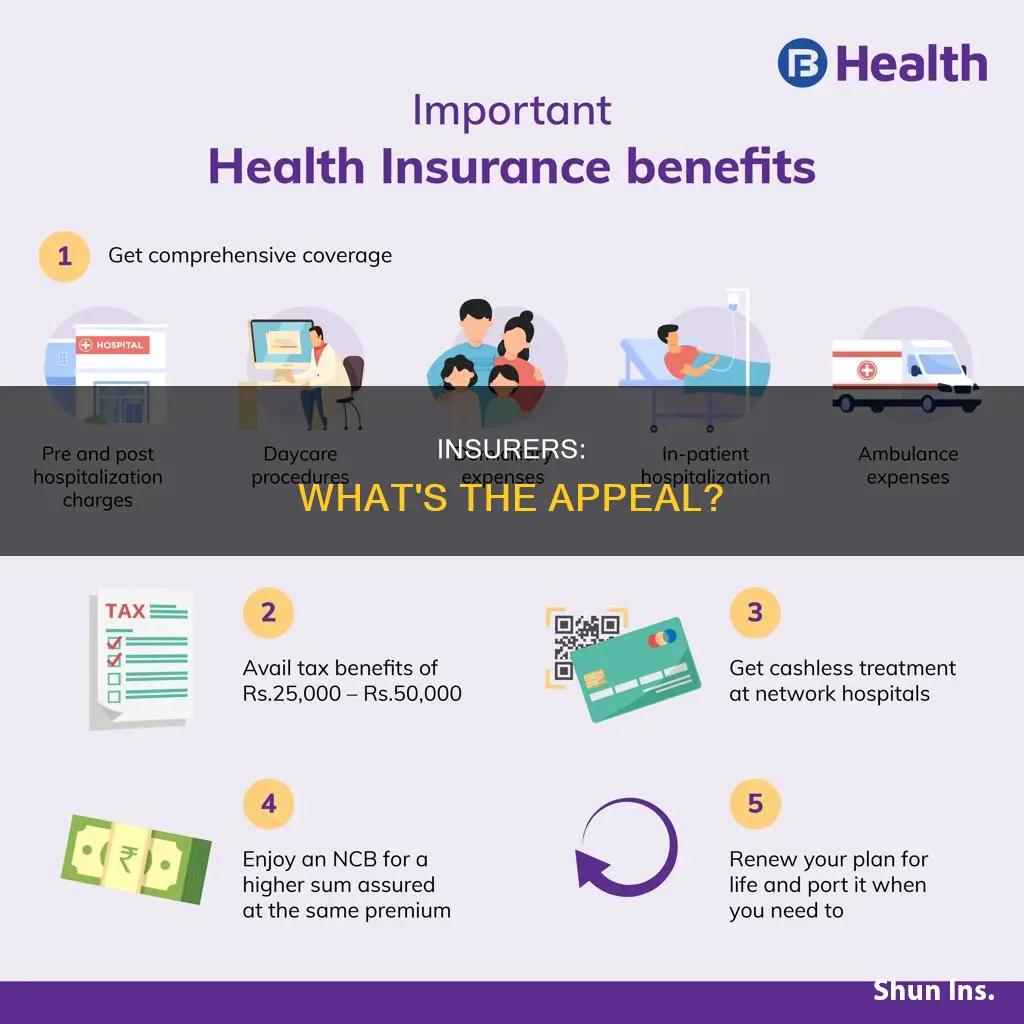

People insure to protect themselves financially from unpredictable, expensive events. For example, health insurance covers the cost of medical treatment, while car insurance provides financial protection in the event of an accident. Insurance is also important for protecting assets, such as homes, cars, and other valuables. By paying an insurance company regularly, individuals can gain peace of mind, knowing that they will be financially covered if something goes wrong.

| Characteristics | Values |

|---|---|

| Protecting assets | Financial protection against loss or damage |

| Peace of mind | Protection against unexpected expenses |

| Compliance with the law | Some types of insurance are legally required |

| Protecting dependents | Life insurance protects those financially dependent on you |

| Avoiding lawsuits | Insurance can protect against costly lawsuits |

What You'll Learn

To protect the people financially dependent on you

Life insurance is a valuable asset if you want to protect the people who are financially dependent on you. This is especially true if you are the higher earner in your household. In the event of your passing, a good insurance policy can be a lifeline for your dependents, protecting them from the financial burden of losing a primary source of income.

In the context of health insurance, dependents can include your spouse, children, and sometimes other relatives like stepchildren or legally adopted children. The rules vary by plan and location, so it's important to check with your insurance provider. Generally, you can add all biological and stepchildren, children under your care who are financially dependent on you, and children who can receive your benefits due to a court order. You can also cover adult children up to the age of 26, although there may be caveats if they are college students.

It's worth noting that if you can count someone as a dependent on your taxes, they are also considered a dependent on your health insurance plan. This means you are required to provide health insurance for anyone you claim as a tax dependent. By doing so, you are protecting them financially and ensuring they have access to essential healthcare services.

Additionally, life insurance can also protect your loved ones from the financial strain of a costly funeral. It is a way to ensure that your death does not impact your dependents with unnecessary financial hardship.

The Mystery of Subsidence: Unraveling the Insurance Enigma

You may want to see also

To protect your assets

Protecting your assets is a crucial aspect of financial planning, especially if you are a business owner. Here are some ways to safeguard your assets:

Insurance

Insurance is essential to protect your assets from various risks. There are two primary types: liability insurance and property insurance. Liability insurance covers damages you cause to others, including personal injuries and property damage. Property insurance, on the other hand, covers damage to your property caused by others.

When choosing insurance, it's important to understand the different types and amounts needed for your specific situation. Consult with a local insurance agent to obtain quotes and advice.

Business Entity Creation

Creating a business entity provides a layer of protection by establishing your business as a separate legal entity. This helps prevent you from being personally liable for the company's debts or legal liabilities. Common business structures include Limited Liability Companies (LLCs) and S-Corporations.

Proper Legal Agreements

Having proper legal agreements in place is vital for protecting your business. Consult a professional business attorney to create, review, and update your company's legal documents, ensuring compliance with state requirements.

Protect Personal Assets

In addition to business assets, it's crucial to safeguard your personal assets. Homeowners insurance, auto insurance, and life insurance are essential tools to protect your valuable assets, such as your home and vehicle, and provide financial security for your loved ones.

Umbrella Coverage

Umbrella coverage provides additional protection on top of your existing insurance policies. It offers increased financial security by covering costs that exceed the limits of your primary policies, providing extra peace of mind.

Retirement Plans

Retirement plans, such as IRAs and company-sponsored plans, often have unlimited protection from bankruptcy and creditors. Maxing out contributions to these plans can be an effective way to protect your assets.

Prenuptial Agreements

A prenuptial agreement is a legal document that specifies the division of assets and other financial matters in the event of a divorce. With a high divorce rate, this type of agreement can provide "insurance" for your assets.

Homestead Exemptions

Some states offer homestead exemptions that protect the equity of your primary residence from creditors. These exemptions vary by state, with some offering unlimited protection. Consult a local attorney or government office to understand the rules applicable to your home.

By implementing these strategies, you can effectively protect your assets and ensure financial security for yourself and your loved ones.

The Intricacies of Insurance Occurrences: Unraveling the Legal and Financial Implications

You may want to see also

To make certain of something

Insurance is a way to make certain that you are financially protected in the event of an accident, natural disaster, or another unexpected incident. For example, if you have car insurance and get into a car accident, your insurance company will help cover the cost of repairs or a new vehicle. Similarly, if you have health insurance and become ill or injured, your insurance will help pay for your medical treatment.

The basic principle of insurance is to spread the risk among a group of people. When you buy insurance, you are essentially paying into a pool of money that will be used to cover the costs of any claims made by policyholders. This means that if you have a large expense that you couldn't afford on your own, insurance can provide financial protection.

It's important to note that insurance is not meant for predictable expenses. For example, there is no need for "property tax insurance" because the insurance company would have to charge a premium that covers the cost of the property taxes anyway, plus their profit. In this case, it would be more cost-effective to budget and save for the expense yourself.

When deciding what to insure, consider the risk and whether it is something you can afford to cover on your own. If the risk is substantial and you cannot bear the cost alone, insurance is a good option.

Understanding Confidentiality: STD Testing and Insurance Claims

You may want to see also

To guarantee or protect the monetary value of something

People insure things to guarantee or protect the monetary value of something. This means that they are protecting their valuables against loss or damage from accidents by taking out insurance policies. Insuring something means paying an insurance company regularly so that if something goes wrong, they will help cover the costs.

Insurance is a system of protection against financial loss that is built on the assumption that the risk of loss can be predicted and quantified. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. Insurance policies are used to hedge against the risk of financial losses, both big and small, that may result from damage to the insured or her property, or from liability for damage or injury caused to a third party.

Insurance works by pooling risk. Insurers use actuarial science to calculate the risk of losses and determine the amount of money that should be collected in premiums to cover the expected losses while making a profit. Insurers can then use the money from premiums to invest and make a profit.

Insurance policies are also used to protect against financial losses that may result from liability for damage or injury to a third party. For example, a person may take out a life insurance policy to ensure that their loved ones will not suffer financial costs associated with losing them. This is especially important when considering how losing a home provider or the costs of a funeral can impact a person's loved ones.

Insurance is also crucial for protecting people from those who are trying to take advantage of them, such as fraudulent claims of injury to pay for non-existent medical bills, or auto-theft and burglaries.

Stress-Free Guide to Switching Health Insurance

You may want to see also

To provide payment in the event of an accident

People insure themselves and their belongings to provide payment in the event of an accident. This means that if something goes wrong, the insurance company will help cover the costs. Insuring is the act of providing or obtaining an insurance policy through an insurance company. This is done by paying an insurance company at regular intervals so that if something goes wrong, they will provide compensation.

Insurance is particularly important for protecting against financial loss in the event of an accident. For example, if you are in a car accident, insurance can help cover the costs of your injuries, vehicle damage, and other expenses. This is especially important if you live in an at-fault state, where the person who caused the accident (or their insurance company) is responsible for paying the damages.

It is important to carefully review the insurance application before signing to ensure that the coverages, policy limits, and deductibles meet your needs. Once you have insurance, it is crucial to understand what is covered and what is excluded. In the event of an accident, you will need to follow the necessary steps, such as notifying your insurance company and providing any required documentation, to ensure that your claim is accepted and that you receive the necessary payment.

In addition to car insurance, people may also want to consider other types of insurance, such as health insurance, home insurance, or life insurance, to protect themselves and their loved ones financially in the event of an accident or other unexpected events. Ultimately, insurance provides peace of mind and financial security, ensuring that people are not left struggling to cover the costs of unexpected accidents or incidents.

Windshield Woes: Understanding Insurance Claims for Auto Glass Replacements

You may want to see also

Frequently asked questions

People insure their valuables to protect themselves financially in the event of accidents, damage, or loss. This provides peace of mind and helps safeguard their assets and earning power.

Yes, in most places, it is mandatory to have automobile insurance. Additionally, in certain US states, it is illegal not to have health insurance and some form of car insurance.

Aside from health and car insurance, people often consider getting homeowner's insurance, long-term disability insurance, and life insurance, especially if they have people financially dependent on them.

Insurance is a risk-management tool. A group of people pay into an insurance policy to protect against a specific risk. If something happens, the insurance company provides financial compensation to cover the costs.