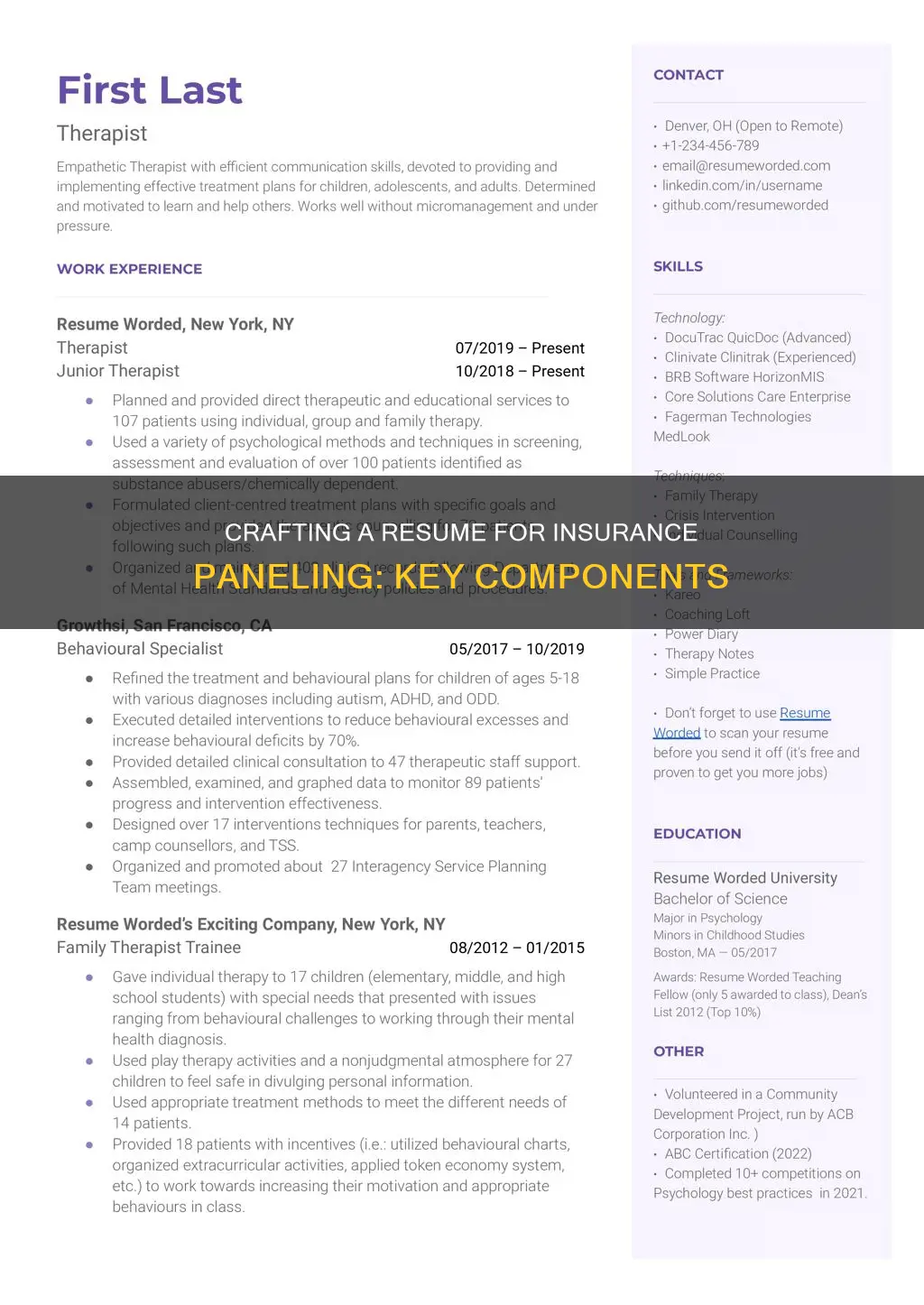

If you're looking to get your private practice insurance-panelled, you'll need to go through the credentialing process. This involves applying to insurance companies to become an in-network provider, which can be time-consuming and complicated. To make the process smoother, you should ensure your resume is up to scratch. A good resume should include your full name and contact information, a professional summary, your work history, a list of relevant skills and academic credentials, and any relevant certifications. It should also be tailored to the specific insurance company and role you're applying to.

What You'll Learn

Include your credentials

When applying for an insurance job, it is important to include your credentials in your resume. This is especially crucial if you have limited work experience or are transitioning careers, as it demonstrates your qualifications and expertise to prospective employers. Here are some tips for effectively showcasing your credentials:

- Emphasise your educational background: Begin by listing your academic credentials, such as a bachelor's degree in business administration, insurance, or a related field. If you have a more advanced degree, such as a master's or doctoral degree, be sure to include it. Additionally, mention any relevant certifications or licences, such as a Certified Insurance Counselor (CIC) or Life and Health Insurance Licence.

- Highlight your work experience: Detail your professional experience, focusing on roles and accomplishments relevant to the insurance industry. Include the duration of your employment, the companies you worked for, and any notable achievements. For instance, you could mention that you "sold the most life insurance policies among agents in 2018" or that you "maintained a 98% customer satisfaction rating".

- Quantify your success: Use numbers and metrics to showcase your performance. For example, instead of simply stating that you "processed insurance claims", specify that you "processed an average of 50 insurance claims per week with a 98% accuracy rate".

- Showcase your specialisations: If you have expertise in a particular type of insurance, such as life insurance, health insurance, or property insurance, be sure to highlight it. This demonstrates your in-depth knowledge and strong understanding of the industry.

- Emphasise your skills: Include a dedicated "Skills" section or weave your skills throughout your work experience. Highlight transferable skills such as communication, negotiation, analytical abilities, and digital proficiency. If you are applying for a sales role, emphasise your persuasive abilities and customer service skills.

- Tailor your resume to the job description: Review the job requirements and highlight how your credentials align with them. For instance, if the position requires experience with risk assessment, be sure to mention your proficiency in this area.

- Provide a professional summary: Begin your resume with a concise summary that showcases your credentials, including your educational background, work experience, and any notable achievements. This gives employers a quick overview of your qualifications and how you can contribute to their organisation.

Remember to update your resume for each job application, ensuring that your credentials match the specific requirements of the role. By effectively showcasing your credentials, you can make a strong impression on hiring managers and increase your chances of securing an interview.

Medcost Private Insurance: What You Need to Know

You may want to see also

Highlight your insurance-specific skills

When writing your insurance resume, it's important to showcase your insurance-specific skills to make your application stand out. Here are some tips and examples to help you effectively convey your expertise and increase your chances of being hired:

- Quantify your sales success: If you're applying for a sales role, provide concrete numbers to showcase your performance. For example, mention the number of new clients you brought on board monthly or the value of insurance policies sold.

- Negotiation and communication skills: Emphasize your ability to negotiate and communicate effectively with clients. Include any relevant experience or accolades that demonstrate your strong interpersonal skills.

- Specialization within insurance: Indicate your area of expertise within the insurance industry, such as life insurance, health insurance, or property and casualty insurance. This showcases your in-depth knowledge and specialization.

- Digital proficiency: Highlight your proficiency in using digital tools and software relevant to the insurance industry, such as customer relationship management (CRM) systems, email automation, and social media platforms.

- Education-focused selling approach: Showcase your ability to educate clients about complex insurance products and help them make informed decisions. Emphasize your commitment to customer satisfaction and ethical sales practices.

- Network and connections: The insurance industry heavily relies on networking. Mention any relevant connections or access to groups of potential clients. This could include experience in a small business or participation in relevant groups or communities.

- Recognition and awards: If you have received any awards or recognition for your work in the insurance industry, be sure to highlight them. This could include sales performance awards or customer satisfaction ratings.

- Career progression: Demonstrate your dedication and growth within the insurance industry. Show how your career has progressed over time, and include any promotions or expanded roles.

- Underwriting success: If you have experience in underwriting, highlight any recognition or awards received for your underwriting skills. This could include high ratings or awards for your risk assessment capabilities.

- Claims processing and management: For roles related to claims processing or management, showcase your ability to handle customer inquiries, process claims efficiently, and collaborate with adjusters and investigators.

- Risk assessment and analysis: Emphasize your skills in assessing risk, especially if applying for roles such as insurance investigator or insurance underwriter. Include any experience in investigating fraudulent claims or analyzing complex risk profiles.

- Industry knowledge and certifications: Stay up-to-date with industry trends, regulations, and software. Mention relevant certifications such as Chartered Property Casualty Underwriter (CPCU) or Certified Insurance Counselor (CIC).

- Customer service excellence: For roles that involve direct customer interaction, highlight your ability to provide exceptional customer service. Include metrics such as customer satisfaction ratings or the number of customer inquiries handled.

Wellfleet Insurance: Private Coverage and Care Options

You may want to see also

Quantify your accomplishments

When applying for insurance paneling for your private practice, it is important to make your resume stand out by quantifying your accomplishments. This means adding specific numbers, percentages, and other metrics to give a clear representation of the value you bring to the company. Here are some tips to help you effectively quantify your accomplishments:

- Track your work: Keep records of your performance data, including important metrics such as sales figures, client acquisition rates, and project completion times. This will allow you to identify the metrics that showcase your strengths and provide concrete evidence of your achievements.

- Gather your data: If you haven't been tracking your performance data, take the time to compile information on your accomplishments. Focus on areas that are most relevant to the position you are applying for and where you excelled the most.

- Use ranges: If exact numbers are not available, provide ranges to give an idea of the scale of your achievements. For example, stating that you "served 15 to 20 clients every week" gives an impression of your client load while acknowledging potential week-to-week variations.

- Focus on key metrics: Use numbers to highlight your achievements in areas such as finances, people management, time management, and rankings. For example, mention the dollar amount of increased sales or net profits, the number of clients or staff members you worked with, the years of experience you have, or any improvements in search engine rankings.

- Double-check your work: Ensure that all the quantities and numbers on your resume are correct and accurate. Presenting honest and precise information is crucial to maintain your credibility during the hiring process.

- Education: Developed and implemented an AP Calculus curriculum, resulting in a 4.3 average on AP testing and a 92% success rate.

- Human Resources: Oversaw a human resources team of seven employees serving an office of 450 staff members, maintaining high staff morale and aiding in retention and production.

- Management: Led a team of 20 employees and implemented innovative policies, resulting in a 27% increase in profits compared to the previous year.

- Marketing: Developed an online marketing platform that achieved top-three search engine rankings for targeted keywords, leading to a 48% increase in organic traffic and $17,000 in additional sales.

- Sales: Developed strong bonds with clients, achieving the title of "#1 Sales Associate in the Northeast and #3 Sales Associate Nationwide."

ACA's Role in Correcting Private Insurance Market Failures

You may want to see also

Tailor your resume to the specific role

When applying for a role in insurance, it's important to tailor your resume to the specific position. This shows employers that you understand the role's requirements and that you have the necessary skills and experience. Here are some tips to help you tailor your resume for a role in insurance:

- Study the job description: Look for keywords, job requirements, qualifications, skills, and responsibilities. Try to mirror the language used in the job description in your resume. For example, if the posting mentions "insurance sales," you can include phrases such as "goal-exceeding sales" in your resume.

- Highlight your insurance-specific skills: Focus on skills relevant to the insurance industry, such as processing claims, managing customer inquiries, assessing risk, underwriting policies, and staying up-to-date with industry regulations.

- Quantify your accomplishments: Use numbers and metrics to make your resume more impactful. For example, instead of simply stating that you "processed insurance claims," specify that you "processed an average of 50 insurance claims per week with a 98% accuracy rate."

- Emphasize your career progression: If you've been promoted or taken on additional responsibilities, make sure to reflect this in your resume. Grouping multiple positions within the same company under one entry can help demonstrate career growth.

- Include relevant certifications and licenses: Many insurance roles require specific certifications or licenses, so be sure to list any you have obtained. Examples include Chartered Property Casualty Underwriter (CPCU), Certified Insurance Counselor (CIC), and state-specific insurance licenses.

- Demonstrate your customer service skills: As many insurance roles involve working directly with customers, highlight your ability to provide excellent customer service. Include examples of how you've handled customer complaints or resolved issues in a timely and professional manner.

- Showcase your industry involvement: Employers value candidates who are actively involved in the insurance industry. Mention any industry associations you're a member of or conferences you've attended. This demonstrates your passion for the field and commitment to staying current with industry trends.

Understanding Private Insurance Payouts: Are They Taxable?

You may want to see also

Include relevant certifications and licenses

When applying for a job in the insurance sector, it is important to include any relevant certifications and licenses in your resume. This is especially crucial if you are applying for a role that requires specific qualifications, such as an insurance agent or broker.

The specific certifications and licenses you need to include will depend on the type of insurance job you are applying for. For example, if you are applying for a role as an insurance agent, you may need a Life and Health Insurance License. On the other hand, if you are applying for a role as an insurance investigator, you may need a bachelor's degree and a license to work in certain states or countries.

- Insurance Agent/Broker: Life and Health Insurance License, Property and Casualty License, Certified Insurance Counselor (CIC)

- Insurance Investigator: Bachelor's degree, license (depending on the state or country)

- Insurance Underwriter: Chartered Property Casualty Underwriter (CPCU), Associate in Risk Management (ARM)

- Health Insurance Agent: Life and Health Insurance Licenses, Certified Insurance Counselor (CIC)

- Insurance Sales Representative: Bachelor's degree in finance or a related field, relevant certification or license from the governing body

In addition to including the names of your certifications and licenses, you may also want to provide some context or details about them. For example, you could mention the year you obtained the certification or license, or any specific requirements or accomplishments associated with it. This can help to demonstrate your expertise and commitment to the field.

Remember to tailor your resume to the specific job you are applying for, and always review the job description and requirements carefully. By including the relevant certifications and licenses in your resume, you can increase your chances of making a strong impression on hiring managers and securing an interview for your dream job in the insurance industry.

Eyeglass Insurance: Private Coverage Options for Individuals

You may want to see also

Frequently asked questions

An insurance resume objective is a one- to two-sentence summary of an insurance professional's desired career path and why they are a good fit for a particular job. It is the first thing hiring managers at insurance companies read, after the contact information, when reviewing candidates' resumes.

A good insurance resume should include a header with your full name and contact information, a professional summary, your work history with quantified accomplishments, your academic credentials, any relevant certifications, and a list of core competencies.

Here are some examples of insurance resume objectives:

- "Highly productive claims representative with six years of experience and exceptional communication and interpersonal skills seeks a long-term position with a renowned insurance firm."

- "Recent Carver College graduate with an economics degree and excellent writing and research skills aims to launch a career in the insurance industry as a claims representative with a nationwide agency."

- "AIC-certified insurance broker with exceptional communication skills and persuasive abilities looking to further long-term career in the industry with a reputable company."