Female life insurance is often more affordable than male life insurance due to a variety of factors. One of the primary reasons is that women generally have a longer life expectancy than men, which translates to a lower risk for insurance companies. Additionally, historical trends in life expectancy and health-related statistics have influenced insurance rates, as women have traditionally had lower mortality rates and healthier lifestyles. These factors, combined with the potential impact of biological and social factors on health and longevity, contribute to the lower cost of female life insurance policies.

What You'll Learn

- Women's Longer Life Expectancy: Statistically, women live longer, reducing insurance costs

- Lower Risk of Heart Disease: Women's lower heart disease risk contributes to cheaper premiums

- Fewer Smoking Rates: Non-smokers, often women, pay less for insurance

- Healthier Lifestyle Choices: Women's health-conscious habits can lead to lower insurance rates

- Lower Incidence of Certain Cancers: Reduced risk of specific cancers makes female insurance cheaper

Women's Longer Life Expectancy: Statistically, women live longer, reducing insurance costs

The concept of lower life insurance premiums for women is rooted in the statistical reality that women generally have a longer life expectancy than men. This phenomenon is a significant factor in the insurance industry's pricing structures, leading to more affordable policies for women. The longevity gap between the sexes is a well-documented trend, and it has a direct impact on the financial products and services available to them.

On average, women outlive men by a substantial margin. This is a result of various biological and lifestyle factors, including differences in life expectancy at birth, age-specific mortality rates, and overall health trends. While life expectancy has increased for both genders over the past century, the gains have been more pronounced for women, leading to a wider gap in longevity. This trend is a critical consideration for insurance companies when calculating premiums, as it directly influences the likelihood of payouts and, consequently, the profitability of the policies.

The statistical advantage of women's longer life expectancy is a key driver for the lower costs of female life insurance. Insurance providers use this data to assess risk and determine the likelihood of a policyholder's death. Since women are statistically less likely to die at any given age, especially in older age groups, insurance companies can offer more competitive rates. This is particularly true for term life insurance, where the focus is on providing coverage for a specific period, and the reduced risk translates to lower premiums.

This phenomenon is not just about individual life insurance policies but also has broader implications for the insurance industry. The gender-based pricing of life insurance is a reflection of the industry's overall risk assessment and the historical data it relies on. As a result, women often benefit from more affordable insurance options, which can be a significant financial advantage. This is especially relevant for long-term financial planning, where the accumulation of savings and investments over a longer lifespan can be more advantageous for women.

Understanding the statistical basis for the lower cost of female life insurance is essential for women to make informed financial decisions. It highlights the importance of considering gender-specific trends when evaluating insurance options. While it may seem counterintuitive, the longer life expectancy of women is a positive factor that contributes to more accessible and cost-effective insurance solutions. This knowledge can empower women to take control of their financial future and make choices that align with their unique life expectancies.

Voluntary Life Insurance for Children: What Parents Need to Know

You may want to see also

Lower Risk of Heart Disease: Women's lower heart disease risk contributes to cheaper premiums

The lower incidence of heart disease in women compared to men is a significant factor in the lower cost of life insurance for females. This reduced risk is primarily due to several biological and lifestyle factors that contribute to a healthier cardiovascular system. On average, women have a lower body mass index (BMI) and tend to have less muscle mass, which is associated with a reduced risk of heart-related issues. Additionally, the female body's natural hormonal balance, particularly the presence of estrogen, plays a protective role in maintaining cardiovascular health. Estrogen helps to keep the blood vessels flexible and promotes healthy cholesterol levels, both of which are crucial in preventing heart disease.

Research has shown that women generally have a lower prevalence of risk factors such as high blood pressure, high cholesterol, and obesity, which are major contributors to heart disease. These factors are often more prevalent in men, leading to a higher incidence of cardiovascular events. As a result, insurance providers consider women to be less likely to develop heart-related issues, which directly influences the pricing of their life insurance policies. The lower risk profile of women allows insurance companies to offer more competitive rates, as the likelihood of claiming on a policy is reduced.

Furthermore, lifestyle choices and habits often play a role in this gender-based difference. Women tend to have healthier diets, engage in regular physical activity, and are more likely to seek medical advice and regular check-ups. These factors contribute to a lower risk of heart disease and other health complications, making women a more attractive demographic for insurance companies. The combination of biological advantages and healthier lifestyle choices results in a reduced need for medical interventions and a lower overall cost of healthcare for women, which is reflected in the more affordable life insurance premiums.

It is important to note that while women generally have a lower risk of heart disease, individual health factors and family medical history can still influence insurance rates. However, the overall trend of lower heart disease risk in women is a significant contributor to the more favorable pricing of female life insurance policies. Understanding these factors can help individuals make informed decisions when considering life insurance options and appreciate the unique advantages that come with being a woman in the context of life insurance.

Whole Life Insurance Riders: Understanding the Benefits and Drawbacks

You may want to see also

Fewer Smoking Rates: Non-smokers, often women, pay less for insurance

The concept of lower life insurance premiums for women is often associated with the lower smoking rates among females compared to males. This is a significant factor in the insurance industry, as smoking is a major health risk that can significantly impact an individual's life expectancy and overall health.

Insurance companies have long recognized the correlation between smoking and health risks. Smokers are generally considered higher-risk clients due to the increased likelihood of developing smoking-related illnesses, such as lung cancer, heart disease, and respiratory issues. As a result, insurers often charge higher premiums to smokers to account for the potential long-term costs associated with their lifestyle choices.

When it comes to gender-based insurance rates, women generally benefit from lower premiums, especially in the context of life insurance. This is primarily because women tend to have lower smoking rates than men. Historically, smoking has been more prevalent among men, and this trend has influenced insurance pricing. Women who do not smoke are seen as lower-risk clients, as they are less likely to develop smoking-related health issues, which can lead to reduced insurance costs.

The lower smoking rates among women contribute to a healthier overall profile for female life insurance policyholders. This means that insurance companies can offer more competitive rates to women who do not smoke, as they are statistically less likely to require frequent medical interventions or claim payouts due to smoking-related illnesses. As a result, women who maintain a non-smoking lifestyle can benefit from more affordable life insurance policies, ensuring financial security for themselves and their loved ones.

In summary, the lower smoking rates among women are a key factor in the lower cost of female life insurance. This trend allows women, especially non-smokers, to access more affordable insurance options, providing them with a valuable financial safety net. It is essential for individuals to understand these factors to make informed decisions when purchasing insurance and to recognize the benefits of maintaining a healthy lifestyle.

Life Insurance: When Payments Outweigh Benefits

You may want to see also

Healthier Lifestyle Choices: Women's health-conscious habits can lead to lower insurance rates

Engaging in a healthier lifestyle can significantly impact your life insurance rates, especially for women. This is because adopting health-conscious habits can lead to a reduced risk profile, which is a key factor in determining insurance premiums. Here's how:

- Regular Exercise and Weight Management: Maintaining a healthy weight and engaging in regular physical activity are essential. Obesity is a significant risk factor for various health issues, including heart disease, diabetes, and certain cancers. By keeping your weight in a healthy range and staying active, you can lower your risk of developing these conditions. Insurance companies often offer lower rates to women who actively manage their weight and exercise regularly, as it indicates a reduced likelihood of developing health complications that could lead to higher insurance claims.

- Healthy Diet and Nutrition: A balanced diet rich in fruits, vegetables, whole grains, and lean proteins is crucial. Eating nutritious meals can help prevent chronic diseases and maintain overall well-being. Women who prioritize healthy eating habits are less likely to suffer from conditions like hypertension, high cholesterol, or obesity, which can drive up insurance costs. Insurance providers often recognize the benefits of a healthy diet and may offer more competitive rates to policyholders who maintain a balanced and nutritious lifestyle.

- Regular Health Check-ups and Preventive Care: Scheduling regular health screenings and check-ups is vital for early detection and prevention of potential health issues. Women who actively participate in preventive care, such as mammograms, Pap smears, and regular blood tests, are more likely to catch health problems early. Early detection can lead to more effective treatment and potentially lower insurance premiums. Insurance companies may view these proactive measures as a sign of responsible health management, resulting in more favorable insurance rates.

- Stress Management and Mental Well-being: Chronic stress and mental health issues can have a significant impact on overall health. Women who practice stress management techniques, such as meditation, yoga, or therapy, may experience improved mental and physical well-being. Lower stress levels can reduce the risk of heart disease, anxiety disorders, and other stress-related illnesses. Insurance providers often consider stress management as a positive factor and may offer reduced rates to policyholders who actively work on their mental health and overall stress levels.

By embracing these healthier lifestyle choices, women can not only improve their overall health and well-being but also potentially secure more affordable life insurance coverage. Insurance companies often reward individuals who take a proactive approach to their health, recognizing the long-term benefits of a healthy lifestyle. This can result in lower insurance premiums, making it a win-win situation for both the individual and the insurance provider.

Unraveling the Mystery: Understanding Supplemental Life AD&D Insurance

You may want to see also

Lower Incidence of Certain Cancers: Reduced risk of specific cancers makes female insurance cheaper

The lower incidence of certain cancers among women is a significant factor contributing to the affordability of female life insurance. This is primarily due to the biological differences between men and women, which influence their susceptibility to various diseases. On average, women have a reduced risk of developing specific cancers compared to men, particularly those affecting the reproductive organs and the breast. For instance, the risk of breast cancer is higher in women, with one in eight women in the United States expected to be diagnosed with the disease during their lifetime. However, other cancers, such as lung, colon, and prostate cancer, are more prevalent in men.

The lower risk of certain cancers in women is often associated with hormonal factors. Estrogen, a female sex hormone, is known to promote the growth of some cancers, while testosterone, a male sex hormone, has a different impact. These hormonal differences contribute to the varying rates of cancer incidence between the sexes. Additionally, lifestyle and behavioral factors also play a role. Women tend to have lower rates of smoking, which is a significant risk factor for lung cancer, and they often have different dietary habits and exposure to certain environmental factors.

The reduced risk of specific cancers in women directly influences the insurance industry's calculations for premium rates. Insurance companies consider the likelihood of an individual developing a particular disease when determining the cost of insurance policies. Since women have a lower incidence of certain cancers, the potential financial burden on insurance providers is reduced, allowing them to offer more affordable life insurance policies tailored to women's needs. This is particularly beneficial for women who may be looking for comprehensive coverage without incurring high costs.

Furthermore, the lower incidence of cancers in women can be attributed to biological and genetic factors. Women's bodies may have natural defenses or different cellular structures that make them less susceptible to certain types of cancer. For example, the female reproductive system's unique characteristics might contribute to a reduced risk of cancers associated with these organs. Understanding these biological differences is essential in explaining why female life insurance is often more affordable.

In summary, the lower incidence of specific cancers in women is a critical factor in making female life insurance cheaper. This is a result of biological, hormonal, and lifestyle differences between men and women, which influence their cancer risk profiles. By considering these factors, insurance companies can provide more competitive rates for women's life insurance policies, ensuring that they can access necessary coverage without incurring excessive costs. This aspect of female life insurance highlights the importance of understanding the underlying health trends and their impact on insurance pricing.

Life Insurance: Can You Lose Money on Policies?

You may want to see also

Frequently asked questions

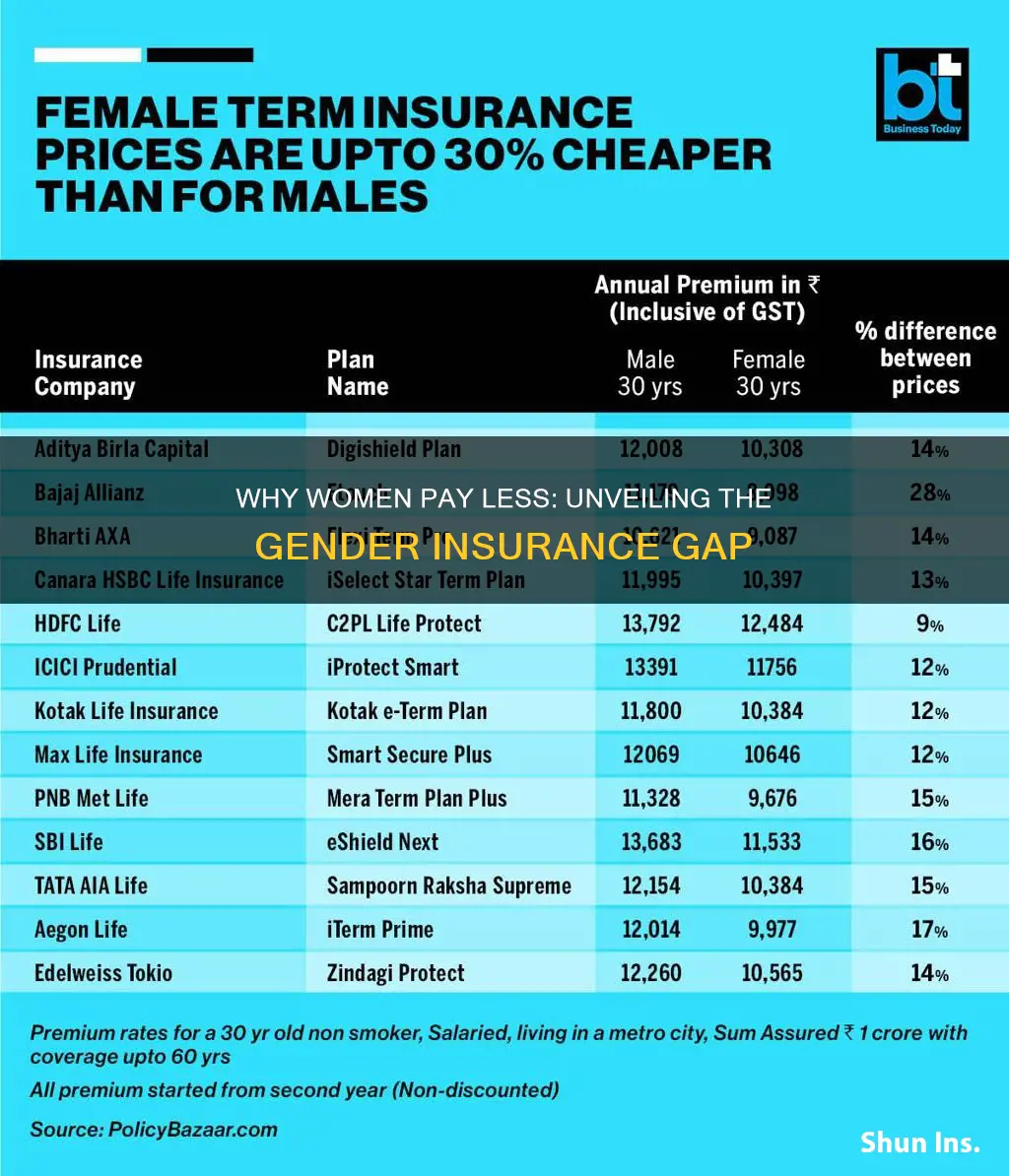

Insurance companies often consider gender-based risk factors when calculating premiums. Historically, women have generally had lower mortality rates and a reduced likelihood of developing certain health conditions, especially those related to smoking and alcohol consumption. This lower risk profile can result in cheaper insurance rates for women.

Yes, age is a significant factor. Younger women tend to have lower insurance premiums because they have more years of life ahead, reducing the potential payout. As women age, especially after the age of 40, the risk of developing health issues increases, which can lead to higher insurance costs.

Certain health conditions and lifestyle choices can impact the price. For instance, women who are non-smokers and maintain a healthy weight may qualify for lower rates. Conversely, pre-existing health conditions like heart disease, diabetes, or certain types of cancer can make insurance more expensive. Additionally, lifestyle factors such as excessive alcohol consumption or a sedentary lifestyle may also affect the premium.

Term life insurance, which provides coverage for a specified period, is often more affordable for women compared to permanent life insurance. The latter offers lifelong coverage and includes a savings component, making it more expensive. The choice of policy depends on individual needs and financial goals.

Pregnancy and childbirth-related complications can influence insurance rates. During pregnancy, some women may experience health issues that could affect their insurance eligibility or increase premiums. Additionally, after childbirth, especially with multiple pregnancies, the risk of certain health conditions may be reassessed, potentially impacting the cost of insurance.