Life insurance for smokers is often more expensive due to the increased health risks associated with smoking. Smokers are generally considered higher-risk clients for insurance companies because they have a higher likelihood of developing smoking-related health issues, such as lung cancer, heart disease, and respiratory problems. These health risks can lead to higher insurance premiums as the insurance company needs to account for the potential costs of paying out claims. Additionally, the habit can impact longevity, and insurance companies often use age and smoking status as key factors in determining the cost of a policy. Understanding these factors can help individuals make informed decisions about their insurance coverage and explore options that provide adequate protection at a manageable cost.

| Characteristics | Values |

|---|---|

| Smoking Status | Smoker |

| Health Risks | Increased risk of heart disease, lung cancer, and other smoking-related illnesses |

| Life Expectancy | Lower compared to non-smokers |

| Insurance Rates | Higher premiums due to higher health risks |

| Medical History | Pre-existing smoking-related conditions may impact eligibility and rates |

| Age | Younger smokers may face higher rates due to longer exposure to health risks |

| Duration of Smoking | Longer smoking history can lead to more severe health issues and higher insurance costs |

| Income and Lifestyle | Higher income smokers might have access to better healthcare, but smoking itself remains a significant factor |

| Gender | Some studies suggest higher smoking rates among men, potentially influencing insurance rates |

| Geographic Location | Regional variations in smoking prevalence and healthcare costs may affect insurance pricing |

What You'll Learn

- Health Risks: Smoking increases health risks, leading to higher insurance premiums

- Longevity: Smokers tend to have shorter life expectancies, impacting insurance costs

- Medical History: Pre-existing conditions from smoking drive up insurance rates

- Claim Frequency: Higher claim rates for smokers result in more expensive policies

- Risk Assessment: Insurance companies assess smoking habits as a significant risk factor

Health Risks: Smoking increases health risks, leading to higher insurance premiums

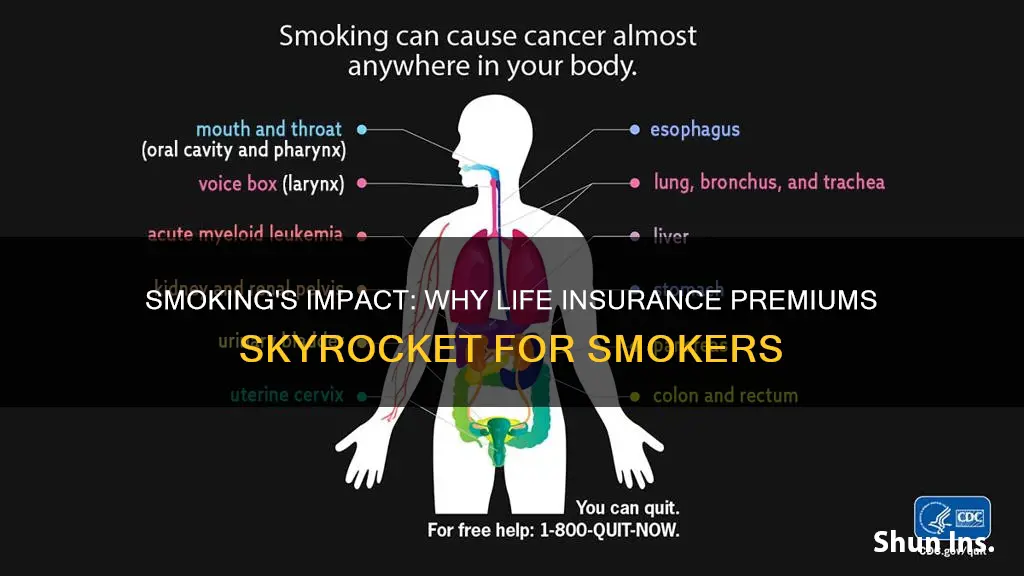

Smoking is a well-known health hazard, and its impact on life insurance premiums is a direct consequence of the increased health risks associated with this habit. When an individual takes out a life insurance policy, the insurer assesses the risk of the insured person's death or the likelihood of developing a critical illness. Smokers are considered high-risk individuals due to the numerous health complications linked to their habit.

The primary reason for the higher insurance costs is the significantly increased risk of various diseases. Smoking is a major risk factor for numerous health issues, including cardiovascular disease, lung cancer, and chronic obstructive pulmonary disease (COPD). These conditions can lead to premature death, and the likelihood of developing them is much higher among smokers. Insurers are aware that smokers have a reduced life expectancy and are more prone to critical illnesses, which directly translates to higher insurance premiums.

The health risks associated with smoking are extensive and can be life-threatening. Smokers are more susceptible to respiratory infections, and their bodies may struggle to heal wounds, making them more vulnerable to complications. Moreover, smoking accelerates the aging process, leading to a higher incidence of age-related diseases. This accelerated aging process is a significant concern for insurers, as it directly impacts the insured's longevity and overall health.

In addition to the immediate health risks, smoking also contributes to long-term health complications. Over time, smokers may experience reduced lung function, increased risk of stroke, and a higher chance of developing type 2 diabetes. These chronic conditions can significantly impact an individual's quality of life and life expectancy, making them a high-risk category for life insurance. As a result, insurers often charge higher premiums to account for the potential medical expenses and the increased likelihood of claiming a payout.

In summary, the higher life insurance premiums for smokers are a direct reflection of the elevated health risks they pose. Insurers must consider the potential financial burden of covering medical expenses related to smoking-related illnesses. By understanding these health risks, individuals can make informed decisions about their lifestyle choices and potentially secure more affordable insurance coverage.

Whole Life and Term Insurance: Can You Have Both?

You may want to see also

Longevity: Smokers tend to have shorter life expectancies, impacting insurance costs

Smoking significantly reduces life expectancy, and this is a critical factor in the higher costs of life insurance for smokers. Research consistently shows that smokers have a higher risk of premature death compared to non-smokers. The harmful chemicals in cigarettes, such as nicotine and tar, damage the body's vital organs, including the heart and lungs. This damage accelerates the aging process and increases the likelihood of developing severe health conditions at a younger age. As a result, insurance companies perceive smokers as higher-risk clients, which justifies the higher premiums they charge.

The impact of smoking on life expectancy is profound. Studies have shown that smokers can expect to live, on average, 10 years less than non-smokers. This reduced life expectancy directly translates to higher insurance costs because the insurance company has to account for the higher likelihood of paying out claims on smokers. The risk assessment is based on statistical data, which shows that smokers are more prone to various health issues, including cardiovascular diseases, lung cancer, and respiratory problems. These conditions often lead to an earlier demise, making smokers statistically more expensive to insure.

The financial implications of this are clear. Insurance companies calculate their premiums based on the expected cost of providing coverage. With smokers having a higher risk profile, the anticipated costs of medical treatments and payouts increase. As a result, insurers charge higher premiums to smokers to cover these potential expenses. This is especially true for term life insurance, where the higher risk is more pronounced due to the fixed coverage period.

Understanding this relationship is essential for smokers considering life insurance. While it may seem unfair, the reality is that smoking habits significantly influence insurance rates. Smokers need to be aware of this and may want to consider quitting to potentially lower their insurance costs. However, it's important to note that even after quitting, the impact on life expectancy and insurance rates may take time to fully reflect, as the body needs to heal and recover from the damage caused by smoking.

Term Life Insurance: Primary Policy Basics

You may want to see also

Medical History: Pre-existing conditions from smoking drive up insurance rates

The higher cost of life insurance for smokers is primarily attributed to the increased health risks associated with their lifestyle. When an individual takes up smoking, they are more likely to develop a range of health issues, many of which can be severe and life-threatening. These health risks are a significant concern for insurance companies, as they directly impact the likelihood and severity of future claims.

Smoking is a well-known risk factor for numerous medical conditions, including cardiovascular disease, lung cancer, and chronic obstructive pulmonary disease (COPD). The harmful chemicals in cigarettes can lead to inflammation and damage to the blood vessels, increasing the chances of heart attacks and strokes. Moreover, the toxins in cigarette smoke can cause mutations in cells, leading to cancerous growths, particularly in the lungs. The risk of developing these conditions is significantly higher for smokers compared to non-smokers, and the progression of these diseases can be rapid and severe.

From a medical history perspective, the presence of pre-existing conditions related to smoking has a direct impact on insurance rates. Insurance companies assess the risk of insuring an individual by considering their medical history, including any existing health issues and lifestyle factors. For smokers, the medical history often reveals a pattern of health complications that are associated with a higher risk of mortality and morbidity. This includes a history of respiratory infections, frequent respiratory issues, and an increased likelihood of developing chronic diseases at a younger age.

The insurance industry's pricing models take into account the statistical likelihood of an individual's death or illness. Given the higher risk profile of smokers, insurance companies must charge more to cover the potential financial losses they may incur. This is because the likelihood of making payouts is significantly increased due to the higher prevalence of smoking-related illnesses. As a result, smokers are often categorized as high-risk individuals, and their life insurance premiums are adjusted accordingly.

In summary, the expensive nature of life insurance for smokers is a direct consequence of the increased health risks and pre-existing conditions associated with their smoking habit. Insurance companies must account for the higher likelihood of claims and the potential long-term costs associated with smoking-related illnesses. Understanding these factors is essential for individuals to make informed decisions about their insurance coverage and to take steps to improve their health and potentially lower their insurance premiums.

Term Life Insurance: Taxable Benefits and Their Implications

You may want to see also

Claim Frequency: Higher claim rates for smokers result in more expensive policies

Smoking significantly impacts life insurance rates, and one of the primary reasons is the higher claim frequency associated with smokers. When an individual takes out a life insurance policy, the insurer evaluates various factors to determine the premium. One of the critical aspects is the likelihood of a claim being made, which is directly linked to the policyholder's health and lifestyle choices. Smokers are considered high-risk individuals for several reasons. Firstly, smoking tobacco is a major risk factor for various health issues, including lung cancer, heart disease, and respiratory problems. These health conditions often lead to premature death, making smokers more susceptible to claiming on their life insurance policies. As a result, insurance companies have to account for the higher probability of payouts, which directly influences the cost of the policy.

The claim frequency for smokers is notably higher compared to non-smokers. Insurance providers analyze historical data and statistical models to predict the likelihood of claims. Research consistently shows that smokers have a shorter life expectancy and a higher incidence of critical illnesses, which translates to more frequent and costly claims. This higher claim rate is a major factor in the increased cost of life insurance for smokers. Insurers must consider the potential financial burden of paying out claims, especially when the policyholder's life is at a higher risk due to smoking.

The impact of smoking on claim frequency is twofold. Firstly, smokers are more prone to developing critical illnesses that can lead to a claim. Conditions like lung cancer, emphysema, and heart disease are more common in smokers, and these illnesses often require extensive medical treatment, hospitalization, and, in some cases, long-term care. Secondly, the premature death of a smoker due to smoking-related causes results in an immediate claim, further increasing the claim frequency. This higher frequency of claims directly contributes to the higher premiums that smokers have to pay for life insurance.

Insurance companies often use smoking status as a significant factor in risk assessment. The data consistently shows that smokers have a higher risk profile, and this is reflected in the pricing of their life insurance policies. By considering the claim frequency and the associated costs, insurers can accurately predict the potential financial losses they may incur from paying out claims to smokers. As a result, they adjust the premiums accordingly to ensure the sustainability of the insurance business.

In summary, the higher claim rates for smokers are a critical factor in making life insurance more expensive for this demographic. The increased likelihood of critical illnesses and premature death due to smoking contributes to a higher frequency of claims, which, in turn, influences the overall cost of the policy. Understanding this relationship is essential for smokers who want to secure affordable life insurance coverage, as it highlights the importance of lifestyle choices in managing insurance premiums.

Life Insurance After Military Service: What's Covered?

You may want to see also

Risk Assessment: Insurance companies assess smoking habits as a significant risk factor

Insurance companies face a complex challenge when it comes to pricing life insurance for smokers, and their risk assessment process is a critical component of this. The primary concern is the increased likelihood of health issues and premature death associated with smoking, which directly impacts the insurer's financial obligations. When assessing the risk of insuring a smoker, several key factors come into play. Firstly, the duration and intensity of smoking habits are crucial. Long-term smokers, especially those with a high daily cigarette consumption, are considered higher-risk individuals. This is because the cumulative effects of smoking over an extended period can lead to severe health complications, including lung cancer, heart disease, and respiratory issues. As such, insurers often request detailed information about an applicant's smoking history, including the number of cigarettes smoked daily, the duration of the habit, and any attempts to quit.

The age at which an individual starts smoking also plays a significant role in risk assessment. Younger smokers may have a longer period of exposure to the harmful effects of tobacco, increasing the chances of developing smoking-related diseases later in life. Additionally, the presence of other health conditions or lifestyle factors can further elevate the risk. For instance, a smoker with a history of heavy drinking or an unhealthy diet may face a higher risk profile, as these factors can exacerbate the negative health impacts of smoking.

Insurance companies employ various tools and methodologies to quantify these risks accurately. They may use statistical models that consider age, smoking duration, and pack-years (the total number of cigarettes smoked over a lifetime) to predict the likelihood of developing smoking-related illnesses. These models help insurers set appropriate premium rates for life insurance policies tailored to smokers. By understanding the risks associated with smoking, insurers can make informed decisions regarding coverage options and pricing, ensuring that the financial obligations are managed effectively while providing a safety net for policyholders and their beneficiaries.

Moreover, the risk assessment process allows insurers to offer customized solutions. For instance, non-smokers may be provided with more competitive rates, while smokers might be encouraged to quit or offered incentives to do so. Some insurers even provide temporary coverage with the option to upgrade to a more comprehensive policy once the smoker's health improves. This approach not only benefits the insurer by reducing potential payouts but also empowers smokers to take control of their health and potentially secure better insurance terms in the future.

In summary, insurance companies' risk assessment of smoking habits is a meticulous process that considers various factors to determine the likelihood of health issues and premature death. This assessment is essential for setting appropriate premiums and providing tailored coverage options. By understanding the risks associated with smoking, insurers can offer life insurance policies that are both financially viable and supportive of policyholders' well-being.

Life Insurance Commissions: Low Rates, High Impact?

You may want to see also

Frequently asked questions

Smoking significantly increases the risk of developing health issues that can lead to early death, making smokers statistically more likely to file a claim. Insurance companies often charge higher premiums to account for this increased risk.

The harmful chemicals in cigarettes can cause various health problems, including lung cancer, heart disease, and respiratory issues. These health risks are higher for smokers, which is why insurance providers consider smoking habits when determining insurance costs.

Yes, quitting smoking can be one of the best decisions a person can make to improve their health and potentially lower life insurance premiums. Insurance companies often offer incentives and lower rates to non-smokers and ex-smokers who have been smoke-free for a certain period.

No, the pricing can vary depending on the insurance provider and the specific policy. Some companies may offer more competitive rates for smokers who are taking steps to quit, while others might have different pricing structures based on factors like age, health, and the amount of coverage desired.

Yes, some insurance companies offer specialized policies tailored to smokers, which may provide coverage at a higher premium but with more flexible terms. Additionally, term life insurance, which offers coverage for a specific period, can be a more affordable option for smokers who want temporary coverage.