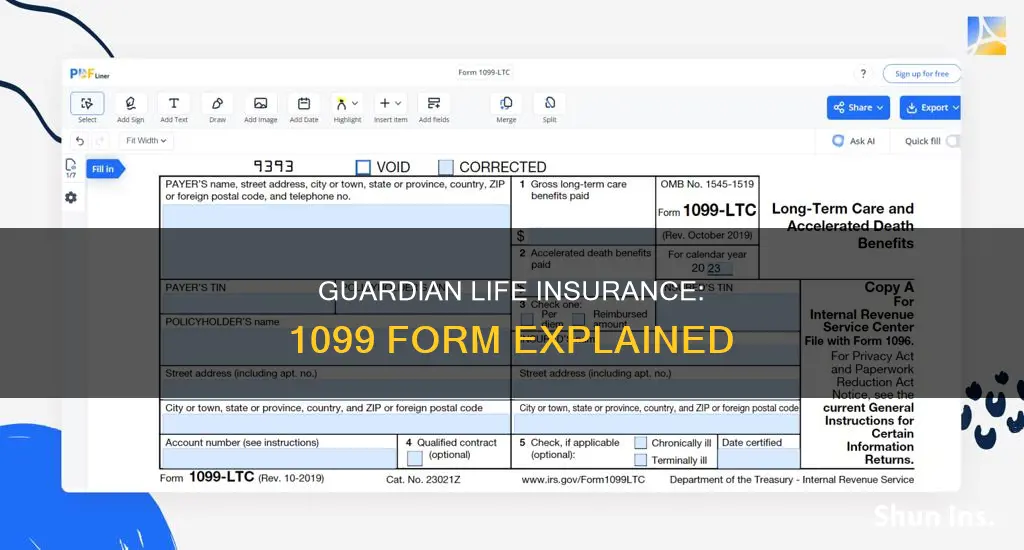

Guardian Life Insurance provides various forms to its policyholders, including those who receive 1099 forms for tax reporting purposes. The specific 1099 form that Guardian Life Insurance sends out depends on the type of payment or income provided to the policyholder. For instance, if the insurance company pays out a lump sum or a series of payments to a policyholder, it may send a 1099-R form, which reports the distribution of retirement plan benefits. Alternatively, if the payments are related to life insurance proceeds, a 1099-G form might be issued. It's important for policyholders to review the appropriate 1099 form they receive from Guardian Life Insurance to ensure accurate tax reporting and compliance with IRS regulations.

| Characteristics | Values |

|---|---|

| Form Type | 1099-R |

| Purpose | Reporting distributions from retirement plans, including insurance settlements |

| Issuer | Guardian Life Insurance Company of America |

| Filing Requirement | Required for recipients who received distributions over $1,000 in the tax year |

| Deadlines | Typically received by January 31st of the following year |

| Content | Includes information such as the type of distribution, amount, and recipient's Social Security Number |

| Tax Implications | Used for tax reporting of non-qualified distributions and can affect retirement plan contributions |

| Additional Forms | May include 1099-S for real estate transactions or 1099-INT for interest income |

What You'll Learn

- Guardian Life Insurance 1099-G: Form for annuity payments and other income

- S: Real estate transactions, including life insurance policy sales

- INT: Interest income from savings and investment accounts

- MISC: Miscellaneous income, including commissions and royalties

- R: Retirement plan distributions and pension income

Guardian Life Insurance 1099-G: Form for annuity payments and other income

If you receive annuity payments or other types of income from Guardian Life Insurance, you will likely receive a 1099-G form as part of your annual tax documentation. This form is crucial for reporting income received during the tax year, and it provides essential details about the payments you've received. Here's a breakdown of what you need to know about the Guardian Life Insurance 1099-G form:

Purpose of the 1099-G:

The 1099-G is a summary form that reports various types of income, including annuity payments, pension payments, and other forms of non-wage income. For Guardian Life Insurance policyholders, this form will detail the annuity payments made during the tax year. It is a standard IRS form used to provide a comprehensive overview of income sources for tax purposes.

Information Included:

When you receive your 1099-G from Guardian Life Insurance, it will include specific details about your annuity payments. This may include the total amount of annuity payments received, the payment frequency (e.g., monthly, quarterly), and the tax year for which the income is reported. Additionally, it might provide information about any federal and state taxes withheld, if applicable. This form is essential for accurately reporting your income and ensuring compliance with tax regulations.

Reporting Requirements:

As a recipient of annuity payments, you must report this income on your tax return. The 1099-G form simplifies this process by providing all the necessary details in one place. You will use the information on this form to fill out the appropriate sections of your tax return, ensuring that you accurately reflect your income. It is important to review the form carefully and compare it with your records to ensure accuracy.

Timely Receipt:

It's essential to receive your 1099-G form from Guardian Life Insurance promptly. This form is typically sent out in early January of the following year, allowing you to have the information readily available for your tax preparation. If you don't receive it by the end of January, you should contact Guardian Life Insurance to request a copy. Having this form in hand is crucial for meeting tax filing deadlines and avoiding any potential issues with the IRS.

Additional Considerations:

While the 1099-G form covers annuity payments, it's also important to be aware of other income sources that may be reported on different 1099 forms. For example, if you receive interest or dividends from Guardian Life Insurance, a separate 1099-INT or 1099-DIV form might be issued. Understanding which forms to expect and how to interpret them is essential for comprehensive tax reporting.

Irrevocable Life Insurance Trust: What You Need to Know

You may want to see also

1099-S: Real estate transactions, including life insurance policy sales

The 1099-S form is a crucial document for individuals involved in real estate transactions, including the sale of life insurance policies. This form is issued by the seller or the party responsible for the transaction to report the proceeds from the sale to the Internal Revenue Service (IRS). It is an essential tool for tax reporting and ensures that all relevant information about the transaction is accurately documented.

When it comes to life insurance policy sales, the 1099-S form becomes even more significant. Guardian Life Insurance, a reputable insurance provider, may send out this form to policyholders or the party involved in the sale of a life insurance policy. The form will outline the details of the transaction, including the sale price, any commissions or fees, and the identification of the buyer and seller. This information is vital for both parties involved and the IRS to ensure compliance with tax regulations.

For individuals receiving a 1099-S from Guardian Life Insurance, it is essential to carefully review the contents. The form will provide a comprehensive summary of the life insurance policy sale, including the policy's cash value and any associated fees. It is crucial to verify the accuracy of the information and ensure that it aligns with the actual transaction details. This process helps in avoiding any potential tax-related issues and ensures that the seller and buyer are both aware of their tax obligations.

In the context of real estate transactions, the 1099-S form serves as a record of the sale, providing a clear picture of the property's sale price and any associated costs. This is particularly important for tax purposes, as it helps individuals and businesses track their income and expenses related to real estate activities. Guardian Life Insurance, by sending out this form, ensures transparency and facilitates the proper reporting of life insurance policy sales, which is a critical aspect of tax compliance.

Understanding the 1099-S form and its relevance to life insurance policy sales is essential for all parties involved. It empowers individuals to make informed decisions and ensures that the necessary tax information is readily available. Whether it's a sale of a life insurance policy or a real estate transaction, this form plays a vital role in maintaining transparency and compliance with tax laws, providing a comprehensive overview of the financial details surrounding these transactions.

Life Insurance for Your Boyfriend: Is It Possible?

You may want to see also

1099-INT: Interest income from savings and investment accounts

When it comes to tax reporting, understanding the various 1099 forms is essential, especially for those with diverse sources of income. One such form is the 1099-INT, which reports interest income earned from savings and investment accounts. If you've received interest from these types of accounts, it's important to know how to handle the 1099-INT form, especially if you're associated with Guardian Life Insurance.

Guardian Life Insurance, a reputable provider of life insurance and investment products, may send out 1099-INT forms to policyholders or account holders who have generated interest income. This form is a crucial document for tax purposes, as it provides a detailed breakdown of the interest earned during the tax year. The 1099-INT will include information such as the type of interest, the account number, and the total interest amount. It's essential to review this form carefully to ensure accurate tax reporting.

For individuals with savings accounts or investment portfolios, the 1099-INT form is a standard way to report interest income. This income can come from various sources, such as certificates of deposit (CDs), savings accounts, or even certain types of bonds. The form will typically list each financial institution separately, making it easier to track interest from multiple sources. It's important to note that the interest income reported on this form is taxable and should be included in your overall income when filing taxes.

To ensure compliance with tax regulations, it's advisable to keep the 1099-INT form in a secure location. This document is often used by the IRS to verify the accuracy of your tax return. If you receive a 1099-INT from Guardian Life Insurance or any other financial institution, review the details carefully and compare them with your records to ensure there are no discrepancies. In case of any errors or omissions, you can contact the issuing institution to request corrections.

In summary, the 1099-INT form is a critical document for individuals with interest income from savings and investment accounts. Guardian Life Insurance, as a financial institution, may send out this form to policyholders, providing a comprehensive report of interest earned. Understanding the content and importance of the 1099-INT is essential for accurate tax reporting and compliance with the IRS regulations.

Selling Life Insurance: A Path to Wealth?

You may want to see also

1099-MISC: Miscellaneous income, including commissions and royalties

When it comes to tax reporting, understanding the various 1099 forms is crucial, especially for those receiving income from different sources. One such form is the 1099-MISC, which is used to report a variety of income types, including commissions and royalties. If you've received income from Guardian Life Insurance or any other company in the form of commissions or royalties, you'll need to be aware of the 1099-MISC form.

Guardian Life Insurance, a reputable life insurance provider, may send out 1099-MISC forms to policyholders or individuals who have received commissions or royalties from their sales or other business activities. This form is a crucial document for tax purposes, as it provides a detailed breakdown of the income earned during the tax year. The 1099-MISC form is particularly relevant for individuals who earn income from multiple sources, as it helps them organize and report their earnings accurately.

Commissions are a common form of income for sales professionals, including those in the insurance industry. Guardian Life Insurance, for instance, might pay commissions to agents or representatives for successful policy sales. These commissions can vary depending on the type of policy sold, the commission structure, and the individual's performance. The 1099-MISC form will list the total commissions earned during the year, ensuring that you have the necessary information for tax filing.

Royalties, on the other hand, are payments made for the use of intellectual property, such as patents, trademarks, or copyrights. If you've received royalties from Guardian Life Insurance or any other company for providing access to your intellectual property, the 1099-MISC form will reflect this income. This form is essential for individuals who earn passive income through royalties, ensuring they meet their tax obligations.

In summary, the 1099-MISC form is a critical document for individuals earning miscellaneous income, including commissions and royalties. Guardian Life Insurance, as a reputable insurance provider, may send out this form to policyholders or individuals who have received income from their sales or intellectual property. Understanding and properly reporting this income on your tax return is essential to ensure compliance with tax laws and regulations. Always review the information provided on the 1099-MISC form carefully and consult with a tax professional if you have any doubts or questions.

Life Insurance: Defining High Coverage Needs

You may want to see also

1099-R: Retirement plan distributions and pension income

When it comes to retirement plan distributions and pension income, the 1099-R form is a crucial document for individuals receiving these payments. This form is issued by financial institutions, such as Guardian Life Insurance, to report the distribution of retirement plan benefits and pension income to the Internal Revenue Service (IRS) and the recipient. Understanding the details of this form is essential for anyone who has received retirement plan distributions or pension payments.

The 1099-R form provides a comprehensive summary of the retirement income received during a specific tax year. It includes important information such as the name of the payer (in this case, Guardian Life Insurance), the recipient's Social Security Number or Tax Identification Number, the type of retirement plan or pension, and the total amount distributed. This form is particularly relevant for individuals who have retired or are approaching retirement age, as it reflects their pension income and retirement plan withdrawals.

One of the key sections of the 1099-R is the 'Box 1' section, which indicates the total amount of distributions received. This includes both the taxable and non-taxable portions of the retirement income. It is important to note that the form also provides details about the tax treatment of these distributions, such as whether they are subject to income tax or not. For example, certain pension payments may be tax-free if they meet specific criteria, and the 1099-R will reflect this.

Additionally, the 1099-R form includes 'Box 2' and 'Box 3', which provide further details. Box 2 shows the total amount of distributions that are subject to income tax, while Box 3 indicates the total amount of distributions that are excludable from income. These boxes are crucial for individuals to understand their tax obligations and plan their finances accordingly.

For individuals receiving retirement plan distributions and pension income, it is essential to review the 1099-R form carefully. This document plays a vital role in tax reporting and can impact an individual's tax liability. By understanding the details of this form, individuals can ensure they have the necessary information to file their taxes accurately and take advantage of any tax benefits associated with retirement income.

Life Insurance Illustrations: How Long to Keep Them?

You may want to see also

Frequently asked questions

Guardian Life Insurance typically sends out Form 1099-MISC (Miscellaneous Income) to policyholders who have received payments or distributions during the tax year. This form reports the total amount of income paid to the policyholder and is used for tax reporting purposes.

The 1099-MISC form is usually sent out by Guardian Life Insurance in early January of the following year. It is important to review this form carefully as it provides essential information for your tax returns.

If you haven't received your 1099-MISC by mid-February, it's advisable to contact Guardian Life Insurance's customer support. They can provide a copy of the form or investigate any potential issues with the mailing process.

Yes, it's crucial to review the information on the 1099-MISC carefully. If there are any discrepancies or errors, you should contact Guardian Life Insurance to request an amendment. Additionally, you will need to include this form when filing your annual tax return to ensure accurate reporting of your income.