Life insurance companies play a crucial role in the financial industry by providing a safety net for individuals and their families. While their primary function is to offer financial protection in the event of death, these companies also manage substantial reserves that they invest in various assets to generate returns. These investments are essential for the companies' financial stability and the long-term viability of the policies they offer. Understanding where and how life insurance companies invest their money is key to grasping the broader financial ecosystem and the strategies employed by these institutions to ensure the continuity of their services.

What You'll Learn

- Investment Portfolios: Diversified funds and stocks for long-term growth

- Real Estate: Property investments for stable returns and asset diversification

- Bonds and Debt: Low-risk securities offering steady income and capital preservation

- Marketable Securities: Liquid assets like treasury bills and short-term loans

- Alternative Investments: Hedge funds, private equity, and venture capital for high returns

Investment Portfolios: Diversified funds and stocks for long-term growth

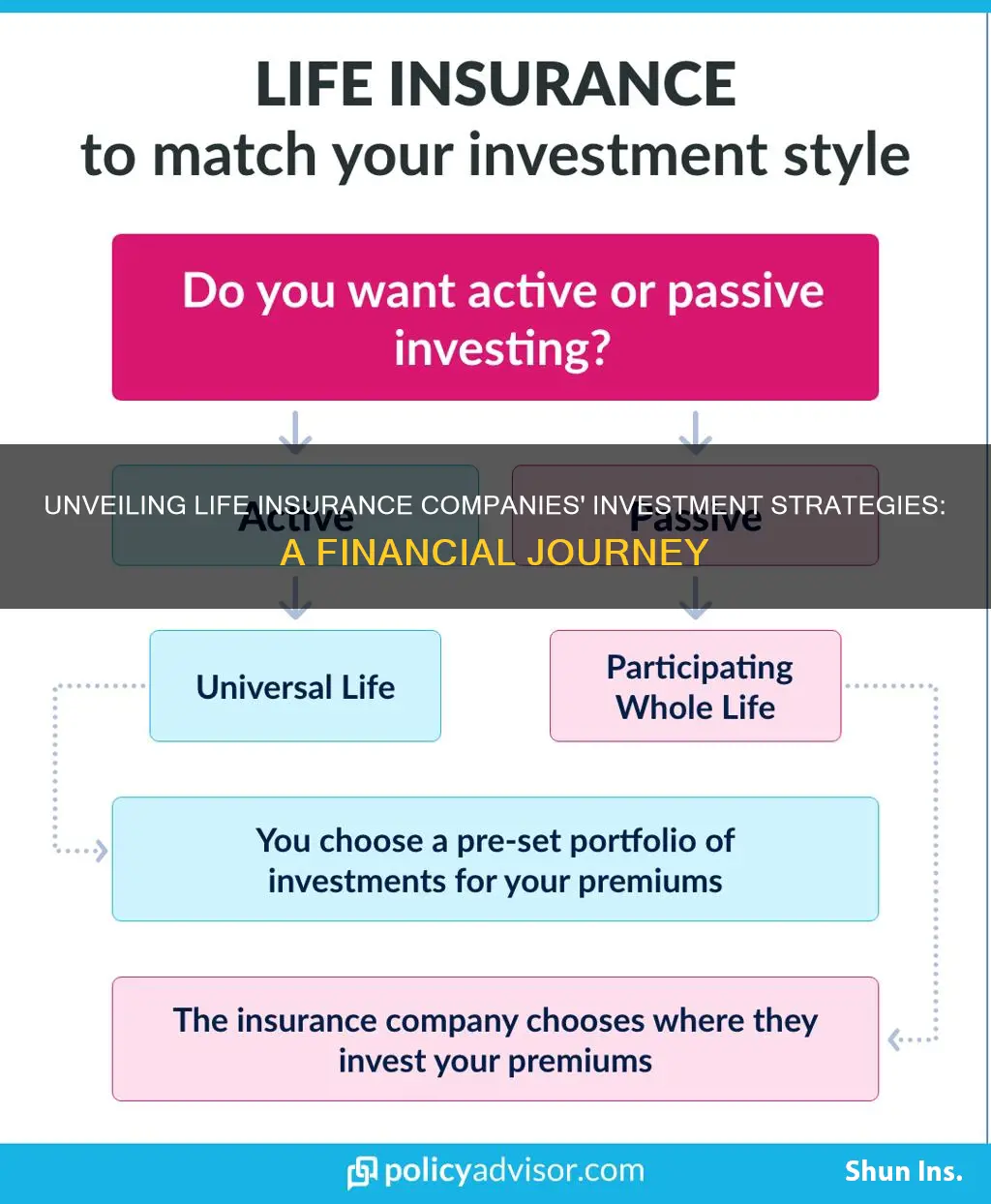

When it comes to investing, life insurance companies often have a unique and crucial role to play. These companies are primarily focused on providing financial security to individuals and families through various insurance products. However, they also need to invest their funds wisely to ensure the long-term stability and growth of their business. The investment portfolios of life insurance companies are carefully constructed to balance risk and return, often with a long-term horizon in mind.

One of the key strategies these companies employ is diversification. Diversification is a risk management technique that involves spreading investments across various asset classes, sectors, and geographic regions. By doing so, life insurance companies aim to reduce the overall risk of their investment portfolio while still pursuing growth. This approach is particularly important for these companies as they manage large pools of funds on behalf of their policyholders.

Diversified funds are a popular choice for investment portfolios. These funds pool money from multiple investors to invest in a wide range of securities, such as stocks, bonds, and other assets. By investing in diversified funds, life insurance companies can gain exposure to various markets and sectors, reducing the impact of any single investment's performance on the overall portfolio. This strategy allows them to maintain a balanced and stable investment approach.

Stocks are another essential component of investment portfolios for life insurance companies. These companies often invest in a mix of large-cap, mid-cap, and small-cap stocks across different industries. By diversifying their stock investments, they can capture the growth potential of various sectors while also managing risk. Life insurance companies may also consider investing in international markets to further diversify their portfolios and take advantage of global growth opportunities.

The investment process for life insurance companies involves rigorous research, analysis, and due diligence. They employ teams of investment professionals who study market trends, assess risk factors, and make informed decisions. These professionals use various tools and models to identify potential investment opportunities and manage the portfolio's risk exposure. Regular reviews and adjustments are made to ensure the portfolio aligns with the company's financial goals and risk tolerance.

In summary, life insurance companies construct investment portfolios with a focus on long-term growth and stability. Diversification is a key strategy, utilizing diversified funds and a wide range of stocks to manage risk effectively. By employing a disciplined investment approach, these companies can ensure they are making prudent decisions on behalf of their policyholders, ultimately contributing to the financial security they provide.

Term Life Insurance: Building Equity or Not?

You may want to see also

Real Estate: Property investments for stable returns and asset diversification

Real estate investments have long been a cornerstone of financial portfolios, offering a tangible asset class that can provide stable returns and act as a hedge against market volatility. When considering where to allocate funds, life insurance companies often turn to property investments as a strategic move. This is primarily due to the real estate market's inherent stability and the potential for long-term capital appreciation.

The appeal of real estate lies in its ability to offer both income and equity growth. For instance, purchasing a rental property generates a steady cash flow through tenant payments, providing a consistent return on investment. Over time, the property's value may increase, allowing investors to benefit from capital gains when they decide to sell. This dual benefit of income and potential capital growth makes real estate an attractive option for risk-averse investors.

Life insurance companies, being risk-averse themselves, often view real estate as a safe haven investment. They may invest in properties directly, either through purchasing and developing land or acquiring existing buildings. Alternatively, they can invest in real estate investment trusts (REITs), which are companies that own and operate income-generating properties. REITs offer a way to gain exposure to the real estate market without the complexities of direct property ownership.

Diversification is a key strategy for risk management, and real estate provides an excellent avenue for achieving this. By investing in various properties across different locations and market segments, life insurance companies can reduce their overall portfolio risk. This approach ensures that the impact of any single investment's performance is minimized, providing a more stable and consistent return over time.

In summary, real estate investments offer life insurance companies a means to achieve stable returns and diversify their portfolios. The tangible nature of property, combined with the potential for both income and capital growth, makes it an attractive investment option. By carefully selecting properties and employing a diversified strategy, these companies can navigate market fluctuations and ensure the long-term health of their investment portfolios.

Whole Life Insurance: A Viable Retirement Option?

You may want to see also

Bonds and Debt: Low-risk securities offering steady income and capital preservation

Bonds and debt securities are a cornerstone of investment portfolios for life insurance companies, offering a relatively low-risk avenue for generating steady income and preserving capital. These securities represent a loan made by an investor (the bondholder) to a borrower (the issuer), typically a government, municipality, or corporation. When an insurance company invests in bonds, it essentially lends its funds to these entities, receiving a promise to repay the principal amount (face value) at a specified future date, along with regular interest payments (coupons).

The appeal of bonds and debt lies in their stability and predictability. Unlike stocks, which can be volatile and subject to market fluctuations, bonds offer a more consistent return. This is particularly important for insurance companies, as they are required to maintain a certain level of financial stability to meet their obligations to policyholders. By investing in bonds, these companies can ensure a steady stream of income, which is crucial for their long-term financial health.

There are various types of bonds, each carrying different levels of risk and return. Government bonds, for instance, are considered the safest, as they are backed by the full faith and credit of the issuing government. These include Treasury bonds, which are issued by the federal government, and municipal bonds, which are issued by local governments or municipalities. Corporate bonds, on the other hand, are issued by companies and carry a higher risk but also offer potentially higher returns. Insurance companies often diversify their bond portfolios across these categories to balance risk and reward.

Debt securities, which include both bonds and short-term debt instruments like commercial paper, provide insurance companies with a means to manage their cash flow and liquidity. These securities offer a relatively low-risk way to invest surplus funds while still generating a steady income stream. For example, commercial paper is a short-term debt instrument typically issued by large, creditworthy companies to meet their short-term financial obligations. It provides insurance companies with a liquid asset that can be easily converted to cash if needed.

In summary, bonds and debt securities are essential components of life insurance company investment strategies, offering a low-risk approach to generating income and preserving capital. These investments provide a stable and predictable return, which is vital for the financial stability of insurance companies. By carefully selecting and diversifying their bond portfolios, insurance companies can effectively manage risk while meeting their financial obligations to policyholders.

Universal Life Insurance: Entering Details in Quicken

You may want to see also

Marketable Securities: Liquid assets like treasury bills and short-term loans

Life insurance companies, like many financial institutions, invest a significant portion of their assets in a variety of financial instruments to ensure they can meet their obligations to policyholders while also growing their capital. One of the key areas where they focus their investments is in marketable securities, which are highly liquid assets that can be quickly converted into cash with minimal impact on their value. These securities play a crucial role in the investment strategy of life insurance companies, offering both safety and potential for growth.

Treasury Bills:

Treasury bills are one of the most common and secure forms of marketable securities. These are short-term debt instruments issued by governments, typically with maturities ranging from a few days to one year. Life insurance companies invest in these bills because they provide a safe haven for their capital, offering a low-risk, highly liquid option. Treasury bills are considered one of the safest investments due to their backing by the government, which guarantees repayment of the principal amount. This makes them an attractive choice for insurers, especially those with a need for immediate access to cash.

Short-Term Loans:

In addition to treasury bills, life insurance companies may also invest in short-term loans, which are essentially loans made to other financial institutions or businesses. These loans are typically secured by high-quality collateral and have short repayment periods, often ranging from a few days to a few months. Short-term loans provide insurers with a slightly higher potential return compared to treasury bills, as they offer a higher interest rate. However, they still maintain a low level of risk due to the short duration and the quality of the collateral. This investment strategy allows life insurance companies to diversify their portfolio while still keeping a significant portion of their assets in liquid form.

The investment in marketable securities, particularly treasury bills and short-term loans, serves multiple purposes for life insurance companies. Firstly, it provides a source of immediate liquidity, ensuring that the company can meet its financial obligations, such as paying out claims and policyholder benefits. Secondly, these investments offer a degree of safety, as they are generally considered low-risk, thus helping to maintain the financial stability of the insurer. Lastly, by investing in these short-term, highly liquid assets, life insurance companies can take advantage of potential market opportunities and generate a steady income stream.

In summary, marketable securities, including treasury bills and short-term loans, are essential components of life insurance company investment portfolios. They provide a balance between liquidity, safety, and potential growth, allowing insurers to manage their assets effectively while fulfilling their primary duty to protect and grow the capital of their policyholders. Understanding these investment strategies is crucial for investors and regulators alike to ensure the financial stability and soundness of life insurance companies.

Colonial Penn Life Insurance: What You Need to Know

You may want to see also

Alternative Investments: Hedge funds, private equity, and venture capital for high returns

Life insurance companies, like any other financial institutions, are constantly seeking ways to maximize their returns while maintaining a stable and secure investment portfolio. When it comes to alternative investments, these companies often turn to hedge funds, private equity, and venture capital as potential avenues for higher returns. These alternative investment strategies offer unique benefits and risks that can complement traditional asset classes.

Hedge funds are an attractive option for life insurance companies due to their focus on absolute returns and the ability to employ various investment strategies. These funds often use leverage, derivatives, and alternative trading techniques to generate profits, which can be particularly appealing during volatile market conditions. Hedge funds typically cater to accredited investors and offer a more specialized approach to investing, allowing life insurance companies to access exclusive investment opportunities. By investing in hedge funds, insurance companies can diversify their portfolios and potentially earn higher returns compared to traditional investments.

Private equity investments involve acquiring or investing in privately held companies, which can offer significant growth potential. Life insurance companies can invest in private equity funds or directly in private companies, often providing capital for expansion, acquisitions, or debt refinancing. This strategy allows insurance companies to become part-owners of these businesses, benefiting from their growth and success. Private equity investments can be highly lucrative, but they also carry higher risks due to the illiquid nature of these investments and the potential for significant capital appreciation or depreciation.

Venture capital, on the other hand, focuses on funding early-stage companies with high growth potential. Life insurance companies can invest in venture capital funds or directly support startups, often in exchange for equity stakes. This approach enables insurance companies to participate in the technology and innovation sectors, which are known for their high-risk, high-reward nature. Venture capital investments can lead to substantial returns if the funded companies achieve success and growth, but they also carry a higher level of risk compared to more established businesses.

Engaging in these alternative investment strategies requires careful consideration and due diligence. Life insurance companies must assess their risk tolerance, investment goals, and the specific characteristics of each investment opportunity. Due to the complex and often illiquid nature of these investments, insurance companies should conduct thorough research, seek expert advice, and diversify their portfolios to manage risk effectively.

In summary, life insurance companies can explore alternative investments in hedge funds, private equity, and venture capital to potentially achieve higher returns. These strategies offer unique benefits and risks, allowing insurance companies to diversify their portfolios and access specialized investment opportunities. However, it is crucial for insurance companies to approach these investments with caution, thorough research, and a well-defined risk management strategy.

Farm Insurance: Whole Life Coverage Options and Benefits

You may want to see also

Frequently asked questions

Life insurance companies invest their funds in a variety of assets to generate returns and meet their financial obligations. These investments are typically made with a focus on safety and liquidity, aiming to provide a steady income stream and capital preservation. Common investment areas include government bonds, corporate bonds, stocks, real estate, and alternative investments like private equity and hedge funds. The specific investment strategies can vary depending on the company's size, risk tolerance, and regulatory requirements.

The investments made by life insurance companies can indirectly affect policyholders in several ways. Firstly, the returns on these investments contribute to the company's ability to pay out death benefits to policyholders' beneficiaries when a covered individual passes away. Secondly, the investment portfolio's performance can influence the company's overall financial health, which may impact the availability and cost of certain insurance products. Lastly, some companies may offer policyholders the option to participate in the investment performance through features like investment-linked policies or variable life insurance, allowing them to potentially benefit from the growth of their investments.

Yes, life insurance companies' investments are subject to regulatory oversight to ensure the safety and stability of the insurance industry. Regulatory bodies, such as the National Association of Insurance Commissioners (NAIC) in the United States, set guidelines and standards for investment practices. These regulations aim to protect policyholders and ensure that insurance companies maintain adequate reserves to meet their financial commitments. Companies must adhere to these rules, which often include restrictions on the types of investments they can make and the level of risk they can assume.

Policyholders typically do not have direct access to the specific investment details held by life insurance companies. However, insurance providers are required to disclose certain financial information in their annual reports and statements. These documents may include a summary of the investment portfolio, asset allocations, and performance metrics. Additionally, policyholders can often find general information about the company's investment strategies and risk management practices on the insurer's website or by contacting their customer service.