Group term life insurance is a valuable benefit that provides financial security for individuals who are part of a larger group, such as employees of a company or members of a professional organization. This type of insurance offers a convenient and cost-effective way to obtain life coverage, as it is typically more affordable than individual term life insurance policies. By enrolling in a group plan, you can ensure that your loved ones are protected financially in the event of your passing, providing them with a lump sum payment or regular income to cover expenses and maintain their standard of living. Understanding the benefits and features of group term life insurance is essential to appreciate why it is a popular choice for many individuals seeking comprehensive protection for themselves and their families.

What You'll Learn

Benefits: Understand the financial support for dependents

Group term life insurance is a valuable benefit that provides financial security for your loved ones in the event of your passing. This type of insurance is often offered as part of an employee's benefits package, and it can be a crucial component of a comprehensive financial plan. When you have group term life insurance, you're ensuring that your family will have a financial safety net during challenging times.

The primary benefit of group term life insurance is the financial support it provides to your dependents. Dependents, such as your spouse, children, or other family members who rely on your income, will receive a death benefit if you were to pass away. This death benefit can be a significant financial cushion, helping to cover various expenses and ensure that your family's standard of living is maintained. It can cover daily living costs, such as mortgage or rent payments, utility bills, groceries, and other essential expenses. Additionally, the death benefit can be used to pay for your children's education, ensuring they have the resources they need to pursue their dreams.

The amount of financial support your dependents receive is typically based on the coverage amount you select. You can choose a coverage amount that aligns with your family's needs and your ability to pay for it. It's essential to consider your family's financial obligations and future goals when determining the appropriate coverage. For example, if you have a large mortgage or a young family with educational expenses, you might opt for a higher coverage amount to ensure your dependents are adequately supported.

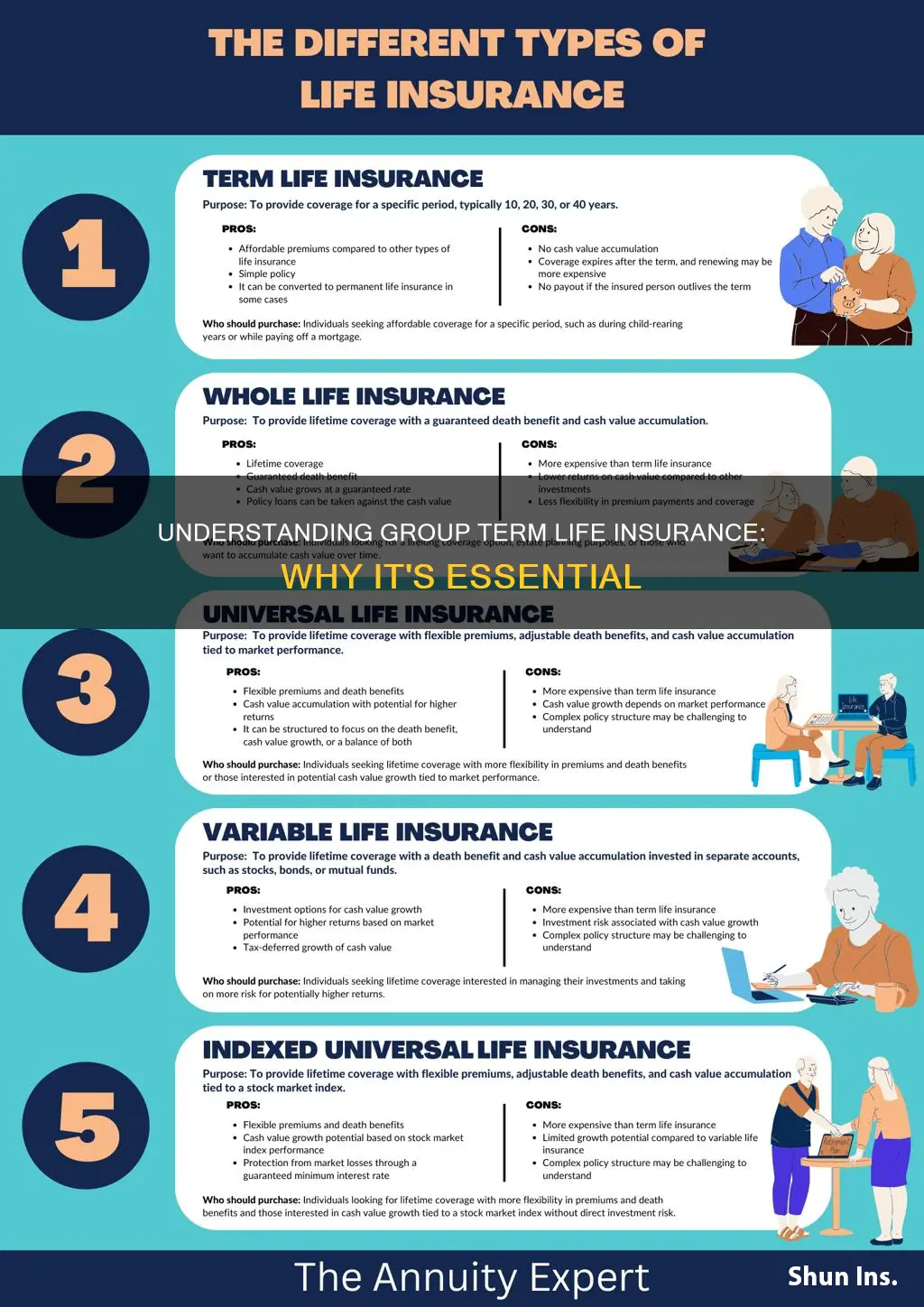

Furthermore, group term life insurance often offers flexibility in terms of coverage duration. You can typically choose the length of the policy, such as 10, 15, or 20 years, depending on your needs and preferences. This flexibility allows you to align the insurance with specific life events or financial goals. For instance, you might choose a shorter-term policy if you plan to become financially independent through other means or a longer-term policy to cover your children's education.

In summary, group term life insurance provides a vital layer of financial protection for your dependents. It ensures that your family will have the necessary resources to maintain their lifestyle and cover essential expenses in the event of your death. By understanding the benefits and carefully selecting the coverage amount and duration, you can provide peace of mind and financial security for your loved ones.

Unlocking Growth: Exploring Whole Life Insurance Benefits

You may want to see also

Coverage: Learn how it provides protection for your loved ones

Group term life insurance is a valuable financial tool that offers a safety net for your loved ones in the event of your untimely passing. This type of insurance provides a lump-sum payment, known as a death benefit, to your designated beneficiaries when you pass away during the term of the policy. The primary purpose of this coverage is to ensure that your family can maintain their standard of living and cover essential expenses, even if you are no longer there to provide financially.

The beauty of group term life insurance lies in its affordability and the fact that it is often included as a benefit in various group settings, such as through your employer or professional associations. This makes it accessible to a wide range of individuals who may not have otherwise been able to afford individual life insurance policies. By providing coverage for a specific term, typically 10, 15, or 20 years, it offers a temporary safety net during the years when you are most likely to be the primary breadwinner for your family.

When you purchase group term life insurance, you select a death benefit amount, which represents the financial support your beneficiaries will receive. This amount should ideally cover a few key financial obligations, such as mortgage or rent payments, children's education expenses, outstanding debts, and daily living expenses for your spouse or partner and dependent children. The coverage ensures that your loved ones can maintain their current lifestyle and have the financial resources to make important decisions regarding their future.

One of the advantages of group term life insurance is the ease of administration. Since the policy is typically part of a larger group, the paperwork and processes are streamlined, making it convenient for both you and your beneficiaries. In the unfortunate event of your death, the insurance company will promptly pay out the death benefit, providing immediate financial relief to your family. This can be a crucial aspect of ensuring your loved ones' financial security during a difficult time.

Moreover, group term life insurance can be a flexible option, allowing you to adjust the coverage amount as your financial situation changes. You can typically increase or decrease the death benefit within certain limits, ensuring that your policy remains aligned with your evolving needs and responsibilities. This flexibility is particularly important as your family's circumstances change over time, such as when you have children, purchase a home, or take on additional financial commitments.

Northwestern's Life Insurance: Principal Provider?

You may want to see also

Term Length: Explore the duration of coverage and its impact

When it comes to group term life insurance, understanding the term length is crucial as it directly impacts the duration of coverage and the overall value of the policy. The term length refers to the period for which the insurance coverage is provided. This duration is typically a set number of years, such as 10, 20, or 30 years. During this period, the insurance company guarantees a death benefit if the insured individual passes away.

The choice of term length is an essential decision as it determines how long the coverage will be in effect. Longer term lengths provide more extended coverage, ensuring financial protection for a more extended period. For example, a 30-year term policy will offer coverage for the entire duration, providing peace of mind and financial security for the policyholder's family. This extended coverage can be particularly valuable for those with long-term financial commitments or responsibilities, such as mortgage payments, children's education, or business ventures.

On the other hand, shorter term lengths, like 10 or 20 years, offer more affordable premiums but provide coverage for a more limited time. This option is suitable for individuals who want coverage for a specific period, such as until a mortgage is paid off or until children reach adulthood. Shorter terms can be more cost-effective, especially for those who believe they may not need long-term coverage or have other means of financial support in place.

It's important to consider your personal circumstances and financial goals when choosing a term length. If you have a long-term financial plan or significant financial obligations, a longer term length might be more appropriate. Conversely, if your financial commitments are short-term or you have alternative sources of income or savings, a shorter term could be sufficient.

Additionally, some group term life insurance policies offer the flexibility to convert the term length at the end of the initial period. This option allows policyholders to extend their coverage if needed, ensuring continued protection for their loved ones. When evaluating your insurance options, consider consulting with a financial advisor or insurance specialist to determine the most suitable term length based on your unique circumstances.

Life Insurance License: Massachusetts Expiry and Renewal Guide

You may want to see also

Cost: Discover the affordability and value of the policy

When considering group term life insurance, one of the most important aspects to evaluate is the cost. This type of insurance is often offered as a benefit through employers, and it can provide valuable financial protection for individuals and their families. Understanding the cost structure is crucial to ensure that the policy offers the right level of coverage at a reasonable price.

The cost of group term life insurance is typically determined by several factors. Firstly, the amount of coverage you choose will significantly impact the premium. Higher coverage amounts mean a higher cost, as the insurance company assumes a greater risk in providing extensive financial protection. It's essential to assess your needs and select a coverage amount that aligns with your financial goals and the level of security required for your loved ones.

Age and health also play a role in determining the cost. Younger individuals generally pay lower premiums because they are considered lower-risk candidates for insurance companies. Additionally, maintaining a healthy lifestyle can lead to more favorable rates. Insurance providers often offer discounts or better terms to policyholders who have a healthy weight, engage in regular exercise, and have no significant medical history.

Another factor influencing the cost is the duration of the policy. Group term life insurance is usually offered for a specific period, often 10, 15, or 20 years. The longer the term, the higher the overall cost, as the insurance company is providing coverage for a more extended period. However, longer-term policies can be more cost-effective in the long run, especially if you plan to maintain the coverage for an extended period.

Lastly, the employer's contribution and the group's overall health can impact the cost. Employers often subsidize the premium, making it more affordable for employees. Additionally, a group with a lower incidence of claims and a healthier overall population may result in more competitive rates for all members. It's worth researching and comparing different group plans to find the most cost-effective option that still meets your coverage needs.

Employer-Provided Life Insurance: What You Need to Know

You may want to see also

Flexibility: See how it can be tailored to your needs

Group term life insurance offers a flexible and customizable solution for individuals who want to protect their loved ones financially. This type of insurance is designed to provide coverage for a specific period, typically one to ten years, and it is often offered as a benefit through employers or professional associations. One of the key advantages of group term life insurance is its flexibility, which allows policyholders to tailor the coverage to their unique needs and circumstances.

When considering group term life insurance, you have the flexibility to choose the coverage amount that suits your financial goals and obligations. This is particularly important as it ensures that your beneficiaries receive adequate financial support in the event of your passing. For instance, you might opt for a higher coverage amount if you have a large family or significant financial responsibilities, such as a mortgage or children's education expenses. Conversely, if you have fewer dependents or a smaller financial burden, a lower coverage amount might be more appropriate.

Another aspect of flexibility in group term life insurance is the option to adjust the coverage duration. The standard term length is often one to ten years, but you can choose a term that aligns with your specific needs. For example, if you are planning to take out a mortgage or a business loan with a term of five years, you can select a corresponding term for your insurance policy. This ensures that the coverage ends at the same time as the loan, providing a precise and tailored solution.

Furthermore, group term life insurance policies often offer the flexibility to convert the coverage to a permanent life insurance policy. This conversion option allows you to continue the insurance beyond the initial term, providing long-term financial protection for your beneficiaries. By converting, you can ensure that your loved ones are covered for life, even if your initial term ends. This flexibility is especially valuable for those who want to build a solid financial safety net for their families.

In summary, group term life insurance provides flexibility in terms of coverage amount and duration, allowing you to customize the policy to fit your unique circumstances. This adaptability ensures that you can make informed decisions about your insurance needs, providing peace of mind and financial security for your loved ones. Understanding these flexible features can help you make the most of group term life insurance and ensure that your financial protection is tailored to your specific requirements.

Unraveling Your Parent's Life Insurance: A Step-by-Step Guide

You may want to see also

Frequently asked questions

Group term life insurance is a type of life insurance policy offered by employers to their employees as part of a benefits package. It provides financial protection to the policyholder and their beneficiaries in the event of the insured individual's death during the term of the policy.

When you enroll in a group term life insurance plan, you typically choose a coverage amount and a term (duration) for the policy. The employer pays the premiums on behalf of the employees, ensuring continuous coverage. If the insured individual passes away during the term, the beneficiaries receive a death benefit, which can be used to cover expenses, repay debts, or provide financial support.

Eligibility criteria vary depending on the employer's policies and the insurance provider. Generally, all employees enrolled in the group plan are eligible for coverage. Some employers may offer different coverage options or allow employees to customize their insurance plans based on their needs.

Group term life insurance offers several advantages. It often provides more affordable coverage compared to individual term life insurance due to the group discount. Additionally, it is typically easy to enroll and manage, as the employer handles the administrative tasks. This type of insurance can provide financial security for your loved ones and help cover various financial obligations in the event of your passing.

In some cases, yes. Many group term life insurance policies offer the option to convert the coverage to a permanent life insurance policy, such as whole life or universal life, after a certain period. This conversion privilege allows you to continue the insurance coverage beyond the initial term and potentially build cash value over time. However, the conversion process and terms may vary, so it's essential to review the policy details.