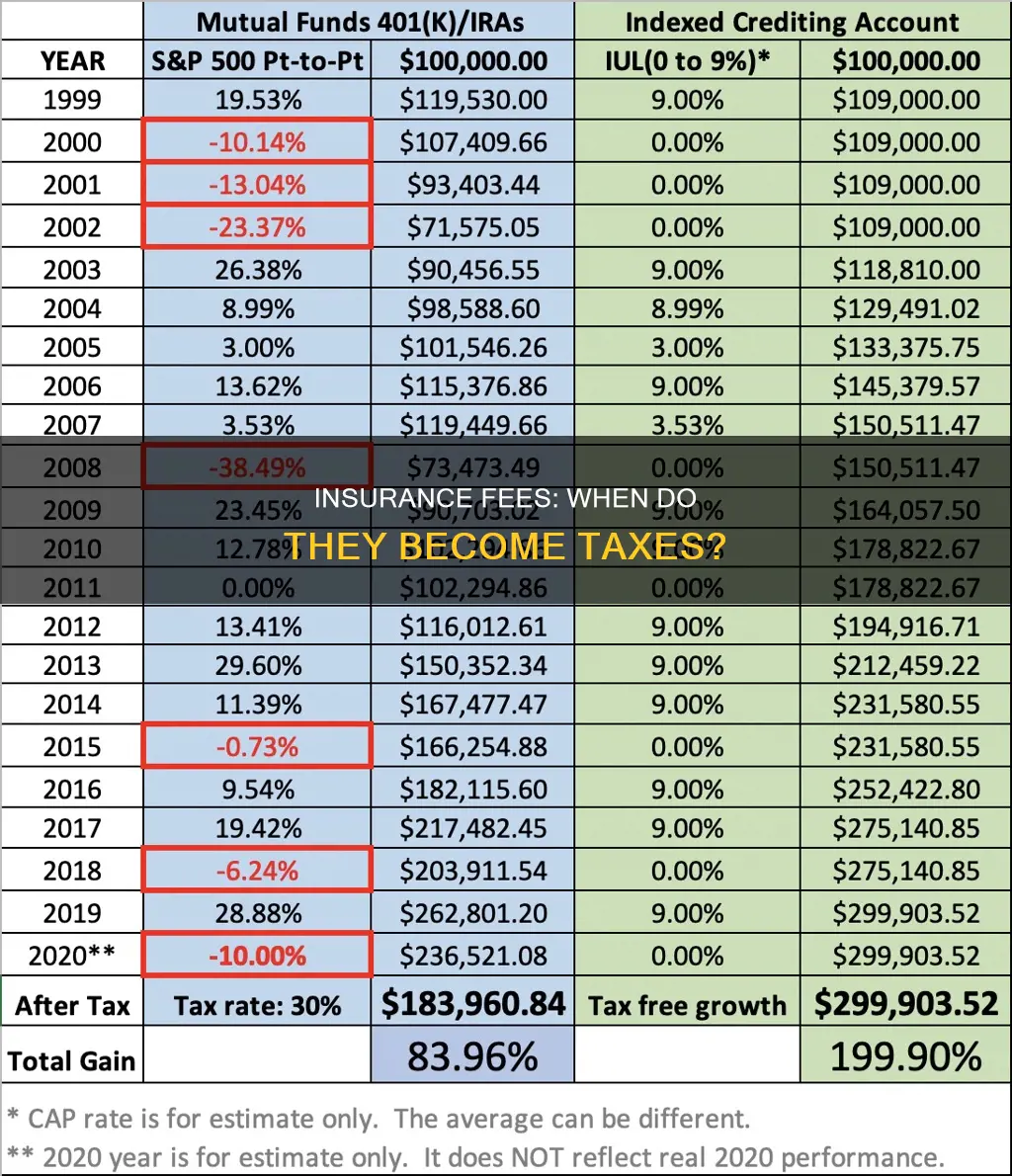

The distinction between insurance fees and taxes is not always clear, and the two are often conflated. Insurance companies are subject to various taxes, including those on gross premiums, and these costs are often passed on to the consumer in the form of higher premiums. In some cases, insurance premiums themselves can be considered a tax-deductible expense, particularly if they are paid for with post-tax income. Additionally, certain types of insurance, such as health insurance, may be tax-deductible, depending on the individual's circumstances. Understanding the interplay between insurance fees and taxes is crucial for both consumers and businesses to ensure compliance with tax laws and to optimize financial decisions.

What You'll Learn

Health insurance premiums and tax deductions

Health insurance premiums can be deducted from your federal taxes if you buy your own health insurance, itemize your deductions, and spent more than 7.5% of your income on medical expenses. However, if your insurance is provided by your employer, you cannot claim your premium payments on your taxes, as they are deducted from your paycheck before taxes.

If you pay for your health insurance after taxes are taken out of your paycheck, you may qualify for a medical expense deduction. This also applies if you pay the premiums for a policy you obtained yourself, as these are out-of-pocket costs.

If you are self-employed, you can claim medical insurance premiums as a standard deduction to reduce your adjusted gross income (AGI). This applies to premiums you pay for yourself, your spouse, and your dependents.

If you are enrolled in Medicare, you can include Medicare B supplemental insurance and Medicare D prescription insurance in your tax deductions. Long-term care insurance can also be included, with maximum deductions depending on your age. For example, the maximum deduction for those aged 61-70 is $4,220, while the maximum deduction for those 71 or older is $5,270.

Updating Your Address: A Nationwide Insurance Guide

You may want to see also

Tax on gross premiums

In the United States, insurance companies are subject to a tax on gross premiums, also known as a premium tax. This is a tax imposed by each state on the gross premium written by insurers allocable to risks located in that state. The tax is based on the gross direct premiums, less any return premiums and dividends paid to policyholders, on risks located or resident within the state.

In California, the insurance tax program is jointly administered by the Board of Equalization (BOE), California Department of Tax and Fee Administration (CDTFA), Department of Insurance (CDI), and the State Controller's Office (SCO). All insurance companies with the authority to transact insurance business in California, known as "admitted insurers", are subject to the tax on gross premiums. This includes both domestic and foreign insurers.

Admitted insurers in California may be subject to up to three insurance taxes: the tax on gross premiums, a retaliatory tax, and an ocean marine tax. The retaliatory tax is owed when an out-of-state insurance company's home state imposes higher taxes on a California-domiciled insurer for the same business. The ocean marine tax applies to insurers conducting ocean marine insurance in California.

In New York, the franchise tax for life insurance corporations is computed based on allocated entire net income, allocated business and investment capital, allocated net income plus compensation alternative, and a minimum tax base. To this, a tax on gross direct premiums, less return premiums and dividends, is added. For non-life insurance corporations, the franchise tax is based solely on gross direct premiums, less any return premiums and dividends, on risks located or resident within the state.

Understanding Qualifying Status Changes for Insurance

You may want to see also

Franchise tax

A franchise tax is a levy imposed by state law on businesses operating within a state. It is also called a privilege tax, as it grants the business the right to be chartered and/or to operate within that state. It is important to note that a franchise tax is not a tax on franchises, despite its name.

The franchise tax is separate from federal and state income taxes and must be paid annually, regardless of whether the business makes a profit. The amount of franchise tax varies depending on the state's tax rules and is not calculated based on the organisation's profit. Some states, like Delaware, have a minimum franchise tax of $175, while others, like New York, have a range from $25 to $200,000.

The franchise tax is typically calculated based on the net worth of the taxpaying entity, rather than its income. Some states may also use other factors, such as the value of a company's capital stock, assets, or gross receipts, to determine the tax amount. For example, in Texas, the franchise tax is calculated based on a company's margin, which can be computed in one of four ways: total revenue multiplied by 70%, total revenue minus cost of goods sold, total revenue minus compensation paid to personnel, or total revenue minus $1 million.

Companies that operate in multiple states may be subject to franchise taxes in all the states in which they are registered. However, sole proprietorships and certain other entities are generally not subject to franchise taxes.

The consequences of not paying franchise taxes can be significant, including financial penalties, damage to credit ratings and business reputation, and legal consequences such as the suspension or revocation of business licenses.

The Mystery of Vesting: Unraveling the Insurance Industry's Unique Take on Ownership

You may want to see also

Insurance Premium Tax for Licensed Companies

Insurance companies are subject to federal, state, and local taxes. State and local governments impose special premium taxes on the premiums written within their jurisdiction. These state premium taxes are a type of sales tax assessed on insurance gross premiums. The insurance company must pay the tax, but they pass the cost on to their customers. The state premium taxes are a percentage of the premiums paid by the insured. The maximum state premium tax is 4%, while the most common percentage is 2.5%. However, municipalities may also impose a premium tax, which would be added to the state tax.

Insurance companies pay corporate tax only in the state in which they are domiciled, but premium taxes are collected by every state in which premiums are written. This premium tax is assessed at a rate equal to the greater of the tax rate in the domicile state or the state in which the premium was written. The tax base is the amount of the written premiums minus any returns of premiums or dividends paid to policyholders.

Most states have retaliatory taxes, designed to equalize the assessed taxes on foreign insurers so that they do not have an advantage over domestic insurers. Hence, insurance companies will pay the greater of the tax rates of its domicile or the tax rate in the state in which the premium was written. A retaliatory tax is the percentage difference between the tax rate of the domicile and the foreign tax rate of the state in which the premium is written.

In addition to premium taxes, states also charge companies, insurance agents, and brokers licensing fees, which must be paid before a company or an insurance salesperson can sell insurance within the state.

The Evolution of Concierge Medicine: Unraveling the Billing Process and Insurance Coverage

You may want to see also

Maintenance taxes/fees

In the United States, insurance companies are subject to various taxes and fees, such as taxes on gross premiums, retaliatory taxes, ocean marine taxes, and franchise taxes. These taxes and fees vary by state and are used to fund various government programs and services. For example, in New York, insurance companies pay a franchise tax based on their gross direct premiums, with different rates for life insurance corporations and non-life insurance corporations. In California, insurance companies may be subject to a tax on gross premiums, a retaliatory tax, and an ocean marine tax.

When a car is totaled, the insurance company will often calculate taxes and fees on a pro-rata basis to compensate the vehicle owner for the unused portion of the annual taxes and fees. This is done by calculating the number of months of the annual taxes and fees that have been used and deducting that amount from the total.

Insurance Refunds: Taxable Income or Not?

You may want to see also

Frequently asked questions

Insurance fees are the costs associated with purchasing an insurance policy, such as premiums, while insurance taxes are levied on insurance companies by governmental bodies.

Insurance fees can be considered taxes when they are used to fund public programs or services, such as in the case of the Volunteer Fire Department Assistance Fund in Texas, which is funded by an annual assessment on property and casualty insurers.

Yes, in some cases, insurance premiums may be tax-deductible. For example, health insurance premiums can be deducted from federal taxes if you buy your own health insurance, itemize deductions, and spent more than 7.5% of your income on medical expenses.

Insurance companies calculate taxes based on factors such as gross premiums, net income, investment capital, and taxable premiums. These calculations can vary depending on the type of insurance company and the jurisdiction in which it operates.