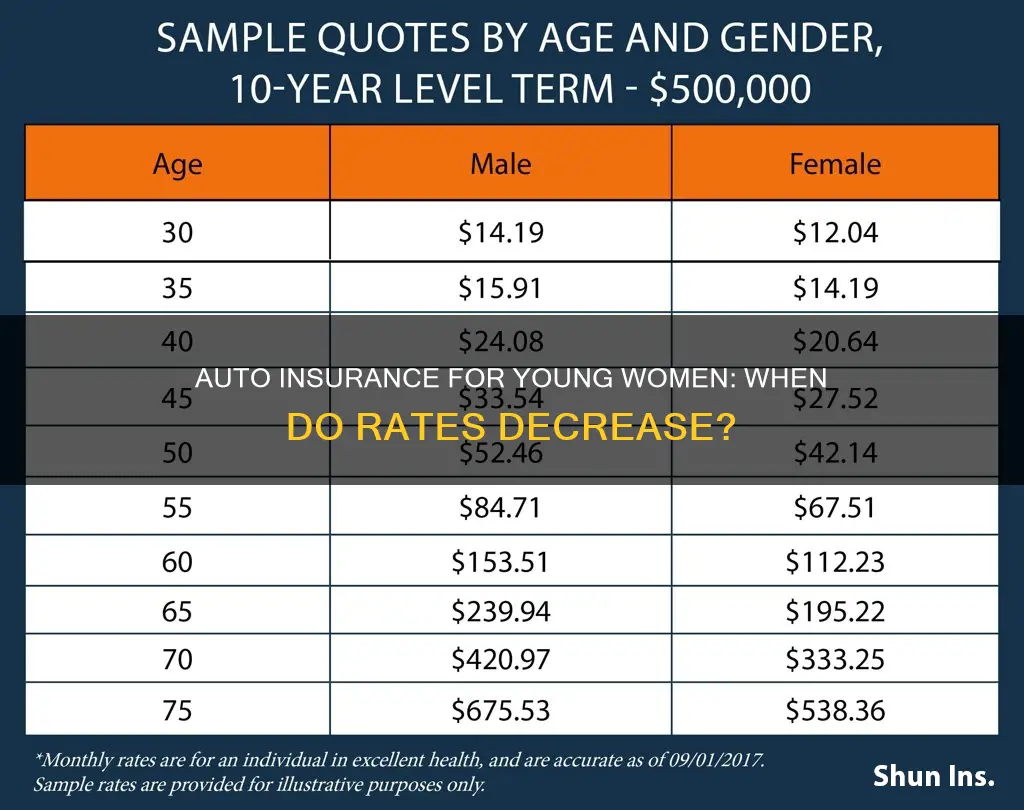

Young, inexperienced drivers are often considered a high risk by auto insurance companies, which translates to higher insurance premiums. However, as these drivers gain experience and get older, their insurance rates tend to decrease. For young female drivers, insurance rates typically start to go down around the age of 18 or 19, with the most significant drops occurring at ages 19 and 21. By the time they reach their mid-twenties, insurance rates stabilize, and females in their 50s often enjoy the lowest insurance rates.

| Characteristics | Values |

|---|---|

| Age when insurance rates go down | 18-19, 21, 25 |

| Average annual full coverage rate for females at 18 | $3,963 |

| Average annual full coverage rate for females at 25 | $1,402 |

| Average annual full coverage rate for females at 30-65 | $703 for a six-month policy |

| Average annual full coverage rate for females at 70+ | Rates begin to increase again |

| Average monthly rate for females at 16-20 | $396 |

| Average monthly rate for females at 25 | $194 |

| Average monthly rate for females at 30-65 | $154 |

What You'll Learn

- Male drivers are twice as likely to be arrested for severe driving violations

- Young drivers are more likely to have accidents or take risks

- Premiums decrease the most at ages 19 and 21

- Insurance rates are lowest for middle-aged drivers

- Premiums are affected by factors like driving experience and history

Male drivers are twice as likely to be arrested for severe driving violations

While women are more likely to have driver's licenses, unlicensed male drivers make up a greater proportion of crash fatalities. Additionally, male drivers are more likely to be involved in speeding-related accidents, with drivers under the age of 20 having the highest rate of speeding-involvement crashes.

The difference in fatality risk between male and female drivers has been diminishing with improvements in vehicle safety and design. However, crashes involving male drivers often result in more severe consequences, and male drivers are more likely to be arrested for severe driving violations.

The Relapse Risk: Understanding Auto Insurance Lapses and Their Impact

You may want to see also

Young drivers are more likely to have accidents or take risks

Young drivers tend to overestimate their driving abilities and, at the same time, underestimate the dangers on the road. They are also more susceptible to peer pressure, with the likelihood of risky behaviour increasing when travelling with multiple passengers. In addition, young drivers are more likely to drive older vehicles, which are less likely to be equipped with key safety features.

However, it's important to note that age is not the only factor affecting insurance rates. Other factors such as driving record, credit score, and location also play a significant role in determining insurance premiums.

Submit Medical Bills: Auto Insurance Guide

You may want to see also

Premiums decrease the most at ages 19 and 21

Auto insurance rates are highest for young drivers, especially teenagers, due to their lack of experience and increased likelihood of exhibiting unsafe driving behaviours. As drivers age, they gain more experience behind the wheel, leading to a reduced risk of accidents and insurance claims. This, in turn, results in lower insurance premiums.

The most significant decreases in auto insurance rates for young adults occur at ages 19 and 21. At age 19, the average savings per year is $1,595. The decrease in premiums at age 21 is slightly less, at 20%. These reductions are attributed to insurance companies considering older drivers as lower risk.

While auto insurance rates continue to decline gradually as individuals move into their mid-to-late twenties, the most substantial drops occur at ages 19 and 21. It is worth noting that the decrease in rates between males and females differs due to factors such as the likelihood of causing accidents and taste in vehicles. Male drivers tend to pay more than female drivers, especially at younger ages.

In addition to age, other factors that contribute to the cost of auto insurance include driving experience, coverage lapses, driving history, gender, marital status, education level, career, and credit score. It is also important to note that insurance rates may vary depending on the insurance company and the driver's location, as different states have different regulations regarding the use of age and gender as rating factors.

Gap Insurance vs. Extended Warranty: What's the Difference?

You may want to see also

Insurance rates are lowest for middle-aged drivers

The cost of auto insurance generally begins to drop when a driver reaches their early 20s. By the age of 25, drivers are no longer considered "youthful operators" by insurance companies and may notice a significant reduction in their premiums. At Progressive, for example, rates drop by an average of 9% at age 25. However, this reduction may not occur if the driver has a history of accidents or other violations.

As drivers gain more experience and mature behind the wheel, insurance rates continue to decrease until they reach middle age, at which point they stabilise or decrease slightly. This is because middle-aged drivers are considered the least risky to insure due to their experience and lower likelihood of making claims.

For female drivers, the difference in premiums between males and females narrows as they age. At age 50, for instance, males pay only 5% more, on average, per year for full coverage than 50-year-old females. It's worth noting that some states, such as California, Hawaii, and Massachusetts, have already begun equalising car insurance rates by prohibiting gender from being used as a rating factor.

While age is a significant factor in determining insurance rates, other factors also come into play, such as driving experience, driving history, credit score, and location. Maintaining a clean driving record, improving your credit score, and shopping around for quotes can help drivers lower their insurance costs and find more affordable premiums.

Full Glass Auto Insurance Coverage: What You Need to Know

You may want to see also

Premiums are affected by factors like driving experience and history

When it comes to auto insurance, driving experience and history are crucial factors in determining the cost of premiums. Generally, the more driving experience an individual has, the lower their insurance rates are likely to be. This is because experienced drivers are considered safer and less likely to file claims.

The number of years a person has been licensed to drive is a significant factor in assessing driving experience. For example, a 35-year-old first-time insurance applicant with no prior insurance history may be viewed as a risky driver due to their lack of verifiable driving history. In contrast, an individual with 20 years of continuous insurance coverage and no accidents is considered a low-risk, experienced driver.

Driving history also plays a vital role in insurance rates. A long history of accident-free driving can result in lower premiums. Conversely, accidents, speeding tickets, or other violations on a driving record can lead to higher rates for a period, typically three years.

While age is not the sole determinant of driving experience, it is a factor that insurers consider. Young drivers, especially teens, often face higher insurance rates due to their inexperience and higher accident risk. Premiums usually decrease as drivers age, with the most significant drop occurring between the ages of 18 and 19. By the mid-20s, many individuals are no longer considered youthful operators, and their premiums may decrease substantially.

However, it is important to note that insurance rates can increase again for older drivers, typically around age 70, due to age-related risk factors such as slower response times and vision loss.

In conclusion, driving experience and history significantly impact auto insurance rates. While age contributes to this assessment, it is not the sole factor, as individuals of any age with extensive safe driving histories are generally viewed favourably by insurers and may benefit from lower premiums.

The Auto Insurance Trap for Seniors: Why Rates Rise After 70

You may want to see also

Frequently asked questions

Auto insurance rates for young adult females decrease the most at ages 19 and 21. The rates continue to lower until the age of 30 and then tend to remain the same until the driver reaches her senior years.

Younger drivers are seen as high-risk by auto insurance providers due to their lack of experience behind the wheel. As they get older, they gain more experience, and insurance companies view them as less risky to insure.

On average, auto insurance rates decrease by 9% when young adult females turn 25.

Improving one's credit score, being mindful of one's driving record, and completing a defensive driving course can help lower auto insurance costs. Additionally, shopping around for quotes from different insurance providers can help find lower rates.