A hit-and-run is a car accident where a driver leaves the scene without providing their contact or insurance details. While it is illegal and usually considered a misdemeanour, drivers still commit hit-and-runs, even if they have insurance. This could be because they panic, are driving under the influence, or don't want to cause delays. If the driver is found, they can face jail time and steep fines, as well as a significant increase in their insurance rates.

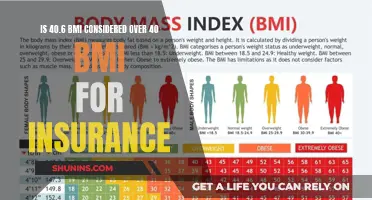

| Characteristics | Values |

|---|---|

| Reasons for hit and run | To avoid exchanging information with the other party, or because of fear of legal consequences |

| Insurance coverage for hit and run | Collision coverage, uninsured motorist property damage (UMPD), uninsured motorist bodily injury (UMBI), personal injury protection (PIP), and medical payments (Med Pay) |

| Legal consequences of hit and run | Jail time, steep fines, criminal charges, increased insurance rates, and administrative penalties |

What You'll Learn

Collision coverage

In the context of a hit-and-run accident, collision coverage can help cover the cost of repairing or replacing your vehicle if it is damaged. If you are the victim of a hit-and-run, your insurance policy may help cover the cost of repairs and injuries if you have the right coverage. Collision coverage is typically required for this scenario, but in some cases, uninsured motorist coverage may also apply.

It is important to note that collision coverage is optional in most states, and having this coverage can provide peace of mind and financial protection in the event of an accident, including hit-and-run incidents.

Sleep Study Insurance Coverage

You may want to see also

Uninsured motorist property damage (UMPD)

UMPD is mandated in some states, available in others, and relatively inexpensive to add to your policy. However, it is not available in all states, and there may be certain requirements for UMPD coverage to apply. For example, some states require that the at-fault driver be identified before UMPD can cover a hit-and-run accident. Additionally, UMPD typically has a deductible that you will need to pay out of pocket.

UMPD is especially useful if you are concerned about damage to your vehicle caused by an uninsured or underinsured driver. It is important to note that UMPD only covers damage caused by a driver with little or no insurance. If you are looking for coverage for any damage to your vehicle, collision coverage may be a better option as it applies to any damage resulting from a collision with another vehicle or object, regardless of fault.

In summary, UMPD can provide valuable protection in the event of a collision with an uninsured or underinsured driver, but it is important to understand the specific requirements and limitations of this type of coverage in your state.

Understanding Bill Insurance: Protecting Your Finances from Unforeseen Costs

You may want to see also

Uninsured motorist bodily injury (UMBI)

The importance of UMBI coverage is underscored by the fact that nearly 13% of drivers countrywide are uninsured, and in some states, this number exceeds 20%. Without UMBI coverage, individuals may be left with substantial out-of-pocket expenses for medical bills and lost income. UMBI coverage ensures that individuals can receive compensation for their injuries and financial losses without having to rely solely on their health insurance or pursue legal action against the at-fault driver.

In some states, UMBI coverage is mandatory, while in others, it is optional. However, even in states where it is not required, it is highly recommended for all drivers. When purchasing UMBI coverage, individuals can typically choose their coverage limits, with the option to match their liability coverage amounts. It is important to note that UMBI coverage does not include a deductible in most states.

In addition to UMBI coverage, individuals may also consider adding uninsured motorist property damage (UMPD) coverage to their policy. UMPD coverage can help pay for repairs to a vehicle damaged by an uninsured or underinsured driver. However, it is important to note that UMPD coverage may not be available in all states and may not cover hit-and-run incidents in certain states.

By having adequate UMBI and UMPD coverage, individuals can have peace of mind knowing that they are protected financially in the event of an accident with an uninsured or underinsured driver, including hit-and-run scenarios.

VA Benefits: Insurance or Not?

You may want to see also

Personal injury protection (PIP)

PIP covers medical expenses for both the policyholder and their passengers, even if they don't have health insurance. It also often provides payments for lost income, childcare, and funeral expenses related to the accident. PIP policies have a minimum coverage amount and a per-person maximum coverage limit, which is usually set at $25,000.

In the context of a hit-and-run accident, PIP can be crucial in covering injuries sustained by the victims. If the at-fault driver flees the scene and cannot be identified, PIP coverage can provide financial protection for the injured parties. It is important to note that PIP does not cover property damage, and it will not cover the injuries of the other driver in a collision.

Renter's Insurance Revolution: Unraveling the Evolution of Tenant Protection

You may want to see also

Medical payments (Med Pay)

Medical payments coverage, also known as MedPay, is an optional car insurance coverage type that pays for the policyholder's and their passengers' medical bills and other expenses resulting from a car accident, regardless of who was at fault. MedPay is available in most states and is required in Maine and New Hampshire. It typically covers:

- Health insurance deductibles and copays

- Hospital visits and stays

- Ambulance fees

- Chiropractic, dental, and prosthetic costs

- Emergency medical care

- Specific diagnostics and treatments, such as X-rays and surgery

- Funeral expenses

MedPay does not cover lost wages, medical expenses unrelated to the car accident, or replacement services for tasks the injured party cannot perform due to their injuries, such as housekeeping or childcare.

The amount of MedPay coverage purchased represents the maximum amount available to each person covered under the policy. For example, if a policyholder buys $2,000 of MedPay coverage and they and their passenger are injured in an accident, each will have up to $2,000 in MedPay coverage.

The average cost of medical payments coverage is typically quite low, and MedPay can be especially beneficial for those without health insurance or with high health insurance deductibles.

The Surprising Truth Behind Hospital Billing: Unraveling the Insurance Enigma

You may want to see also

Frequently asked questions

Your priority should be the health and safety of you and your passengers. Pull over, make sure everyone is okay, and assess the damage to your car. If anyone is seriously injured, call 911. Call the police right away and file an accident report within 24 hours of the incident.

Leaving the scene of an accident is against the law. Every state requires that drivers stop after an accident to exchange information or render aid if needed. If you're caught, expect to pay for both the damage to the other person’s car and for the crime of leaving the scene. A hit and run may be a misdemeanor or a felony.

Your insurance policy may help cover the cost of repairs and injuries. Depending on your policy and state, the following insurance coverages may apply: collision, uninsured motorist property damage (UMPD), uninsured motorist bodily injury (UMBI), personal injury protection (PIP), and medical payments (Med Pay).

If you're convicted of a hit-and-run, you can expect your insurance company to raise your rates significantly upon renewal. You will likely see a rate increase above what you would pay for a standard at-fault accident.