In the realm of financial planning, a revolutionary concept emerged, combining the security of life insurance with the growth potential of investment accounts. This innovative approach, known as combined life insurance with investment, offers individuals a dual-purpose financial tool. It provides both immediate protection against unforeseen circumstances and long-term wealth-building opportunities. By integrating life insurance and investment, this product allows policyholders to secure their loved ones' financial future while also growing their assets over time. This unique combination has become increasingly popular among those seeking a comprehensive and efficient way to manage their finances and secure their financial well-being.

What You'll Learn

- Life Insurance Basics: Understanding coverage options and benefits of combined life insurance and investment accounts

- Investment Accounts: How these accounts work, offering both savings and insurance benefits

- Tax Advantages: Tax benefits of combined insurance and investment accounts, including tax-deferred growth

- Investment Options: Choices of investments within the combined account, such as stocks, bonds, and mutual funds

- Death Benefits: How death benefits are paid out, providing financial security for beneficiaries

Life Insurance Basics: Understanding coverage options and benefits of combined life insurance and investment accounts

Life insurance is a crucial financial tool that provides security and peace of mind for individuals and their loved ones. When considering life insurance, it's essential to understand the various coverage options available, especially the benefits of combined life insurance and investment accounts. This type of policy offers a unique blend of protection and financial growth, making it an attractive choice for many.

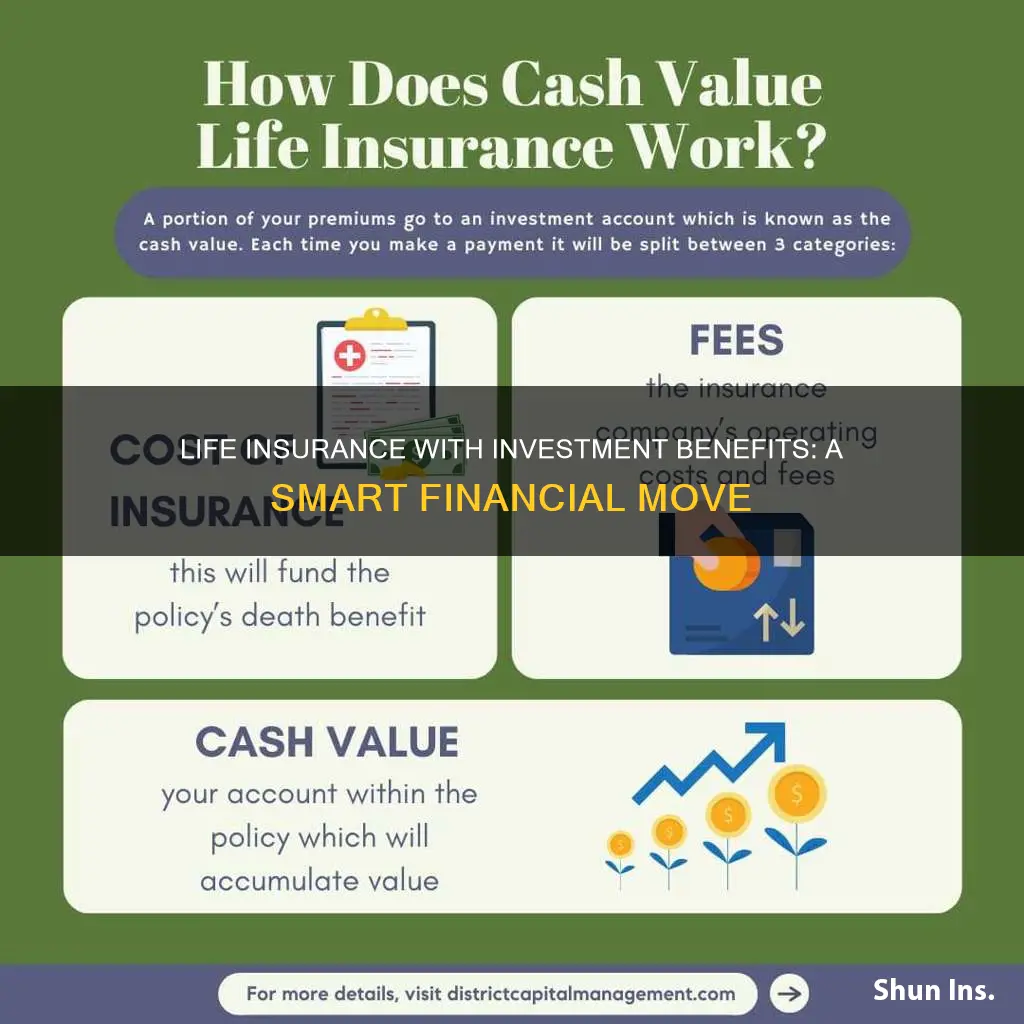

Combined life insurance and investment accounts, often referred to as 'whole life insurance' or 'permanent life insurance,' offer a comprehensive approach to financial planning. Here's a breakdown of its key features:

- Long-Term Coverage: This type of insurance provides coverage for the entire life of the policyholder, ensuring that beneficiaries receive a death benefit regardless of the policy's duration. It offers a sense of security, knowing that your loved ones will be financially protected even if you pass away.

- Investment Component: The investment aspect of this policy allows the policyholder to build a cash value over time. This cash value can accumulate and grow, providing a financial asset that can be borrowed against or withdrawn. It offers a way to grow your money while also having a safety net in place.

- Flexible Premiums: One of the advantages is the ability to choose flexible premium payment options. Policyholders can opt for level premiums, which remain constant throughout the policy's term, or adjustable premiums that may change over time based on individual needs and financial circumstances.

- Tax Advantages: Combined life insurance and investment accounts often provide tax benefits. The cash value growth within the policy may be tax-deferred, allowing it to grow faster. Additionally, withdrawals or loans taken from the policy's cash value may be tax-free, provided certain conditions are met.

When considering this type of insurance, it's essential to evaluate your specific needs and financial goals. Combined life insurance and investment accounts can be tailored to suit various objectives, such as providing for your family's long-term financial needs, funding education expenses, or even as a potential retirement plan. Understanding the coverage options and benefits allows individuals to make informed decisions about their financial security and legacy.

In summary, combined life insurance and investment accounts offer a powerful tool for individuals seeking both financial protection and growth. By exploring these options, you can ensure that your loved ones are cared for, and your financial goals are met, all while potentially building a valuable asset. It is a comprehensive approach to life insurance, providing both immediate and long-term benefits.

Renewing Your Colorado Life Insurance License: A Step-by-Step Guide

You may want to see also

Investment Accounts: How these accounts work, offering both savings and insurance benefits

The concept of combining life insurance with investment accounts is an innovative approach to financial planning, offering individuals a comprehensive way to secure their future and build wealth. This unique financial product integrates the security of life insurance with the growth potential of investment accounts, providing a dual benefit that caters to various financial needs. Here's an overview of how these accounts work and the advantages they offer:

Understanding Investment Accounts:

Investment accounts, also known as retirement or savings accounts, are financial vehicles designed to help individuals grow their money over time. These accounts typically offer tax advantages, allowing investors to accumulate wealth more efficiently. Common types include Individual Retirement Accounts (IRAs), 401(k) plans, and various brokerage accounts. The primary goal is to provide a structured way to save and invest for the future, often with tax-deferred or tax-free growth.

Combining Life Insurance and Investment:

The innovative aspect comes into play when life insurance is integrated into these investment accounts. This combination is often referred to as a "combined life insurance and investment product" or "life insurance with an investment component." Here's how it works:

- Life Insurance Component: This part provides a death benefit, ensuring financial security for the policyholder's beneficiaries in the event of their passing. It offers peace of mind, knowing that loved ones will receive a financial payout to cover expenses and maintain their standard of living.

- Investment Account: Within the same product, there is an investment account that allows policyholders to grow their money. This account can be used to build wealth, save for retirement, or achieve other financial goals. The investment portion often offers a range of options, such as stocks, bonds, mutual funds, or a mix of these, providing diversification and potential for long-term growth.

Benefits of Combined Accounts:

- Financial Security and Growth: These combined accounts offer a dual advantage. Policyholders can secure their family's financial future with life insurance while also benefiting from the investment opportunities available. This approach allows individuals to plan for both immediate and long-term financial needs.

- Tax Advantages: Investment accounts often provide tax benefits, such as tax-deferred growth or tax-free withdrawals in retirement, depending on the account type. This feature can significantly enhance the overall growth potential of the investment portion.

- Flexibility: Combined accounts may offer flexibility in investment choices, allowing policyholders to tailor their portfolio to their risk tolerance and financial goals. This customization can be particularly appealing to those seeking a more personalized investment strategy.

- Simplified Financial Planning: By combining life insurance and investment in one product, individuals can streamline their financial planning. This integration simplifies the management of different financial instruments, making it easier to monitor and adjust their overall financial strategy.

In summary, investment accounts that incorporate life insurance offer a powerful tool for individuals seeking to secure their financial future while also building wealth. This combination provides a comprehensive solution, ensuring both financial protection and growth potential, all within a single financial product. It is a strategic approach to financial planning, catering to the diverse needs of modern investors.

Good Life Insurance: Is American Family the Right Choice?

You may want to see also

Tax Advantages: Tax benefits of combined insurance and investment accounts, including tax-deferred growth

The concept of combining life insurance with an investment account offers a unique financial strategy with several tax advantages. This approach, often referred to as a combined insurance and investment product, provides individuals with a way to secure their financial future while also growing their wealth over time. One of the key tax benefits is the ability to enjoy tax-deferred growth, which can be a powerful tool for long-term financial planning.

When an individual invests in a combined insurance and investment account, they can benefit from tax-deferred growth on their investments. This means that any earnings or capital gains generated within the account are not subject to immediate taxation. Instead, the growth compounds over time, allowing the account value to increase without the need to pay taxes on the accumulated gains. This tax-deferred status can be particularly advantageous for long-term investors, as it enables their money to grow more efficiently.

In addition to tax-deferred growth, these combined products often offer tax-free withdrawals. This means that when the individual eventually takes money out of the account, either through withdrawals or upon maturity, they may not have to pay taxes on those distributions. This can be especially beneficial for retirement planning, as it provides a tax-efficient way to access funds without incurring significant tax liabilities. The tax-free nature of these withdrawals can also encourage individuals to keep their money invested for the long term, allowing for potential wealth accumulation.

Furthermore, the tax advantages of these combined insurance and investment accounts can extend to estate planning. By utilizing these products, individuals can potentially reduce the tax burden on their beneficiaries when they pass away. The tax-deferred growth and tax-free withdrawals can help ensure that a larger portion of the account value is passed on to heirs, providing a more substantial financial legacy.

In summary, the tax advantages of combined insurance and investment accounts, including tax-deferred growth, offer individuals a strategic way to manage their finances. This approach allows for the potential accumulation of wealth over time without the immediate impact of taxes on investment earnings. With the possibility of tax-free withdrawals and its implications for estate planning, this financial strategy can be a valuable tool for those seeking to secure their financial future and pass on a substantial inheritance.

Disability Waiver Life Insurance: What You Need to Know

You may want to see also

Investment Options: Choices of investments within the combined account, such as stocks, bonds, and mutual funds

When considering a combined life insurance and investment account, understanding the various investment options available is crucial. These accounts offer a unique blend of financial security and growth potential, allowing individuals to secure their loved ones' futures while also building their wealth. Here's an overview of the investment choices typically found within such accounts:

Stocks: One of the most common investment options is stocks, which represent ownership in companies. Investing in stocks can provide the potential for significant returns over time. Combined life insurance with investment accounts often offer a range of stock options, including individual stocks from various sectors and industries. This allows investors to diversify their portfolio and potentially benefit from the growth of different companies. Stocks can be further categorized into different types, such as common stocks, preferred stocks, and exchange-traded funds (ETFs), each offering unique advantages and risk profiles.

Bonds: Bonds are another essential investment vehicle within these combined accounts. They represent a loan made to a government, municipality, or corporation. Bondholders receive regular interest payments and the principal amount upon maturity. Investing in bonds can provide a steady income stream and is generally considered less risky than stocks. The account may offer government bonds, corporate bonds, or municipal bonds, each with its own tax implications and risk factors. Diversifying bond investments can help manage risk and provide a stable component to the overall portfolio.

Mutual Funds: Mutual funds are a popular investment choice as they offer instant diversification. These funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. By investing in mutual funds, individuals can access a professionally managed portfolio, reducing the risk associated with individual stock or bond selection. Combined life insurance and investment accounts may offer various mutual funds, such as equity funds, bond funds, or balanced funds, catering to different risk appetites and investment goals.

The investment options within these combined accounts provide individuals with a flexible and comprehensive approach to financial planning. It allows them to align their insurance needs with investment strategies, ensuring both protection and growth. When considering these accounts, it is essential to carefully review the investment choices, understand the associated risks and fees, and seek professional advice to make informed decisions that align with one's financial objectives.

Becoming an Independent Life Insurance Distributor: A Guide

You may want to see also

Death Benefits: How death benefits are paid out, providing financial security for beneficiaries

When an individual purchases a combined life insurance policy with an investment component, they are essentially combining two powerful financial tools into one. This type of insurance offers both a death benefit and an investment opportunity, providing financial security and growth potential. Upon the insured's passing, the death benefit is paid out to the designated beneficiaries, ensuring a financial safety net for those who depend on the policyholder's income or support.

The process of receiving death benefits is straightforward and typically involves several steps. Firstly, the insurance company receives a claim from the beneficiaries, providing necessary documentation such as the death certificate and proof of the insured's identity. This information is then verified by the insurance provider to ensure the accuracy of the claim. Once the claim is approved, the death benefit is paid out according to the policy's terms and conditions.

The payout can be structured in various ways, depending on the policyholder's preferences and needs. One common method is a lump-sum payment, which provides the beneficiaries with a large sum of money all at once. This option offers immediate financial relief and flexibility, allowing beneficiaries to use the funds as they see fit, whether for immediate expenses, investments, or long-term financial planning. Alternatively, some policies offer periodic payments, providing a steady income stream for the beneficiaries over an extended period. This can be particularly beneficial for those who rely on regular financial support.

In addition to the death benefit, some combined life insurance and investment policies may also offer additional features. For instance, certain policies provide an option for accelerated death benefits, allowing the policyholder to access a portion of the death benefit while still alive if they are diagnosed with a critical illness or meet specific medical criteria. This feature provides financial flexibility and can be especially valuable for those facing potential health challenges.

It is essential for policyholders to carefully review the terms and conditions of their combined life insurance and investment policies to understand the specific death benefit options available. Consulting with a financial advisor or insurance professional can also provide valuable guidance in choosing the most suitable payout structure and ensuring that the policy aligns with one's financial goals and the needs of the beneficiaries. By doing so, individuals can maximize the financial security and peace of mind that this type of insurance offers.

Globe Life Insurance: Whole Life or Term?

You may want to see also

Frequently asked questions

Combined life insurance with an investment account, often referred to as a "life insurance with an investment component" or "whole life insurance with an investment feature," is a financial product that offers both death benefit coverage and long-term savings. It combines a life insurance policy with an investment account, allowing policyholders to build cash value over time.

The investment account within the policy is typically a separate component that grows tax-deferred. Policyholders can contribute a portion of their premium payments into this investment account, which is invested according to their chosen investment options. The cash value in the investment account can be used to pay for future premiums, providing financial security and flexibility.

This combined insurance offers several advantages. Firstly, it provides a guaranteed death benefit, ensuring a financial safety net for your loved ones. Secondly, the investment component allows your money to grow over time, potentially outpacing traditional savings accounts. Additionally, policyholders can borrow against the cash value or withdraw funds (with certain restrictions) to access their accumulated savings.

A A: While combined life insurance with an investment account has benefits, it may not be suitable for everyone. The investment performance is not guaranteed, and there are risks associated with market volatility. Policyholders should carefully review the investment options and associated fees to ensure they align with their financial goals.

Selecting the appropriate policy involves considering your financial objectives, risk tolerance, and long-term savings goals. It's essential to evaluate different insurance providers, compare features and fees, and understand the investment options available. Consulting with a financial advisor can help you make an informed decision based on your unique circumstances.