The ability to sell life insurance is a skill that not everyone possesses, and it's important to understand the demographics and expertise of those who can offer this essential financial product. This paragraph aims to explore the percentage of the population that can effectively sell life insurance, shedding light on the specialized knowledge and skills required for success in this field. By examining various factors, we can gain insight into the limited number of individuals who are qualified to provide this crucial service to others.

What You'll Learn

- Regulatory Requirements: Understanding legal and licensing standards for life insurance sales

- Market Trends: Analyzing sales data to identify growth patterns and potential

- Demographic Analysis: Examining age, income, and education to target specific customer groups

- Product Knowledge: Understanding various life insurance policies and their benefits

- Sales Techniques: Employing effective strategies to engage and convert potential clients

Regulatory Requirements: Understanding legal and licensing standards for life insurance sales

The sale of life insurance is a highly regulated industry, and understanding the legal and licensing requirements is essential for anyone looking to enter this field. These regulations are in place to protect consumers and ensure that only qualified individuals provide life insurance advice and services. Here's an overview of the key regulatory considerations:

Legal and Professional Qualifications: Selling life insurance often requires specific legal and professional qualifications. Many countries have laws that mandate individuals must be licensed or registered to offer such financial products. For instance, in the United States, life insurance agents and brokers must obtain a state-issued license. This process typically involves passing exams, such as the Life and Health Insurance License Examination (LIKE) or the Series 6 and 63 exams, which assess knowledge of insurance principles, product offerings, and regulatory compliance. Similarly, in the UK, the Financial Conduct Authority (FCA) regulates insurance intermediaries, including those selling life insurance, and requires them to meet specific fitness and propriety standards.

Regulatory Bodies and Their Roles: Regulatory bodies play a crucial role in overseeing the life insurance industry. These organizations set and enforce rules to ensure fair practices and consumer protection. For example, the National Association of Insurance Commissioners (NAIC) in the US provides guidelines and standards for insurance regulation, including life insurance. They offer licensing requirements, continuing education mandates, and guidelines for ethical conduct. In other jurisdictions, similar regulatory bodies exist, such as the Insurance Regulatory Authority (IRA) in Kenya or the Insurance Regulatory and Development Authority (IRDA) in India, each with its own set of rules and licensing criteria.

Continuing Education and Training: Regulatory requirements often emphasize the importance of ongoing education and training. Life insurance professionals must stay updated with industry changes, new products, and regulatory updates. Many regulatory bodies mandate continuing education hours or require agents to participate in regular training programs. These programs ensure that advisors and brokers remain knowledgeable about legal obligations, ethical standards, and best practices in selling life insurance.

Compliance and Ethical Standards: Adherence to compliance and ethical standards is vital for life insurance sales. Regulatory bodies often provide guidelines on fair treatment of customers, accurate product representation, and transparency in fees and commissions. For instance, the Insurance Information Institute (III) in the US offers resources and guidelines to help consumers understand their rights and the responsibilities of insurance professionals. Ethical conduct is a cornerstone of the profession, ensuring that advisors act in the best interest of their clients.

Licensing and Registration Process: The licensing or registration process varies by region and regulatory body. It typically involves submitting an application, providing personal and professional information, and meeting specific criteria. This may include background checks, proof of education or training, and passing relevant examinations. Once licensed, individuals must adhere to ongoing regulatory requirements, such as maintaining a certain level of professional liability insurance and providing regular updates to their regulatory body.

Understanding these regulatory requirements is crucial for anyone aiming to enter the life insurance sales profession. It ensures that individuals are well-informed about the legal obligations and standards they must meet, ultimately benefiting both the industry and its consumers.

How Life Insurance Defers Earned Income Tax

You may want to see also

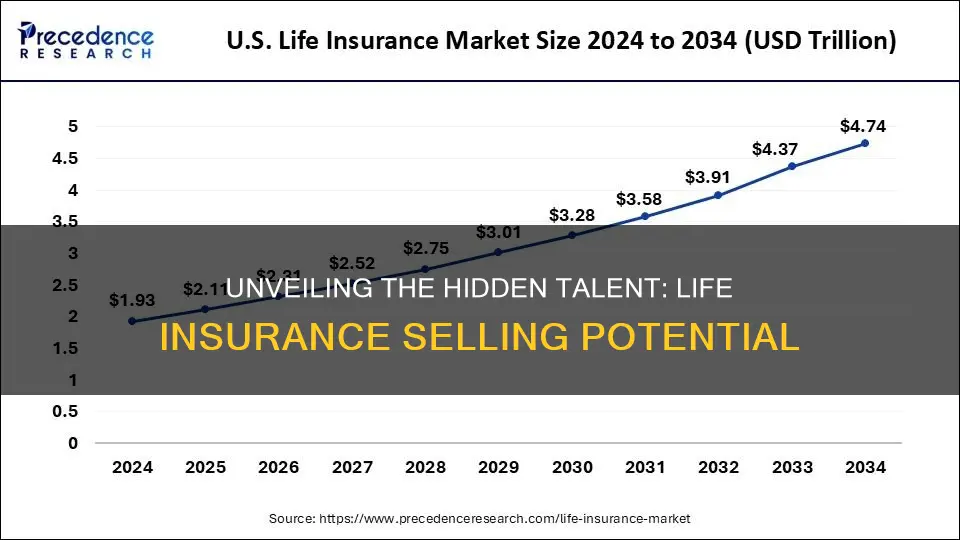

Market Trends: Analyzing sales data to identify growth patterns and potential

The insurance industry, particularly the life insurance sector, is a dynamic and ever-evolving market. Understanding sales trends and identifying growth patterns is crucial for insurance companies to stay competitive and meet the evolving needs of their customers. By analyzing sales data, insurers can gain valuable insights into consumer behavior, market preferences, and emerging trends, allowing them to make informed decisions and adapt their strategies accordingly.

One of the key aspects of analyzing sales data is identifying growth patterns. This involves studying historical sales figures and trends over time. By examining these patterns, insurers can determine which products or services are gaining popularity and why. For instance, a consistent increase in sales of term life insurance over the past few years could indicate a growing awareness of the need for financial security among the population. This information can be used to optimize product offerings and marketing strategies.

Market trends can also be identified by analyzing demographic data. Different age groups, genders, and income brackets may have varying preferences and purchasing behaviors. For example, younger individuals might prefer more affordable term life insurance policies, while older adults may opt for whole life insurance to ensure long-term financial security. By segmenting the market and understanding these preferences, insurers can tailor their products and marketing campaigns to specific demographics, thus increasing sales and customer satisfaction.

Furthermore, sales data analysis can help identify potential areas of growth and expansion. For instance, if there is a significant increase in sales in a particular region or among a specific demographic, it could indicate a growing demand for insurance products in that area. Insurers can then consider expanding their operations or introducing new products to tap into these emerging markets. This proactive approach can help companies stay ahead of the competition and capitalize on emerging trends.

In addition to identifying growth patterns, analyzing sales data can also reveal areas that require improvement or innovation. If certain products consistently underperform, it may indicate a need for product redesign or the introduction of new features to meet changing consumer expectations. By staying agile and responsive to market trends, insurance companies can ensure they remain relevant and competitive in a rapidly changing business landscape.

In summary, analyzing sales data is a powerful tool for insurance companies to gain a competitive edge. It allows them to identify growth patterns, understand market trends, and make data-driven decisions. By staying attuned to consumer behavior and market dynamics, insurers can optimize their product offerings, marketing strategies, and overall business approach, ultimately leading to increased sales and customer loyalty. This proactive and analytical approach is essential for success in the life insurance industry.

Life Insurance Payouts: Taxed in Canada?

You may want to see also

Demographic Analysis: Examining age, income, and education to target specific customer groups

Demographic analysis is a powerful tool for understanding and targeting specific customer groups in the insurance industry, particularly when it comes to life insurance sales. By examining age, income, and education levels, insurance companies can tailor their strategies to appeal to different segments of the population, ensuring that their products and services meet the unique needs of these diverse groups.

Age is a critical factor in life insurance sales. Younger individuals often have different priorities compared to older adults, and this can influence their purchasing decisions. For instance, younger adults might be more inclined to purchase term life insurance, which provides coverage for a specific period, often until a certain age. This type of policy is typically more affordable and can be a practical choice for those starting their careers and families. On the other hand, older adults may be more interested in permanent life insurance, which offers lifelong coverage and can be a valuable asset for estate planning and wealth accumulation. Understanding these age-related preferences allows insurance agents to recommend the most suitable products, ensuring that younger clients feel their needs are met and older clients receive appropriate advice.

Income level also plays a significant role in demographic analysis. Higher-income individuals often have more complex financial needs and may require comprehensive life insurance solutions. They might be interested in policies that provide substantial coverage, such as whole life insurance, which offers a combination of death benefit, cash value accumulation, and investment opportunities. These individuals may also appreciate the tax advantages and long-term financial planning benefits associated with certain life insurance products. In contrast, lower-income earners might prefer more affordable options, such as term life insurance with lower coverage amounts, ensuring that the policy remains accessible and affordable without compromising their financial stability.

Education level is another important demographic factor. Insurance agents can adapt their sales strategies by understanding the educational background of their target audience. For instance, individuals with higher education levels may have a better understanding of financial concepts and be more inclined to explore complex insurance products. They might appreciate the detailed explanations and benefits associated with whole life insurance or universal life insurance, which offer flexibility and potential investment returns. Conversely, those with lower educational attainment might prefer simpler, more straightforward policies, ensuring that the product is easy to understand and the sales process is transparent.

By analyzing these demographics, insurance companies can create targeted marketing campaigns and develop tailored products. For example, a life insurance provider might design a marketing strategy focused on young professionals, highlighting the benefits of term life insurance for building a secure future. Alternatively, they could create a campaign targeting retired individuals, emphasizing the long-term financial security and legacy planning aspects of permanent life insurance. This targeted approach ensures that the sales process is more efficient and effective, as it caters to the specific needs and preferences of different customer groups.

In summary, demographic analysis, particularly focusing on age, income, and education, is essential for insurance companies to identify and cater to specific customer groups. By understanding these factors, insurance agents can provide personalized recommendations, ensuring that life insurance products are accessible, relevant, and beneficial to diverse populations. This targeted approach not only enhances customer satisfaction but also contributes to the success of insurance sales and marketing efforts.

Whole Life Insurance: Splitting Term Insurance for Long-term Gain

You may want to see also

Product Knowledge: Understanding various life insurance policies and their benefits

Life insurance is a vital financial tool that provides security and peace of mind to individuals and their families. Understanding the different types of life insurance policies and their benefits is essential for anyone considering purchasing a policy. Here's an overview to enhance your product knowledge:

Term Life Insurance: This is a straightforward and cost-effective type of life insurance. It provides coverage for a specified period, often 10, 20, or 30 years. During this term, the policyholder pays a fixed premium, and in return, the insurance company promises to pay a death benefit to the policy's beneficiaries if the insured individual passes away during that term. Term life insurance is ideal for those seeking temporary coverage, especially for young families or individuals with specific financial goals. It offers a simple and affordable way to secure financial protection during a particular life stage.

Whole Life Insurance: In contrast to term life, whole life insurance offers permanent coverage for the entire lifetime of the insured individual. It provides a guaranteed death benefit and accumulates cash value over time. Policyholders pay premiums that are typically higher than term life insurance. The cash value component allows the policy to grow, and it can be borrowed against or withdrawn. Whole life insurance is suitable for long-term financial planning and can be an excellent option for those seeking a consistent and reliable insurance solution.

Universal Life Insurance: This type of policy offers flexibility and adaptability. It provides permanent coverage and allows policyholders to adjust their premiums and death benefits over time. Universal life insurance has an investment component, where a portion of the premium is invested in various funds, offering the potential for higher returns. Policyholders can increase or decrease their death benefit and premium payments as their financial situation changes. This policy is ideal for those who want control over their insurance and investment decisions.

Variable Life Insurance: Similar to universal life, variable life insurance offers permanent coverage with an investment component. However, the investment options are more diverse, allowing policyholders to choose from various investment accounts. The death benefit and premiums can be customized, providing flexibility. Variable life insurance is suitable for individuals who want to actively manage their investments and insurance needs.

Understanding these different life insurance policies is crucial for making informed decisions. Each type has its advantages and is suited to specific life stages and financial goals. When considering life insurance, it's essential to evaluate your unique circumstances, such as your age, health, financial obligations, and long-term goals, to determine the most appropriate policy for your needs.

Whole Life Insurance and Cash Value: What's the Difference?

You may want to see also

Sales Techniques: Employing effective strategies to engage and convert potential clients

In the realm of life insurance sales, understanding the demographics and skills of potential clients is crucial. Research indicates that a significant portion of the population can indeed sell life insurance, but success relies on more than just numbers. It's about employing effective sales techniques to engage and convert these prospects. Here's an exploration of some strategies to achieve this:

Building Rapport and Trust: Establishing a strong rapport with potential clients is fundamental. Salespeople should aim to create a comfortable and friendly environment during initial interactions. This can be achieved by actively listening to the client's needs, concerns, and goals. For instance, a salesperson might ask open-ended questions like, "What are your primary motivations for considering life insurance?" or "How do you envision your family's financial future?" By demonstrating genuine interest and empathy, the salesperson can build trust, which is essential for long-term relationships.

Personalized Approach: Tailoring the sales pitch to individual clients is a powerful technique. Each person has unique circumstances, and a one-size-fits-all approach may not be effective. For example, a salesperson could research the client's background, family structure, and financial situation to offer personalized solutions. If a client is a young professional, the focus might be on building long-term wealth and ensuring financial security for their future family. Conversely, an older client might prioritize legacy planning and ensuring their family's financial stability.

Addressing Objections: Anticipating and addressing common objections is a critical aspect of sales. Many potential clients may have concerns about the cost, complexity, or necessity of life insurance. A skilled salesperson should be prepared to handle these objections gracefully. For instance, they could provide clear explanations, offer comparisons with other financial products, or share success stories of how life insurance benefited families in similar situations. By actively addressing these concerns, the salesperson can build confidence and move the client towards a purchase decision.

Utilizing Visual Aids and Demonstrations: Visual tools can significantly enhance the sales process. Presenting information in a clear and engaging manner can help clients understand complex concepts. For life insurance, this could involve using interactive charts to illustrate the impact of different coverage amounts or demonstrating how premium payments work over time. Visual aids make the sales pitch more memorable and help clients grasp the value proposition more effectively.

Following Up and Nurturing Leads: The sales process doesn't end after the initial presentation. Following up with potential clients is essential to nurture the lead and answer any lingering questions. This could involve sending personalized emails, offering additional resources, or scheduling follow-up meetings. By staying in touch, salespeople can build trust, address concerns, and ultimately convert more prospects into satisfied customers.

In summary, selling life insurance is a skill that combines understanding the market, building relationships, and employing strategic sales techniques. By focusing on rapport, personalization, addressing objections, and utilizing visual aids, salespeople can effectively engage and convert potential clients. The key is to provide value, educate, and guide clients through their financial decision-making journey.

Life Insurance: Accidental Death Coverage Explained

You may want to see also

Frequently asked questions

The percentage of licensed life insurance agents varies by country and region. In the United States, for example, the number of licensed life insurance agents is relatively small compared to the total population. As of 2022, there were approximately 1.2 million life insurance agents in the US, which translates to about 0.37% of the population being licensed to sell life insurance.

Selling life insurance is not a common profession in the sense that it is not a widely held career path. However, it is a profession that can be accessible to a diverse range of individuals. Many people who sell life insurance are independent contractors or work for insurance companies, and they often have a background in sales, customer service, or financial services.

Yes, there are specific requirements and regulations that vary by jurisdiction. Typically, individuals must complete a training program, pass a licensing exam, and meet age and residency criteria. They may also need to maintain a certain level of continuing education to renew their license. These requirements ensure that agents are knowledgeable and competent in the field of life insurance.

The number of licensed life insurance agents can influence the accessibility and distribution of life insurance products. A higher number of agents can lead to increased market coverage, allowing more people to access life insurance policies. However, it also depends on the insurance company's distribution strategy and the agents' ability to reach potential customers.