When it comes to preparing for your life insurance exam, having the right resources is crucial. One of the most popular and comprehensive study guides is the Life Insurance Exam Book. This book is designed to help you understand the various aspects of life insurance, from the basics to more advanced concepts. Whether you're a beginner or looking to refresh your knowledge, this guide provides in-depth explanations, practice questions, and real-world examples to ensure you're fully prepared for the exam. In this paragraph, we'll explore where you can find this valuable resource to enhance your learning experience and boost your confidence for the life insurance exam.

What You'll Learn

- Life Insurance Basics: Understand the fundamentals of life insurance policies and coverage options

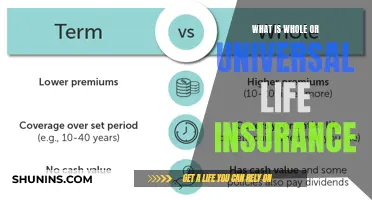

- Policy Types: Explore different types like term, whole, and universal life insurance

- Underwriting Process: Learn how insurance companies assess risk and determine eligibility

- Benefits and Payouts: Study the various benefits and how death benefits are paid out

- Regulatory Compliance: Understand the legal and regulatory requirements for life insurance sales

Life Insurance Basics: Understand the fundamentals of life insurance policies and coverage options

Life insurance is a financial tool that provides a safety net for individuals and their loved ones. It is a contract between an insurance company and an individual, where the insurer promises to pay a designated beneficiary a sum of money upon the insured person's death. Understanding the basics of life insurance is essential for anyone considering this important financial decision. Here's an overview to help you grasp the fundamentals:

Policy Types: Life insurance comes in various forms, each with unique features. The two primary types are Term Life Insurance and Permanent (or Whole) Life Insurance. Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years. It offers a straightforward way to secure financial protection during a particular stage of life. On the other hand, permanent life insurance, including whole life and universal life, offers lifelong coverage. These policies accumulate cash value over time, providing a financial benefit even before a claim is made.

Coverage and Premiums: The amount of coverage you choose is a critical aspect of life insurance. It represents the financial benefit paid to your beneficiaries when you pass away. The coverage amount should consider your family's needs, including expenses like mortgage payments, children's education, and daily living costs. Premiums are the regular payments made to the insurance company to maintain the policy. These premiums can vary based on factors such as age, health, lifestyle, and the type of policy selected. Younger individuals often benefit from lower premiums, while older individuals may face higher costs due to increased health risks.

Benefits and Payouts: When a life insurance policy is in effect, the insured person's beneficiaries receive a death benefit upon their passing. This payout can provide financial security, ensuring that loved ones have the resources to cover essential expenses and maintain their standard of living. The death benefit can be a lump sum or paid out over time as a regular income. Some policies also offer living benefits, such as accelerated death benefits, which allow policyholders to access a portion of the death benefit if they are diagnosed with a terminal illness, providing financial support during their final days.

Factors Affecting Premiums: Insurance companies consider several factors when determining premiums. Age is a significant factor, as younger individuals are generally healthier and less likely to require immediate payouts. Health status, including medical history and current well-being, plays a crucial role. Smokers, for instance, may face higher premiums due to increased health risks. Lifestyle choices, such as occupation, hobbies, and travel habits, can also impact costs. Additionally, the amount of coverage chosen and the policy's duration influence premium rates.

Understanding these life insurance basics is the first step towards making informed decisions. It empowers individuals to choose the right policy, ensuring that their loved ones are protected financially during challenging times. When selecting a life insurance provider, it is advisable to compare different companies, review policy details, and seek professional advice to make an informed choice.

Cashing in on Aflac: Surrendering Whole Life Insurance

You may want to see also

Policy Types: Explore different types like term, whole, and universal life insurance

When considering life insurance, understanding the various policy types is crucial to making an informed decision. Here's an overview of the three primary types of life insurance policies:

Term Life Insurance: This is a straightforward and affordable type of life insurance that provides coverage for a specified period, known as the 'term.' It is ideal for individuals seeking temporary coverage, often for a specific financial goal or a defined period, such as covering mortgage payments or providing financial security for children's education. Term life insurance offers a fixed death benefit, and premiums are typically lower compared to other policy types. The policyholder pays premiums for the agreed-upon term, and if a covered event (death) occurs during this period, the beneficiary receives the death benefit. After the term ends, the policy may be renewed, but at a potentially higher cost. Term life insurance is a popular choice for those who want coverage without the long-term financial commitment of permanent insurance.

Whole Life Insurance: In contrast to term life, whole life insurance offers permanent coverage for the entire lifetime of the insured individual. It provides a guaranteed death benefit and accumulates cash value over time, which can be borrowed against or withdrawn. This policy type is more expensive than term life due to its permanent nature and the associated investment component. With whole life insurance, the premiums are typically higher, but they remain consistent throughout the policy's life. The cash value grows tax-free and can be used to pay for future premiums, providing financial security and a sense of stability. This policy is suitable for those seeking long-term financial protection and the potential for tax-advantaged savings.

Universal Life Insurance: This policy offers flexibility and permanent coverage, combining the features of term and whole life insurance. Universal life provides a death benefit and allows policyholders to adjust their premiums and death benefit over time. The premiums are typically higher than term life but lower than whole life, and they can be adjusted based on the policyholder's financial situation. One of the key advantages is the ability to increase or decrease the death benefit and premiums, providing flexibility. Universal life insurance also accumulates cash value, which can be used to borrow against or withdraw funds. This policy is suitable for those who want the security of permanent coverage and the option to customize their policy as their financial needs change.

Each of these policy types has its own advantages and considerations, and the choice depends on individual financial goals, risk tolerance, and long-term plans. Understanding the differences between term, whole, and universal life insurance is essential to selecting the right coverage for your specific needs.

Child's Father: Insuring My Child's Future Security

You may want to see also

Underwriting Process: Learn how insurance companies assess risk and determine eligibility

The underwriting process is a critical aspect of the insurance industry, as it involves assessing the risk associated with insuring an individual or entity and determining their eligibility for coverage. This process is essential for insurance companies to manage their risk exposure and ensure the financial stability of their business. Here's an overview of how underwriting works and the key factors considered:

Underwriters play a vital role in the insurance lifecycle, acting as gatekeepers who evaluate and analyze potential risks. When an individual or business applies for insurance, the underwriting team reviews the application, considering various factors to make an informed decision. This process typically involves a thorough examination of the applicant's medical history, lifestyle choices, financial situation, and other relevant details. For life insurance, underwriters scrutinize medical reports, lab results, and even lifestyle choices like smoking or excessive alcohol consumption, as these can significantly impact longevity and, consequently, the insurance premium.

One of the primary methods used in underwriting is risk assessment, which involves assigning a risk score or category to the applicant. This score is derived from a combination of factors, including age, gender, medical history, occupation, and lifestyle. Younger individuals and non-smokers often receive lower risk assessments, resulting in more favorable insurance rates. Conversely, older applicants or those with pre-existing health conditions may face higher risk categories, leading to increased premiums or even denial of coverage.

Underwriters also consider the type of insurance being applied for. Different insurance policies have varying levels of risk and coverage. For instance, term life insurance, which provides coverage for a specified period, may be underwritten differently compared to whole life insurance, which offers lifelong coverage. The underwriting process takes into account the policy's duration, benefits, and the applicant's ability to meet the financial obligations associated with the premium payments.

In addition to individual assessments, insurance companies may also consider broader factors such as industry trends, economic conditions, and demographic data. These factors help underwriters make informed decisions about risk management and pricing. For instance, if a particular profession or lifestyle trend is associated with higher risks, underwriters might adjust their assessment criteria accordingly.

Understanding the underwriting process is crucial for individuals seeking insurance coverage, as it highlights the importance of transparency and risk management. By knowing the factors considered, applicants can take steps to improve their eligibility and potentially secure more favorable insurance terms.

Understanding Life Insurance: Protecting Your Loved Ones' Future

You may want to see also

Benefits and Payouts: Study the various benefits and how death benefits are paid out

When studying life insurance, understanding the benefits and payout structures is crucial. Life insurance policies offer a range of benefits, and knowing how these are structured can help you make informed decisions. Here's a detailed look at the key aspects:

Benefits Offered: Life insurance policies typically provide two main types of benefits: death benefits and living benefits. Death benefits are the primary focus of life insurance and are paid out upon the insured individual's passing. These benefits can be a lump sum payment, an annuity, or a combination of both. Living benefits, on the other hand, are designed to provide financial assistance during the insured's lifetime and can include critical illness coverage, long-term care benefits, and disability income. Understanding these benefits is essential to grasp the full value of a life insurance policy.

Death Benefits Payout: The death benefit is the core of life insurance and is designed to provide financial security for the insured's loved ones. When the insured dies, the death benefit is paid out according to the policy's terms. This payout can be a lump sum, which is a single payment, or an annuity, providing regular payments over a specified period. Some policies also offer a combination of both, ensuring a mix of immediate financial support and long-term security. It's important to study the payout options to ensure the policy aligns with your financial goals and the needs of your beneficiaries.

Factors Affecting Payouts: Several factors influence the amount and structure of death benefits. These include the policy's term, the insured's age, health, and lifestyle factors. Longer policy terms often result in higher death benefits, as the insurance company assumes a higher risk over an extended period. Additionally, the insured's health and lifestyle play a significant role in determining eligibility and premium costs. Understanding these factors is essential when comparing policies and ensuring you receive the most suitable coverage.

Customizing Benefits: One of the advantages of life insurance is the ability to customize benefits to fit individual needs. You can choose the death benefit amount, select the payout option (lump sum or annuity), and even add riders or endorsements to enhance coverage. For instance, you might opt for a higher death benefit or include a waiver of premium rider, ensuring that your beneficiaries are not burdened with ongoing premiums during their time of need. This customization ensures that the policy is tailored to your specific requirements.

Review and Adjustment: Regularly reviewing your life insurance policy is essential to ensure it remains appropriate as your life circumstances change. Life events like marriage, the birth of children, or significant financial milestones may warrant adjustments to your policy. By staying proactive, you can ensure that your death benefits and overall coverage are adequate to support your loved ones and meet your financial objectives.

Primerica Life Insurance: Contacting the Company for Your Insurance Needs

You may want to see also

Regulatory Compliance: Understand the legal and regulatory requirements for life insurance sales

When it comes to selling life insurance, understanding the legal and regulatory landscape is crucial for both the agent and the consumer. This knowledge ensures that the process is fair, transparent, and compliant with all applicable laws. Here's a breakdown of the key regulatory considerations:

Licensing and Registration:

Life insurance agents are typically required to obtain specific licenses to sell policies. This licensing process often involves background checks, education requirements, and passing relevant exams. The licensing authority in your jurisdiction will dictate the specific credentials needed. It's essential to check with your state or provincial insurance department to understand the licensing requirements in your area.

Regulatory Bodies:

Several regulatory bodies oversee the life insurance industry to protect consumers. These organizations set rules and guidelines for insurance companies and agents. For example, in the United States, the National Association of Insurance Commissioners (NAIC) develops model regulations that states often follow. Other countries have their own equivalent bodies. Familiarize yourself with the regulatory body in your region and its published guidelines.

Product Disclosure and Consumer Protection:

Regulations mandate that insurance companies provide clear and comprehensive information about their products. This includes detailed policy documents, illustrations, and explanations of coverage. Agents are responsible for ensuring that consumers receive these disclosures and understand the terms and conditions. Misrepresentation or failure to disclose relevant information can lead to legal consequences.

Ethical Conduct and Anti-Fraud Measures:

Regulatory frameworks emphasize the importance of ethical behavior in the insurance industry. This includes avoiding fraudulent activities, ensuring accurate policy administration, and maintaining client confidentiality. Agents must adhere to strict codes of conduct set by regulatory bodies to avoid penalties and maintain their professional reputation.

Ongoing Compliance and Training:

Regulatory compliance is an ongoing process. Insurance agents should stay updated on any changes in legislation and industry regulations. This may involve attending mandatory training sessions or completing regular continuing education courses. Staying informed ensures that you can provide the best service while adhering to the latest legal standards.

The Intricacies of Life Insurance Product Creation

You may want to see also

Frequently asked questions

You can find a variety of resources online and in bookstores that offer study materials for the life insurance exam. Websites like Amazon, Barnes & Noble, and specialized insurance exam preparation platforms provide books, study guides, and practice questions. Look for titles that specifically mention "Life Insurance Exam" or "Life and Health Insurance Licensing Exam" to ensure you get the right material.

Yes, there are several free resources available. Many insurance regulatory bodies and industry associations provide official study guides and practice questions on their websites. These resources are often regularly updated and can be a great starting point for your preparation. Additionally, some insurance companies offer free online courses or webinars to help aspiring agents prepare for the exam.

While free resources are helpful, purchasing a study book can significantly enhance your preparation. Exam books provide a structured approach to learning, covering all the relevant topics in detail. They often include practice questions, flashcards, and explanations to reinforce your understanding. A good study book can help you identify areas that need improvement and ensure you are well-prepared for the exam's content and format.

Absolutely! Online platforms dedicated to insurance exam preparation often offer practice exams as a valuable tool. These exams simulate the actual test environment and help you become familiar with the exam's structure and timing. By taking practice tests, you can assess your knowledge, identify weak areas, and improve your performance. Look for reputable websites that provide accurate and up-to-date practice materials.

When selecting a study book, consider the following:

- Relevance: Ensure the book covers the latest exam content and syllabus.

- Reputation: Choose books from reputable authors or publishers known for their insurance exam preparation materials.

- Reviews: Read reviews from previous buyers to gauge the book's effectiveness and clarity.

- Format: Decide whether you prefer a physical book or an online/digital version based on your learning preferences.

- Additional Resources: Some books offer companion websites with extra practice materials, which can be a valuable bonus.