Primerica offers a range of life insurance products designed to provide financial security and peace of mind to its customers. These policies are tailored to meet diverse needs, including term life insurance, which offers coverage for a specified period, and permanent life insurance, which provides lifelong protection. Primerica's life insurance options are known for their competitive rates and customizable features, allowing individuals to choose the coverage amount and term length that best suit their financial goals and family circumstances. Whether it's ensuring financial stability for loved ones or planning for long-term financial security, Primerica's life insurance products are designed to offer comprehensive protection and peace of mind.

What You'll Learn

- Term Life: Primerica offers temporary coverage with fixed premiums

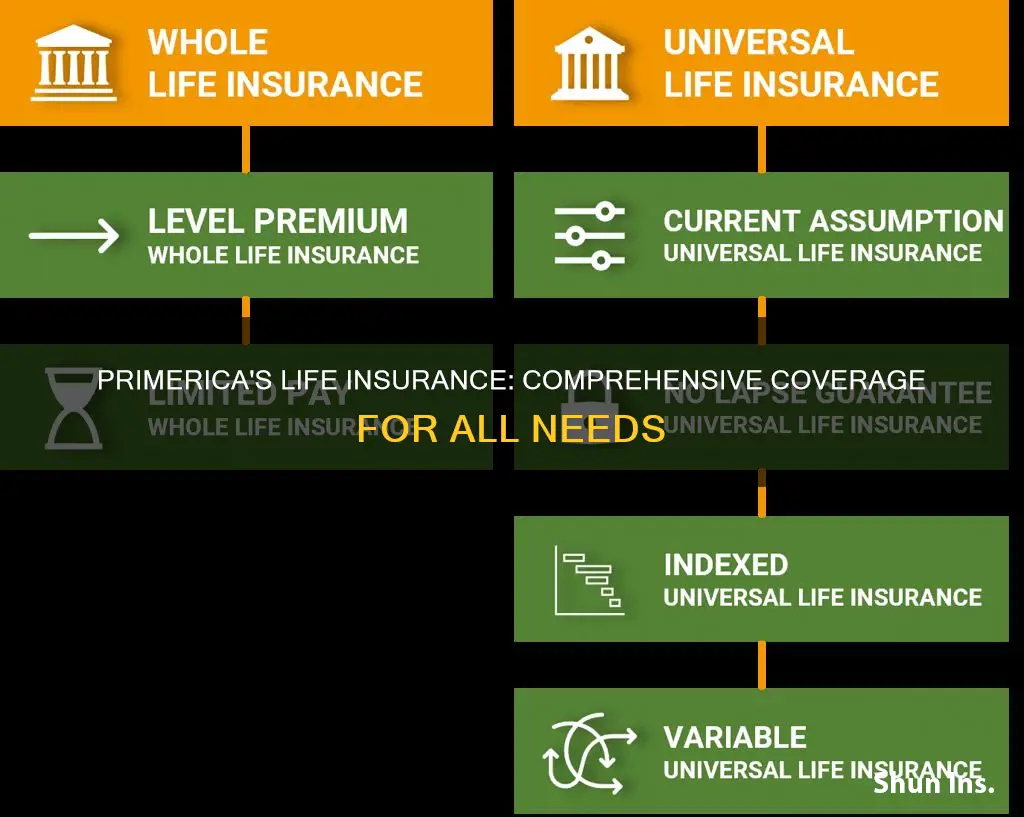

- Whole Life: Provides lifelong protection with a cash value component

- Universal Life: Flexible policy with adjustable premiums and investment options

- Final Expense: Covers funeral and burial costs, often for seniors

- Group Life: Offers coverage for employees in a collective plan

Term Life: Primerica offers temporary coverage with fixed premiums

Primerica, a financial services company, offers a range of life insurance products, including term life insurance, which provides coverage for a specific period. This type of insurance is a popular choice for individuals seeking temporary protection at a predictable cost. Here's a detailed look at what term life insurance from Primerica entails:

Term life insurance is a straightforward and cost-effective way to secure financial protection for a defined period. With Primerica's offering, policyholders can choose the duration of coverage, typically ranging from 10 to 30 years. During this term, the premiums remain consistent, providing a sense of financial stability. This fixed-rate structure is one of the key advantages, as it allows individuals to plan their budget effectively without worrying about premium fluctuations. For instance, if you opt for a 20-year term, your monthly payments will remain the same throughout that period, making it easier to manage your finances.

The temporary nature of term life insurance is particularly appealing to those who want coverage for a specific goal or responsibility. For example, a young professional might choose a 10-year term to protect their family in case of an unexpected event while they are building their career. Similarly, someone with a mortgage might opt for a 15-year term to ensure their financial burden is covered during the loan's repayment period. This type of insurance is ideal for those who want a simple, no-frills approach to life insurance without the complexity of permanent policies.

Primerica's term life insurance is designed to be accessible and affordable. The company aims to provide coverage to individuals who may not qualify for more extensive or expensive policies. By offering temporary protection, Primerica caters to a wide range of customers, including those with specific financial goals or short-term needs. This approach allows people to obtain the necessary insurance without the long-term commitment or higher costs associated with permanent life insurance.

When considering term life insurance from Primerica, it's essential to evaluate your unique circumstances. The duration of coverage should align with your financial goals and responsibilities. For instance, if you have a young family and want to ensure their financial security, a longer term might be more appropriate. Conversely, if you're close to retirement age and have already provided for your family, a shorter term could be more suitable. Understanding your needs and choosing the right term length will ensure you get the most out of your life insurance policy.

In summary, Primerica's term life insurance offers a practical solution for individuals seeking temporary coverage with consistent premiums. This type of insurance is ideal for those with specific financial goals or short-term responsibilities, providing a sense of security without the complexity of permanent policies. By offering this product, Primerica caters to a diverse range of customers, ensuring they can find the right life insurance solution to meet their unique needs.

Understanding Life Insurance Trusts: A Beginner's Guide

You may want to see also

Whole Life: Provides lifelong protection with a cash value component

Whole life insurance is a type of permanent life insurance that offers lifelong coverage and a unique feature: a cash value component. This means that, in addition to providing a death benefit to your beneficiaries when you pass away, whole life insurance also accumulates a cash value over time. This cash value is essentially an investment within the policy, and it can grow tax-deferred. Here's a breakdown of how it works and why it might be a valuable consideration:

Lifelong Coverage: One of the key advantages of whole life insurance is that it provides coverage for your entire life. Unlike term life insurance, which has a specific period of coverage (e.g., 10, 20, or 30 years), whole life insurance remains in force as long as you make the required premium payments. This ensures that your loved ones are protected financially throughout your entire life, providing peace of mind and long-term security.

Cash Value Accumulation: The cash value component of whole life insurance is a significant feature. As you make regular premium payments, a portion of each payment goes towards building this cash value. This investment grows over time, and you can access it through policy loans or surrender the policy for its cash value. The cash value can be used for various purposes, such as funding college education, starting a business, or providing financial security during retirement. It also ensures that your policy has a guaranteed death benefit, even if the cash value fluctuates.

Fixed Premiums: With whole life insurance, you pay a fixed premium for the entire term of the policy. This means your monthly or annual payments remain consistent, providing budget certainty. The premiums are typically higher than those for term life insurance, but they are designed to cover the lifelong coverage and the growing cash value.

Tax Advantages: The cash value in a whole life policy grows tax-deferred, similar to a tax-deferred annuity. This means that the earnings on the cash value are not taxed until they are withdrawn or the policy is surrendered. Additionally, policy loans, if taken, are generally tax-free as long as they are used for policy-related expenses.

Financial Security and Flexibility: Whole life insurance offers a combination of financial security and flexibility. It provides a guaranteed death benefit, ensuring your family is protected, and the cash value component allows you to build a financial asset. This asset can be used to meet various financial goals, providing flexibility and control over your financial future.

When considering life insurance, especially with a company like Primerica, understanding the different types of coverage available is essential. Whole life insurance, with its lifelong protection and cash value accumulation, can be a powerful tool for building financial security and providing long-term peace of mind.

Life Insurance for Indian Army: What's the Deal?

You may want to see also

Universal Life: Flexible policy with adjustable premiums and investment options

Universal life insurance is a flexible and customizable policy offered by Primerica, providing policyholders with a range of features that can adapt to their changing needs over time. This type of life insurance offers a unique advantage in that it combines the permanent nature of whole life insurance with the flexibility and potential for higher returns of term life insurance.

One of the key benefits of universal life is its adjustable nature. Policyholders have the freedom to customize their premiums, allowing them to increase or decrease payments based on their financial situation and goals. This flexibility is particularly useful for those who may experience fluctuations in income or who want to ensure that their insurance coverage remains adequate as their financial circumstances evolve. For instance, during periods of higher income, individuals can opt for higher premiums to build up more cash value, which can be used to pay for future expenses or to increase the death benefit. Conversely, when income is lower, lower premiums can be paid, ensuring that the policy remains affordable without compromising its value.

The investment options within universal life policies are another significant advantage. Policyholders can choose to allocate a portion of their premiums into an investment account, where the money can grow tax-deferred. This investment component allows individuals to potentially earn higher returns compared to traditional savings accounts. The investment options may include a range of funds, bonds, or other investment vehicles, providing policyholders with the opportunity to diversify their portfolio and potentially increase the overall value of their policy over time. This feature is especially appealing to those who are interested in growing their money while also having a safety net in the form of life insurance coverage.

Furthermore, the cash value accumulation in universal life policies can be a valuable asset. As premiums are paid, a portion of the money goes towards building up cash value, which can be borrowed against or withdrawn (subject to certain restrictions and fees). This cash value can be used for various purposes, such as funding education expenses, starting a business, or providing financial security in retirement. The ability to access this cash value without surrendering the policy or taking out a loan can be a significant advantage, especially during times of financial need.

In summary, universal life insurance from Primerica offers a flexible and adaptable solution for individuals seeking life insurance with adjustable premiums and investment opportunities. This policy type provides the freedom to customize coverage, the potential for higher returns through investment, and the security of a growing cash value, all while maintaining the permanent nature of whole life insurance. It is a comprehensive and personalized approach to life insurance, catering to the diverse needs and preferences of policyholders.

Understanding Universal Life Insurance: A Comprehensive Guide

You may want to see also

Final Expense: Covers funeral and burial costs, often for seniors

When considering life insurance options, it's important to understand the specific coverage provided by different providers, especially when it comes to specialized plans like those offered by Primerica. One such plan is the Final Expense insurance, which is designed to cover the costs associated with end-of-life arrangements, including funeral and burial expenses. This type of insurance is particularly relevant for seniors who may have accumulated significant debts related to their final wishes and want to ensure their loved ones are not burdened with these financial responsibilities.

Final Expense insurance is a straightforward and often affordable way to secure financial protection for your family during a difficult time. It provides a lump sum payment upon your passing, which can be used to cover various expenses, such as funeral costs, burial or cremation fees, and even outstanding medical bills. This coverage is especially beneficial for the elderly, as it can help alleviate the financial strain on their families and ensure that their wishes are respected.

The beauty of Final Expense insurance lies in its simplicity and the peace of mind it offers. By purchasing this policy, you can rest assured that your loved ones will not have to make difficult decisions regarding your final arrangements while also dealing with the emotional aftermath of your passing. This type of insurance is often more accessible to seniors because it focuses on providing a specific benefit rather than a long-term investment, making it a cost-effective solution for end-of-life coverage.

Primerica, as a financial services company, offers various insurance products, and it is worth researching their specific Final Expense plan to understand the coverage details. This research will help you make an informed decision about your insurance needs, ensuring that you and your family are adequately protected during a challenging period. It is always advisable to compare different providers and policies to find the best fit for your requirements.

In summary, Final Expense insurance is a specialized life insurance product that caters to the unique needs of seniors and their families. It provides a financial safety net for end-of-life expenses, ensuring that your loved ones can honor your wishes without incurring significant debt. Considering this type of insurance can be a wise decision, and exploring Primerica's offerings might provide valuable insights into their approach to this essential coverage.

Adding a Life Partner to Your Health Insurance: Is It Possible?

You may want to see also

Group Life: Offers coverage for employees in a collective plan

Primerica, a financial services company, offers a range of insurance products, including group life insurance, which is designed to provide coverage for employees as part of a collective plan. This type of life insurance is typically offered to a group of people, such as employees of a company, and provides a standardized level of coverage to all members. Here's a detailed look at how group life insurance works in the context of Primerica's offerings:

Collective Plan Structure: Primerica's group life insurance is often structured as a collective plan, where the insurance company negotiates terms and rates with the employer or group administrator. This approach allows for efficient administration and can provide cost-effective coverage for employees. The plan is typically customized to fit the specific needs of the group, including the number of employees, their ages, and the desired level of coverage.

Coverage Benefits: Group life insurance offers a predetermined amount of coverage for each employee. This coverage amount is usually a multiple of the employee's salary or a set amount per person. For instance, an employee might be offered a policy with a death benefit of $50,000, which would be paid out to their designated beneficiaries in the event of their passing. The coverage can be adjusted based on the group's demographics and the employer's preferences.

Administration and Premiums: The administration of group life insurance plans can be streamlined, as the employer or group administrator is responsible for managing the policy and collecting premiums from employees. Premiums are typically deducted from employees' paychecks, making it convenient for them. The employer may also have the option to pay a portion or all of the premium, depending on the arrangement. This collective approach simplifies the process and ensures that coverage is maintained for all eligible employees.

Flexibility and Customization: One of the advantages of group life insurance is the flexibility it offers. Primerica can customize the plan to include additional benefits such as accidental death insurance, critical illness coverage, or long-term disability insurance. This allows employers to provide a comprehensive benefits package to their employees. The coverage can be tailored to meet specific industry or company requirements, ensuring that the insurance meets the unique needs of the workforce.

Portability and Conversion: Group life insurance often provides employees with the option to convert their group coverage to an individual policy if they leave the company. This portability ensures that employees can maintain their life insurance coverage even after their employment ends. Primerica's group life insurance plans may also offer other conversion options, allowing individuals to continue their coverage as they transition between jobs or start their own businesses.

Primerica's group life insurance is a valuable component of an employee's benefits package, offering financial security and peace of mind. It is a convenient and cost-effective way to provide coverage to a large group of individuals, ensuring that their loved ones are protected in the event of unforeseen circumstances.

Life Insurance Proceeds: Taxable Income or Not?

You may want to see also

Frequently asked questions

Primerica provides two main types of life insurance policies: Term Life Insurance and Permanent Life Insurance. Term life insurance offers coverage for a specified period, while permanent life insurance provides lifelong coverage and includes a savings component.

Primerica's life insurance policies are designed to be simple and affordable. They offer straightforward coverage options with no hidden fees, making it easy for customers to understand and choose the best plan for their needs. The company also provides a unique "Guaranteed Insurability" option, allowing policyholders to increase their coverage without a medical exam.

Yes, Primerica offers the option to convert a term life insurance policy to a permanent life insurance policy. This conversion can be done at any time during the initial term period, providing flexibility for policyholders.

Primerica's life insurance policies are available to most individuals, regardless of their health status. However, certain medical conditions or lifestyle factors may impact the premium rates or eligibility for specific coverage options. During the application process, Primerica will assess your health and lifestyle to determine the appropriate coverage and premium.