When life insurance won't cover you, it can be a frustrating and challenging experience. It's important to understand the reasons why your policy may not provide the coverage you need and to explore alternative options. This could include reviewing your current policy to ensure it meets your needs, considering additional coverage, or seeking out other financial products that can provide the protection you require. Understanding your rights and the claims process can also help you navigate this situation more effectively.

What You'll Learn

- Legal Options: Explore legal avenues to challenge insurance decisions

- Medical Documentation: Ensure all medical records support your claim

- Policy Review: Carefully examine your policy for coverage gaps

- Alternative Plans: Consider alternative insurance products for comprehensive coverage

- Financial Support: Seek financial assistance through other means if necessary

Legal Options: Explore legal avenues to challenge insurance decisions

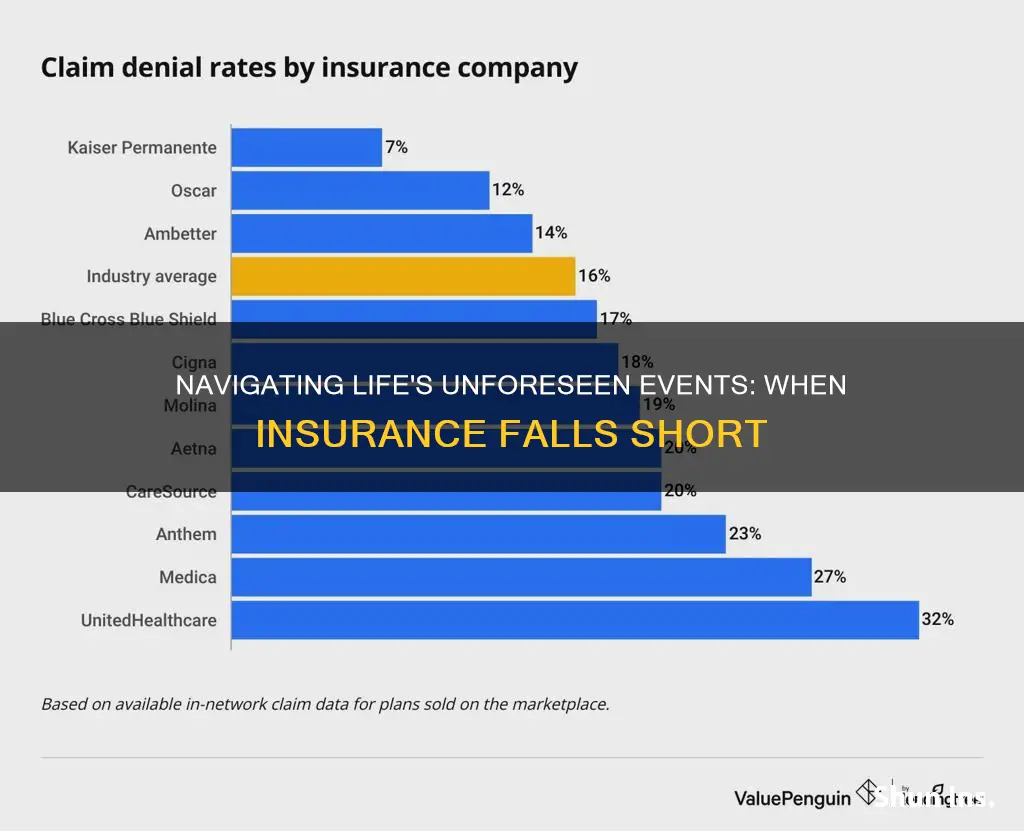

When life insurance companies deny coverage or fail to provide the promised benefits, it can be a frustrating and challenging experience. In such situations, exploring legal options is a crucial step to ensure your rights are protected and to seek the compensation you deserve. Here's an overview of the legal avenues you can consider:

- Review the Insurance Contract: Begin by thoroughly examining your insurance policy documents. These documents should outline the terms and conditions, coverage details, and any exclusions or limitations. Look for any clauses that might justify the insurance company's decision to deny coverage. Understanding the contract is essential as it forms the basis of your legal argument. If you find any discrepancies or unclear terms, consult a legal professional to interpret the contract accurately.

- Dispute Resolution Processes: Many insurance companies have internal dispute resolution mechanisms. This often involves a formal process where you can submit your concerns and evidence to challenge the decision. Typically, this process includes providing a detailed explanation of why you believe the insurance company has made an incorrect decision. Gather all relevant documents, medical records, and any other supporting evidence to strengthen your case. Contact the insurance company's customer service or claims department to initiate the dispute resolution process and understand their specific requirements.

- Administrative Law and Insurance Regulators: Insurance companies are subject to regulations set by government agencies or insurance regulators. These regulators often provide oversight and ensure that insurance practices are fair and transparent. If you feel that your case is being unfairly handled, you can file a complaint with the relevant insurance regulator. They will investigate your claim and may intervene on your behalf. This step can be particularly useful if you believe the insurance company has acted in bad faith or violated insurance regulations.

- Litigation: In more complex or severe cases, legal action may be necessary. If all other avenues fail, you can consider filing a lawsuit against the insurance company. This involves presenting your case in a court of law, where a judge or jury will make a decision. Litigation can be a lengthy and costly process, but it provides an opportunity to have your case heard by an impartial decision-maker. Consult with an experienced insurance lawyer who can guide you through the legal process, help gather evidence, and represent your interests in court.

When exploring these legal options, it is crucial to act promptly. Insurance companies often have time limits for dispute resolution or legal claims. Keep all relevant documentation organized and maintain a record of all communications with the insurance company. Additionally, seek legal advice early in the process to understand your rights and the best course of action for your specific situation.

Breast Cancer: Life Insurance Impact and Your Options

You may want to see also

Medical Documentation: Ensure all medical records support your claim

When dealing with life insurance claims, especially those that involve pre-existing conditions or sudden illnesses, having comprehensive and accurate medical documentation is crucial. This documentation serves as the backbone of your claim, providing the insurance company with the necessary evidence to support your case. Here's a guide on how to ensure your medical records are robust and supportive:

- Gather Comprehensive Medical Records: Start by collecting all relevant medical documents, including hospital discharge summaries, lab test results, doctor's notes, and any other records related to your health. Ensure that these records are up-to-date and cover a significant period, especially if you have a history of chronic illnesses or conditions. The more comprehensive the documentation, the stronger your case will be.

- Verify Accuracy and Consistency: Medical records should be accurate and consistent with your personal knowledge of your health. Review these documents carefully to ensure they are free from errors or discrepancies. If you notice any inaccuracies, contact the healthcare provider to request corrections. Consistency in medical notes is essential, especially when dealing with insurance companies, as it helps build a reliable narrative of your health journey.

- Include Detailed Medical History: Provide a detailed medical history, including any previous surgeries, hospitalizations, and ongoing treatments. This information is vital for insurance companies to understand the context of your current health status. Be thorough in your descriptions, mentioning specific conditions, medications, and their effects on your overall well-being. A comprehensive medical history can help insurers make informed decisions about your claim.

- Follow-up and Updates: Medical conditions can evolve, and so should your documentation. Keep your medical records updated with any new diagnoses, treatments, or changes in your health. Regularly follow up with healthcare providers to obtain updated records, especially if your condition is progressive or requires ongoing management. This ensures that your insurance claim reflects the most current and relevant medical information.

- Seek Professional Advice: If you're unsure about the medical documentation process, consider seeking advice from a medical professional or a legal expert in insurance claims. They can provide guidance on what specific information is required and how to present it effectively. Professional advice can be invaluable, especially when dealing with complex medical conditions or insurance policies with unique requirements.

By ensuring that your medical records are comprehensive, accurate, and up-to-date, you provide the insurance company with the necessary tools to assess your claim fairly. This attention to detail can significantly impact the outcome of your claim, especially when trying to prove that life insurance should cover specific medical circumstances. Remember, thorough documentation is a powerful tool in advocating for your rights and ensuring a smoother claims process.

Selling Life Insurance: Phone Calls and Policies

You may want to see also

Policy Review: Carefully examine your policy for coverage gaps

When it comes to life insurance, a thorough policy review is essential to identify any coverage gaps that may leave you and your loved ones vulnerable. Here's a step-by-step guide to help you navigate this process:

Understand Your Policy: Begin by reading your life insurance policy from cover to cover. This document is a legal contract between you and the insurance company, and it's crucial to understand its terms and conditions. Pay close attention to the following sections:

- Coverage Amount: Determine the total life insurance coverage you have. This amount is typically referred to as the 'death benefit' and is the payout the insurance company will provide upon your passing.

- Policy Type: Identify whether your policy is a term life, whole life, universal life, or another type of insurance. Each type has unique features and benefits.

- Exclusions and Limitations: These sections will highlight what is not covered by the policy. Common exclusions might include pre-existing medical conditions, extreme sports, or certain health-related risks. Understanding these exclusions is vital to know what your policy doesn't cover.

Identify Coverage Gaps: After a thorough review, look for any areas where your policy might fall short of your expected coverage. Here are some questions to consider:

- Adequacy of Coverage: Is the death benefit sufficient to cover your family's financial needs, including mortgage payments, education expenses, and daily living costs? If not, you may need to consider increasing the coverage amount.

- Long-Term Care: Does your policy provide coverage for long-term care expenses, which can be significant and often not covered by standard life insurance?

- Critical Illness: Some policies offer critical illness coverage, which pays out if you are diagnosed with a serious illness, providing financial support during treatment and recovery.

- Wealth Accumulation: If your policy includes a savings or investment component, understand how it works and if it aligns with your financial goals.

- Review Regularly: Life insurance needs can change over time due to various life events like marriage, the birth of children, career changes, or significant financial milestones. It's essential to review your policy annually or whenever your circumstances change. This regular review ensures that your coverage remains appropriate and up-to-date.

- Seek Professional Advice: Consider consulting a financial advisor or insurance specialist who can provide an unbiased review of your policy. They can help you identify gaps and suggest appropriate solutions, such as purchasing additional coverage or exploring alternative insurance products.

By carefully examining your policy and staying proactive, you can ensure that your life insurance provides the necessary protection for your loved ones, even in the event of unforeseen circumstances. Remember, knowledge of your policy is power, and taking control of your insurance coverage is a crucial step in financial planning.

Life Insurance: NRMA's Offerings and Your Options

You may want to see also

Alternative Plans: Consider alternative insurance products for comprehensive coverage

When traditional life insurance policies fall short, it's essential to explore alternative options to ensure you have the coverage you need. Here are some strategies to consider:

- Critical Illness Insurance: This type of insurance provides financial protection if you are diagnosed with a critical illness, such as cancer, heart attack, or stroke. It offers a lump-sum payment to help cover medical expenses, treatment costs, and potential loss of income. Critical illness insurance can be a valuable addition to your coverage, especially if you want to ensure financial security during a serious health crisis.

- Income Protection Insurance: Also known as disability insurance, this policy replaces a portion of your income if you become unable to work due to illness or injury. It provides a regular income stream to help maintain your standard of living and cover essential expenses while you recover or manage a long-term disability. Income protection insurance is particularly useful if you rely on your income to meet financial obligations.

- Long-Term Care Insurance: As you age, the risk of requiring long-term care services increases. This insurance policy covers the costs associated with extended periods of care, including nursing home stays, assisted living, and in-home care. It ensures that you or your loved ones don't have to bear the financial burden of long-term care, which can be significantly expensive.

- Term Life Insurance with an Enhanced Rider: If you're looking for a more affordable option, consider a term life insurance policy with an enhanced rider. This allows you to increase your coverage temporarily during specific life events, such as marriage, the birth of a child, or a career change. By adjusting your policy accordingly, you can ensure that your coverage aligns with your evolving life circumstances.

- Group Insurance Plans: Check with your employer or professional associations if they offer group insurance plans. These plans often provide comprehensive coverage at a lower cost compared to individual policies. Group insurance can include life, health, disability, and other benefits, making it an attractive option for those seeking affordable and often tax-advantaged coverage.

Exploring these alternative insurance products can provide the comprehensive coverage you desire when traditional life insurance might not be sufficient. It's essential to assess your unique needs, consider your budget, and consult with insurance professionals to find the best fit for your situation. Remember, having the right insurance coverage can provide peace of mind and financial security for you and your loved ones.

Gerber Life Insurance: What You Need to Know

You may want to see also

Financial Support: Seek financial assistance through other means if necessary

When life insurance fails to provide the expected coverage, it can be a challenging and stressful situation. In such cases, it's crucial to explore alternative financial support options to ensure you and your loved ones are protected. Here are some steps to consider:

Review Your Policy and Understand the Exclusions: Begin by thoroughly examining your life insurance policy. Pay close attention to the terms and conditions, as well as any specific exclusions. Insurance policies often have certain conditions or circumstances under which they may not provide full coverage. Understanding these exclusions can help you identify potential gaps in your policy and take appropriate action.

Consider Additional Insurance Products: Life insurance policies come in various forms, such as term life, whole life, and universal life. If your current policy falls short, consider exploring other insurance products. For instance, you might opt for a term life insurance policy with a higher coverage amount or a different type of policy that better suits your current needs. Consulting with an insurance advisor can provide valuable insights and help you make an informed decision.

Seek Financial Assistance from Employers: Many employers offer group life insurance plans as part of their employee benefits package. If you're employed, review your workplace benefits to see if there's an option to increase your coverage or access additional financial support. Sometimes, employers may provide financial assistance or resources to help employees manage unexpected financial burdens.

Explore Government and Community Programs: Governments and community organizations often provide financial assistance programs to support individuals and families in need. These programs can offer various forms of financial aid, including grants, subsidies, or low-interest loans. Research and reach out to local government agencies, non-profit organizations, or community groups to inquire about available resources. They may provide support for healthcare, education, or other essential expenses.

Build an Emergency Fund: One of the most effective ways to prepare for unexpected financial challenges is to establish an emergency fund. Aim to save a portion of your income regularly, setting aside funds for unexpected expenses or emergencies. This financial cushion can provide a safety net during difficult times, reducing the reliance on life insurance coverage.

Remember, when facing a situation where life insurance doesn't meet your expectations, it's essential to stay proactive and explore all available options. Seeking financial assistance through these alternative means can help ensure your financial security and provide peace of mind.

Life Insurance for Seniors: Is It Possible?

You may want to see also

Frequently asked questions

When a life insurance application is denied, it can be a challenging and frustrating experience. Firstly, it's essential to understand the reasons for the denial. Common factors include pre-existing medical conditions, lifestyle choices (such as smoking or excessive alcohol consumption), or even occupation-related risks. Review your application and medical records to identify any potential issues. If you believe the decision was unfair, you can request a review and appeal process. Gather supporting documents and medical evidence to strengthen your case. Consider consulting a financial advisor or an insurance specialist who can help navigate the process and potentially find alternative coverage options.

Yes, there are alternative life insurance options for individuals who may not qualify for standard policies. One option is term life insurance, which provides coverage for a specific period, such as 10, 20, or 30 years. This type of policy is generally more affordable and can be a good starting point. Another option is whole life insurance, which offers lifelong coverage and includes an investment component. Additionally, you can explore critical illness insurance or income protection insurance, which provide financial support if you're diagnosed with a critical illness or suffer an injury that prevents you from working. These specialized policies can offer tailored coverage and peace of mind.

If your initial coverage amount is lower than desired, there are a few strategies to consider. Firstly, review the policy and understand the factors that influence the premium and coverage. You might be able to increase the coverage by providing additional medical information or undergoing a medical examination, which can help assess your health and reduce potential risks. Another approach is to adjust the policy term; longer terms often result in lower premiums. Additionally, consider taking out a policy with a higher face value, as this will increase the coverage amount. It's essential to carefully evaluate the trade-offs between coverage and cost before making any changes.

Ensuring a successful life insurance claim is a crucial aspect of financial planning. Firstly, provide accurate and detailed information during the application process. Disclose all relevant medical history and lifestyle factors to avoid surprises later. Regularly review and update your policy to reflect any significant life changes, such as marriages, births, or major health issues. Additionally, keep all necessary documents, including death certificates and medical records, organized and easily accessible. If you have a terminal illness, consider notifying the insurer early, as some policies offer accelerated benefits. Finally, seek professional advice to understand your policy's terms and conditions and ensure you're prepared for any potential claim scenarios.