FEGLI, or the Federal Employees Group Life Insurance, is a comprehensive life insurance program designed specifically for federal employees. It offers a range of coverage options, including term life, permanent life, and accidental death insurance. FEGLI is known for its competitive rates and the ability to purchase additional coverage beyond the standard amount, providing federal employees and their families with a valuable financial safety net. This insurance is an essential component of the benefits package for federal workers, ensuring financial security and peace of mind.

| Characteristics | Values |

|---|---|

| Definition | Federal Employees Group Life Insurance (FEGLI) is a group life insurance program provided by the U.S. government for its employees. |

| Coverage | Offers basic and optional life insurance coverage to federal employees and their beneficiaries. |

| Benefits | Provides death benefits to the insured's designated beneficiaries in the event of the insured's death while covered under the policy. |

| Ownership | The U.S. government owns the policy and has the right to pay the death benefit to the beneficiaries. |

| Eligibility | Available to all full-time federal employees, including those in the civil service and the military. |

| Premiums | Premiums are deducted from the employee's pay and are not tax-deductible. |

| Face Value | The face value of the policy is typically $50,000, but employees can choose to increase this amount by enrolling in the optional coverage. |

| Conversion Option | Employees can convert their basic coverage to an individual policy after a certain period. |

| Term | Basic coverage is for life, while optional coverage is for a term of one year, five years, or ten years. |

| Portability | Coverage is portable, meaning it can be transferred to a new employer if the employee leaves federal service. |

| Tax-Free Benefits | Proceeds from FEGLI are generally tax-free to the beneficiaries. |

| Administration | Managed by the Office of Personnel Management (OPM) within the U.S. government. |

What You'll Learn

- FGEGL Coverage: Basic overview of FGEGL insurance, its benefits, and types

- Eligibility Criteria: Who is eligible for FGEGL coverage and how to qualify

- Policy Types: Different types of FGEGL policies and their unique features

- Benefits and Payouts: Details on death benefits, survivor benefits, and payout options

- Comparison with Other Plans: How FGEGL compares to other life insurance plans

FGEGL Coverage: Basic overview of FGEGL insurance, its benefits, and types

FGEGL, or Federal Government Employees Group Life Insurance, is a comprehensive life insurance program designed specifically for federal employees in the United States. It offers a range of coverage options to provide financial security to employees and their beneficiaries in the event of the insured's death. This insurance is an essential component of the benefits package for federal workers, ensuring that their families are protected even if they are no longer able to provide for them.

The primary benefit of FGEGL is its affordability and the extensive coverage it provides. It is a group life insurance program, which means that the cost of the policy is typically shared by the employer and the employee, making it more accessible and cost-effective compared to individual life insurance plans. The coverage amount can vary depending on the employee's position, age, and the number of years they have been with the federal service. FGEGL offers a standard basic coverage of $50,000, which can be increased up to $100,000 or more, providing a substantial financial safety net for the insured's family.

There are two main types of FGEGL coverage: Basic and Optional. The Basic coverage is mandatory for all federal employees and provides the standard $50,000 death benefit. This coverage is a valuable asset for employees, ensuring that their families receive financial support during a difficult time. The Optional coverage, on the other hand, allows employees to purchase additional life insurance beyond the basic coverage. This can be particularly useful for those with higher financial needs or those who want to ensure their family's long-term financial stability. Optional coverage can be increased in increments of $10,000, up to a maximum of $100,000.

One of the key advantages of FGEGL is its portability. Federal employees can continue their FGEGL coverage even if they change jobs or retire, provided they maintain their federal status. This portability ensures that employees can maintain their life insurance coverage throughout their career, providing peace of mind and financial security. Additionally, FGEGL offers a range of payment options, allowing employees to choose the most suitable plan for their financial situation.

In summary, FGEGL is a valuable life insurance program tailored to federal employees, offering affordable and extensive coverage. With its mandatory basic coverage and optional additional benefits, FGEGL ensures that federal workers can provide financial security for their families. The portability and flexibility of this insurance make it an attractive option for those seeking reliable life insurance coverage in their professional capacity. Understanding the details of FGEGL can help employees make informed decisions about their insurance needs and ensure their loved ones are protected.

Standard Life Health Insurance: Maternity Coverage Explained

You may want to see also

Eligibility Criteria: Who is eligible for FGEGL coverage and how to qualify

FGEGL, or Federal Government Employees Group Life Insurance, is a comprehensive life insurance program designed specifically for federal employees in the United States. It offers a range of coverage options to suit the diverse needs of these employees and their families. Understanding the eligibility criteria is crucial for those seeking to enroll in this valuable benefit.

Eligibility for FGEGL coverage is primarily based on employment status and role within the federal government. Here's a breakdown of who qualifies:

- Federal Employees: Active employees of the federal government, including those working for the executive, legislative, and judicial branches, are eligible. This includes a wide range of professions, from government officials and military personnel to scientists, educators, and administrative staff.

- Military Personnel: Members of the Armed Forces serving on active duty are also eligible for FGEGL. This coverage extends to active-duty personnel in the Army, Navy, Air Force, Marines, and Coast Guard.

- Retirees and Annuitants: Federal employees who have retired or are receiving an annuity from the federal government are eligible for FGEGL. This ensures that even after retirement, these individuals can maintain a level of financial security for their loved ones.

- Surviving Spouses and Dependents: In the event of a federal employee's death, their surviving spouse and eligible dependents are entitled to FGEGL benefits. This provision offers crucial financial support during challenging times.

To qualify for FGEGL coverage, federal employees must meet specific requirements. Firstly, they must be actively enrolled in the Federal Employees Health Benefits Program (FEHBP), which is a comprehensive health insurance program for federal employees. This enrollment is a prerequisite for accessing FGEGL. Additionally, employees must complete an application process, providing relevant personal and employment information to the FGEGL program administrators. The application ensures that the coverage is tailored to the individual's needs and employment status.

It is important to note that FGEGL coverage can be adjusted based on the employee's role and preferences. Federal employees can choose from various coverage options, including basic life insurance, additional life insurance, and optional riders. This flexibility allows employees to customize their coverage to align with their specific circumstances and financial goals.

In summary, FGEGL coverage is an essential benefit for federal employees and their families, offering financial security and peace of mind. Understanding the eligibility criteria and enrollment process is the first step toward securing this valuable life insurance program. By meeting the employment and enrollment requirements, federal employees can ensure they and their loved ones are protected with appropriate coverage.

Life Insurance Basics: Unum's Essential Coverage Explained

You may want to see also

Policy Types: Different types of FGEGL policies and their unique features

FGEGL, or Federal Government Employees Group Life Insurance, is a comprehensive life insurance program designed specifically for federal employees in the United States. It offers various policy types, each with distinct features and benefits tailored to different needs. Understanding these policy types is crucial for federal employees to make informed decisions about their life insurance coverage.

Basic Level of Insurance: The most basic FGEGL policy provides a standard level of coverage. It typically offers a fixed amount of insurance, often ranging from $50,000 to $100,000, depending on the employee's grade and salary. This policy is straightforward and provides a solid foundation of financial protection for the employee's beneficiaries in the event of their passing.

Optional Level of Insurance: FGEGL also allows employees to purchase an optional level of insurance, which provides additional coverage beyond the basic amount. This option is particularly beneficial for those seeking higher protection. The optional insurance can be purchased in increments of $10,000, up to a maximum of $500,000. By opting for this feature, employees can ensure that their loved ones receive a substantial financial benefit in the event of their death.

Group Term Life Insurance: This policy type is a term life insurance plan that is part of the FGEGL program. It offers coverage for a specific period, typically one to ten years, and provides a predetermined death benefit. Group term life insurance is often more affordable compared to individual term life policies, making it an attractive option for federal employees. The coverage amount can vary, and employees can choose the term length that best suits their needs.

Convertibility: One unique feature of FGEGL is the convertibility option. This allows employees to convert their term life insurance into a permanent life insurance policy, such as whole life or universal life, after a certain period. Convertibility ensures that employees can adapt their insurance plan as their needs change over time, providing long-term financial security.

Additional Benefits: FGEGL policies may also include various riders and optional benefits. For instance, the "Accidental Death Benefit" rider provides an additional payout if the insured's death is a result of an accident. Other riders might offer coverage for critical illnesses or disability. These additional features can enhance the policy's value and provide comprehensive protection.

Understanding the different policy types and their unique features is essential for federal employees to choose the right FGEGL coverage. Each policy type caters to specific needs, ensuring that employees can select the level of protection that aligns with their financial goals and provides peace of mind for their loved ones.

Life Insurance Exclusion Period: Understanding the Waiting Time

You may want to see also

Benefits and Payouts: Details on death benefits, survivor benefits, and payout options

FEGLI, short for Federal Employees Group Life Insurance, is a comprehensive life insurance program designed specifically for federal employees in the United States. It offers a range of benefits and payout options to provide financial security for the policyholder's beneficiaries in the event of their passing.

One of the key features of FEGLI is the death benefit, which is a lump-sum payment made to the designated beneficiaries upon the insured individual's death. This benefit is a critical source of financial support for the family, helping to cover various expenses such as funeral costs, outstanding debts, and daily living expenses. The death benefit amount is typically based on the policyholder's salary and can be adjusted annually to account for salary increases. This ensures that the financial protection provided by FEGLI keeps pace with the policyholder's earning potential.

In addition to the death benefit, FEGLI also provides survivor benefits, which are designed to support the insured individual's spouse, children, or other designated beneficiaries in the long term. These benefits can be particularly valuable if the primary breadwinner in a family passes away. Survivor benefits can be paid as a monthly income for the remaining years of the beneficiary's life, providing a steady financial stream to cover essential costs. The amount of survivor benefits is often a percentage of the death benefit and can be tailored to the specific needs of the family.

The payout options within FEGLI are flexible, allowing policyholders to choose how they prefer their benefits to be distributed. One common option is a single-sum payout, where the entire death benefit is paid out as a lump sum to the beneficiaries. This provides a significant financial windfall, which can be used to pay off debts, invest in assets, or provide a substantial inheritance. Alternatively, some policyholders may opt for an income payout, where the death benefit is paid out over a period, providing a regular income stream to the beneficiaries. This option is especially useful for those who want to ensure a steady financial flow for their family over an extended period.

Furthermore, FEGLI offers the option to convert the death benefit into a long-term care benefit, which can be valuable for those who want to ensure their beneficiaries are protected in the event of their own long-term care needs. This conversion allows the death benefit to be used to cover medical expenses and daily living costs, providing an additional layer of financial security.

In summary, FEGLI provides a robust set of benefits and payout options, ensuring that federal employees and their families are financially protected. The death benefit offers a lump-sum payment to cover immediate expenses, while survivor benefits provide long-term financial support. The flexibility in payout options allows policyholders to choose the best course of action for their beneficiaries, ensuring a secure financial future. Understanding these benefits and payout structures is essential for federal employees to make informed decisions about their life insurance coverage.

Finding the Best Term Life Insurance for You

You may want to see also

Comparison with Other Plans: How FGEGL compares to other life insurance plans

FGEGL, or Federal Government Employees Group Life Insurance, is a unique type of life insurance plan offered to federal employees in the United States. It is a form of group term life insurance, providing coverage to employees and their beneficiaries. When comparing FGEGL to other life insurance plans, several distinct features set it apart.

One of the key advantages of FGEGL is its simplicity and ease of understanding. Unlike some other life insurance plans, FGEGL offers a straightforward structure with no complex investment components. This simplicity ensures that employees can easily comprehend their coverage and the associated benefits. The plan's structure is based on a set rate per thousand of the employee's salary, making it a transparent and predictable form of insurance.

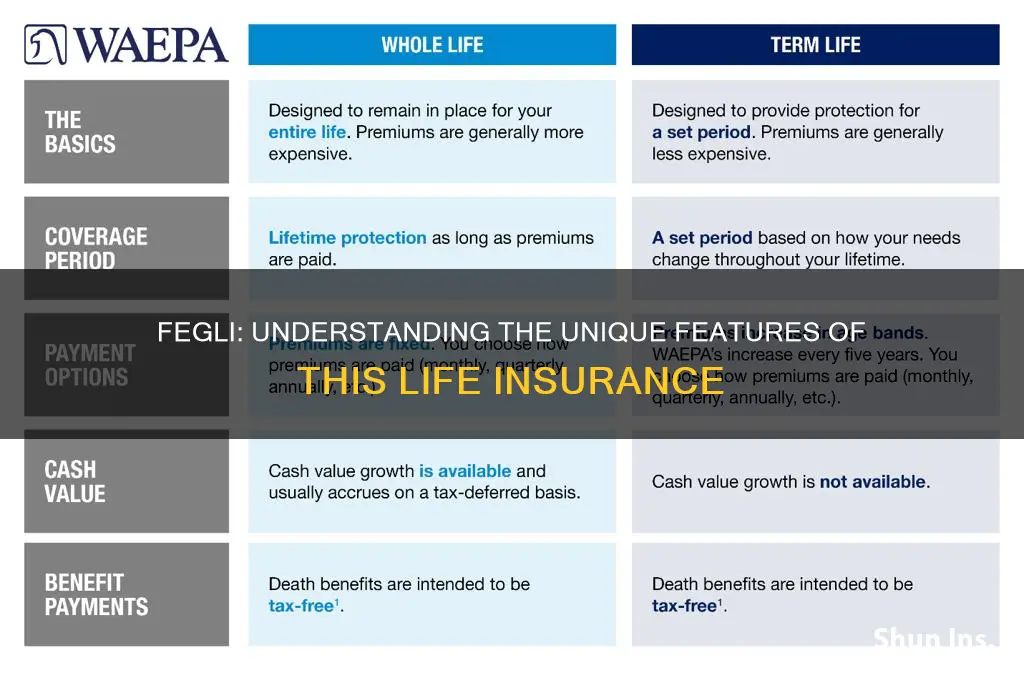

In contrast to permanent life insurance, which provides lifelong coverage, FGEGL is a term life insurance. This means it offers coverage for a specific period, typically one year, and requires renewal annually. While this may seem like a drawback, it provides a cost-effective solution for federal employees, as the premiums are generally lower compared to permanent plans. The annual renewal process also allows employees to reassess their coverage needs and adjust their policy accordingly.

When compared to whole life insurance, FGEGL has some notable differences. Whole life insurance provides lifelong coverage with fixed premiums, and the policy's cash value grows over time. In contrast, FGEGL is a term policy, and its coverage is limited to the specified term. Additionally, whole life insurance offers a guaranteed death benefit, whereas FGEGL's benefit is based on the employee's salary and can vary. However, FGEGL's simplicity and lower premiums make it an attractive option for those seeking basic term life insurance.

Another advantage of FGEGL is its availability to federal employees, including those in the military and their families. This accessibility ensures that a wide range of federal workers can benefit from this insurance plan. While other life insurance plans may have specific eligibility criteria, FGEGL's inclusion of federal employees and their dependents is a significant advantage.

In summary, FGEGL stands out among other life insurance plans due to its simplicity, transparency, and accessibility. Its term-based structure, lower premiums, and availability to federal employees make it a valuable option for those seeking basic life insurance coverage. Understanding these comparisons can help employees make informed decisions about their insurance needs and choose the most suitable plan for their circumstances.

Unveiling the Average Salary: Life Insurance Agent Earnings Demystified

You may want to see also

Frequently asked questions

FELGI is a group life insurance program offered to federal employees in the United States. It provides coverage to employees and their beneficiaries in the event of the employee's death.

FELGI is a no-lapse guaranteed death benefit plan, meaning the insurance company guarantees the death benefit will not decrease over time. It also offers a higher death benefit compared to some other group life insurance plans.

Federal employees, including those in the military, are automatically enrolled in FELGI. Spouses and dependent children of covered employees can also be added to the policy.

The death benefit from FELGI provides a lump-sum payment to the beneficiary(ies) upon the insured employee's death. This financial support can help cover various expenses, such as funeral costs, outstanding debts, and living expenses for the family.

Yes, FELGI offers flexibility in terms of coverage. Employees can choose to increase or decrease their coverage by a multiple of $500, up to a maximum of $50,000. This option allows individuals to customize their insurance coverage based on their specific needs and preferences.