are customizable, allowing policyholders to choose the level of coverage that best suits their needs and budget.

The flexibility and comprehensiveness of Voya Life Insurance's benefits make it an attractive choice for individuals and families seeking financial security. By providing a death benefit, income replacement, and long-term care options, Voya ensures that policyholders and their beneficiaries are protected against various life events and financial challenges. It is a valuable tool for anyone looking to secure their loved ones' financial future and manage potential long-term care needs.

In summary, Voya Life Insurance offers a robust set of benefits that cater to different aspects of financial planning. The death benefit provides peace of mind and financial support to dependents, while income replacement ensures financial stability during times of illness or injury. Long-term care options further enhance the policy's value, allowing individuals to age with dignity and security. Considering these benefits, Voya life insurance can be a wise investment for anyone seeking to protect their loved ones and secure their financial future.

Life Insurance Payout: How Long Are the Checks Valid?

You may want to see also

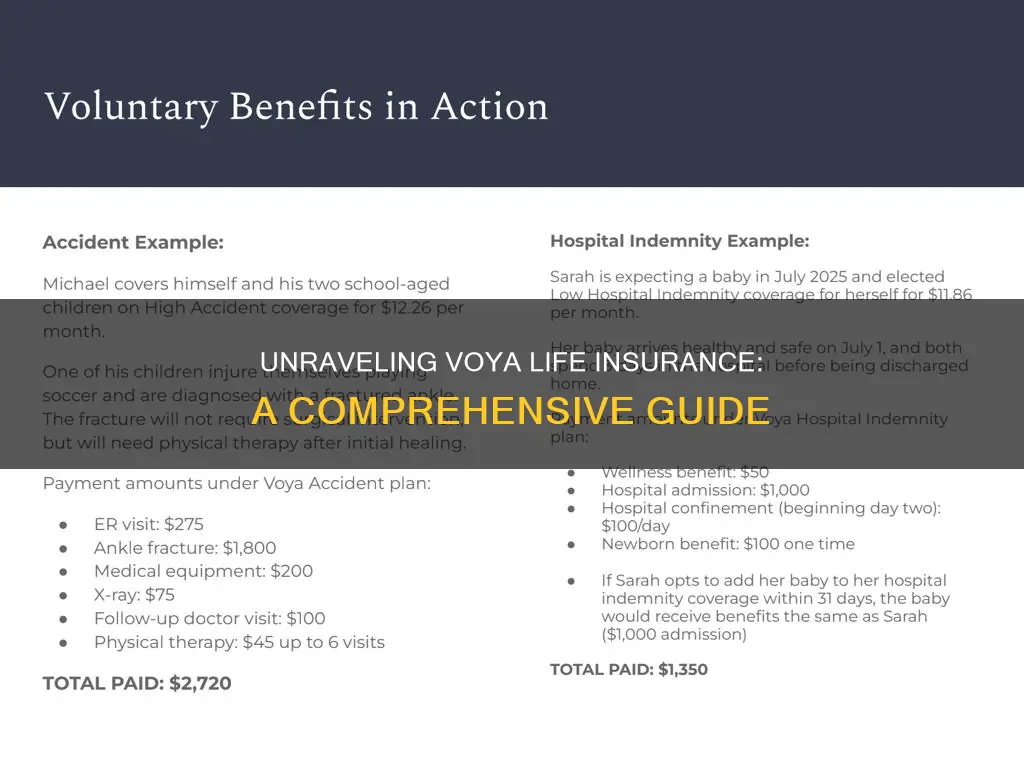

Features: Customizable policies, flexible payment options, and digital tools for easy management

Voya Life Insurance offers a range of features that set it apart from other insurance providers, providing customers with a highly customizable and flexible approach to life insurance. One of its key strengths is the ability to tailor policies to individual needs, ensuring that each customer receives a personalized plan. This customization extends to various aspects, including coverage amounts, policy terms, and rider options, allowing individuals to create a policy that perfectly aligns with their financial goals and risk tolerance.

In terms of payment flexibility, Voya understands that financial situations can vary greatly. They offer multiple payment options to accommodate different budgets and preferences. This includes the choice between monthly, semi-annual, or annual payments, as well as the ability to set up automatic payments for added convenience. Such flexibility ensures that policyholders can manage their insurance premiums without financial strain, making it an attractive choice for those seeking affordable and adaptable insurance solutions.

The digital tools provided by Voya Life Insurance are designed to simplify policy management and enhance the overall customer experience. Through their user-friendly online platform, customers can access their policy information, make payments, and even request policy changes or updates. This digital approach streamlines the entire process, allowing individuals to manage their insurance effortlessly. Additionally, Voya's mobile app provides further convenience, enabling customers to stay connected with their policies on the go, ensuring that they can make informed decisions about their insurance whenever and wherever needed.

With customizable policies, flexible payment options, and a comprehensive digital toolkit, Voya Life Insurance empowers individuals to take control of their financial well-being. This level of customization and flexibility ensures that customers can find the perfect insurance solution to suit their unique circumstances, providing peace of mind and financial security. By offering these advanced features, Voya Life Insurance demonstrates its commitment to meeting the diverse needs of its customers in the ever-evolving insurance market.

Canceling Symetra Life Insurance: A Step-by-Step Guide

You may want to see also

Eligibility: Available to individuals based on age, health, and other factors

Voya Life Insurance is a financial product designed to provide financial security and peace of mind to individuals and their families. It is a type of insurance that offers a range of benefits, including death benefit, income replacement, and long-term care. The eligibility criteria for Voya Life Insurance are based on several factors, including age, health, and other considerations.

Age is a critical factor in determining eligibility for Voya Life Insurance. The insurance company typically has age limits for applicants, which can vary depending on the specific product and the individual's health status. Generally, younger individuals may have more favorable rates and terms compared to older applicants. This is because younger individuals are considered to have a lower risk profile, as they have more years ahead to benefit from the insurance coverage.

Health is another essential consideration in the eligibility process. Voya Life Insurance companies often conduct medical underwriting to assess an individual's health and determine their risk level. This may involve a medical examination, a review of medical records, or a health questionnaire. Individuals with pre-existing health conditions, chronic illnesses, or a history of smoking or substance abuse may face higher premiums or may be deemed ineligible for certain types of coverage. The insurance company aims to ensure that the policy is financially viable and provides adequate protection for the insured.

In addition to age and health, other factors come into play when assessing eligibility. These factors can include occupation, lifestyle choices, and financial circumstances. For example, individuals in high-risk occupations, such as construction or emergency services, may be subject to additional scrutiny or higher premiums. Lifestyle choices, such as frequent travel or extreme sports participation, can also impact eligibility and premium costs. Financial assessments may be required to ensure that the individual can afford the premiums and that the policy fits within their overall financial plan.

It is important to note that Voya Life Insurance companies may have different eligibility requirements and underwriting processes. Prospective applicants should carefully review the specific terms and conditions of the policy they are interested in. Consulting with a financial advisor or insurance specialist can also provide valuable guidance in understanding the eligibility criteria and finding the most suitable life insurance product for individual needs.

Life Insurance Exam: What You Need to Know

You may want to see also

Claims Process: Simplified claims process for quick and efficient payouts upon policyholder's death

The Voya Life Insurance Company offers a comprehensive and streamlined claims process designed to provide quick and efficient payouts to the beneficiaries upon the death of the policyholder. This process is a testament to Voya's commitment to ensuring financial security for those who rely on the insurance policy. Here's an overview of how the claims process works:

When a policyholder's death is reported, the first step is to notify Voya's claims department. This can be done through various means, including phone, email, or by completing an online claim form. The claims team is trained to handle these situations with sensitivity and efficiency. They will guide the beneficiary through the necessary steps and provide the required documentation. Typically, the beneficiary will need to submit a copy of the death certificate, along with any other supporting documents, such as the insurance policy document and proof of identity.

Once the initial notification and documentation are received, Voya's claims department will initiate a thorough review process. This involves verifying the policyholder's identity, confirming the cause and date of death, and ensuring that all necessary paperwork is in order. The company aims to complete this review process within a specified timeframe, often within a few days to a week, depending on the complexity of the case.

After the review, if all the information is in order and the claim is approved, Voya will proceed with the payout. The payment method and timing will depend on the policy terms and the beneficiary's preferences. Voya offers various payout options, including lump-sum payments, periodic payments, or even charitable donations as per the policyholder's wishes. The company ensures that the entire process is transparent and that the beneficiaries are kept informed throughout.

Voya Life Insurance's simplified claims process is designed to minimize the burden on beneficiaries during a difficult time. By providing clear guidelines, efficient handling, and various payout options, Voya aims to deliver on its promise of financial security. This streamlined approach ensures that the policyholders' loved ones can access the benefits they are entitled to without unnecessary delays or complications.

Understanding the Core: Life Insurance Framework Explained

You may want to see also

Frequently asked questions

Voya Life Insurance is a comprehensive insurance policy offered by Voya Financial, a leading insurance and financial services company. It provides financial protection and peace of mind to individuals and their families by offering various life insurance products, including term life, permanent life, and universal life insurance.

Voya Life Insurance policies provide a financial benefit to the policyholder's beneficiaries upon their death. The policyholder pays regular premiums, and in return, the insurance company promises to pay out a death benefit to the designated recipients. This benefit can be used to cover various expenses, such as mortgage payments, children's education, or everyday living costs.

Voya Life Insurance offers several advantages, including flexibility in policy customization, various coverage options to suit individual needs, and the potential for cash value accumulation in permanent life insurance policies. It provides financial security, ensuring that loved ones are taken care of in the event of the insured's passing.

Voya Life Insurance is available to individuals who meet the company's underwriting criteria, which may include factors such as age, health, lifestyle, and financial situation. The specific eligibility requirements can vary depending on the type of policy and the insured's profile.