When you purchase life insurance, it's crucial to understand the various factors that can influence your coverage and ensure you're making the right choices for your needs. This includes considering your age, health, lifestyle, and financial goals. Additionally, it's important to research and compare different insurance providers, policies, and coverage options to find the best fit for you. By taking the time to educate yourself and seek professional advice, you can make an informed decision and secure the life insurance that provides the necessary financial protection for you and your loved ones.

What You'll Learn

- Understand coverage options: Research and compare different policies to find the best fit

- Assess your needs: Determine the amount of coverage based on financial obligations and dependents

- Choose a policy type: Select between term life, whole life, or universal life insurance

- Review policy details: Carefully read the policy to understand benefits, exclusions, and terms

- Seek professional advice: Consult a financial advisor to ensure informed decision-making

Understand coverage options: Research and compare different policies to find the best fit

When considering life insurance, it's crucial to understand the various coverage options available to ensure you make an informed decision. The first step is to research and compare different policies offered by various insurance providers. This process allows you to evaluate the features, benefits, and potential drawbacks of each policy, ensuring you choose the one that best suits your needs.

Start by identifying the specific coverage requirements you have. Consider factors such as your age, health, financial situation, and the number of dependents you have. Younger individuals might opt for term life insurance, which provides coverage for a specified period, often at a lower cost. On the other hand, older individuals may prefer permanent life insurance, which offers lifelong coverage and includes an investment component. Understanding your unique circumstances will help narrow down the policy options.

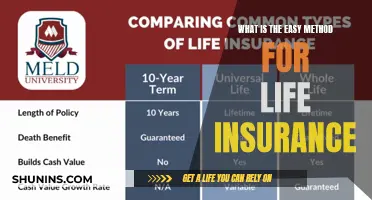

Explore the different types of life insurance policies, such as term life, whole life, universal life, and variable life insurance. Term life insurance is a straightforward choice, offering coverage for a predetermined period, typically 10, 20, or 30 years. It provides a fixed death benefit and is often more affordable. Whole life insurance, on the other hand, offers lifelong coverage with a fixed premium, and it also includes an investment component that grows over time. Universal life insurance provides flexible coverage with adjustable premiums, allowing you to increase or decrease the death benefit as needed. Variable life insurance combines insurance with an investment portfolio, offering potential for higher returns but also carrying more risk.

Comparing policies from different insurance companies is essential. Review the policy details, including the coverage amount, premium costs, policy duration, and any additional benefits or riders offered. Pay attention to the fine print and understand the terms and conditions to avoid any surprises. Additionally, consider the financial strength and reputation of the insurance provider to ensure they can honor their commitments in the long term.

Seeking professional advice from a licensed insurance agent or financial advisor can be invaluable during this research process. They can provide personalized recommendations based on your unique circumstances and help you navigate the complexities of different policies. These experts can also assist in understanding the tax implications and the impact of life insurance on your overall financial plan.

By thoroughly researching and comparing coverage options, you can make a well-informed decision when purchasing life insurance. This ensures that you select a policy that provides adequate financial protection for your loved ones and aligns with your long-term financial goals. Remember, the right life insurance policy is one that offers the coverage you need, fits your budget, and provides peace of mind.

Chlamydia and Life Insurance: Does It Affect Your Premiums?

You may want to see also

Assess your needs: Determine the amount of coverage based on financial obligations and dependents

When considering life insurance, one of the most crucial steps is assessing your unique needs to ensure you have the right coverage. This involves a deep understanding of your financial obligations and the impact of your dependents' well-being. Here's a detailed guide on how to determine the appropriate amount of life insurance coverage:

Identify Financial Responsibilities: Start by making a comprehensive list of all your financial commitments. This includes mortgage or rent payments, car loans, student loans, credit card debts, and any other regular expenses. Calculate the total amount you need to cover these obligations for a specific period, such as until the mortgage is paid off or the children reach adulthood. For instance, if your monthly expenses amount to $5,000 and you want to ensure your family can maintain this standard of living for the next 15 years, you'll need to consider a substantial insurance payout.

Consider Dependents' Needs: The presence of dependents, such as children or a spouse, significantly influences your life insurance requirements. Dependents often rely on your income for their daily needs, education, and future financial security. Calculate the annual cost of raising and educating your dependents until they become financially independent. This calculation should consider not only the present expenses but also the potential future costs, such as college tuition. For example, if your annual expenses for raising a child until they turn 18 are $12,000, and you have two children, your total annual expense is $24,000. This figure will help you determine the necessary insurance payout to cover their needs.

Account for Inflation and Future Expenses: Life is unpredictable, and financial obligations can change over time. Consider the potential impact of inflation on your expenses. For instance, if you expect the cost of living to increase by 3% annually, your future expenses will be higher than your current ones. Additionally, factor in potential future expenses, such as planned vacations, weddings, or business ventures, which may require a substantial financial cushion.

Review and Adjust Regularly: Life insurance needs are not static and may change over time. It's essential to review and adjust your policy periodically. Major life events like marriages, births, or significant financial milestones should prompt a re-evaluation of your coverage. As your financial obligations and dependents' needs evolve, ensure your life insurance policy reflects these changes to provide adequate protection.

By carefully assessing your financial obligations and the needs of your dependents, you can determine the appropriate amount of life insurance coverage. This process ensures that your loved ones are financially secure in the event of your passing, providing peace of mind and a safety net for the future. Remember, the key is to be thorough and proactive in managing your life insurance needs.

Alcoholics and Life Insurance: Getting Covered

You may want to see also

Choose a policy type: Select between term life, whole life, or universal life insurance

When considering life insurance, one of the most crucial decisions you'll make is choosing the right policy type. This decision will significantly impact your financial security and the coverage you receive. Here's a breakdown of the three primary policy types to help you make an informed choice:

Term Life Insurance: This is a straightforward and cost-effective option, providing coverage for a specified term, typically 10, 20, or 30 years. It is ideal for individuals who want coverage for a specific period, such as until a child's education is funded or a mortgage is paid off. Term life insurance offers high coverage amounts at lower premiums compared to other types. It is a popular choice for those seeking temporary protection without the long-term financial commitment of permanent insurance. During the term, if a covered event (like death) occurs, the beneficiary receives the death benefit. If you outlive the term, the policy expires, and no further payments are required.

Whole Life Insurance: This is a permanent life insurance policy that provides coverage for your entire life, as the name suggests. It offers a combination of insurance and savings components. With whole life, you pay a fixed premium, and the policy accumulates cash value over time, which can be borrowed against or withdrawn. This type of insurance provides guaranteed death benefits and a consistent premium, making it a stable long-term financial commitment. The cash value can grow tax-deferred, providing an asset that can be borrowed against or used to pay for future expenses. Whole life is suitable for those seeking lifelong coverage and a consistent financial plan.

Universal Life Insurance: This policy offers flexibility and adaptability, allowing you to adjust your coverage and premiums over time. It provides permanent coverage and includes an investment component, similar to whole life. With universal life, you can increase or decrease the death benefit and premium payments as your financial situation changes. This type of insurance is suitable for those who want the security of permanent coverage but prefer the flexibility to adjust their policy as their needs evolve. The investment aspect allows for potential growth, but it also comes with the risk of losing some of the accumulated value if investment returns are poor.

In summary, the choice between term, whole, and universal life insurance depends on your specific needs and financial goals. Term life is ideal for temporary coverage, whole life offers lifelong protection with savings, and universal life provides flexibility and investment potential. It is essential to evaluate your financial situation, long-term goals, and risk tolerance before making a decision. Consulting with a financial advisor can help you navigate these options and choose the policy that best suits your requirements.

Disability Rider on Life Insurance: Enough Coverage?

You may want to see also

Review policy details: Carefully read the policy to understand benefits, exclusions, and terms

When you purchase life insurance, it is crucial to thoroughly review the policy details to ensure you fully understand the coverage you are acquiring. This process is essential as it empowers you to make informed decisions and ensures you receive the benefits you expect. Here's a step-by-step guide on how to approach this critical aspect of your insurance journey:

Read the Policy Document: Start by obtaining a copy of the actual insurance policy document. This document is the legal contract between you and the insurance company, outlining the terms and conditions of your coverage. It is essential to read it carefully, as it contains all the specific details about your policy. Look for the following sections:

- Coverage Amount: Understand the financial benefit or payout that will be provided to your beneficiaries upon your death. This amount is a critical aspect of your policy and should align with your financial goals.

- Benefits and Riders: Policies often include various benefits and riders that extend coverage. These could include options like accelerated death benefits, which allow you to access a portion of your death benefit while still alive if you have a terminal illness. Review these to ensure they meet your needs.

- Exclusions and Limitations: Every policy has certain events or conditions that are not covered. These exclusions might include pre-existing health conditions, certain high-risk activities, or specific causes of death. Understanding these limitations is vital to manage your expectations.

- Understand the Policy Language: Insurance policies often use complex language and technical terms. Take the time to familiarize yourself with these terms to ensure you grasp the full meaning of the policy. Common terms to look out for include 'rider,' 'benefit period,' 'conversion privilege,' and 'waiver of premium.' Understanding these terms will help you make informed decisions and identify any potential issues.

- Verify Benefits and Payouts: Double-check the policy's benefits and the amount that will be paid out. Ensure that the coverage amount matches your expectations and financial needs. Consider your family's lifestyle, outstanding debts, and future expenses when determining the appropriate payout. This step is crucial to ensure the policy adequately supports your loved ones.

- Review Exclusions and Restrictions: Pay close attention to the policy's exclusions and any restrictions on coverage. These details can vary widely between policies, and understanding them is essential to avoid surprises. For example, some policies may exclude coverage for certain medical conditions or specific activities like skydiving. Knowing these exclusions will help you manage your expectations and make informed choices.

- Seek Clarification: If you come across any confusing or unclear information, don't hesitate to contact the insurance company or your agent for clarification. They should be able to provide explanations and address any concerns you may have. It is better to seek clarification early on to ensure you fully understand the policy before finalizing the purchase.

By carefully reviewing the policy details, you can ensure that your life insurance policy meets your needs and provides the expected financial security for your loved ones. This process empowers you to make informed decisions and ensures a smooth and successful insurance experience.

Lucrative Insurance Agent Careers: Earning and Living

You may want to see also

Seek professional advice: Consult a financial advisor to ensure informed decision-making

When considering life insurance, seeking professional advice is an essential step to ensure you make an informed decision. Life insurance is a significant financial commitment, and the process can be complex, especially with various types of policies available. Consulting a financial advisor can provide you with the guidance and expertise needed to navigate this important decision.

A financial advisor will assess your unique circumstances and offer tailored advice. They will consider your age, health, financial situation, and long-term goals to recommend the most suitable life insurance policy. This personalized approach ensures that you choose a plan that aligns with your specific needs and provides adequate coverage. For instance, they might recommend term life insurance if you have a family and want coverage for a specific period, or permanent life insurance for long-term financial security.

Professional advisors can also help you understand the various policy options, benefits, and potential pitfalls. They will explain the different types of life insurance, such as whole life, universal life, and variable life insurance, highlighting the advantages and disadvantages of each. By doing so, you can make an educated choice, ensuring the policy meets your expectations and provides the desired level of protection.

Moreover, financial advisors can assist in comparing different insurance providers and their offerings. They have access to a wide range of products and can negotiate on your behalf to secure the best rates and terms. This process can save you time and money, as advisors often have established relationships with insurance companies, allowing them to provide competitive options.

In summary, consulting a financial advisor when purchasing life insurance is a strategic move. Their expertise and personalized approach will empower you to make a well-informed decision, ensuring you have the right coverage for your circumstances. This step is crucial in securing your financial future and providing peace of mind for you and your loved ones.

Congressman's Insurance: A Lifetime Benefit?

You may want to see also

Frequently asked questions

Life insurance is a crucial financial decision that should be considered at various life stages. It is generally recommended to start thinking about life insurance in your 20s or 30s when you have a growing family, financial responsibilities, or long-term goals. This is when you can typically secure more affordable rates and ensure that your loved ones are protected in the event of your passing.

When purchasing life insurance, several key factors should be taken into account. Firstly, determine the appropriate coverage amount based on your family's needs and financial obligations. Consider your age, health, and lifestyle, as these factors influence premium costs. Evaluate different types of policies, such as term life or permanent life insurance, and choose a reputable insurance provider with a strong financial rating.

To get the best value for your life insurance, it's essential to compare quotes from multiple insurers. Request quotes from at least three different companies to understand the market rates. Pay attention to the policy's features, such as coverage duration, death benefit options, and any additional benefits like critical illness or disability coverage. Regularly review and adjust your policy as your life circumstances change to ensure it remains suitable.