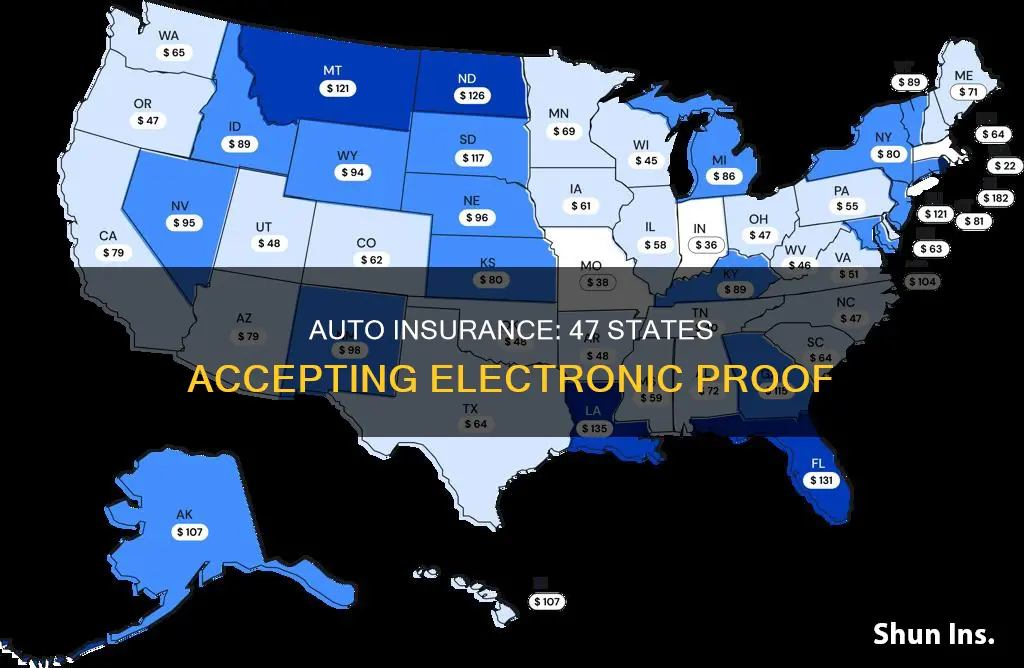

As of 2024, almost every state in the US accepts electronic proof of auto insurance. The exceptions are New Mexico and, as of February 2018, Connecticut and Washington, D.C. However, the situation is changing fast. In 2011, no states allowed electronic proof of insurance, but by 2019, all 50 states and Washington, D.C., permitted drivers to show proof of insurance on their phones.

| Characteristics | Values |

|---|---|

| Number of States Accepting Electronic Auto Insurance | 47 |

| States That Don't Accept Electronic Auto Insurance | New Mexico |

| States That Don't Require Proof of Insurance | New Hampshire, Massachusetts |

What You'll Learn

- As of 2022, nearly every state accepts electronic auto insurance

- New Mexico was the last state to accept electronic auto insurance

- Some auto insurance companies include State Farm, Geico, and Progressive

- States that accepted electronic proof of insurance early include Alaska, Alabama, Arizona, Arkansas, and California

- Some states that do not require proof of insurance include New Hampshire and Massachusetts

As of 2022, nearly every state accepts electronic auto insurance

As of 2022, nearly every state in the US accepts electronic auto insurance. This means that drivers can show proof of their insurance coverage through their smartphones or other electronic devices. This is a significant change from just a few years ago when no states allowed electronic proof of insurance. Now, all 50 states and Washington, D.C., permit drivers to show their insurance information digitally, providing convenience and peace of mind for motorists.

The ability to present electronic proof of insurance is especially useful when pulled over by law enforcement or when involved in an accident. In most places, failing to provide proof of insurance when requested can result in a ticket and a trip to court. With electronic proof, drivers can easily access their insurance information and avoid these hassles. Additionally, insurance companies provide customers with digital insurance cards that can be accessed on smartphones, tablets, or laptops.

While almost every state has embraced electronic proof of insurance, there are a couple of exceptions. As of October 2022, New Mexico was the only state that did not accept electronic proof of insurance. Connecticut and Washington, D.C., had also been slow to adopt electronic ID laws but eventually came around. It is worth noting that some states, like Massachusetts, do not require drivers to carry a physical insurance card, as insurance information is included in vehicle registration certificates.

The widespread acceptance of electronic auto insurance is a testament to the integration of technology into our daily lives. It also highlights the efforts of policymakers and insurance companies to adapt to the changing needs and expectations of consumers. By allowing electronic proof of insurance, states are recognizing the convenience and accessibility that technology provides. This trend towards digitization is likely to continue, making it even easier for drivers to stay compliant and avoid unnecessary penalties.

Gap Insurance: Essential Protection for Car Owners

You may want to see also

New Mexico was the last state to accept electronic auto insurance

New Mexico has a diverse landscape, ranging from forested mountains to sparse deserts, and its economy is driven by various sectors, including cattle ranching, agriculture, lumber, scientific and technological research, and tourism. The state has a significant military presence and hosts many protected wilderness areas and national monuments.

The state's population is predominantly Hispanic and Latino, with a large Native American community as well. New Mexico's distinct culture, art, and architecture reflect the influences of its indigenous, Spanish, and Mexican heritage.

New Mexico has a long history of ranching and was once a part of the "Old West" during the American westward expansion. The state also played a central role in the development of atomic weapons, with sites like Los Alamos National Laboratory and the Trinity test site located there.

In terms of auto insurance, New Mexico was the last state to accept electronic proof of insurance. While almost every other state allowed drivers to show their insurance coverage on their phones, New Mexico was an exception as of October 2022. This meant that drivers in New Mexico had to carry and present a physical copy of their insurance card during traffic stops. However, it's important to note that this requirement may have changed since then, and it's always a good idea to check with the relevant authorities for the most up-to-date information.

Direct Auto Insurance: Number and Benefits Explained

You may want to see also

Some auto insurance companies include State Farm, Geico, and Progressive

As of 2023, almost every state in the US allows drivers to show electronic proof of insurance coverage during a traffic stop. The exceptions are New Mexico and, as of 2019, Washington, D.C. and Connecticut.

Some auto insurance companies that provide customers with a digital insurance card that can be accessed on a smartphone or tablet include State Farm, Geico, and Progressive. State Farm has been in business since 1922 and offers a range of insurance products, including auto insurance. They provide various discounts and savings opportunities for their customers, such as bundling home and auto insurance and safe driving discounts. State Farm also offers coverage for electric vehicles, which may be more expensive to insure due to higher purchase prices and repair costs.

Geico is another well-known auto insurance company that provides digital insurance cards. They offer a mobile app for their customers to access their ID cards and other features. Geico also has a presence in the electric vehicle insurance market, providing coverage options for EV owners.

Progressive is another insurer that provides digital insurance cards to its customers. They are known for their name-your-price tool, which allows customers to design a policy that fits their budget. Progressive also offers a variety of discounts and savings opportunities, such as bundling home and auto insurance and good student discounts.

These companies, along with other major auto insurers, have embraced digital technology, allowing customers to conveniently access their insurance information electronically. This provides peace of mind and convenience, especially during traffic stops or when travelling, as customers no longer need to worry about carrying a physical insurance card.

Auto Insurance: Hurricane Damage Covered?

You may want to see also

States that accepted electronic proof of insurance early include Alaska, Alabama, Arizona, Arkansas, and California

As of October 2022, nearly every state in America allows drivers to show electronic proof of insurance during a traffic stop. The exceptions are New Mexico and, previously, New Jersey (which accepted electronic proof of insurance in 2015) and Washington, D.C. (which accepted it in 2019).

Several states accepted electronic proof of insurance early, including Alaska, Alabama, Arizona, Arkansas, and California. In 2013, Alaska, Arizona, Kansas, Minnesota, Oklahoma, and Texas passed laws allowing consumers to access their insurance policies through a website.

Alaska, Alabama, Arizona, Arkansas, and California are joined by several other states in allowing electronic proof of insurance, including Colorado, Florida, Georgia, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Minnesota, Mississippi, North Dakota, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and Wyoming.

The ability to present electronic proof of insurance is not only convenient but also saves time and money. Without it, drivers pulled over without proof of insurance will typically receive a ticket and have to go to court to show a judge that they are covered.

Auto Insurance Costs in Long Beach, CA: What to Expect

You may want to see also

Some states that do not require proof of insurance include New Hampshire and Massachusetts

As of 2023, all 50 states and Washington, D.C., allow drivers to show proof of insurance electronically. However, some states, including New Hampshire and Massachusetts, do not require proof of insurance at all.

New Hampshire, the tenth-least populous state, is known for its libertarian-leaning political culture. It is one of only three states that do not require adults to wear seat belts in their vehicles and one of nine without an income tax. In line with this, New Hampshire does not require most drivers to carry auto insurance.

Massachusetts, New Hampshire's southern neighbour, also does not require drivers to show a car insurance card as proof of coverage. Instead, vehicle registration certificates include insurance information.

Auto Insurance Abroad: American Companies in South Korea

You may want to see also

Frequently asked questions

As of 2024, all states except New Mexico accept electronic proof of auto insurance.

Electronic proof of insurance is a digital version of your insurance card, which you can access on your smartphone or tablet.

While it's a good idea to have a physical copy of your insurance card, you can now show electronic proof to law enforcement in all states except New Mexico.

If you're pulled over and can't show proof of insurance, you may receive a ticket or fine. The penalty for driving without insurance varies by state, but it can include a fine, suspension of your driver's license, and/or suspension of your vehicle registration.