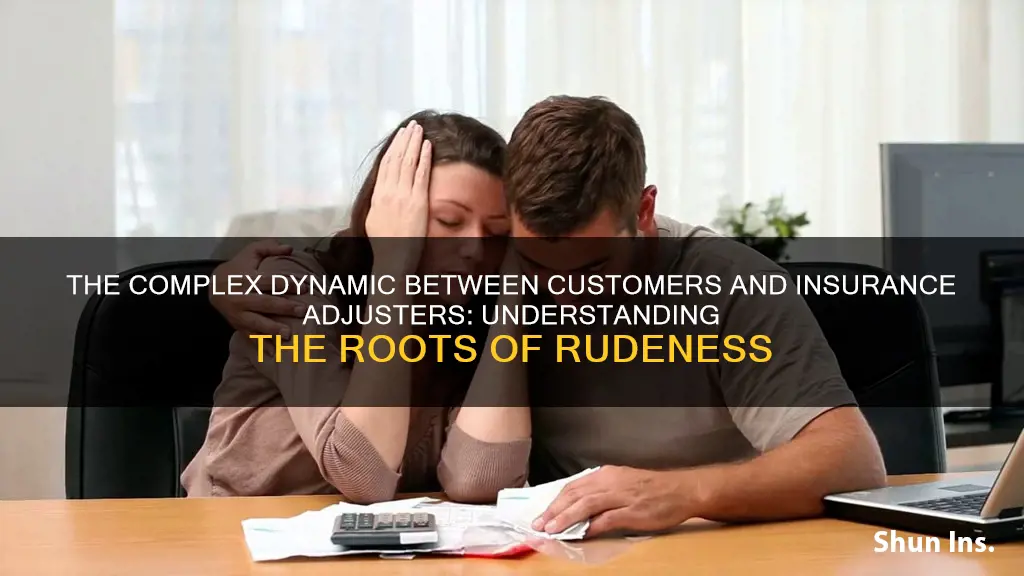

Dealing with insurance adjusters can be a frustrating experience, especially when they are rude or difficult. Adjusters are hired by insurance companies to resolve claims as quickly and cheaply as possible, which often involves employing misleading tactics to pressure claimants into accepting low settlement offers. This can involve attempting to delegitimise claims, such as by proving shared liability or getting claimants to admit fault, as well as delaying the process to increase the likelihood of mistakes.

Adjusters may also try to take advantage of claimants' emotional states and financial pressures, particularly if they are in a vulnerable position following an accident. They might also use high-pressure tactics, such as repeated phone calls, to get claimants to sign a release or accept a settlement.

Ultimately, insurance adjusters are not working for the claimant; they are working for the insurance company and will use various strategies to minimise payouts.

| Characteristics | Values |

|---|---|

| Adjuster's goal | Get claimants to accept the lowest possible settlement amounts or find ways to issue no settlements at all |

| Adjuster's approach | Friendly and personable |

| Adjuster's tactics | Use high-pressure tactics, make the claimant feel at fault, use lack of communication, delay the payment of the claim, use surveillance |

| Adjuster's employer | The insurance company |

| Adjuster's job | To avoid fraudulent insurance claims, settle claims quickly and for the lowest possible payouts |

What You'll Learn

Adjusters are hard to get a hold of

Customers may find insurance adjusters hard to get a hold of for several reasons. Firstly, adjusters are often handling multiple cases simultaneously, which can make it challenging to respond promptly to each customer. This delay in communication can be frustrating for customers, especially if they have urgent queries or concerns.

Additionally, adjusters may intentionally avoid or delay communication to pressure customers into accepting lower settlement offers. By prolonging the claims process, adjusters hope that customers will become discouraged and accept a quick, low-value settlement to expedite the resolution. This tactic is particularly effective when customers are already dealing with the stress and financial burden of an accident or injury.

Moreover, adjusters may be hard to reach due to their busy work schedules and on-call availability. Adjusters often work long hours and are expected to be available outside of regular business hours, including weekends and holidays. This availability can make it challenging for customers to connect with them during standard working hours.

To overcome these challenges, customers can try to be persistent in their communication attempts, leave detailed voicemails or emails, and follow up at appropriate intervals. It is also crucial to be prepared and organized when communicating with adjusters, having relevant documents and information readily available to support their claims.

However, if customers continue to experience difficulties in reaching their adjuster or feel that they are being intentionally evasive, it may be advisable to escalate the matter to the adjuster's supervisor or consider seeking legal assistance.

Training Techniques for Insurance Adjusters: A Comprehensive Guide

You may want to see also

They discount the severity of the accident and resulting injuries

Customers may be rude to insurance adjusters because they discount the severity of the accident and resulting injuries. This can cause customers to feel that they are being denied the appropriate compensation for their situation.

Insurance adjusters are hired by insurance companies to resolve claims as quickly as possible, while saving as much money as they can. They are trained to serve the financial interests of the insurance company, which can often be at odds with the interests of the claimant. As such, adjusters will use a variety of tactics to try to reduce the amount of money paid out to claimants.

One such tactic is to discount the severity of the accident and resulting injuries. They may refuse to pay the appropriate amounts for repairs, rental cars, and medical treatments. While doing so, they will collect information, including the victim's own recorded statement, to twist and use against them to justify a smaller payout. For example, they may obtain a victim's complete medical history and try to claim that their injuries were pre-existing. They may also try to get claimants to admit partial fault for the accident, or use their words against them to cast doubt on the legitimacy of their claim.

The adjuster's goal is to get claimants to accept the lowest possible settlement amount or to find ways to issue no settlements at all. They do this by coaxing injury victims into making statements that undermine their claims or by pressuring them to settle too soon. They may also delay the payment of a claim, knowing that the claimant is in a precarious financial position and hoping that they will accept a meagre settlement.

Understanding the Adjusting Entry for Expired Insurance: A Comprehensive Guide

You may want to see also

They use high-pressure tactics to get customers to sign a release

Customers may be rude to insurance adjusters because they use high-pressure tactics to get them to sign a release. Insurance adjusters are hired by insurance companies to resolve claims as quickly as possible while saving as much money as they can. They do this by employing a range of misleading tactics to get claimants to accept lower settlement amounts or to issue no settlements at all.

One of these tactics is to use high-pressure tactics to get customers to sign a release. Insurance adjusters may call repeatedly and use high-pressure tactics to get customers to sign a release before they have even heard about their injuries. They might also try to make customers feel like their injuries are their fault, even when another party is at fault.

Insurance adjusters are trained to sound friendly and approachable to coax injury victims into making statements that undermine their claims or by pressuring them to settle for less money than they are owed. They will also try to get claimants to make recorded statements that can be used against them.

It is important for customers to carefully guard their speech and avoid making statements about their health or admitting fault. They should also be aware that they are not required to deal with rude insurance adjusters and can ask for the adjuster's supervisor or hire a lawyer to handle the negotiations on their behalf.

The Compensation Conundrum: Unraveling the Truth About Insurance Adjuster Commissions

You may want to see also

They make customers feel like their injuries are their fault

Insurance adjusters are employed by insurance companies to investigate the facts of an accident and determine how much the insurance company should pay out. Insurance adjusters are trained to use a variety of tactics to minimize the amount of money the insurance company pays out. One of these tactics is to make the customer feel like their injuries are their own fault.

Insurance adjusters are trained to be friendly and personable. They do this to get the customer to open up and make statements that undermine their claims or make them seem at fault. For example, an insurance adjuster might ask a series of loaded questions that make the customer seem partially responsible for the accident.

> “I understand that the other car ran the red light and hit you, but what more could you have done to avoid the accident?”

>

> “I understand that it rained on the day of the accident. How much of an effect do you think the slick roads had on your ability to avoid the accident?”

>

> "You are new to the area. Did your lack of familiarity with the area change how you drove that day?"

Insurance adjusters also try to get the customer to make a recorded statement. They do this because it's much easier to get someone to say something that hurts their claim in a verbal conversation than in writing.

Consequences of Misinformation: Navigating the Impact of Inaccurate Details on Insurance Claims

You may want to see also

They are seen as working against the customer's financial interests

Customers may be rude to insurance adjusters because they are seen as working against the customer's financial interests. Insurance adjusters are hired by insurance companies to resolve claims as quickly as possible, while saving as much money as possible for their employer. This means that adjusters will often employ a wide array of misleading tactics to trick customers into taking a lower settlement amount than they deserve.

Adjusters are trained in the art of negotiating insurance claims and resolving settlements with minimal payouts. They use variations of settlement formulas and negotiating strategies to arrive at a number for the claim request. They will also look for any way to delegitimize a claim, such as proving shared liability, getting the claimant to admit fault, or delaying the process to frustrate the claimant into making a mistake.

Adjusters may also use a "deny first" strategy, denying a claim even if they think it is valid, or they may exaggerate the urgency of a claim, hoping that the claimant will settle for a lowball offer. They may also try to get the claimant to make a recorded statement, which can then be used against them, taking answers out of context.

The overarching goal of insurance adjusters is to get claimants to accept the lowest possible settlement amounts or to find ways to issue no settlements at all. This is done by coaxing injury victims into making statements that undermine their claims or by pressuring them to settle too soon.

Understanding Adjustable ComLife Insurance: Flexibility for a Dynamic Life

You may want to see also

Frequently asked questions

Customers may be rude to insurance adjusters because they believe the adjuster is not working in their best interest. Insurance adjusters are hired by insurance companies to resolve claims as quickly as possible while saving as much money as they can. This can cause customers to feel that their claim is not being taken seriously or that the adjuster is trying to take advantage of them.

If an insurance adjuster is being rude, you can ask for their supervisor and request a different adjuster. You are not required to speak to an adjuster who is being rude and you can also insist that all communication be in writing. It may also be helpful to hire a personal injury attorney to handle negotiations on your behalf.

Some tactics insurance adjusters may use include avoiding communication to cause frustration, attempting to get you to admit fault for the accident, using your medical records against you, and delaying the payment of your claim. Adjusters may also try to record you or use social media to find evidence that could hurt your claim.