Parents often add their children to their car insurance policies, but when is the right time to remove a new driver from a parent's insurance? There are several factors to consider, including the child's driving record, maturity, and financial situation, as well as the parents' plans for their financial future. While parents can keep their children on their insurance policies for as long as they want, it may not always be financially prudent to do so. The cost of insuring a young driver is high, and removing them from a parent's policy can result in significant savings. However, it is essential to ensure that the child has alternative insurance coverage to avoid a lapse in coverage, which could lead to higher premiums in the future.

| Characteristics | Values |

|---|---|

| Child's living situation | If the child has moved out of the family home permanently, they can be removed from the parents' insurance policy. |

| Child's insurance status | If the child has their own insurance policy, they can be removed from the parents' insurance policy. |

| Child's vehicle ownership | If the child is the sole registered owner of their vehicle, they can be removed from the parents' insurance policy. |

| Child's driving record | If the child is an experienced driver with a safe driving record, they can be removed from the parents' insurance policy. |

| Child's financial situation | If the child can afford their own insurance, they can be removed from the parents' insurance policy. |

| Parents' financial plans | If the parents no longer wish to cover the cost of the child's insurance, they can be removed from the parents' insurance policy. |

| Child's age | If the child is no longer a teenager or young adult, their insurance risk level may decline, and they can be removed from the parents' insurance policy. |

| Child's gender | If the child is female, they may be rated lower than a male child and can be removed from the parents' insurance policy. |

What You'll Learn

The new driver has their own vehicle and insurance

If a new driver has their own vehicle and insurance, they can be removed from their parents' insurance policy. This is because, when buying car insurance, all licensed drivers in the household need to be listed on the policy. However, once a child moves out of the family home permanently, they no longer need to be covered by their parents' insurance.

When a child is removed from their parents' insurance, the premium for the family policy will decrease, as will the premium for the parent's excess liability or umbrella policy. This can save the family thousands of dollars annually. However, it is important to note that the child's insurance premium will increase as a result of them becoming a single driver.

Parents should be mindful of the potential lapse in coverage when removing a child from their insurance policy. If a child is removed from their parents' insurance before purchasing their own insurance, they will be considered a high-risk driver and will be charged higher premiums. Therefore, it is recommended that the child is removed from their parents' insurance on the same day their new insurance coverage starts.

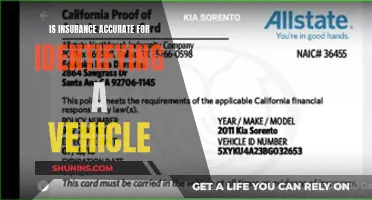

To remove a child from a car insurance policy, the policyholder should contact their insurance company and provide proof of the child's new insurance policy or proof that they no longer live with their parents. An alternative option is to list the child as an excluded driver, but this means they will not be covered to drive their parents' car under any circumstances.

After a Collision: Sharing Insurance Details with Other Drivers

You may want to see also

The new driver no longer lives with their parents

If a new driver no longer lives with their parents, they will likely need to obtain their own car insurance policy. This is because, when buying car insurance, all licensed drivers in the household need to be listed on the policy. However, if the driver still borrows a parent's car, they can remain on their parents' insurance policy.

There are several factors to consider when deciding whether to remove a new driver from their parents' insurance policy. Firstly, the cost of buying car insurance independently may be high for a new driver, especially if they are in their late teens or early 20s. In this case, it may be more financially viable for them to remain on their parents' policy, even if they no longer live at home.

On the other hand, a parent may want to remove a new driver from their insurance policy once they move out to reduce the cost of their premium. A youthful driver is considered a riskier driver, so removing them from the family policy can reduce the probability of a claim for property damage, injuries, and other liabilities. Additionally, if the new driver has moved to a state with lower insurance premiums, it may be more affordable for them to purchase their own insurance.

It is important to note that removing a new driver from a parent's insurance policy before they have found another policy can create a lapse in coverage, which may result in higher premiums when they apply for car insurance. Therefore, it is recommended that the new driver secures their own insurance policy before being removed from their parents' policy.

Understanding UDM Conversion and its Impact on Auto Insurance

You may want to see also

The new driver is an excluded driver

An excluded driver is someone who is explicitly excluded from coverage under your car insurance policy. They are usually a member of your household who is of driving age and licensed to drive. However, they are not covered by your insurance when driving your car, even with your permission. This means that if an excluded driver operates your vehicle and is involved in an accident, they will be considered an uninsured driver and held liable for any damages and injuries resulting from the incident.

There are a few reasons why you may choose to exclude a new driver from your parents' insurance policy. One reason could be to reduce insurance costs. Risky drivers, such as those with multiple accidents or violations, can cause a significant increase in insurance premiums. By excluding such drivers, you can lower your insurance rates. Additionally, if the new driver has their own vehicle and insurance or is listed on someone else's policy, exclusion from the parents' insurance may be appropriate. This is common when the child has moved out of the family home permanently or is no longer a dependent.

It is important to note that not all states allow policyholders to exclude household members from coverage. Some states specifically prohibit named driver exclusions, while others may require excluded drivers to have their own auto insurance before being excluded from a policy. Therefore, it is essential to understand the specific rules and regulations of your state and insurance provider before excluding a new driver from your parents' insurance policy.

To exclude a driver, you will need to contact your auto insurance company and may be required to fill out and sign a driver exclusion form. This process may vary depending on the insurer and the state in which you reside. It is also crucial to understand the implications of excluding a driver. Once a driver is excluded, they must not drive any of the vehicles listed on the insurance policy. Doing so could result in legal and financial consequences in the event of an accident.

In summary, excluding a new driver from parents' insurance can be a way to manage insurance costs and reflect changes in living situations or vehicle ownership. However, it is important to carefully consider the applicable laws, regulations, and potential consequences before making any exclusions to an insurance policy.

Auto Insurance Claims: Understanding Where Your Money Goes

You may want to see also

The new driver has a poor driving record

A new driver with a poor driving record will likely be considered a high-risk driver by insurance providers. This is because they are more likely to file a claim or get into an accident, which leads to higher insurance premiums. While it is possible to keep a new driver with a poor driving record on their parents' insurance, it may not be the best financial decision.

Parents can keep their children on the family auto insurance policy for as long as they want, but it is not always the most financially prudent decision. A youthful driver, even one in their early 20s, is considered riskier and can increase the probability of a claim for property damage, first-party and third-party injuries, and other liabilities that may result from an accident. Removing a young driver from their parents' insurance policy can help reduce these risks and lower insurance costs.

However, removing a new driver from their parents' insurance policy can also create a lapse in coverage, which can suggest they are a high-risk driver. This can result in higher premiums when they apply for car insurance and may even make it difficult to obtain coverage. Therefore, it is essential to ensure that the new driver has other insurance coverage before removing them from their parents' policy.

If a new driver with a poor driving record is removed from their parents' insurance, they may find it challenging to obtain affordable car insurance. Their poor driving record will likely result in higher insurance premiums, and they may be considered a high-risk driver by insurance providers. To mitigate these challenges, new drivers can consider improving their driving record by taking a defensive driving course, waiting for offenses to leave their record, or comparing quotes from multiple insurers to find the lowest rates.

Additionally, new drivers with a poor driving record can explore insurance companies that specialize in covering high-risk drivers, such as The General, Dairyland, or Farmers. These companies offer affordable insurance options and may provide accident forgiveness coverage. Improving their credit score can also help lower insurance premiums, as insurers consider drivers with poor credit to be riskier. Overall, while it is possible to remove a new driver with a poor driving record from their parents' insurance, it is important to carefully consider the potential challenges and explore ways to mitigate the financial impact.

Infinity's Gap Insurance: What You Need to Know

You may want to see also

The parents' plans for their financial future

Parents need to consider their financial future when deciding whether to keep their child on their car insurance policy or remove them. There are several factors to take into account when making this decision. Firstly, it is important to note that parents can keep their children on the family auto insurance policy for as long as they wish. However, this decision may impact their financial future, as adding a child to a car insurance policy typically results in higher premiums. Parents who add a driver under the age of 21 to their auto policy experience an average premium increase of $2,411 per year. This increase may be even higher if the child is male, if a new car is added to the policy, or if the child has a history of accidents or tickets.

On the other hand, removing a child from a car insurance policy can also have financial implications. If the child is a safe and experienced driver, removing them from the policy may not significantly affect the parents' insurance rates. However, if the child is a risky driver with a poor driving record, removing them from the policy could result in considerable savings for the parents. Additionally, once a youthful driver is removed from the insurance, the premium for the family policy will likely decrease, improving the parents' financial situation.

Furthermore, parents should be aware of the potential lapse in coverage when removing their child from their insurance policy. Ensuring that the child has other insurance coverage before removing them from the parents' policy is crucial to avoid financial risk in case of any losses. Additionally, parents can explore various discounts and compare quotes from different insurance carriers to optimize their financial situation when deciding whether to keep or remove their child from their car insurance policy.

Best Auto Insurance Company in Michigan: Who's Top?

You may want to see also

Frequently asked questions

You can remove your child from your car insurance when they move out of your home permanently or have their own vehicle and insurance.

Contact your car insurance company, either by phone or online, and let them know you need to take a named insured off your policy. They may ask for proof of your child's new insurance policy or new residence.

The premium for the family policy will decline considerably, as will the premium for the parent’s excess liability or umbrella policy.

Removing your child from your car insurance before they've found another policy can create a lapse in coverage. This can suggest they're a high-risk driver, and they will typically be charged higher premiums when they apply for car insurance.