Life insurance is a financial tool designed to provide financial security and peace of mind to individuals and their loved ones. Its primary function is to offer a financial safety net in the event of the insured's death, ensuring that their dependents are protected from the financial impact of losing their primary income earner. The policyholder pays a premium to the insurance company, which then promises to pay out a lump sum or regular income to the beneficiaries upon the insured's death. This financial support can help cover essential expenses, such as mortgage payments, children's education, and daily living costs, allowing the family to maintain their standard of living and achieve their financial goals even in the face of tragedy.

What You'll Learn

- Risk Mitigation: Life insurance provides financial protection against unforeseen death, ensuring loved ones' financial security

- Income Replacement: It offers a steady income stream to replace lost wages and maintain a family's standard of living

- Debt Management: Insurance can help pay off debts, like mortgages or loans, preventing financial strain on beneficiaries

- Estate Planning: A tool for transferring wealth, ensuring a smooth transition of assets to heirs and minimizing tax burdens

- Peace of Mind: Knowing you're protected offers emotional comfort, allowing individuals to focus on living rather than worrying about the future

Risk Mitigation: Life insurance provides financial protection against unforeseen death, ensuring loved ones' financial security

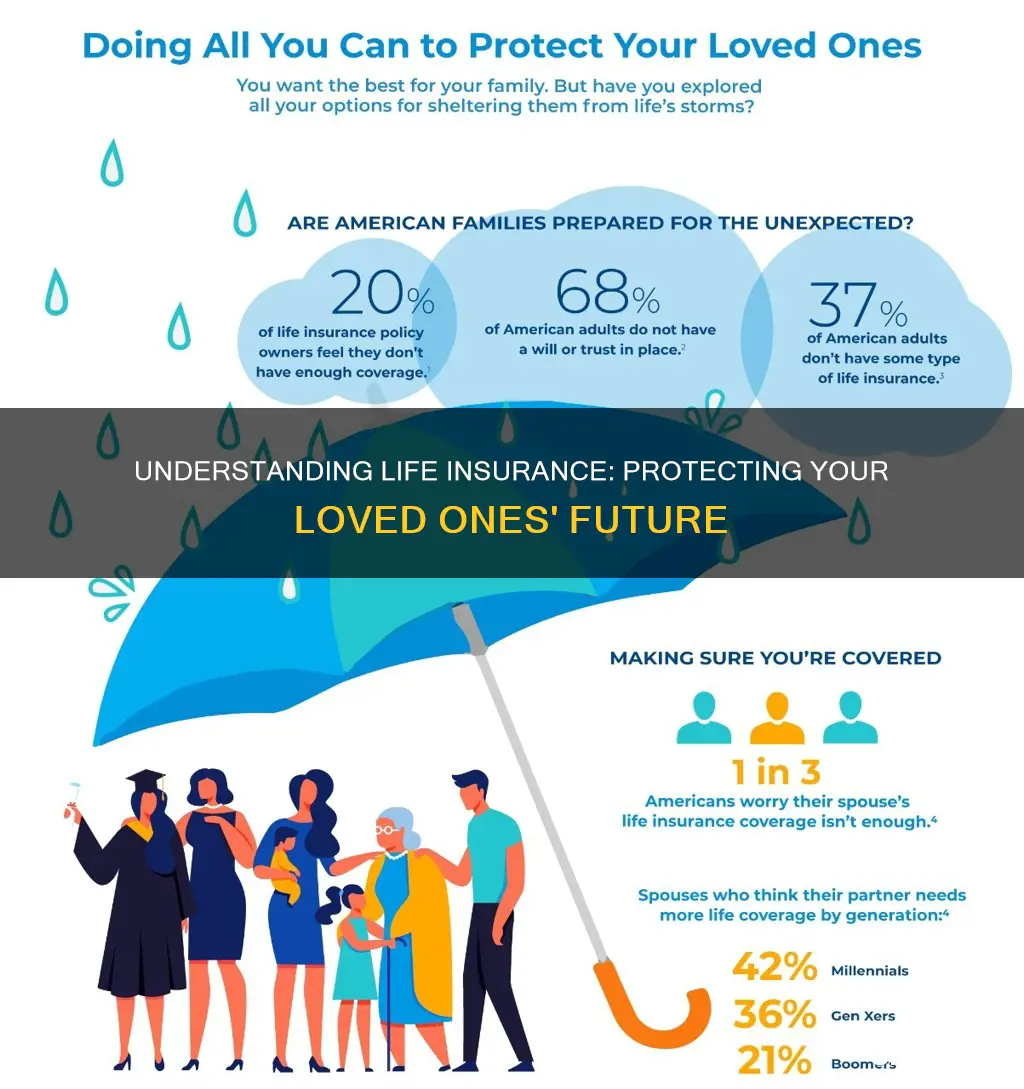

Life insurance is a financial tool designed to provide a safety net for individuals and their families, offering a crucial layer of protection against the unexpected. Its primary function is to mitigate the financial risks associated with death, ensuring that loved ones are financially secure even in the face of tragedy. This is particularly important as the loss of a primary income earner can have devastating consequences for a family's financial well-being.

When an individual purchases life insurance, they essentially enter into a contract with an insurance company. In this contract, the insurer agrees to pay a predetermined sum of money (the death benefit) to the policyholder's beneficiaries upon the insured individual's death. This financial guarantee serves as a powerful risk mitigation tool, providing peace of mind and financial stability. The death benefit can cover various expenses, including mortgage payments, children's education, daily living costs, and other financial obligations, ensuring that the family's standard of living is maintained even if the primary breadwinner is no longer present.

The beauty of life insurance lies in its ability to provide long-term financial security. It allows individuals to plan for the future, knowing that their loved ones will be taken care of, regardless of the circumstances. For example, a young family with a mortgage and a child's college fund in the works can benefit from life insurance. In the event of the primary caregiver's death, the death benefit can cover the remaining mortgage, ensuring the family's home remains intact, and the child's education fund can be used to cover the associated costs.

Moreover, life insurance provides a safety net for entrepreneurs and business owners. The financial loss incurred by the business in the event of the owner's death can be substantial. Life insurance can help mitigate this risk by providing a financial cushion to cover business debts, ongoing expenses, and even the cost of finding and training a replacement, ensuring the continuity of the business.

In summary, the primary function of life insurance is to provide financial protection and peace of mind. It ensures that loved ones are financially secure, allowing them to maintain their lifestyle and meet financial obligations even when faced with the loss of a primary income earner. By mitigating the risks associated with death, life insurance empowers individuals to take control of their financial future and provide for their families' long-term well-being.

Group Life Insurance: Myths and Facts About Coverage

You may want to see also

Income Replacement: It offers a steady income stream to replace lost wages and maintain a family's standard of living

Life insurance is a financial tool designed to provide financial security and peace of mind for individuals and their families. Its primary function is to offer a safety net in the event of the insured's death, ensuring that their loved ones are protected and their financial obligations are met. One of the key aspects of life insurance is its ability to provide a steady income stream, which is particularly crucial for maintaining a family's standard of living and replacing lost wages.

Income replacement is a fundamental concept in life insurance, especially in the context of term life insurance. When an individual purchases a term life insurance policy, they agree to pay a premium for a specified period, known as the term. In return, the insurance company promises to pay a death benefit to the policyholder's beneficiaries if the insured individual passes away during that term. This death benefit serves as a financial cushion, providing a steady income stream to the family.

The primary purpose of this income replacement is to ensure that the family can maintain their current lifestyle and cover essential expenses even if the primary earner is no longer present. It helps cover daily living costs, such as mortgage or rent payments, utility bills, groceries, and other household expenses. Additionally, it can provide funds for education, healthcare, and other long-term financial goals that the family may have. By offering this financial support, life insurance ensures that the family's financial stability is not disrupted, allowing them to cope with the emotional and financial challenges that often accompany the loss of a loved one.

Moreover, income replacement through life insurance can provide a sense of security and peace of mind. It allows individuals to focus on their current responsibilities and daily routines without constantly worrying about their family's financial future. This aspect is particularly valuable for those with young children, elderly parents, or other dependents, as it ensures that their loved ones will be cared for and their financial needs will be met.

In summary, the primary function of life insurance, particularly in the context of income replacement, is to provide a reliable and steady income stream to the family in the event of the insured's death. This financial support enables the family to maintain their standard of living, cover essential expenses, and achieve their long-term financial goals. By offering this protection, life insurance plays a vital role in ensuring the financial security and well-being of individuals and their loved ones.

Geico: Life Insurance Options and Benefits Explored

You may want to see also

Debt Management: Insurance can help pay off debts, like mortgages or loans, preventing financial strain on beneficiaries

The primary function of life insurance is to provide financial security and peace of mind to individuals and their loved ones. It is a crucial tool for managing risks and ensuring that the financial obligations and commitments of an individual are met, even in the event of their untimely demise. One of the key aspects of this insurance is its ability to help manage and pay off debts, which can be a significant source of financial strain for beneficiaries.

When an individual purchases life insurance, they essentially enter into a contract with an insurance company. The policyholder agrees to pay regular premiums in exchange for a death benefit, which is a lump sum amount paid out to the beneficiaries upon the insured individual's death. This death benefit can be a powerful tool for debt management. For example, if an individual has a substantial mortgage or a large student loan, the life insurance policy can be structured to ensure that these debts are fully or partially covered by the death benefit. This means that even if the primary breadwinner passes away, the remaining family members or beneficiaries will not be burdened with the financial strain of these debts.

The process of utilizing life insurance for debt management is straightforward. The policyholder can name beneficiaries who will receive the death benefit upon their death. These beneficiaries can then use the funds to pay off any outstanding debts. For instance, if a family has a $200,000 mortgage and the primary earner dies, the life insurance policy could be set up to provide a death benefit of $150,000, which can be used to clear the mortgage, leaving the remaining $50,000 for other expenses or future financial needs. This ensures that the family's home remains in their possession and that the financial obligations are met without causing a significant financial burden.

Furthermore, life insurance can also be used to pay off other types of loans, such as personal loans, car loans, or business loans. By ensuring that these debts are covered by the death benefit, individuals can provide financial security for their beneficiaries and prevent the accumulation of high-interest debt that could otherwise lead to financial strain. This is especially important for families who rely on a single income or for individuals with significant financial commitments.

In summary, life insurance plays a vital role in debt management by providing a financial safety net. It ensures that beneficiaries are not burdened with the repayment of debts, allowing them to focus on grieving and moving forward with their lives. By carefully structuring the policy and considering the various financial obligations, individuals can utilize life insurance to create a more secure and stable financial future for their loved ones. This aspect of life insurance is often overlooked but can have a profound impact on the financial well-being of those left behind.

Congressional Health Benefits: Free Insurance for Life?

You may want to see also

Estate Planning: A tool for transferring wealth, ensuring a smooth transition of assets to heirs and minimizing tax burdens

Estate planning is a crucial aspect of financial management, serving as a strategic tool to efficiently transfer wealth and ensure a seamless transition of assets to beneficiaries. It involves a comprehensive approach to managing one's possessions, including real estate, investments, businesses, and personal belongings, with the primary goal of minimizing tax liabilities and maximizing the value of the estate for the intended heirs. This process is particularly important for individuals with substantial assets, as it can significantly impact the distribution of their wealth and the financial well-being of their loved ones.

The primary function of estate planning is to provide a clear roadmap for the distribution of one's possessions after their passing. It involves making informed decisions about the allocation of assets, often through legal documents such as wills, trusts, and power of attorney. By creating a structured plan, individuals can ensure that their wishes are respected and that their estate is managed according to their intentions. This process also allows for the appointment of guardians for minor children, ensuring their care and well-being in the event of the parent's death.

One of the key benefits of estate planning is the ability to minimize tax burdens. Through strategic planning, individuals can take advantage of various tax-efficient strategies, such as gifting assets during their lifetime, utilizing life insurance policies, and establishing trusts. These methods can help reduce the overall tax liability on the estate, ensuring that more of the wealth goes to the intended beneficiaries. For example, life insurance can be a powerful tool, as the proceeds can be used to pay for estate taxes, thus preserving the value of the estate for the heirs.

In addition to tax minimization, estate planning also ensures a smooth transition of assets. It involves identifying and valuing all relevant possessions, which can be a complex task, especially for those with diverse investments or international assets. By creating a detailed inventory and plan, individuals can ensure that their estate is distributed efficiently, avoiding potential disputes among heirs. This process may also include the establishment of backup plans and contingency measures to address unforeseen circumstances, further safeguarding the interests of the beneficiaries.

Furthermore, estate planning allows individuals to have a say in the management of their assets even after their death. Through the creation of trusts, individuals can appoint fiduciaries who will manage the assets according to their instructions. This ensures that the beneficiaries receive the intended support and that the estate is protected from potential mismanagement or fraud. In summary, estate planning is a comprehensive strategy that enables individuals to transfer wealth effectively, provide for their loved ones, and minimize financial burdens, all while maintaining control over their assets.

Life Insurance: Curing the Confusion and Complexity

You may want to see also

Peace of Mind: Knowing you're protected offers emotional comfort, allowing individuals to focus on living rather than worrying about the future

The primary function of life insurance is to provide financial security and peace of mind to individuals and their loved ones. It serves as a safety net, ensuring that in the event of an untimely death, the insured's family will have the necessary financial resources to maintain their standard of living and cover essential expenses. This is particularly crucial for those with dependents, as it guarantees that the family's financial obligations and daily needs will be met, even when the primary breadwinner is no longer present.

When you purchase life insurance, you are essentially making a promise to your loved ones that you will provide for them financially, even if you are no longer around. This promise offers a sense of security and emotional comfort, knowing that your family will be taken care of, no matter what life throws their way. It empowers individuals to face the future with confidence, knowing that they have taken a proactive step to protect their loved ones.

The peace of mind that comes with life insurance is invaluable. It allows individuals to focus on the present and enjoy their lives without constantly worrying about the future. Instead of spending time and energy on financial stress, people can pursue their passions, spend quality time with family, and create lasting memories. This freedom from financial anxiety enables a more fulfilling and enjoyable lifestyle, knowing that one's family is protected.

Moreover, life insurance provides a sense of control and preparedness. It allows individuals to plan for the future and make decisions that align with their values and goals. With life insurance in place, people can make choices regarding their careers, investments, and lifestyle without the constant fear of leaving their family vulnerable. This sense of control and financial security is a powerful motivator for individuals to take charge of their lives and make the most of their time.

In summary, the primary function of life insurance is to offer peace of mind and financial security. It enables individuals to focus on living their lives to the fullest, knowing that their loved ones are protected. By providing a safety net and a promise of financial support, life insurance empowers people to make the most of their time, make informed decisions, and create a secure future for their families. This emotional comfort and financial assurance are the core benefits that make life insurance an essential tool for anyone seeking to protect their loved ones and ensure a stable future.

Life Insurance and Direct Deposit: What's the Link?

You may want to see also

Frequently asked questions

The primary function of life insurance is to provide financial protection and security to individuals and their families in the event of the insured person's death. It ensures that beneficiaries receive a lump sum payment or regular income, helping them cover expenses, pay off debts, and achieve their financial goals.

Life insurance operates by an agreement between the policyholder and the insurance company. The policyholder pays regular premiums to the insurer, and in return, the company promises to pay a death benefit to the designated beneficiaries when the insured individual passes away. The amount of coverage and the premium vary based on factors like age, health, lifestyle, and the desired policy term.

There are several types of life insurance policies, including term life insurance, whole life insurance, universal life insurance, and variable life insurance. Term life insurance provides coverage for a specific period, while whole life offers lifelong coverage. Universal life allows flexibility in premium payments and investment options. Variable life insurance combines insurance with investment features, and the death benefit can vary based on investment performance.

The ideal time to purchase life insurance is when you are young and healthy, as premiums are generally lower during this period. However, it is never too late to consider life insurance, especially if you have dependents or financial responsibilities. Young families, new homeowners, and individuals with significant assets or debts may find it particularly beneficial to secure life insurance coverage early on to protect their loved ones and financial interests.