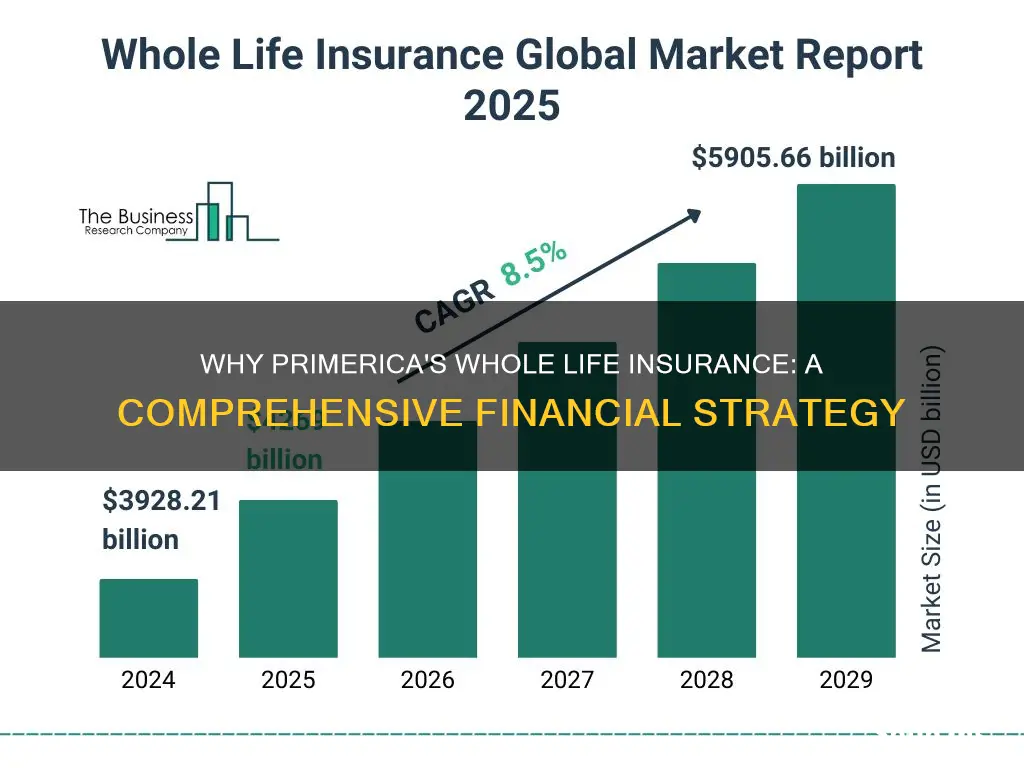

Many people wonder why Primerica sells whole life insurance, a complex financial product. Whole life insurance is a long-term commitment, offering lifelong coverage and a cash value component, which can be a valuable investment. Primerica, a financial services company, promotes whole life insurance as a way to provide financial security and build wealth over time. The company's representatives often highlight the product's ability to offer guaranteed death benefits, tax-deferred growth, and the potential for loan features, making it an attractive option for those seeking comprehensive financial protection and investment opportunities. Understanding the benefits and potential risks of whole life insurance is crucial for consumers to make informed decisions about their financial future.

What You'll Learn

- Financial Security: Primerica agents emphasize the long-term financial security whole life insurance provides

- Death Benefit: The guaranteed death benefit is a key selling point for families seeking financial protection

- Cash Value: Accumulated cash value in whole life policies can be borrowed against or withdrawn

- Tax Advantages: Tax-deferred growth and potential tax deductions make whole life attractive

- Legacy Planning: Whole life insurance helps build a legacy by providing financial support to beneficiaries

Financial Security: Primerica agents emphasize the long-term financial security whole life insurance provides

Financial security is a cornerstone of financial planning, and Primerica agents understand the importance of offering their clients a comprehensive solution to ensure their long-term financial well-being. Whole life insurance is a powerful tool in this regard, and Primerica agents emphasize its ability to provide financial security for their clients' families and loved ones.

When it comes to financial security, whole life insurance offers a unique and valuable proposition. Unlike term life insurance, which provides coverage for a specific period, whole life insurance is a permanent policy that offers lifelong coverage. This means that once the policy is in force, the death benefit is guaranteed, providing financial security for the insured's beneficiaries regardless of their age or health status.

Primerica agents highlight the long-term financial security that whole life insurance provides. They explain that the policy's death benefit is fixed, meaning it will grow at a consistent rate, often with an investment component. This allows the policy to accumulate cash value over time, which can be borrowed against or withdrawn tax-free. The cash value can be used to pay for college tuition, start a business, or provide financial support during retirement. This flexibility ensures that the policyholder's financial goals are met, even in the event of their passing.

Furthermore, Primerica agents educate their clients about the stability and predictability that whole life insurance offers. The policy's premiums are typically level, meaning they remain consistent over the life of the policy. This provides a sense of financial predictability, allowing individuals to plan and budget effectively. Unlike other investment vehicles, whole life insurance guarantees a return on investment, ensuring that the money invested in the policy is protected and can grow over time.

In summary, Primerica agents emphasize the long-term financial security that whole life insurance provides. They understand that this type of insurance offers a comprehensive solution, ensuring that individuals and their families are protected financially for the long haul. By highlighting the stability, predictability, and growth potential of whole life insurance, Primerica agents empower their clients to make informed decisions about their financial future.

Beneficiary's Right to Refuse Life Insurance Payout

You may want to see also

Death Benefit: The guaranteed death benefit is a key selling point for families seeking financial protection

The death benefit is a critical aspect of whole life insurance, and it is a primary reason why Primerica, a financial services company, promotes this type of insurance to its customers. When an individual purchases a whole life insurance policy, they are essentially making a promise to their loved ones that a financial safety net will be provided in the event of their passing. This promise is the death benefit, a guaranteed amount of money that is paid out to the policyholder's beneficiaries upon their death.

For families, the death benefit serves as a powerful tool to ensure financial stability and peace of mind. It provides a lump sum payment that can cover various expenses and provide long-term financial security. This is especially crucial for families with children, as the death benefit can help cover the costs of raising a child, such as education, healthcare, and everyday living expenses. Additionally, it can be used to pay off any outstanding debts, such as mortgages or loans, ensuring that the family's financial obligations are met even if the primary breadwinner is no longer present.

The guaranteed nature of the death benefit is a significant advantage. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers lifelong coverage. This means that as long as the premiums are paid, the death benefit will be paid out when the insured individual passes away, providing a consistent and reliable source of financial support for the family. This guarantee is particularly attractive to those seeking long-term financial protection and a sense of security for their loved ones.

Primerica's sales approach often emphasizes the peace of mind that comes with knowing your family is protected. By highlighting the death benefit as a key feature, the company aims to showcase how this insurance product can provide financial security and stability during challenging times. It encourages individuals to consider the long-term impact of their decisions and the potential benefits for their loved ones.

In summary, the death benefit is a compelling reason for Primerica to promote whole life insurance. It offers a guaranteed financial safety net for families, ensuring that their loved ones are provided for in the event of the insured's passing. This aspect of the insurance policy provides a sense of security and peace of mind, making it an attractive option for those seeking long-term financial protection.

Term Life Insurance: Convertible, Flexible Protection for Your Future

You may want to see also

Cash Value: Accumulated cash value in whole life policies can be borrowed against or withdrawn

Whole life insurance, a permanent life insurance policy, offers a unique feature that sets it apart from other insurance products: cash value. This accumulated cash value is a significant benefit for policyholders, providing them with a financial asset that can be utilized in various ways. One of the primary reasons Primerica, a financial services company, promotes whole life insurance is the potential for policyholders to access this cash value.

The cash value in a whole life policy grows over time as premiums are paid. It represents the portion of the policy that is not used to pay death benefits. This value can accumulate and grow tax-deferred, similar to a savings account. Policyholders can build a substantial amount of cash value, which can be a valuable asset in their financial portfolio.

One of the key advantages of this feature is the ability to borrow against the cash value. Policyholders can take out a loan against their policy, allowing them to access funds without selling the policy or disrupting their coverage. This can be particularly useful for various financial needs, such as starting a business, funding education, or covering unexpected expenses. The loan is typically interest-free, and as long as the policy remains in force, the borrower can repay the loan with interest, ensuring the policy's value remains intact.

Additionally, the accumulated cash value can be withdrawn as needed. Policyholders have the option to take out funds from the cash value, providing immediate access to their savings. This flexibility is beneficial for those who may require quick access to funds for various financial goals. Withdrawals can be made without affecting the death benefit or the overall policy structure, making it a convenient way to access funds while maintaining coverage.

In summary, the cash value in whole life policies is a powerful feature that allows policyholders to build a financial asset, borrow funds without selling their policy, and access their savings when needed. Primerica's focus on whole life insurance is justified by the potential financial benefits and security it provides to policyholders, offering a comprehensive financial solution that goes beyond traditional insurance coverage.

Life Insurance: USAA's Comprehensive Coverage Options

You may want to see also

Tax Advantages: Tax-deferred growth and potential tax deductions make whole life attractive

Whole life insurance offers significant tax advantages that can make it an attractive financial product for many individuals. One of the key benefits is tax-deferred growth, which allows the policy's cash value to accumulate over time without being subject to annual income tax. This means that the money grows tax-free, providing a substantial benefit when compared to other investment vehicles. As the cash value builds up, it can be used to pay for future premiums, ensuring that the policy remains in force and continues to provide coverage. This tax-deferred growth is particularly advantageous for long-term financial planning, as it allows individuals to build a substantial fund that can be used for various purposes, such as retirement, education, or other financial goals.

In addition to tax-deferred growth, whole life insurance also provides potential tax deductions. Policyholders can deduct the annual premium payments from their taxable income, which can result in significant tax savings. This is especially beneficial for those in higher tax brackets, as the deduction can offset a substantial portion of their annual income. Furthermore, the cash value of the policy, which grows tax-free, can be borrowed against or withdrawn without triggering taxable events, providing flexibility and potential tax advantages for policyholders.

The tax benefits of whole life insurance are particularly appealing for long-term financial planning. As the policy's cash value grows, it can be used to secure a financial safety net for the future. For example, the accumulated cash value can be used to pay for long-term care expenses, providing financial security and peace of mind. Additionally, the tax-deferred nature of the policy allows individuals to build a substantial fund that can be passed on to beneficiaries tax-free, ensuring that the entire death benefit is received by the intended recipients.

For those looking to maximize their tax efficiency, whole life insurance can be a valuable tool. The tax-deferred growth and potential tax deductions make it an attractive option for individuals seeking to build a substantial financial asset while also enjoying tax benefits. By understanding these advantages, individuals can make informed decisions about their financial planning and potentially optimize their overall financial strategy.

In summary, the tax advantages of whole life insurance, including tax-deferred growth and potential tax deductions, make it a compelling choice for individuals seeking long-term financial security and tax efficiency. These benefits allow policyholders to build substantial cash values, secure their financial future, and potentially pass on a significant inheritance to their beneficiaries, all while enjoying the tax advantages of a well-structured financial product.

Life Insurance Licenses: Felony Impact Explained

You may want to see also

Legacy Planning: Whole life insurance helps build a legacy by providing financial support to beneficiaries

Whole life insurance is a powerful tool for legacy planning, offering a unique way to ensure your loved ones are financially secure for the long term. When you consider the benefits of this type of insurance, it becomes clear why Primerica, a financial services company, would emphasize its importance.

The primary advantage of whole life insurance in the context of legacy planning is its ability to provide financial support to beneficiaries. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers permanent coverage. This means that once the policy is in force, the death benefit is guaranteed to be paid out to the designated beneficiaries, regardless of the insured's age or health at the time of death. This financial support can be a significant legacy, ensuring that your family has the resources to maintain their standard of living, cover expenses, and achieve their financial goals.

For beneficiaries, the financial support provided by whole life insurance can be life-changing. It can help cover various expenses, such as mortgage payments, education costs, or even provide a lump sum for investment opportunities. This financial security allows beneficiaries to focus on their future, make important life decisions, and build their own legacies without the immediate financial burden.

Moreover, whole life insurance policies often accumulate cash value over time, which can be borrowed against or withdrawn. This feature provides an additional layer of financial security and flexibility. Beneficiaries can access this cash value to meet unexpected expenses or take advantage of investment opportunities, further enhancing the legacy-building potential of the policy.

In the context of Primerica's sales approach, understanding the legacy-building aspect of whole life insurance can be a compelling argument for potential clients. By emphasizing the long-term financial security it provides, Primerica can help individuals recognize the value of whole life insurance as a means to leave a lasting legacy for their loved ones. This perspective can be a powerful motivator for those seeking to create a more secure future for their families.

Understanding the Most Common Group Life Insurance Plans

You may want to see also

Frequently asked questions

Whole Life Insurance is a permanent life insurance policy that offers a guaranteed death benefit and a fixed premium. It is an attractive product for Primerica because it provides a long-term financial security solution for clients. The policy's level premiums and cash value accumulation make it a stable and reliable investment, ensuring that the insurance company can meet its obligations over time.

Primerica's role as an insurance agency allows them to offer a range of financial products, including Whole Life Insurance, to their clients. By selling Whole Life Insurance, Primerica can provide comprehensive financial planning solutions. This product enables them to build long-term relationships with customers, offering both protection and investment opportunities. Primerica's commission-based structure also provides an incentive for agents to educate and guide clients towards suitable insurance options.

Whole Life Insurance offers several benefits to policyholders. Firstly, it provides lifelong coverage, ensuring that the insured individual's beneficiaries receive the death benefit regardless of when the policyholder passes away. Secondly, the cash value component of the policy grows over time, allowing policyholders to borrow against it or use it as an investment. This feature can be particularly useful for those seeking long-term financial planning and wealth accumulation.

Yes, Whole Life Insurance can be advantageous in various life situations. For instance, it is often recommended for individuals seeking long-term financial security, such as those starting a family or planning for retirement. The guaranteed death benefit can provide peace of mind, knowing that loved ones will be financially protected. Additionally, Whole Life Insurance can be a valuable tool for business owners to ensure the continuity of their business in the event of their passing.