Insurance is a way of managing risks and protecting yourself financially. When you buy insurance, you're buying a promise that you'll be supported if something unexpected happens. Accidents and disasters can be costly, and insurance helps to cover these expenses. It's a way to protect your life, health, ability to earn an income, and your property.

There are many types of insurance available, from health and life insurance to auto and home insurance. Each type of insurance provides essential coverage for different aspects of your life. For example, health insurance covers medical costs, while life insurance provides for your family or covers your debts after your death.

Insurance is also necessary for businesses to protect themselves financially and ensure their survival in the face of unforeseen events. It helps cover the costs associated with property damage, liability claims, and employee injuries or illnesses.

In some cases, insurance is compulsory, such as auto insurance in certain states. Additionally, lenders often require insurance as a condition for providing funding.

Overall, insurance provides peace of mind and helps to secure your future goals by mitigating risks and providing financial protection.

| Characteristics | Values |

|---|---|

| Peace of mind | Insurance provides peace of mind by acting as a safety net for when things go wrong. |

| Financial protection | Insurance protects against financial losses due to accidents, disasters, repairs, healthcare costs, legal expenses, etc. |

| Stability | Life insurance ensures family stability by providing financial support in the event of a death. |

| Business continuity | Insurance helps businesses recover from property damage, liability claims, and other unforeseen events, enabling them to continue operations. |

| Compliance | In some states, certain types of insurance are compulsory, such as auto insurance and workers' compensation insurance. |

| Commerce | Insurance keeps commerce moving by providing coverage for businesses, allowing them to secure funding and operate in risky environments. |

| Risk management | Insurance helps individuals and businesses manage risks by transferring the cost of potential losses to the insurance company. |

What You'll Learn

Protects your family's financial needs

Life insurance is a crucial step in ensuring your family's financial security. It is designed to protect your loved ones when you're no longer around to provide for them. If you're responsible for the financial well-being of your family, life insurance can be a smart way to ensure their future. Here are some ways in which insurance protects your family's financial needs:

Financial Security

Life insurance can provide peace of mind that your family will be financially secure upon your passing. The death benefit can assist with mortgage payments, care of disabled family members, and basic needs like food and childcare. It can enable your loved ones to maintain their current standard of living without worrying about the loss of income.

Coverage for Final Expenses

The costs of final expenses, such as caskets and burial plots, can amount to thousands of dollars. Life insurance can help cover these expenses, ensuring your family isn't burdened with these costs after your passing.

Medical Bills Coverage

Life insurance can also help your loved ones pay for any outstanding medical bills that may have accumulated before your death. This can be especially helpful if you pass away due to a health-related issue that incurred substantial medical expenses.

Cash Value Component

Some life insurance policies, like whole life insurance, have a cash value component. This allows you to build up cash value over time by paying your premiums. Once you've accumulated enough cash value, you can borrow against it to fund things like a down payment on a home, school tuition, or investing in a business. This can be beneficial while you're still alive and provide financial flexibility for your family.

Education Expenses

The death benefit from life insurance can also be used to pay for your children's college education. This ensures that your children's education is not interrupted or hindered due to financial constraints after your passing.

Maintaining Lifestyle

If your family relies on your income for their daily needs and expenses, life insurance can help replace the loss of your income. It can provide the financial means for your family to maintain their current lifestyle, including paying monthly bills and day-to-day expenses.

In summary, life insurance is a vital tool to protect your family's financial future. It ensures that your loved ones have the resources they need to continue their lives with financial stability, even after your death. By considering the different types of insurance policies and their benefits, you can make an informed decision to safeguard your family's economic well-being.

Billing Insurance for Interpreter Services: A Comprehensive Guide

You may want to see also

Peace of mind

For business owners, insurance can act as a safety net, covering unexpected costs resulting from events such as fires, natural disasters, or legal disputes. It enables them to focus on growth and innovation instead of worrying about potential crises. The predictability of insurance premiums in an unpredictable world also eases the burden of uncertainty. Business insurance can also help cover legal bills, protecting the business's reputation, finances, and future.

Personal insurance, including health, life, auto, and home insurance, offers similar benefits by safeguarding individuals and families from financial hardships caused by unexpected events. Health insurance ensures access to quality healthcare without the fear of excessive medical bills, promoting overall well-being. Life insurance provides financial security for loved ones in the event of the policyholder's passing, ensuring they are taken care of. Auto and home insurance protect against accidents, theft, and property damage, covering repair or replacement costs.

Insurance is not just about financial protection; it's about having peace of mind. It addresses a deep psychological need by reducing stress, anxiety, and uncertainty. Research has shown that having health insurance may lower stress and cortisol levels, leading to a 30% reduction in depression among individuals in one study. It also improves sleep quality, as insured individuals experience longer sleep durations due to reduced anxiety.

Insurance has evolved from communal agreements, where communities would help each other in times of need, to the corporatized structure we know today. However, the essence of insurance remains the same: protecting ourselves, our loved ones, and our businesses from risks. By obtaining insurance, we gain the confidence that we are prepared for unpredictable events, fostering a sense of tranquility and peace of mind.

Understanding the Criteria: Unlocking Short-Term Insurance Eligibility

You may want to see also

Protects your assets

Insurance is a way of managing risks. When you buy insurance, you transfer the cost of a potential loss to the insurance company in exchange for a fee, known as the premium. There are two basic types of insurance: liability insurance and property insurance.

Insurance is a way to protect your assets. There are many different types of insurance to protect your assets, but asset commercial property insurance is one of the most important. This insurance protects your property from damage or theft and can help you replace lost or damaged items.

Your personal assets include the physical items, real estate, as well as any financial and investment accounts that you own. These assets are considered your wealth and make up your net worth. For some, these assets can be quite extensive.

Unfortunately, all of this wealth could be at risk if you are not adequately protected with the right personal umbrella insurance. Most people, even those with a higher net worth, falsely believe their assets are protected under their other personal insurance policies, only to find out too late that they are not.

Umbrella insurance is an insurance policy that covers any gaps in your homeowners or auto policies that could leave your assets vulnerable and subject to seizure. It also provides additional liability protection in the event you are sued and the liability coverage of your other policies is exhausted.

Instead of being forced to turn over assets if you are held responsible for damages, personal umbrella insurance protects these assets up to the amount of coverage you purchase.

Even if your only asset is your home, this type of policy can prevent you from losing it in a liability lawsuit. Those with more substantial assets may be especially at risk. Today, people are often more willing to file lawsuits against those they view as being wealthy and better able to afford to pay for damages.

Therefore, it is recommended that anyone who has wealth to be protected obtain enough personal umbrella insurance to cover all assets to prevent the possibility of asset seizure. These supplemental policies are generally written to provide between $1 million and $5 million in coverage and can be purchased from most agencies that write homeowners and auto insurance.

Whether your assets consist of real estate, investment accounts, or even expensive antique jewelry, you don't want them seized to pay for a judgment in a liability suit if your personal insurance coverage is insufficient. Protect your wealth by purchasing umbrella insurance to cover your assets beyond the coverage provided by other policies.

Policybazaar's Term Insurance: A Safe Bet for Long-Term Financial Security?

You may want to see also

It's compulsory in some states

Insurance is compulsory in some states, and this is an important reason why insurance is necessary. In the US, auto insurance is compulsory in most states, with laws requiring a minimum level of liability insurance. This is because few people could afford the costs associated with collisions and injuries without coverage. Auto insurance helps to cover the risk of financial liability or the loss of a motor vehicle, ensuring drivers can cover the cost of damage to other people or property in the event of an accident.

Compulsory insurance is any insurance coverage required by state law before an individual or business can engage in certain activities. It is designed to ensure that all parties are covered or financially responsible in the event they are adversely affected by an incident included in the policy and cause injury or damage to a third party.

Each state decides the types of insurance that are compulsory and the minimum coverage required. While auto insurance is the most well-known type of compulsory insurance, other types include workers' compensation insurance and professional liability insurance for specific occupations, such as doctors and lawyers.

In addition to protecting third parties, compulsory insurance also provides benefits to the policyholder. For example, in the case of auto insurance, it can cover the cost of repairs, health care, and legal expenses associated with a collision. Compulsory insurance, therefore, helps to keep premiums low by mitigating the risk of life on the road.

The importance of compulsory insurance extends beyond financial protection. In the case of workers' compensation insurance, it ensures that employers can cover medical costs, lost wages, and death benefits for employees who are injured, fall ill, or die due to job-related reasons. This type of insurance provides stability for both the employee and their family, as well as the business.

Retiree Guide: Navigating GIC Insurance Changes

You may want to see also

Protects your business

Accidents can happen at any time, and insurance is necessary to protect your business from financial ruin. Business insurance helps you cover the costs associated with property damage, legal claims and employee injuries or illnesses. Without insurance, you may have to pay out of pocket for costly damages and lawsuits, which could be financially devastating.

There are various types of business insurance to consider, depending on your business's specific needs. Here are some common types of business insurance:

- Commercial property insurance: This helps protect the physical location of your business and its assets in the event of damage or loss.

- General liability insurance: This covers the costs of liability claims made against your business, such as a customer injury on your property.

- Business income insurance: This replaces lost income when your business can't operate due to a covered loss, helping you pay bills and payroll.

- Data breach insurance: This protects your business and customers in the event of a security breach.

- Workers' compensation insurance: This provides financial support to employees who are unable to work due to a job-related injury or illness, and it's required in most states.

- Unemployment insurance: This provides benefits to workers who lose their jobs through no fault of their own.

- Disability insurance: This insurance varies by state but can provide benefits to employees with disabilities.

- Professional liability insurance: Also known as errors and omissions insurance, this covers legal costs if your business is sued for making mistakes or providing inadequate services.

- Employment practices liability insurance: This protects your business from employee lawsuits or complaints regarding workplace harassment, wrongful termination, timesheet discrepancies, and more.

By having the appropriate insurance coverage, you can protect your business, your employees, and your customers. It's a safeguard against the unpredictable, helping you manage risks and providing peace of mind.

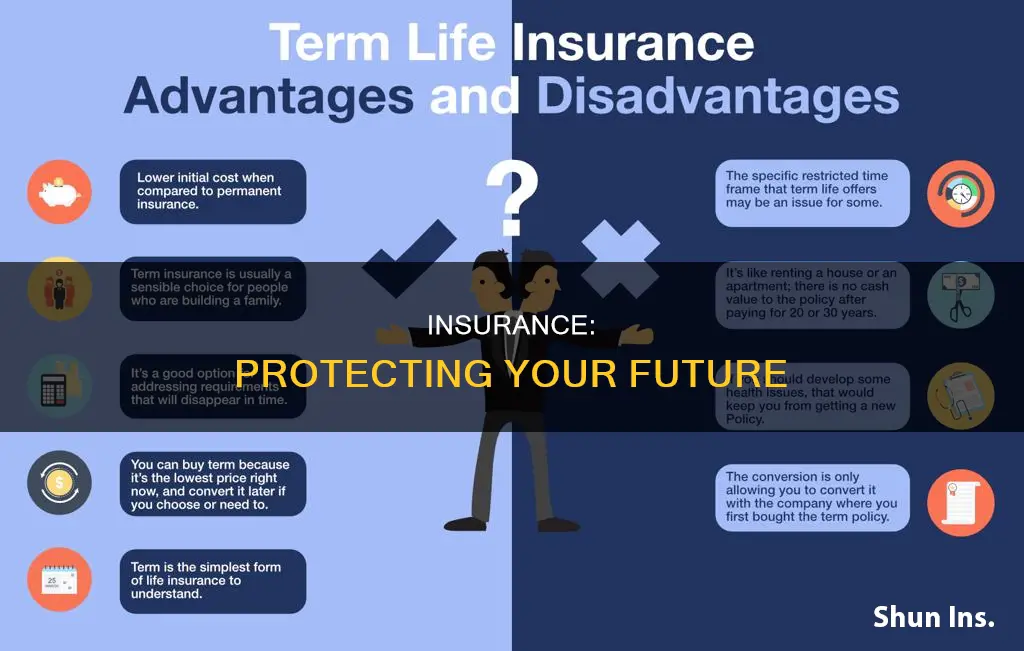

Understanding the Fundamentals: Is Insurance Term or Permanent?

You may want to see also

Frequently asked questions

Accidents and disasters can happen at any time, and the financial burden of dealing with them can be overwhelming. Insurance provides peace of mind and helps you manage risks by transferring the cost of potential losses to the insurance company. It ensures that you are financially protected and can maintain your standard of living during unexpected events.

While it is commendable to be conscious of your health, especially when you are young, unforeseen circumstances can arise at any time. Having health insurance ensures that you are covered in the event of an unexpected illness or injury. It also helps cover the costs of prescription drugs, dental care, and vision care, and other health-related expenses.

Insurance is not just about protecting your valuable possessions. It also provides liability coverage in case someone is accidentally injured on your property. Additionally, if you own a vehicle, insurance is necessary to protect you financially in the event of collisions, injuries, repairs, or vehicle theft.