When considering the process of surrendering a life insurance policy, it's important to understand the options available for listing the surrender. This can involve contacting the insurance company directly, where you can typically find detailed information on their website or by speaking with a customer service representative. Alternatively, you may also list the surrender through a financial advisor or broker who can provide guidance and assistance throughout the process. It's crucial to carefully review the terms and conditions of your policy to ensure you are aware of any fees, penalties, or requirements associated with surrendering the policy.

What You'll Learn

- Regulatory Bodies: Understand surrender rules and requirements from insurance regulators

- Company Policies: Review your insurance company's surrender policy and procedures

- Financial Implications: Consider tax consequences and surrender fees

- Alternative Options: Explore alternatives like policy loans or annuitization

- Legal Considerations: Seek legal advice for complex surrender scenarios

Regulatory Bodies: Understand surrender rules and requirements from insurance regulators

When it comes to life insurance surrenders, understanding the regulatory framework is crucial for both insurance companies and policyholders. Insurance regulators play a vital role in overseeing the insurance industry, ensuring fair practices, and protecting consumers' interests. Here's a detailed guide on how to navigate the regulatory landscape regarding life insurance surrenders:

Research and Identify Relevant Regulators: The first step is to identify the regulatory bodies that oversee insurance operations in your region. These regulators are typically government agencies or departments responsible for financial services and insurance. For instance, in the United States, the National Association of Insurance Commissioners (NAIC) provides guidelines and standards for insurance practices, including surrender rules. In the UK, the Financial Conduct Authority (FCA) regulates insurance companies and ensures compliance with consumer protection laws. Researching and understanding the specific regulators in your jurisdiction is essential.

Understand Surrender Regulations: Life insurance surrender regulations vary across different regions and countries. Regulators often have specific rules governing how insurance companies handle surrender requests and the associated processes. These regulations may include requirements for notice periods, surrender fees, and the calculation of surrender values. For example, some jurisdictions might mandate a cooling-off period after a surrender request is made, during which the policyholder can revoke their decision. It is imperative to study these regulations to ensure compliance and provide accurate information to policyholders.

Compliance and Reporting: Insurance companies are required to comply with the surrender rules set by regulatory bodies. This includes maintaining transparent communication with policyholders, providing clear surrender options, and disclosing all relevant fees and charges. Regulators often mandate that insurance providers offer policyholders a fair market value for their surrender, ensuring they receive a reasonable amount for their policy. Companies must also report surrender-related activities to the relevant authorities, including data on surrender rates, reasons for surrender, and any associated financial impacts.

Policyholder Rights and Protections: Regulatory bodies emphasize the importance of protecting policyholders' rights during the surrender process. This includes ensuring that policyholders are aware of their options, providing them with all necessary information, and obtaining their consent for any changes or surrenders. Regulators may also require insurance companies to offer alternative solutions or products if a surrender is requested, ensuring policyholders have other options. Understanding these rights and protections is essential for both insurance providers and policyholders to maintain a fair and transparent relationship.

By thoroughly researching and understanding the surrender rules and requirements from insurance regulators, insurance companies can ensure compliance, provide better service to policyholders, and maintain a positive reputation. It is a critical aspect of the insurance industry, promoting transparency and consumer protection.

Chase Life Insurance: What You Need to Know

You may want to see also

Company Policies: Review your insurance company's surrender policy and procedures

When it comes to life insurance surrenders, it's crucial to understand the policies and procedures of your insurance company. Life insurance surrender policies can vary significantly between different providers, so reviewing your specific company's guidelines is essential. This process ensures you are aware of your options and the potential consequences of surrendering your policy.

Start by locating your insurance company's official website or customer portal. Most insurance providers have dedicated sections for policyholders to access important information. Look for a 'Policy Documents' or 'Surrender Process' section, where you should find detailed instructions and forms related to surrenders. These resources will outline the specific requirements and steps you need to follow.

Pay close attention to the surrender fees and penalties associated with your policy. Insurance companies often charge a surrender charge or a penalty if you decide to surrender the policy early. These fees can vary depending on the type of policy, the time elapsed since the policy's inception, and the company's regulations. Understanding these charges is vital to making an informed decision.

Additionally, review the company's guidelines on how to initiate the surrender process. This may involve filling out a surrender request form, providing necessary documentation, and following specific instructions provided by the insurance company. Ensure you adhere to their procedures to avoid any unnecessary delays or complications.

Remember, each insurance company has its own unique policies, so it's essential to thoroughly review the information provided. If you have any doubts or concerns, contact your insurance company's customer service team for clarification. They can provide personalized guidance based on your specific policy and circumstances. Being well-informed about your surrender options will help you make the best decision regarding your life insurance policy.

Is Cash Value Life Insurance Beneficial for Small Businesses?

You may want to see also

Financial Implications: Consider tax consequences and surrender fees

When considering the financial implications of surrendering a life insurance policy, it's crucial to understand the potential tax consequences and surrender fees associated with the process. These factors can significantly impact your overall financial decision-making.

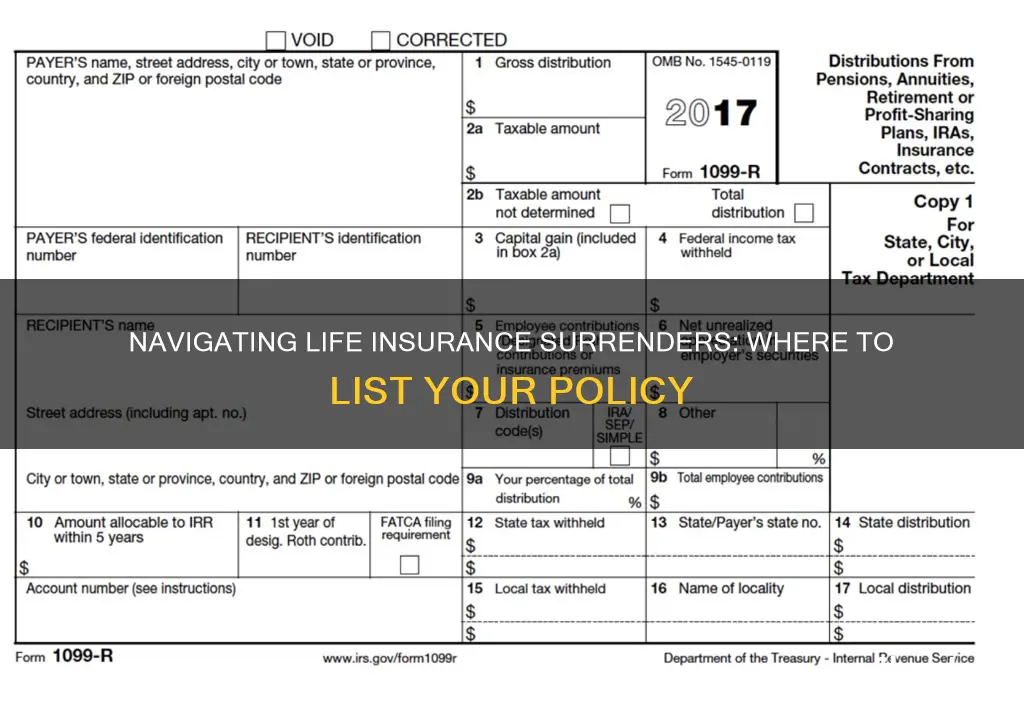

Tax Implications:

Surrendering a life insurance policy may trigger tax consequences, depending on the type of policy and your personal financial situation. If you have a cash value life insurance policy, the surrender of the policy could result in a taxable event. The IRS considers the surrender of a policy as a distribution, and you may be subject to income tax on the amount you receive from the insurance company. It's important to consult with a tax professional to understand the specific tax implications based on your circumstances. They can provide guidance on how to structure the surrender to minimize tax liabilities.

Surrender Fees:

Many life insurance companies charge surrender fees when a policy is surrendered, especially if it has been in force for a short period. These fees are typically a percentage of the policy's cash value and are designed to cover the costs associated with setting up the policy. The fee structure can vary between companies, and it's essential to review the policy's terms and conditions to understand the specific surrender fees applicable. Surrender fees can be substantial, and they reduce the overall value of the policy. It's advisable to calculate the surrender fees in relation to the policy's cash value to determine the true financial impact.

Understanding the tax implications and surrender fees is vital for making an informed decision. It's recommended to seek professional advice to navigate these financial considerations effectively. By carefully evaluating these factors, you can make a well-informed choice regarding the surrender of your life insurance policy. Remember, the financial implications can vary, so personalized advice is essential to ensure you make the best decision for your financial well-being.

Supplemental Life Insurance: Can You Take It With You?

You may want to see also

Alternative Options: Explore alternatives like policy loans or annuitization

When you decide to surrender your life insurance policy, it's important to understand that there are alternative options available that can provide financial benefits without completely giving up the policy. Two such options are policy loans and annuitization, each offering unique advantages.

Policy Loans:

Life insurance policies often have a built-in loan feature, allowing policyholders to borrow money against the cash value of their policy. This can be a valuable tool for accessing funds without surrendering the policy. Here's how it works: You can take out a loan against the policy's cash value, which is the accumulated value of the premiums paid minus any outstanding loans. The loan is typically interest-free and can be repaid over time, often with the interest added to the loan balance. This option provides immediate access to funds without the need for a surrender, allowing you to utilize the policy's value for various financial needs.

Annuitization:

Annuitization is a process where the future payments from your life insurance policy are converted into a fixed income stream. Instead of receiving a lump sum or periodic payments, you can choose to annuitize the policy. This option is particularly beneficial for those seeking a steady income stream during retirement. By annuitizing, you essentially sell the future payments of the policy to an insurance company, who then provides you with regular payments for a specified period or for life. This can provide financial security and peace of mind, knowing that you have a guaranteed income source.

Both policy loans and annuitization offer ways to access the value of your life insurance policy without surrendering it entirely. These alternatives can be especially useful when you need immediate funds or want to ensure a consistent income stream. It's essential to carefully consider your financial goals and consult with a financial advisor to determine which option aligns best with your needs. Understanding these alternatives can empower you to make informed decisions regarding your life insurance policy and its potential benefits.

Hartford's Supplemental Life Insurance: A Comprehensive Guide

You may want to see also

Legal Considerations: Seek legal advice for complex surrender scenarios

When it comes to life insurance surrenders, seeking legal advice is crucial, especially in complex scenarios. Life insurance policies can be intricate financial instruments, and the process of surrendering them involves various legal considerations that may not be immediately apparent. Complex surrender scenarios often arise when an individual wants to surrender a policy but has outstanding loans, beneficiaries, or complex tax implications. In such cases, the legal implications can be far-reaching and may require specialized knowledge.

Legal professionals, particularly those with expertise in insurance law, can provide invaluable guidance. They can help individuals navigate the legal process, ensuring that all necessary steps are taken to protect their interests. For instance, if a policyholder has taken out a loan against their life insurance policy, the legal advisor can assist in understanding the implications of the surrender and the potential impact on the loan. They can also advise on the best course of action to minimize any adverse effects on the policyholder's financial situation.

Furthermore, legal advice is essential when dealing with beneficiaries. Life insurance policies often have designated beneficiaries, and any changes or surrenders must be handled carefully to avoid legal complications. A legal expert can help clarify the rights and obligations of both the policyholder and the beneficiaries, ensuring that the surrender process is fair and in compliance with the policy's terms. This is particularly important to prevent disputes and potential legal battles that could arise from unclear or misunderstood beneficiary arrangements.

In addition, tax implications are a significant aspect of life insurance surrenders. The tax consequences can vary depending on the policy type, surrender value, and the individual's overall financial situation. A legal advisor can provide insights into the tax laws and help structure the surrender in a way that minimizes tax liabilities. They can also advise on the potential impact of the surrender on the policyholder's estate planning and overall financial strategy.

Engaging a legal professional for complex surrender scenarios is a proactive approach to managing one's financial affairs. It ensures that individuals make informed decisions and understand the full scope of legal and financial implications. By seeking legal advice, policyholders can navigate the surrender process with confidence, knowing that their interests are protected and that any potential legal pitfalls are avoided. This is especially important when dealing with substantial financial decisions that could have long-lasting effects on one's financial well-being.

No Exam Life Insurance: Quick Coverage, No Hassle

You may want to see also

Frequently asked questions

You can typically find details about listing life insurance surrenders on the website of your insurance company. Look for the "Policyholder Services" or "Customer Support" section, where you might find a dedicated page or a link to resources regarding policy management and surrender options.

Online listing of a life insurance surrender usually involves logging into your account on the insurance company's website. Navigate to the "Policy Management" or "Surrender Request" section, where you can initiate the process. You may need to provide personal details, policy information, and a reason for the surrender. Follow the on-screen instructions to complete the online form.

Yes, there often are fees involved in listing a life insurance surrender. These fees can vary depending on the insurance company and the type of policy. Common fees include surrender charges, which are typically a percentage of the policy's cash value, and administrative fees. It's essential to review the policy documents and contact the insurance company for specific fee details to understand the financial implications of surrendering your policy.