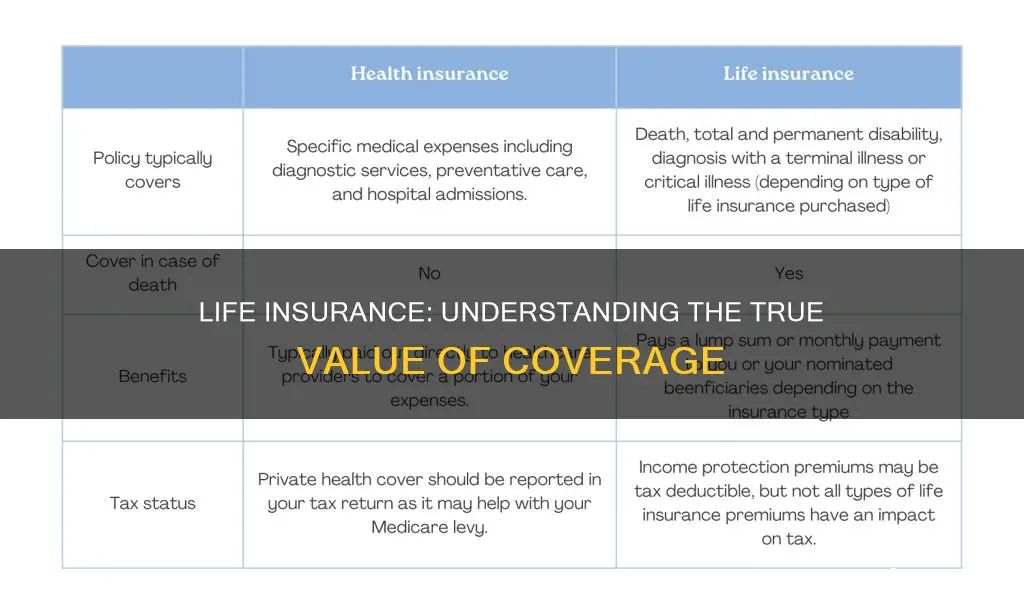

Life insurance is a crucial financial tool that provides a safety net for individuals and their families. When considering life insurance coverage, it's essential to understand the various aspects that define its true nature. This paragraph aims to explore the fundamental statement that encapsulates the essence of life insurance: Life insurance coverage is a promise of financial security, ensuring that loved ones are protected and their financial goals are met in the event of the insured's passing. This statement highlights the core purpose of life insurance, emphasizing its role in providing peace of mind and financial stability during challenging times.

What You'll Learn

- Coverage Amount: The amount of life insurance coverage you need depends on your financial obligations and dependents

- Term vs. Permanent: Term life is cheaper and provides coverage for a specific period, while permanent insurance offers lifelong coverage

- Underwriting Process: Insurance companies assess health, lifestyle, and family medical history to determine eligibility and premium rates

- Beneficiary Designations: You can choose who receives the death benefit, ensuring your wishes are honored

- Regular Review: Periodically review and adjust coverage to reflect changes in financial status and family circumstances

Coverage Amount: The amount of life insurance coverage you need depends on your financial obligations and dependents

When considering life insurance, the coverage amount is a critical factor that determines the financial security of your loved ones in the event of your passing. The primary purpose of life insurance is to provide financial support to your family or beneficiaries, ensuring they can maintain their standard of living and cover essential expenses. The amount of coverage you need should be a reflection of your unique circumstances and the potential financial impact of your death.

To determine the appropriate coverage amount, it is essential to consider your financial obligations and dependents. Financial obligations can include various expenses, such as mortgage or rent payments, car loans, student loans, credit card debt, and other regular financial commitments. These obligations can create a significant financial burden for your family if they are not adequately addressed. For example, if you have a substantial mortgage or a young child with ongoing educational costs, a larger coverage amount would be necessary to ensure that these expenses are covered in your absence.

Dependents also play a crucial role in calculating the required life insurance coverage. Dependents can be your spouse, children, or other family members who rely on your income for their financial well-being. The more dependents you have, the higher the coverage amount should be to provide for their long-term needs. Consider the potential future expenses, such as education costs for children or long-term care for a spouse, and ensure that your life insurance policy adequately covers these potential liabilities.

Assessing your financial obligations and dependents requires a thorough evaluation of your current and future financial situation. Create a list of all your regular expenses and the potential costs associated with your dependents' needs. This will help you determine the minimum coverage amount required to provide financial security. It is also beneficial to consult with a financial advisor who can offer personalized guidance based on your specific circumstances.

Remember, the goal of life insurance is to provide peace of mind and financial stability for your loved ones. By carefully considering your financial obligations and dependents, you can choose a coverage amount that ensures their long-term financial security. Regularly reviewing and adjusting your policy as your life changes is also essential to maintain appropriate coverage.

Life Insurance vs. Assurance: What's the Real Difference?

You may want to see also

Term vs. Permanent: Term life is cheaper and provides coverage for a specific period, while permanent insurance offers lifelong coverage

When considering life insurance, understanding the differences between term and permanent policies is crucial. One of the key distinctions is the duration of coverage. Term life insurance provides protection for a specified period, typically ranging from 10 to 30 years. During this term, the policy offers a fixed death benefit if the insured individual passes away. This type of insurance is often more affordable because it doesn't include a savings or investment component, making it a cost-effective choice for those seeking coverage for a particular period. For instance, if you want to ensure your family's financial security for the next 20 years, a 20-year term life policy might be the right fit.

On the other hand, permanent life insurance, also known as whole life insurance, offers lifelong coverage. This policy provides a death benefit and includes a cash value component that grows over time. The cash value can be borrowed against or withdrawn, making it a more complex and potentially more expensive option. Permanent insurance is typically more expensive than term life due to the additional features and the promise of coverage for the entire life of the insured individual. It is suitable for those who want the security of knowing they have coverage for life, even if they outlive the initial term period.

The choice between term and permanent life insurance depends on individual needs and financial goals. If you prioritize affordability and a specific coverage period, term life is an excellent choice. It allows you to secure coverage for a defined time frame without the long-term financial commitment of permanent insurance. Conversely, if you desire the reassurance of lifelong coverage and are willing to invest in a more comprehensive policy, permanent life insurance might be preferable. It provides a safety net for your loved ones and can also serve as an asset-building tool over time.

In summary, term life insurance is a cost-effective solution for temporary coverage, while permanent life insurance offers the security of lifelong protection. Understanding these differences can help individuals make informed decisions when selecting a life insurance policy that aligns with their specific needs and financial circumstances. It is always advisable to consult with a financial advisor or insurance professional to determine the best course of action.

Life Insurance and Suicidal Death: What Employers Cover

You may want to see also

Underwriting Process: Insurance companies assess health, lifestyle, and family medical history to determine eligibility and premium rates

The underwriting process is a critical aspect of life insurance, as it involves a thorough evaluation of an individual's health, lifestyle choices, and family medical history to determine their eligibility for coverage and to set appropriate premium rates. This process is designed to assess the risk associated with insuring a particular individual and to ensure that the insurance company can provide the necessary financial protection.

During underwriting, insurance companies will typically request detailed information about the applicant's health. This includes medical history, current and past medical conditions, medications, and any ongoing or recent treatments. They may also inquire about lifestyle factors such as smoking or tobacco use, alcohol consumption, drug use, and physical activity levels. These factors are crucial as they can significantly impact an individual's health and longevity. For example, a heavy smoker may be considered a higher risk for certain health issues, which could affect their insurance eligibility and premium costs.

Family medical history is another essential component of the underwriting process. Insurance companies often review the medical records of immediate family members, such as parents, siblings, and children, to identify any hereditary or genetic conditions. This information helps underwriters understand the potential risk of developing similar health issues in the future. For instance, a family history of heart disease or cancer may influence the insurance company's decision and the premium amount.

The underwriting team will carefully analyze all the provided information to assess the overall health and risk profile of the applicant. They may also conduct medical exams or order laboratory tests to verify the accuracy of the information. This comprehensive evaluation allows insurance companies to make informed decisions regarding the acceptance of the application and the terms of the policy.

Based on the underwriting assessment, insurance companies will determine whether to approve the life insurance application and set the premium rates accordingly. Applicants with a lower risk profile, as indicated by a favorable health assessment and a healthy lifestyle, may be offered more competitive rates. Conversely, those with health concerns or a family history of serious medical conditions might face higher premiums or even be declined coverage. This process ensures that life insurance companies can provide tailored policies that meet the specific needs of their customers while managing their risk exposure.

Companion Life Insurance: What Vision Benefits Are Covered?

You may want to see also

Beneficiary Designations: You can choose who receives the death benefit, ensuring your wishes are honored

When it comes to life insurance, one of the most crucial aspects to consider is the beneficiary of your policy. The beneficiary is the person or entity who will receive the death benefit payout when you pass away. This is a significant decision, as it ensures that your wishes are honored and that your loved ones are taken care of according to your intentions.

Life insurance policies typically allow you to name multiple beneficiaries, providing flexibility and control over how the death benefit is distributed. You can choose to name a primary beneficiary, who will receive the full amount, or you can split the payout among multiple beneficiaries. This feature is especially useful for families with complex financial situations or those with specific inheritance plans. For example, you might want to provide a larger portion to a spouse for their immediate needs and then allocate the rest to children or other dependents.

The process of designating beneficiaries is usually straightforward. You'll need to provide the insurance company with the names and contact information of your chosen beneficiaries. Some policies may also allow you to specify the percentage or amount each beneficiary should receive. It's essential to keep this information updated, especially if there are any changes in your personal or family circumstances. Regularly reviewing and updating your beneficiary designations can help ensure that your life insurance proceeds go to the right people at the right time.

In the event of your passing, the insurance company will verify the validity of the beneficiary designations and distribute the death benefit accordingly. This process can provide peace of mind, knowing that your loved ones will receive the financial support they need during a difficult time. It's a simple yet powerful way to exercise control over your finances and ensure your family's financial security.

By carefully considering and documenting your beneficiary choices, you can provide a safety net for your loved ones and ensure that your life insurance policy fulfills its intended purpose. This aspect of life insurance coverage is often overlooked but can have a profound impact on the well-being of your family.

Life Insurance: A Necessary Safety Net for Peace of Mind

You may want to see also

Regular Review: Periodically review and adjust coverage to reflect changes in financial status and family circumstances

Regularly reviewing and adjusting your life insurance coverage is an essential practice that ensures your policy remains relevant and beneficial throughout your life's journey. Life insurance is a critical financial tool that provides financial security for your loved ones in the event of your passing. As your life progresses, so should your insurance coverage. Here's why a periodic review is crucial:

Financial Status Changes: Over time, your financial situation will evolve. You might experience salary increases, bonuses, or even career advancements that lead to higher earnings. Conversely, you could face financial setbacks like job loss or reduced income. These changes directly impact the amount of coverage you need. For instance, if you've recently purchased a home or started a business, you might require additional insurance to cover potential liabilities. Regularly assessing your financial status allows you to ensure that your life insurance policy aligns with your current earning capacity and financial obligations.

Family Milestones: Life is filled with significant milestones, such as marriages, births, or deaths within the family. These events can significantly alter the need for insurance coverage. For example, getting married might increase the value of your policy, especially if your spouse relies on your income. The birth of a child often prompts parents to reevaluate their insurance needs to ensure adequate coverage for their family's well-being. As family dynamics change, so should your insurance strategy.

Lifestyle and Health Considerations: Your lifestyle choices and overall health can also influence insurance coverage. If you've taken on new hobbies or sports that carry higher risks, you might want to adjust your policy to account for potential medical expenses. Additionally, significant health changes, such as chronic illnesses or major surgeries, could impact your insurance premiums and coverage options. Regular reviews allow you to stay proactive in managing these aspects.

Policy Reviews and Adjustments: During these periodic reviews, it's essential to assess the performance of your current life insurance policy. This includes checking the coverage amount, term length, and any additional benefits or riders. You might discover that your policy has gaps or that certain aspects no longer serve your best interests. Adjustments could involve increasing or decreasing coverage, converting term life to permanent life insurance, or adding riders to enhance protection.

By implementing a regular review process, you demonstrate a commitment to your family's financial security. It ensures that your life insurance remains a reliable safety net, providing peace of mind and financial stability when it's needed most. Remember, life insurance is not a one-time purchase but an ongoing commitment to protect your loved ones.

How to Change Your OPM Life Insurance Policy

You may want to see also