Colonial Penn Life Insurance is a popular choice for those seeking affordable coverage, and its competitive pricing is often attributed to several factors. One key reason is the company's focus on providing term life insurance, which typically offers lower premiums compared to permanent life insurance. Additionally, Colonial Penn targets specific demographics, such as seniors and individuals with pre-existing conditions, who may be considered higher-risk but are willing to pay more for the coverage they need. The company's direct-to-consumer approach and streamlined application process also contribute to its cost-effective model, allowing them to offer competitive rates without the overhead associated with traditional insurance agencies. Understanding these factors can help individuals make informed decisions about their insurance needs.

What You'll Learn

- Low Overhead: Colonial Penn Life Insurance operates with a direct-to-consumer model, reducing administrative costs

- Targeted Marketing: They focus on older adults, a demographic with higher mortality rates, allowing for lower premiums

- Simplified Policies: Simplified issue policies skip medical exams, making it accessible to those with health issues

- Guaranteed Acceptance: No medical questions asked, ensuring everyone qualifies, despite pre-existing conditions

- Limited Benefits: Policies offer basic coverage, appealing to those seeking affordable protection

Low Overhead: Colonial Penn Life Insurance operates with a direct-to-consumer model, reducing administrative costs

Colonial Penn Life Insurance has gained attention for its affordable rates, and one of the key factors contributing to this is its unique business model. Unlike traditional insurance companies, Colonial Penn operates with a direct-to-consumer approach, cutting out the middlemen and significantly reducing overhead costs. This strategy allows them to offer competitive pricing without compromising on the quality of their products and services.

By eliminating the need for a large network of agents and brokers, Colonial Penn streamlines its operations. This direct-to-consumer model enables the company to have more control over the entire process, from policy issuance to customer service. As a result, they can allocate resources more efficiently, ensuring that the majority of their funds go directly towards providing insurance coverage rather than excessive administrative expenses.

The reduced administrative costs have a direct impact on the premiums customers pay. With lower operational expenses, Colonial Penn can offer simplified life insurance policies at more attractive prices. This approach is particularly appealing to older adults who may be seeking affordable coverage without the complexity often associated with traditional life insurance plans.

Furthermore, this direct-to-consumer model allows Colonial Penn to build stronger relationships with its customers. By cutting out the intermediaries, the company can provide personalized service and support, ensuring that policyholders receive the attention and assistance they need. This level of customer engagement can lead to higher satisfaction and loyalty, which are essential in a competitive insurance market.

In summary, Colonial Penn Life Insurance's direct-to-consumer model is a significant factor in their ability to offer cheap yet comprehensive life insurance policies. By minimizing administrative costs and maximizing efficiency, they can provide affordable coverage options without sacrificing the quality of their services. This approach has made Colonial Penn a popular choice for individuals seeking cost-effective life insurance solutions.

Collateral Assignment: Whole Life Insurance Options

You may want to see also

Targeted Marketing: They focus on older adults, a demographic with higher mortality rates, allowing for lower premiums

Colonial Penn Life Insurance Company has built its business model around a unique and controversial strategy: targeting older adults with their life insurance policies. This approach has sparked debate among industry experts, as it involves marketing directly to a demographic that is statistically more likely to pass away, which is a critical factor in determining insurance rates. By focusing on this specific age group, Colonial Penn can offer its policies at significantly lower premiums compared to traditional life insurance providers.

The key to their success lies in understanding the demographics and their associated risks. Older adults, especially those in their 60s and 70s, often face higher mortality rates due to age-related health issues and medical conditions. Life insurance companies typically use these mortality rates to calculate premiums, and as such, older individuals are often charged higher rates. However, Colonial Penn's targeted marketing strategy allows them to bypass this conventional pricing structure.

By directly marketing to older adults, Colonial Penn can offer a sense of security and peace of mind to a vulnerable demographic. Many older individuals may not have had access to life insurance in their younger years or may be looking for a more affordable option as they age. This targeted approach ensures that Colonial Penn can cater to a specific market segment that is often overlooked or charged higher rates by other insurers.

The lower premiums are a direct result of this strategic focus. With a higher mortality rate among the target demographic, the insurance company can set rates lower, knowing that a significant portion of the policyholders will likely pass away within a certain timeframe. This calculation enables Colonial Penn to offer competitive pricing, making life insurance more accessible and affordable for older adults who may have been priced out of the market otherwise.

Critics argue that this business model may be exploitative, as it preys on the vulnerability of older adults. However, Colonial Penn's marketing materials emphasize the importance of having life insurance, especially for those who may not have had the opportunity to secure coverage earlier in life. The company's approach has sparked discussions about ethical marketing practices and the potential benefits of making insurance more accessible to those who need it most.

Life Insurance Rates: Recession's Impact and You

You may want to see also

Simplified Policies: Simplified issue policies skip medical exams, making it accessible to those with health issues

Colonial Penn Life Insurance Company has gained a reputation for offering affordable life insurance policies, particularly its simplified issue options. One of the key reasons behind the low cost of these policies is the streamlined process they employ, which significantly reduces the typical underwriting requirements. This approach allows Colonial Penn to cater to a broader range of individuals, including those who might face challenges in obtaining traditional life insurance due to health concerns or other factors.

Simplified issue policies are designed with accessibility in mind. When you apply for this type of policy, you'll typically be asked to complete a simplified medical questionnaire rather than undergo a comprehensive medical examination. This questionnaire focuses on your current health status and lifestyle, providing Colonial Penn with a snapshot of your overall well-being. By skipping the medical exam, the insurer can quickly assess your risk profile and offer a policy without the extensive medical scrutiny that is usually required.

This streamlined process is particularly beneficial for individuals with pre-existing health conditions or those who have been diagnosed with chronic illnesses. For example, people with diabetes, heart disease, or even cancer survivors can find it easier to qualify for life insurance through simplified issue policies. The absence of a medical exam means that individuals don't have to disclose sensitive health information or undergo invasive procedures, making the process less stressful and more convenient.

The affordability of Colonial Penn's simplified issue policies is a direct result of this simplified underwriting process. Without the need for extensive medical exams, the insurer can offer coverage at lower rates. This is especially attractive to those who might not qualify for standard life insurance due to health issues, as it provides them with a means to secure financial protection for their loved ones. The company's ability to cater to a diverse range of customers contributes to its competitive pricing strategy.

In summary, Colonial Penn's simplified issue policies are a cost-effective solution for individuals seeking life insurance coverage without the typical medical exam. This approach not only makes life insurance more accessible but also ensures that a wider range of people can benefit from the financial security it provides. By focusing on streamlined underwriting, Colonial Penn has successfully tailored its products to meet the needs of a specific market segment, resulting in its reputation for affordable life insurance.

Uncover the Rewards: Why Life Insurance Sales is a Dream Career

You may want to see also

Guaranteed Acceptance: No medical questions asked, ensuring everyone qualifies, despite pre-existing conditions

Colonial Penn Life Insurance Company has gained a reputation for offering affordable life insurance policies, particularly to individuals with pre-existing health conditions or those who might be considered higher-risk by traditional insurance providers. One of the key factors that contribute to the affordability of Colonial Penn's products is their unique approach to underwriting.

The company's "Guaranteed Acceptance" policy is a cornerstone of its business model. This policy guarantees that anyone, regardless of their medical history or current health status, will be approved for a life insurance policy. By eliminating the need for medical questions or assessments, Colonial Penn simplifies the application process and makes it accessible to a broader range of consumers. This approach is particularly attractive to those with pre-existing conditions who might struggle to obtain coverage through conventional means.

The guaranteed acceptance aspect is a significant selling point for Colonial Penn. It ensures that individuals with health issues or a history of medical problems can secure a life insurance policy without the typical delays or denials associated with standard underwriting practices. This feature is especially valuable for older adults or those with chronic illnesses who may have limited options when it comes to life insurance.

Colonial Penn's strategy allows them to offer competitive rates because they can assess risk differently. Instead of relying on medical histories, they focus on the guaranteed acceptance aspect, which means they may not need to consider the same level of detail as other insurers. This approach can result in lower administrative costs and more straightforward underwriting, contributing to the affordability of their products.

However, it's important to note that while Colonial Penn's guaranteed acceptance policy provides an opportunity for those who might be turned away by other insurers, the coverage and benefits may be more limited compared to standard life insurance policies. The company's products are often term life insurance, which provides coverage for a specified period, and the benefits might not be as comprehensive as those offered by other providers. Nonetheless, for individuals who qualify, Colonial Penn's guaranteed acceptance policy can be a valuable option, offering a sense of security and financial protection without the typical medical underwriting process.

Term vs Life Insurance: Is It Worth the Switch?

You may want to see also

Limited Benefits: Policies offer basic coverage, appealing to those seeking affordable protection

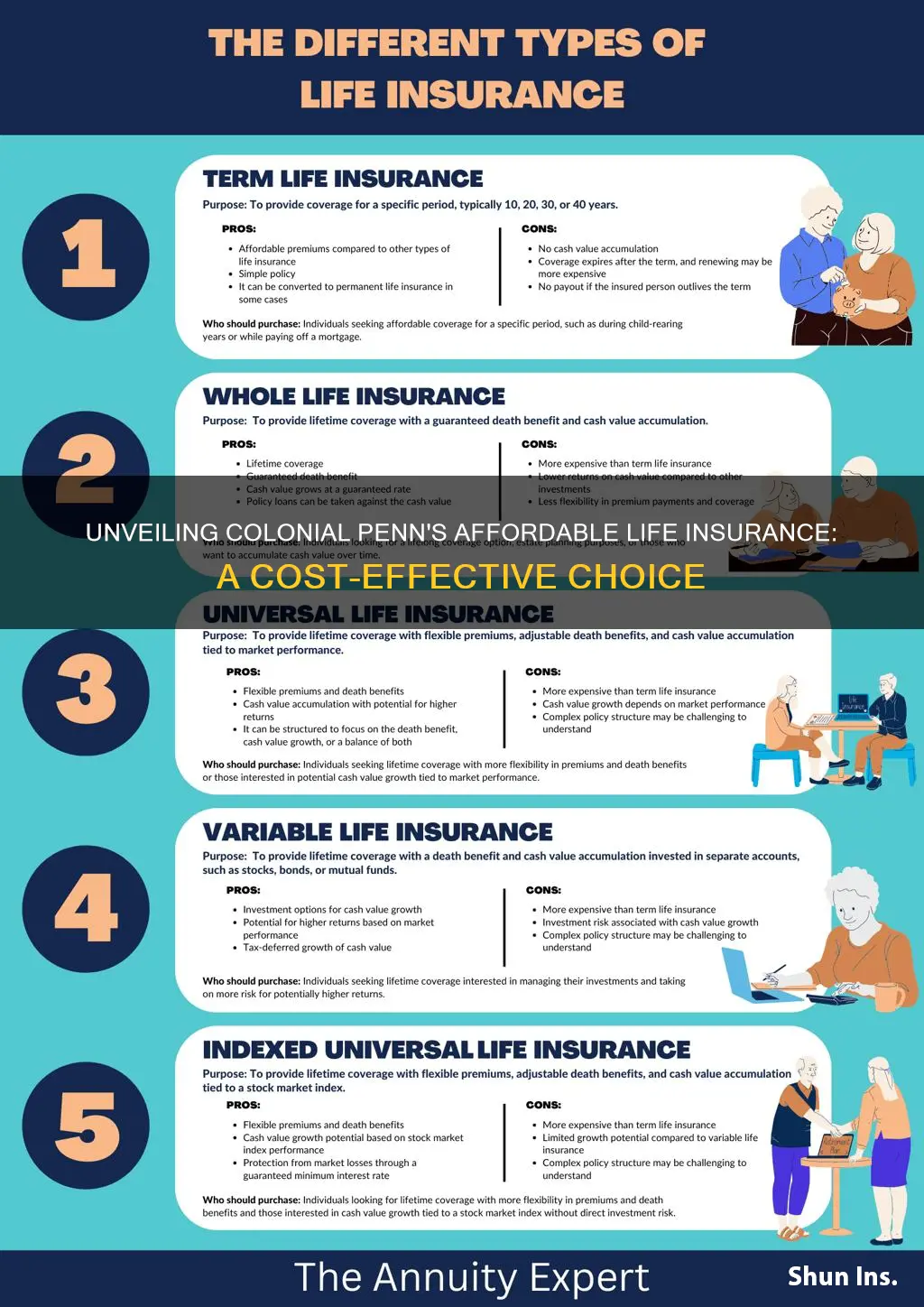

Colonial Penn Life Insurance is often considered affordable due to its limited benefit policies, which provide a basic level of coverage. These policies are designed to offer essential protection without the extensive features and benefits found in more comprehensive plans. By focusing on the core aspects of life insurance, such as death benefit and coverage period, Colonial Penn can keep costs relatively low. This approach makes their products appealing to individuals who prioritize affordability over additional perks.

The limited benefits structure allows Colonial Penn to streamline their offerings, reducing the complexity and associated costs. With fewer features, the policies become more accessible to a broader range of consumers, especially those who may have been priced out of traditional life insurance. For instance, a basic policy might cover a specific amount for a set period, ensuring that the insured individual's family receives financial support in the event of their passing. This straightforward approach can be particularly attractive to those seeking temporary coverage or a safety net during challenging financial times.

One of the key advantages of these limited benefit policies is their simplicity. They often have fewer exclusions and easier eligibility criteria, making the underwriting process more straightforward. This simplicity translates to faster approval and lower administrative costs, which are then passed on to the policyholder in the form of reduced premiums. As a result, individuals with pre-existing health conditions or those who may not qualify for standard life insurance can still access affordable coverage.

However, it's important to note that the trade-off for this affordability is a lack of comprehensive benefits. Limited benefit policies may not include features like accelerated death benefits, long-term care riders, or investment components. These additional benefits are typically found in more expensive, whole life or universal life insurance policies. Therefore, individuals considering Colonial Penn should carefully evaluate their needs and understand the extent of coverage provided to ensure it aligns with their expectations.

In summary, the affordability of Colonial Penn Life Insurance can be attributed to its limited benefit policies, which offer essential coverage at a lower cost. This approach caters to those seeking basic protection without the added complexities and expenses of more comprehensive plans. By understanding the trade-offs involved, individuals can make informed decisions about their insurance needs and find the right balance between affordability and the desired level of coverage.

Botswana Life Insurance: Understanding the Basics

You may want to see also

Frequently asked questions

Colonial Penn offers simplified underwriting, which means they focus on pre-existing medical conditions and age rather than a lengthy medical questionnaire. This streamlined process allows them to provide coverage at competitive rates, especially for individuals with health issues who might be declined by other insurers.

Yes, Colonial Penn's policies typically have lower coverage amounts compared to standard life insurance. They offer term life insurance, which provides coverage for a specific period, and whole life insurance with a limited death benefit. The lower coverage amounts contribute to the affordability of their products.

Colonial Penn primarily targets older adults, especially those over 50, who may face challenges in obtaining traditional life insurance. By focusing on this demographic, they can offer competitive pricing as they cater to a specific market segment.

Yes, like any insurance provider, Colonial Penn has certain exclusions and limitations. For instance, they may not cover pre-existing conditions or certain health issues, and there could be waiting periods for specific benefits. It's essential to review the policy details to understand what is and isn't covered.

Colonial Penn offers various discounts, including a preferred rate for non-smokers and a group discount for those purchasing coverage through a group or association. These discounts can further reduce the cost of their life insurance policies.