Term life insurance is a valuable financial tool that provides coverage for a specific period, typically 10, 20, or 30 years. While it offers essential protection during this time, it's important to consider what happens after the policy expires. When the term life insurance expires, the coverage ends, and the policyholder is no longer protected by the insurance company's promise to pay out a death benefit. This transition can be a significant concern for individuals and families who relied on the insurance to provide financial security. Understanding the options available after the term life insurance expires is crucial to ensure that your loved ones remain protected and that your financial goals are met. In the following paragraphs, we will explore the various steps and considerations to take when facing the expiration of a term life insurance policy.

What You'll Learn

- Review Your Needs: Assess current financial situation and goals to determine if extended coverage is necessary

- Consider Alternatives: Explore options like term life insurance riders or whole life policies

- Evaluate Premiums: Compare costs of new policies to ensure affordability

- Consult an Advisor: Seek professional guidance for informed decision-making

- Plan for the Future: Develop a comprehensive financial plan considering insurance needs

Review Your Needs: Assess current financial situation and goals to determine if extended coverage is necessary

Reviewing your current financial situation and long-term goals is a crucial step when considering what to do after your term life insurance policy expires. This assessment will help you make an informed decision about whether extended coverage is necessary and, if so, what type of policy would best suit your needs. Here's a detailed guide on how to approach this process:

Evaluate Your Financial Situation: Start by taking a comprehensive look at your finances. Calculate your total assets, including savings, investments, real estate, and any other valuable possessions. Also, consider your liabilities, such as mortgage payments, car loans, credit card debt, and any other ongoing financial obligations. Understanding your net worth and cash flow will give you a clear picture of your financial health and help you determine if you have sufficient resources to cover potential risks without additional insurance.

Assess Your Goals and Responsibilities: Reflect on your short-term and long-term financial goals. Do you have a family that relies on your income? Are there any specific financial goals you're working towards, such as saving for your child's education or planning for retirement? Consider your age, health, and any existing medical conditions that could impact your insurance rates. If you have a young family or significant financial responsibilities, extended coverage might be essential to ensure their well-being in your absence.

Determine the Need for Extended Coverage: Based on your financial assessment and goals, decide if you require additional life insurance beyond the term policy. If your financial situation has improved, and you've built a substantial nest egg, you might feel confident in your ability to manage risks without further insurance. However, if your goals and responsibilities remain unchanged or if you have a higher-than-average risk profile, extended coverage could provide valuable peace of mind.

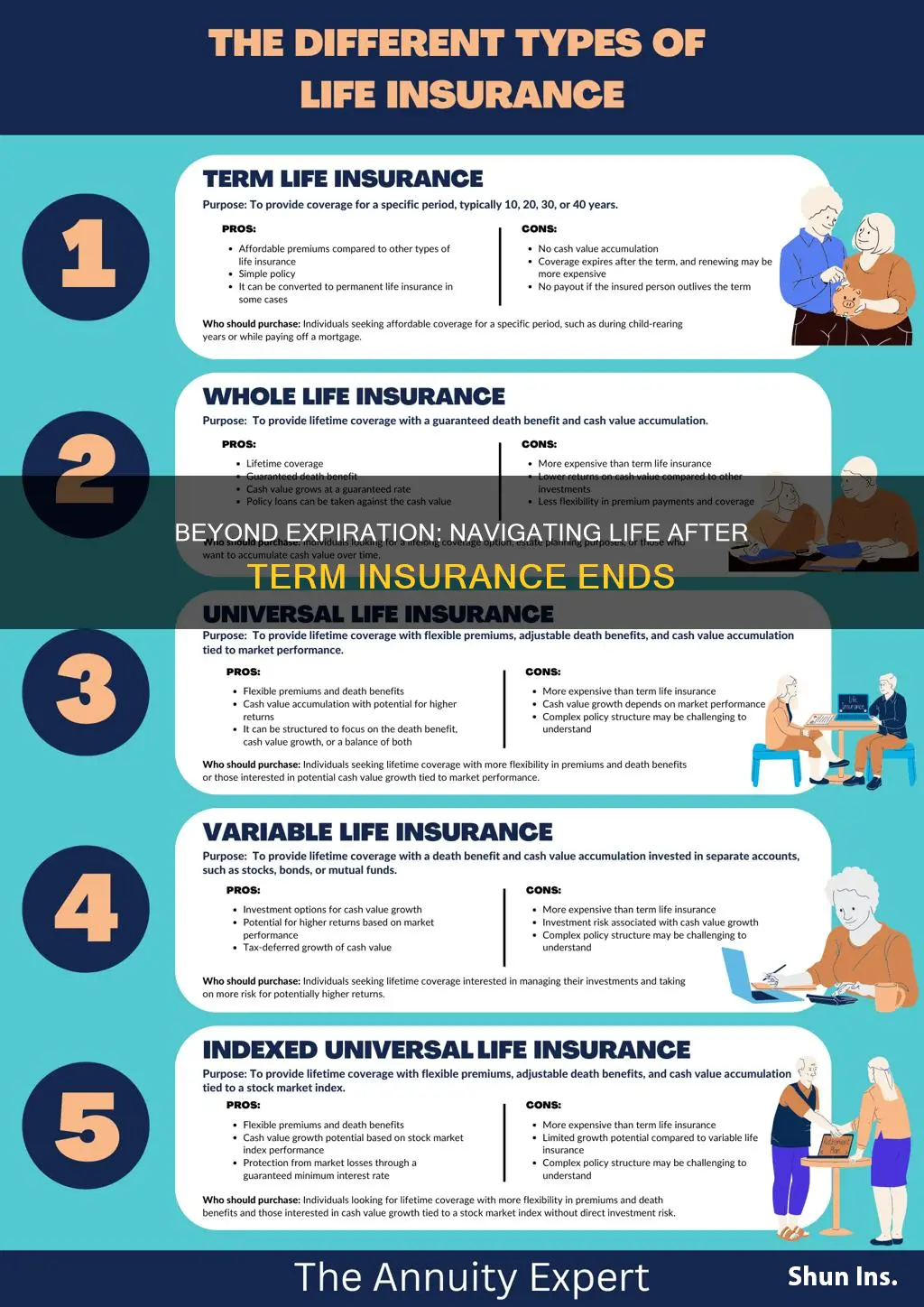

Consider Alternative Options: If you decide that extended term life insurance is not suitable, explore other options. You could consider converting your term policy to a permanent life insurance plan, which offers lifelong coverage. Alternatively, you might look into other insurance products like universal life insurance or whole life insurance, which provide flexibility and potential cash value accumulation. Each type of policy has its advantages and disadvantages, so it's essential to understand the features and benefits before making a decision.

Review and Adjust Regularly: Life circumstances can change rapidly, so it's crucial to review your insurance needs periodically. Major life events like marriages, births, or significant financial milestones should prompt a re-evaluation of your coverage. Regularly assessing your financial situation and goals will ensure that your insurance strategy remains aligned with your evolving life path.

Did Your Dad Have Life Insurance? How to Find Out

You may want to see also

Consider Alternatives: Explore options like term life insurance riders or whole life policies

When your term life insurance policy comes to an end, it's important to consider your options to ensure you and your loved ones remain protected. One of the key alternatives to consider is exploring different types of life insurance riders or converting your term policy into a more permanent solution. Here's a detailed look at these options:

Term Life Insurance Riders:

Term life insurance riders are additional benefits or extensions that can be added to your existing term policy. These riders can provide coverage for a specific period, often aligning with the duration of your initial term life insurance. For example, a "Level Term Rider" guarantees a fixed death benefit for a specified term, ensuring your family's financial needs are met during that time. Another popular rider is the "Conversion Option," which allows you to convert your term policy into a permanent life insurance policy without a medical examination, providing long-term coverage without the need for a new application process. These riders offer flexibility and can be tailored to your changing needs over time.

Whole Life Insurance:

Whole life insurance is a permanent policy that provides coverage for your entire life, as long as the premiums are paid. One of the significant advantages of whole life insurance is its guaranteed death benefit, which means your beneficiaries will receive a fixed amount upon your passing. Unlike term life, whole life policies accumulate cash value over time, which can be borrowed against or withdrawn, providing financial flexibility. This type of policy offers stability and long-term financial security, ensuring your loved ones are protected even if your initial term policy expires.

When considering these alternatives, it's crucial to evaluate your current financial situation, future goals, and the level of coverage you require. Term life insurance riders can provide a cost-effective way to extend coverage, while whole life insurance offers a more permanent solution with long-term benefits. Consulting with a financial advisor or insurance professional can help you navigate these options and make an informed decision to ensure your peace of mind and the financial well-being of your family. Remember, exploring these alternatives can provide the necessary protection and flexibility as you transition from one life insurance term to another.

Making Money from Life Insurance: Is It Possible?

You may want to see also

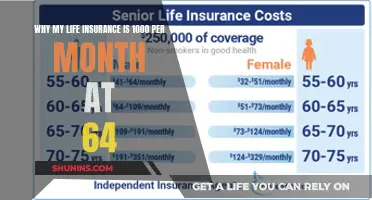

Evaluate Premiums: Compare costs of new policies to ensure affordability

When your term life insurance policy comes to an end, it's crucial to evaluate your options and ensure that you have adequate coverage. One of the most important steps is to assess the costs of new policies and compare them to determine the most affordable option. Here's a detailed guide on how to approach this process:

Review Your Current Policy: Start by understanding the details of your existing term life insurance policy. Check the expiration date and the coverage amount. Make a note of any special features or riders that you might want to continue or modify. This initial review will give you a baseline to compare with new policies.

Assess Your Needs: Evaluate your current financial situation and future goals. Consider your age, health, and any changes in your lifestyle or responsibilities. For instance, if you have recently started a family or purchased a new home, you may require higher coverage. Determine the amount of life insurance you need to protect your loved ones and assets in the long term.

Compare Premiums: Obtain quotes from multiple insurance providers for new term life insurance policies. Request quotes for different coverage amounts and policy terms to find the best rates. Compare the premiums offered by various companies, ensuring that you consider the following:

- Term Length: Decide on the duration of the new policy, whether it's a 10, 15, or 20-year term, and compare the costs accordingly.

- Coverage Amount: Ensure that the coverage amount aligns with your assessed needs.

- Riders and Add-ons: Evaluate any additional benefits or riders you might want, such as critical illness coverage or accidental death benefits, and factor in their costs.

Consider Affordability: Ensure that the new policy's premiums are affordable in the long term. Calculate your monthly or annual budget and determine how much you can comfortably allocate to life insurance. Remember that insurance premiums can vary significantly based on factors like age, health, and lifestyle. It's essential to find a balance between coverage and cost.

Review and Adjust: After comparing multiple quotes, review the options and choose the policy that best suits your needs and budget. If you find that the premiums are higher than expected, consider adjusting your coverage amount or exploring alternative insurance products. You might also want to discuss your options with a financial advisor to make an informed decision.

By following these steps, you can effectively evaluate and compare the costs of new term life insurance policies, ensuring that you make an informed decision about your long-term coverage and financial security.

Explore Life Insurance Options for 40-Year Terms

You may want to see also

Consult an Advisor: Seek professional guidance for informed decision-making

When your term life insurance policy comes to an end, it's a significant moment that requires careful consideration. This is a crucial time to assess your evolving needs and make informed decisions about your future financial security. Consulting a financial advisor or insurance specialist is an essential step to ensure you make the right choices. These professionals can provide valuable insights and guidance tailored to your unique circumstances.

The advisor will begin by evaluating your current financial situation and understanding your long-term goals. They will consider factors such as your age, health, income, and dependents to determine the most appropriate coverage options. This comprehensive assessment is vital as it allows the advisor to recommend suitable alternatives to your expired term life insurance. They can explore various permanent life insurance options, such as whole life or universal life, which offer lifelong coverage and potential investment benefits.

During this consultation, the advisor can explain the different types of permanent life insurance and their advantages. For instance, whole life insurance provides consistent coverage and a guaranteed death benefit, while universal life insurance offers flexibility in premium payments and potential cash value accumulation. By understanding these options, you can make an informed decision that aligns with your financial objectives.

Furthermore, a financial advisor can assist in creating a comprehensive financial plan. They will help you navigate the complexities of insurance policies, ensuring you understand the terms, conditions, and potential tax implications. This professional guidance is invaluable, as it empowers you to make decisions with full knowledge and confidence. They can also provide strategies to optimize your insurance coverage, ensuring you have the protection you need without unnecessary costs.

In summary, consulting a financial advisor when your term life insurance expires is a proactive step towards securing your future. Their expertise and personalized advice will enable you to make informed choices, ensuring your financial well-being and peace of mind. This consultation is a vital part of long-term financial planning, allowing you to adapt to changing circumstances and maintain a robust insurance strategy.

Life Insurance: Can You Opt-Out of Your Employer's Plan?

You may want to see also

Plan for the Future: Develop a comprehensive financial plan considering insurance needs

When your term life insurance policy expires, it's crucial to reassess your financial situation and insurance needs to ensure you and your loved ones remain protected. Here's a step-by-step guide to developing a comprehensive financial plan:

- Evaluate Your Current Financial Situation: Begin by assessing your financial health. Calculate your net worth by listing your assets (bank accounts, investments, property) and liabilities (debts, mortgages). This snapshot will help you understand your overall financial position and identify areas for improvement.

- Reassess Insurance Needs:

- Life Coverage: Consider your remaining life goals and obligations. Do you still have a family to support? Are there outstanding debts or long-term financial commitments? If so, you may still need life insurance. Evaluate your current needs and explore options like permanent life insurance or term life insurance with extended coverage periods.

- Other Types of Insurance: Review your existing insurance policies (health, disability, long-term care). Ensure they remain adequate and aligned with your current circumstances. Consider any gaps in coverage and adjust your policies accordingly.

Create a Financial Plan:

- Budgeting: Develop a realistic budget that accounts for your income, expenses, and savings goals. Prioritize essential expenses and allocate funds for short-term and long-term savings.

- Debt Management: If you have outstanding debts, create a strategy to pay them off efficiently. Focus on high-interest debt first while making minimum payments on others.

- Retirement Planning: Start saving for retirement early. Explore retirement accounts like 401(k)s or IRAs and consider consulting a financial advisor for personalized advice.

Explore Permanent Insurance Options:

- Whole Life Insurance: This type of permanent insurance offers lifelong coverage and a cash value component that grows over time. It can be a valuable tool for building wealth and providing long-term financial security.

- Universal Life Insurance: Offers flexibility in premium payments and death benefit amounts. You can adjust your coverage as your needs change.

Review and Adjust Regularly:

Financial planning is an ongoing process. Regularly review your financial plan and adjust it as your life circumstances change. This ensures your insurance and financial strategies remain aligned with your evolving needs.

Remember, consulting a qualified financial advisor is highly recommended to tailor a comprehensive financial plan specific to your individual circumstances.

Life Insurance and Vaccines: What's the Connection?

You may want to see also

Frequently asked questions

When a term life insurance policy expires, the coverage it provides also ends. This means that if you were relying on this insurance for financial protection, you will no longer have that safety net. It's important to consider your current financial situation and determine if you still need life insurance coverage. If you do, you might want to explore other options like converting to a permanent life insurance policy or finding a new term policy with a different insurer.

Yes, you can definitely shop around and compare different insurance providers to find a new term life insurance policy. When renewing, it's beneficial to assess your current needs and any changes in your life that might affect your insurance requirements. You can also consider increasing the coverage amount if your financial obligations or family responsibilities have grown.

Converting a term life insurance policy to a permanent one, also known as a whole life or universal life policy, can provide long-term financial security. Permanent life insurance offers lifelong coverage and an accumulation of cash value, which can be borrowed against or withdrawn. This option ensures that you maintain coverage even if you outlive the initial term, and it also provides a savings component, making it a valuable financial tool for the long term.