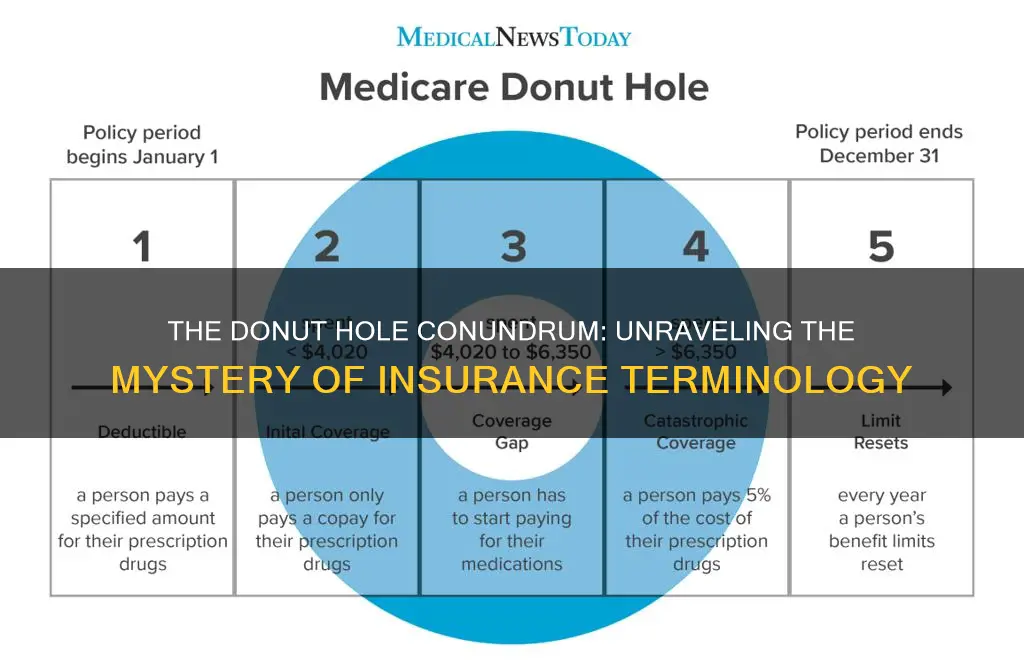

The donut hole is a term used in insurance to describe a coverage gap in most Medicare Part D prescription drug plans. This gap refers to a temporary limit on what the drug plan will cover for drugs after the total amount paid by the insured and the drug plan reaches a certain threshold. In 2024, this limit is $5,030, and it may change annually. Once this limit is reached, the insured enters the donut hole and becomes responsible for a higher percentage of the drug cost, typically 25%, until their out-of-pocket expenses reach a specified amount, after which the plan resumes covering a larger share of the drug costs.

| Characteristics | Values |

|---|---|

| What is it? | A coverage gap in Medicare Part D prescription drug plans |

| When does it occur? | After you and your plan have spent a certain amount on covered drugs during a calendar year ($5,030 in 2024) |

| Who does it apply to? | Not everyone will enter the donut hole. It does not apply to members who get Extra Help to pay for their Part D costs. |

| What happens when you're in the donut hole? | You pay a maximum of 25% of the cost of brand-name and generic prescription drugs covered by your plan. You will also pay 25% of the dispensing fee. |

| How do you get out of the donut hole? | Your total out-of-pocket costs must reach $8,000. At this point, you enter the catastrophic coverage stage, where your plan pays most of the cost for your drugs. |

What You'll Learn

The donut hole is a temporary limit on what a drug plan will cover

The "donut hole" is a term used to refer to the point at which a drug plan reaches its limit on what it will cover for drugs. Most Medicare Part D prescription drug plans have a coverage gap, commonly known as the "donut hole". This means that there is a temporary limit on what the drug plan will cover for drugs.

The "donut hole" is the third of four payment stages in Medicare Part D plans. You enter the "donut hole" when your total drug costs—including what you and your plan have paid for your drugs—reach a certain limit. In 2024, that limit is $5,030. This amount may change each year.

Once you enter the "donut hole", you are responsible for a percentage of the cost of your drugs. In 2024, you will pay no more than 25% of the cost for brand-name and generic prescription drugs covered by your plan. You will also pay 25% of the dispensing fee. The amount you pay will count toward your out-of-pocket spending, helping you get out of the "donut hole".

Not everyone will enter the "donut hole". People with Medicare who get Extra Help paying Part D costs will never enter it. Additionally, due to changes in the Inflation Reduction Act (IRA), starting in 2025, there will no longer be a "donut hole" on Medicare Part D plans.

The Intricacies of Level Term Insurance: Unraveling the Meaning of "Level

You may want to see also

It is also known as the coverage gap

The "donut hole" in insurance terms refers to a coverage gap in the Part D prescription drug benefit. It is a phase in Medicare Part D prescription drug coverage where beneficiaries must bear a higher portion of their medication costs. This phase begins after the initial coverage period, when the total drug costs—including what the beneficiary and the plan have paid for the drugs—reach a certain limit. This limit may change annually and was $5,030 in 2024. During the coverage gap, beneficiaries are responsible for a percentage of the cost of their drugs, typically 25%.

The term "donut hole" is used to describe this phase because it represents a gap in the middle of the overall prescription drug coverage. The initial coverage phase covers the outer ring of the circle, where both the beneficiary and the plan share the cost. Then, there is a gap in the middle (resembling a hole) where the beneficiary has to pay more. Finally, the catastrophic coverage phase covers the inner circle, where costs are significantly reduced for the beneficiary.

The donut hole or coverage gap can have significant financial implications for beneficiaries, especially regarding brand-name and generic medications. During this phase, beneficiaries with brand-name medications will have the amount they pay for the prescription drug and the manufacturer discount applied to the coverage gap. On the other hand, if a beneficiary purchases a generic medication, only the amount they pay for the medication applies to the coverage gap. This means that beneficiaries who choose generic prescription drugs may take longer to reach the catastrophic coverage phase.

It is important to note that not everyone will enter the coverage gap. People with Medicare who receive Extra Help paying Part D costs will not enter the coverage gap and will have different drug costs throughout the year. Additionally, due to changes in the Inflation Reduction Act, starting in 2025, there will no longer be a coverage gap stage on Medicare Part D plans.

Policybazaar's Term Insurance: A Safe Bet for Long-Term Financial Security?

You may want to see also

The donut hole occurs after the initial coverage period

The "donut hole" refers to a coverage gap in most Medicare Part D prescription drug plans. This coverage gap occurs after the initial coverage period, when the total amount paid by the insured and the plan for prescription drugs reaches a certain limit, which was $5,030 in 2024. During the donut hole stage, there is a temporary limit to what the drug plan will cover for drugs. This means that the insured will have to pay all costs out-of-pocket for their prescriptions up to a yearly limit.

Once in the donut hole, the insured will pay no more than 25% of the cost for brand-name and generic prescription drugs covered by their plan. Additionally, they will pay 25% of the dispensing fee. The insured will pay a discounted rate if they buy their medications at a pharmacy or through the mail. It is important to note that only the amount paid by the insured will count towards getting out of the donut hole.

To exit the donut hole, the insured's total out-of-pocket costs must reach a certain limit, which was $8,000 in 2024. At this point, they enter the catastrophic coverage stage, where their plan pays most of the cost for their drugs. They may only need to pay a small copay or coinsurance, and they will remain in this stage for the rest of the year.

Not everyone will enter the donut hole stage. Those with Medicare who receive Extra Help with their Part D costs will not experience the coverage gap. Additionally, due to changes in the Inflation Reduction Act (IRA) in 2022, starting in 2025, there will no longer be a coverage gap stage on Medicare Part D plans.

Long-Term Security: Exploring the Benefits of 20-Year Term Life Insurance Plans

You may want to see also

Not everyone will enter the donut hole

The donut hole, or coverage gap, is a phase of Medicare Part D coverage that begins when the total cost of drugs—including what the beneficiary and their plan have paid—reaches a certain limit. This limit was \$5,030 in 2024. Once this limit is reached, the beneficiary enters the coverage gap and becomes responsible for a percentage of the cost of their drugs.

However, not everyone will enter the donut hole. Firstly, this coverage gap only applies to Medicare Part D prescription drug plans, and not all Medicare plans are the same. Secondly, people with Medicare who get Extra Help paying Part D costs won't enter the coverage gap. This includes people who qualify for Extra Help, a low-income subsidy designed to help with prescription drug costs.

The Intricacies of Insurance Twisting: Unraveling the Practice and Its Impact

You may want to see also

You can leave the donut hole by reaching a certain amount in out-of-pocket costs

The "donut hole" is a colloquial term for the coverage gap in Medicare Part D, which is a prescription drug benefit plan. It refers to the point where a person has to pay for their medications out of pocket until their insurance begins cost-sharing again. This occurs when the total drug costs, including what the individual and their plan have paid, reach a certain limit. In 2024, this limit is $5,030. While in the coverage gap, individuals are responsible for a percentage of the cost of their drugs, typically 25%.

To leave the donut hole, an individual must reach a certain amount in out-of-pocket costs. In all Part D plans, catastrophic coverage is reached after an individual incurs $8,000 in out-of-pocket expenses for covered drugs. This amount includes what the individual paid during the initial coverage period, almost the full cost of brand-name drugs purchased during the coverage gap, and amounts paid by others on their behalf, such as family members or financial assistance programs. During catastrophic coverage, the individual owes no cost-sharing for the remainder of the year, and their plan pays most of the cost for their drugs.

It is important to note that not everyone will enter the donut hole or coverage gap. Additionally, people with Medicare who receive Extra Help with Part D costs will not enter the coverage gap and will have different drug costs throughout the year.

Minimizing the Cost of Nylon-Term Insurance: Strategies for Savvy Consumers

You may want to see also

Frequently asked questions

A donut hole, or coverage gap, refers to a limit on what a drug plan will cover for drugs in most Medicare Part D prescription drug plans.

Once you and your plan have spent a certain amount on covered prescription drugs during a calendar year, you reach the coverage gap and are considered to be in the "donut hole". In 2024, that limit is $5,030.

When you're in the donut hole, you will be responsible for a percentage of the cost of your drugs. In 2024, you will pay no more than 25% of the cost of brand-name and generic prescription drugs covered by your plan.

In all Part D plans, you enter catastrophic coverage after you reach $8,000 in out-of-pocket costs for covered drugs. During this period, you will pay no cost-sharing for the cost of your covered drugs for the remainder of the year.

Not everyone will enter the donut hole. People with Medicare who get Extra Help paying Part D costs won't enter the coverage gap.