Whole life plus insurance is a comprehensive and permanent life insurance policy that offers both a death benefit and a cash value component. It provides long-term financial security and a guaranteed death benefit, ensuring that your loved ones receive financial support even after your passing. This type of insurance also accumulates cash value over time, which can be used for various purposes, such as loaning against the policy or taking out withdrawals. With whole life plus, you can enjoy the peace of mind that comes with knowing your family's financial future is protected, all while building a valuable asset that can grow and provide financial flexibility.

What You'll Learn

- Definition: Whole Life Plus is a permanent insurance policy with a guaranteed death benefit and an investment component

- Features: It offers lifelong coverage, cash value accumulation, and potential dividends

- Benefits: Provides financial security, tax advantages, and a flexible investment option

- Cost: Premiums are typically higher but offer long-term stability and guaranteed returns

- Comparison: It combines whole life insurance with additional features, offering more flexibility than traditional whole life

Definition: Whole Life Plus is a permanent insurance policy with a guaranteed death benefit and an investment component

Whole Life Plus is a specialized type of permanent life insurance that offers both a safety net and an investment opportunity. It is designed to provide long-term financial security and peace of mind to policyholders and their beneficiaries. This insurance policy is a form of whole life insurance with an added feature, hence the name "Plus."

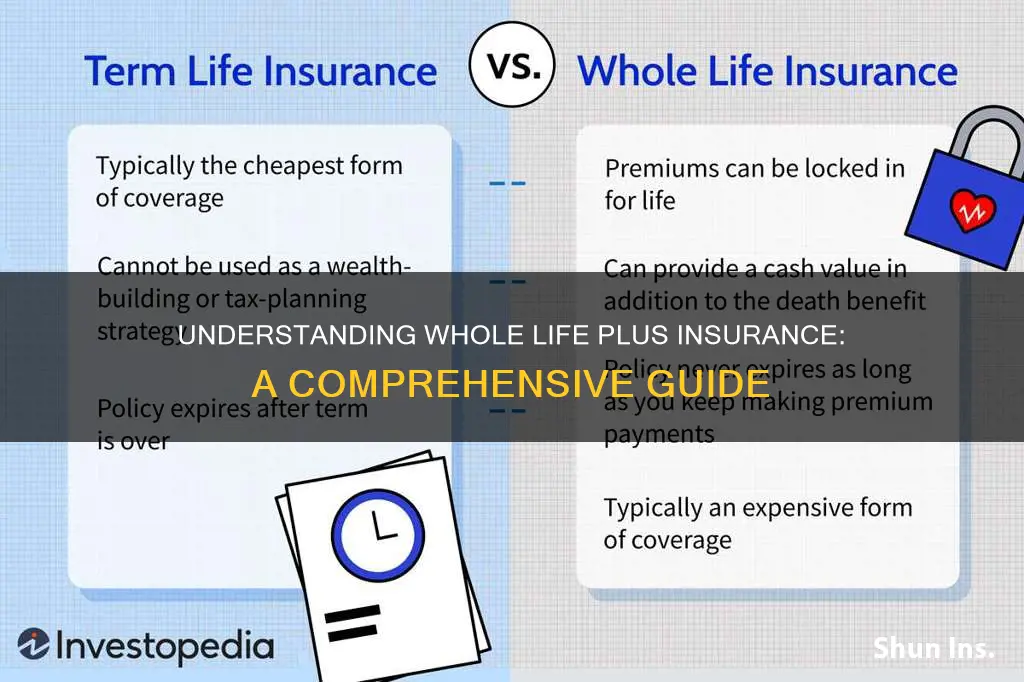

The core characteristic of Whole Life Plus is its permanence. Unlike term life insurance, which provides coverage for a specified period, whole life insurance, and by extension, Whole Life Plus, is a lifelong commitment. It ensures that the policyholder's beneficiaries receive a guaranteed death benefit, which is a fixed amount of money upon the insured individual's passing. This guaranteed benefit is a significant advantage, offering financial security to the policyholder's family or designated recipients.

In addition to the death benefit, Whole Life Plus incorporates an investment component. This aspect allows the policyholder to utilize the policy's cash value as an investment vehicle. The cash value is the portion of the policy's value that accumulates over time, and it can be borrowed against or withdrawn. The investment component provides an opportunity for the policyholder to potentially grow their money, offering a dual benefit of insurance protection and financial growth. Policyholders can choose how to allocate their funds, allowing for customization based on their financial goals and risk tolerance.

The investment aspect of Whole Life Plus is often associated with a guaranteed minimum interest rate, ensuring that the policyholder's money grows steadily. This feature is particularly attractive to those seeking a stable and secure investment option while also having the insurance coverage they need. It provides a sense of control and predictability, allowing individuals to plan for the future with confidence.

In summary, Whole Life Plus is a comprehensive financial tool that combines the security of a guaranteed death benefit with the potential for investment growth. It is a permanent insurance policy that caters to those seeking long-term financial protection and the opportunity to build wealth. Understanding the features of Whole Life Plus can help individuals make informed decisions about their insurance and investment needs.

Life Insurance at 25: A Smart Move?

You may want to see also

Features: It offers lifelong coverage, cash value accumulation, and potential dividends

Whole Life Plus insurance is a comprehensive and long-term financial product that provides several key features to its policyholders. Firstly, it offers lifelong coverage, ensuring that the insurance remains in force for the entire life of the policyholder. This means that as long as the premiums are paid, the coverage will continue, providing a sense of security and peace of mind. Unlike term life insurance, which provides coverage for a specific period, whole life plus insurance guarantees protection throughout one's life.

Secondly, this type of insurance includes a cash value accumulation feature. Over time, a portion of the premiums paid by the policyholder is invested and grows within the policy. This cash value can accumulate and build up a significant amount, providing a financial asset for the policyholder. It can be used for various purposes, such as borrowing funds, paying for college education, or even as a source of emergency funds. The cash value grows tax-deferred, allowing it to compound and increase in value over the years.

Another attractive feature is the potential for dividends. Whole Life Plus insurance policies often have an investment component that allows the insurance company to distribute a portion of their profits as dividends to policyholders. These dividends can vary depending on the company's performance and the overall market conditions. Dividends provide an additional source of income for policyholders, which can be used to increase the cash value of the policy or even as a form of savings.

The combination of lifelong coverage, cash value accumulation, and potential dividends makes Whole Life Plus insurance an attractive option for individuals seeking long-term financial security. It provides a sense of stability and offers policyholders the opportunity to build a substantial financial asset over time. This type of insurance is particularly valuable for those who want a consistent and reliable financial product that can adapt to their changing needs and goals.

Unlocking the Best Value in Whole Life Insurance

You may want to see also

Benefits: Provides financial security, tax advantages, and a flexible investment option

Whole life plus insurance is a comprehensive and long-term financial planning tool that offers a range of benefits to policyholders. One of its primary advantages is providing financial security for individuals and their families. This type of insurance ensures that a predetermined amount is paid out upon the death of the insured individual, offering a financial safety net for beneficiaries. The payout can be a significant financial resource for covering various expenses, such as funeral costs, outstanding debts, or providing for loved ones' future needs. This financial security aspect is particularly valuable for those who want to ensure their family's long-term financial stability, even in the event of their untimely passing.

In addition to financial security, whole life plus insurance also provides tax advantages. The policy's cash value, which grows over time, can be used to pay premiums, and any earnings on this cash value are typically tax-deferred. This means that the policyholder can benefit from tax-free growth, allowing the cash value to accumulate over the policy's term. When the policy matures, the cash value can be withdrawn tax-free, providing a flexible financial resource that can be utilized for various purposes, such as funding education, starting a business, or investing in other growth opportunities.

The flexibility of whole life plus insurance is another key benefit. Policyholders can customize their coverage to suit their specific needs. They can choose the amount of coverage, the term of the policy, and even the investment options associated with the cash value. This flexibility allows individuals to tailor the insurance to their financial goals and risk tolerance. For instance, some may opt for a higher coverage amount to ensure comprehensive financial protection, while others might focus on the investment aspect, allowing the cash value to grow over time.

Furthermore, the investment component of whole life plus insurance offers a unique opportunity for long-term financial growth. The cash value can be invested in various options, such as stocks, bonds, or mutual funds, allowing the policyholder's money to potentially earn higher returns over time. This investment aspect provides a way to build wealth and achieve financial goals, all while having the peace of mind that comes with knowing a financial safety net is in place. Policyholders can also access their cash value through loans or withdrawals, providing access to funds without the need to surrender the policy, making it a highly flexible financial tool.

In summary, whole life plus insurance offers a powerful combination of financial security, tax advantages, and investment opportunities. It provides a safety net for beneficiaries, tax-deferred growth, and the flexibility to customize coverage and investment strategies. This type of insurance is an excellent choice for those seeking long-term financial planning, ensuring that their loved ones are protected and their financial goals are achieved. Understanding the benefits and features of whole life plus insurance can empower individuals to make informed decisions about their financial future.

Life Insurance Beneficiaries: Minors and Their Rights Explained

You may want to see also

Cost: Premiums are typically higher but offer long-term stability and guaranteed returns

Whole Life Plus insurance is a type of permanent life insurance that offers a unique combination of features, providing both a death benefit and an investment component. One of the key aspects that sets it apart is its cost structure, which is typically higher compared to other insurance products. However, this higher cost is justified by the long-term stability and guaranteed returns it offers to policyholders.

The higher premiums are often a result of the extended coverage period and the investment aspect of the policy. Unlike term life insurance, which provides coverage for a specified period, whole life plus insurance is designed to offer lifelong protection. This means that the policy remains in force as long as the premium payments are made, ensuring that the beneficiary receives the death benefit when the insured individual passes away. Additionally, the investment component allows policyholders to build a cash value over time, which can be borrowed against or withdrawn, providing financial flexibility.

The cost-effectiveness of this insurance is evident in the long-term stability it provides. As the policy grows, the cash value accumulation increases, offering a financial cushion that can be utilized for various purposes. This feature is particularly beneficial for those seeking a more secure and predictable financial plan, as it provides a guaranteed return on the investment portion of the policy. Over time, the cash value can accumulate to a significant amount, ensuring that the policyholder's family is financially protected and that the investment grows steadily.

While the initial cost may seem higher, the long-term benefits and stability make whole life plus insurance an attractive option for those seeking comprehensive financial protection. The guaranteed returns and the ability to build equity make it a sound investment, especially for individuals who want a more permanent and secure financial strategy. Policyholders can rest assured that their premiums are contributing to both a death benefit and a growing investment, providing a sense of financial security and peace of mind.

In summary, the higher premiums of whole life plus insurance are a trade-off for the long-term stability and guaranteed returns it offers. This type of insurance provides a comprehensive financial solution, ensuring that policyholders and their beneficiaries are protected while also allowing for potential investment growth. Understanding the cost structure and the benefits it provides is essential for individuals seeking a more permanent and secure insurance option.

The Ultimate Guide to the Most Expensive Life Insurance: Unlocking the Secrets

You may want to see also

Comparison: It combines whole life insurance with additional features, offering more flexibility than traditional whole life

Whole Life Plus insurance is an innovative type of permanent life insurance that offers a unique blend of benefits, providing a more flexible and comprehensive financial protection plan. This type of insurance combines the guarantees of whole life insurance with additional features, allowing policyholders to customize their coverage and adapt it to their changing needs over time.

One of the key advantages of Whole Life Plus is the flexibility it provides. Unlike traditional whole life insurance, which offers a fixed death benefit and premiums, this variant allows for more customization. Policyholders can choose to increase or decrease the death benefit, adjust the premium payments, or even take out loans against the cash value of the policy. This adaptability is particularly beneficial for individuals who want to ensure their insurance plan aligns with their evolving financial goals and circumstances. For instance, a young professional might opt for a higher death benefit to secure their family's future, while an older individual may prefer to reduce the benefit and focus on building cash value for retirement.

The additional features of Whole Life Plus insurance include a built-in investment component. The policy's cash value, which grows tax-deferred, can be used to pay for future premiums, providing financial security and potentially increasing the overall value of the policy over time. This investment aspect allows policyholders to benefit from potential market growth while also ensuring a guaranteed death benefit, a feature that is often lacking in other investment vehicles. Furthermore, the policy can be passed on as an inheritance, providing financial security for beneficiaries even after the insured individual's passing.

In comparison to traditional whole life, Whole Life Plus insurance offers a more tailored and dynamic approach to financial planning. It provides the security of a guaranteed death benefit while allowing for adjustments to suit individual needs. This flexibility is especially valuable for those who want to maximize their insurance benefits and ensure their coverage remains relevant and effective throughout their lives. With its combination of insurance and investment features, Whole Life Plus insurance presents a comprehensive solution for long-term financial security.

Life Insurance Denial: What You Need to Know

You may want to see also

Frequently asked questions

Whole Life Plus Insurance is a type of permanent life insurance that offers a combination of features from both whole life and universal life insurance policies. It provides a guaranteed death benefit and a fixed interest rate on the cash value, ensuring a steady growth of the policy's value over time. This insurance type is designed to offer long-term financial security and can be tailored to meet specific needs.

Traditional Whole Life Insurance has a fixed premium and a guaranteed death benefit, but the cash value accumulation is typically slower. Whole Life Plus, on the other hand, often includes an investment component, allowing policyholders to potentially earn higher returns on their premiums. This feature provides more flexibility and can be advantageous for those seeking both insurance coverage and investment opportunities.

Yes, there are several benefits. Firstly, the guaranteed death benefit ensures that your loved ones receive a specified amount upon your passing. Secondly, the investment aspect can help grow your money, providing potential tax advantages and the possibility of outperforming traditional savings accounts. Additionally, Whole Life Plus policies often offer flexibility in premium payments, allowing policyholders to make adjustments as their financial situation changes.

Yes, one of the key advantages is the ability to access funds through policy loans or withdrawals. Policyholders can borrow against the cash value or make withdrawals, providing financial flexibility. These options can be particularly useful for covering major expenses or accessing funds without surrendering the policy. However, it's important to note that withdrawals may impact the policy's death benefit and overall value, so careful consideration is advised.