Life Insurance Corporation of India (LIC) is one of the most trusted and leading insurance companies in India, with a customer base of over 250 million. LIC offers a wide range of life insurance products, including retirement plans, endowment plans, term plans, and ULIP plans, as well as plans for children and money-back plans. The company has a strong background as an Indian statutory insurance and investment corporation, undertaken by the Ministry of Finance, Government of India, and has been in force since 1956. LIC's insurance plans are designed to be dynamic and flexible, keeping in mind the needs of the consumers, and offering financial protection for individuals and their families. The company has a high claim settlement ratio of 98.2%, indicating its reliability in settling claims. LIC also provides survival benefits, death benefits, and loan facilities, making it a top choice for life insurance in India.

What You'll Learn

LIC has a strong background and is a trusted brand

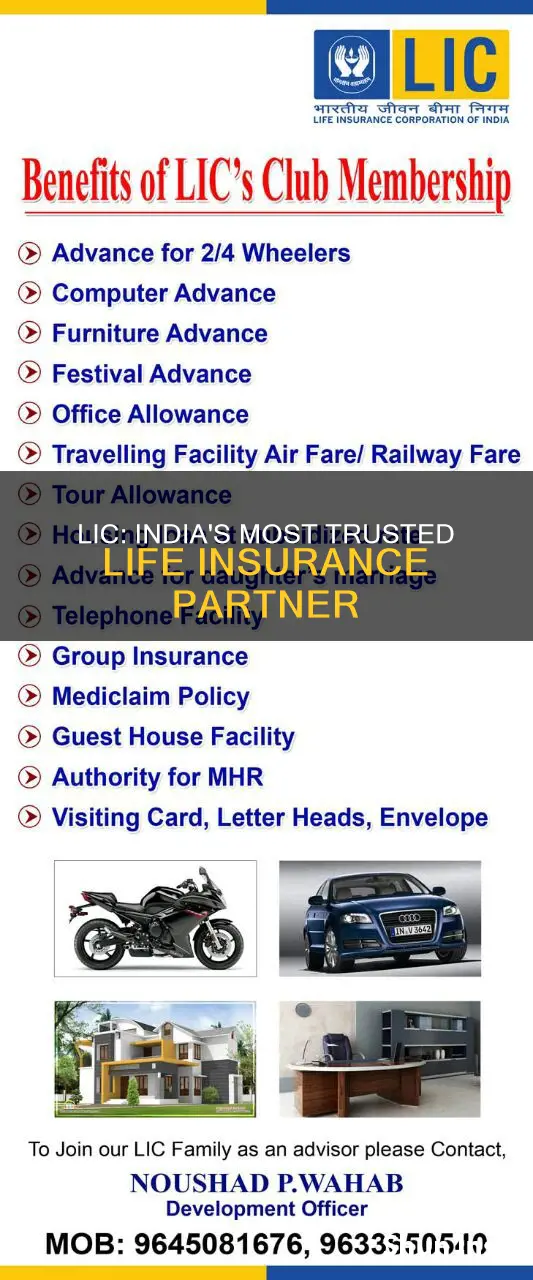

LIC (Life Insurance Corporation of India) is a trusted brand with a strong background. It is an Indian statutory insurance and investment corporation that is undertaken by the Ministry of Finance, Government of India. LIC was founded in 1956 to strengthen the life insurance segment in India. Over 245 insurance companies and provident societies were merged to create it. LIC has been serving its customers faithfully ever since, fulfilling each requirement and building a customer base of over 250 million in India.

LIC offers a wide range of life insurance products, including retirement plans, endowment plans, term plans, ULIP plans, plans for children, and money-back plans, with lots of variants to cater to the varied needs of every individual. LIC's insurance plans are policies that cater to individuals and give them the most suitable options to fit their requirements. LIC's plans are dynamic and flexible and are designed in a customer-friendly manner, keeping in mind the needs of the consumers. LIC has kept its promise, ,“Zindagi Ke Saath Bhi, Zindagi Ke Baad Bhi”, which means LIC is always with you 'in life' and 'after life'.

LIC's plans offer financial protection and safeguard you and your family, even in your absence. LIC's top plans include LIC Jeevan Umang, LIC Jeevan Amar, and LIC Jeevan Anand Plan. LIC Jeevan Umang is the only whole-life plan LIC is offering at present. This is a 100-year plan that provides guaranteed survival benefits and thus offers a combination of income and protection to you and your family. LIC Jeevan Amar is a pure term plan that provides the required financial assistance to the family in case of the insured’s demise. LIC Jeevan Anand Plan is a non-linked and participating policy that provides an exclusive mixture of savings and financial protection. It is the highest-selling LIC insurance policy due to its numerous advantages, including coverage for risk even after maturity.

LIC has an impressive claim settlement ratio of 98.2% (98.52% in FY22-23), making it one of the most trusted insurers in the country. During the Fiscal Year 2022-2023, LIC successfully settled claims totaling Rs. 18,398 Crores, showcasing its strong financial position and dedication to meeting policyholder obligations. LIC also maintained an impressive solvency ratio of 187% in the same year, indicating its excellent financial health and ability to pay possible liabilities.

Life Insurance and Alfac: What You Need to Know

You may want to see also

LIC offers a wide range of life insurance products

One of the key strengths of LIC is its ability to tailor its insurance plans to the unique needs of individuals. The company offers flexible and dynamic plans, recognising that each person has different insurance requirements. LIC's insurance plans are designed to be customer-friendly, providing financial protection and security for individuals and their families in the face of life's uncertainties.

LIC's product portfolio includes the LIC Jeevan Umang plan, which is a unique 100-year plan offering a combination of income and protection. This plan provides guaranteed survival benefits, ensuring financial support for the policyholder's family. The LIC Jeevan Amar plan, launched in 2019, is another notable offering—a pure term plan that provides financial assistance to the policyholder's family in the event of their demise.

The LIC Jeevan Anand Plan is a popular choice among customers, known for its combination of savings and financial protection benefits. This plan offers coverage for risk even after maturity and includes a bonus facility. LIC also offers pension plans designed specifically for the elderly, as well as various scholarship programs that go beyond traditional insurance offerings.

Additionally, LIC provides a range of investment funds and insurance coverage during the policy term. The company's New Children Money Back Plan is tailored to support children's financial needs, with payouts at key milestones. LIC also offers plans with health insurance cover, providing protection against specified health risks and coverage for hospitalisation and surgery costs.

Retired Teachers: Life Insurance Options and Benefits

You may want to see also

LIC has a high claim settlement ratio

When it comes to life insurance, the Life Insurance Corporation of India (LIC) is one of the best and most trusted providers in the country. LIC has been providing financial security to millions of Indians for over six decades, and its high claim settlement ratio is a testament to its reliability and efficiency.

LIC's claim settlement ratio (CSR) is a key performance indicator that measures the percentage of claims the company has settled in a given year. A high CSR is indicative of an insurer's commitment to fulfilling its promises and providing assurance to policyholders. LIC has consistently maintained a high CSR, which demonstrates its dedication to its policyholders.

In the fiscal year 2022-23, LIC's CSR was 98.52%, settling most of the claims it received. This percentage is slightly lower than the previous fiscal year's 98.84%, but it still reflects LIC's strong position and commitment to meeting its obligations. During this period, LIC settled claims totalling Rs. 18,398 Crores, showcasing its financial stability and ability to honour policyholder claims.

LIC's high CSR can be attributed to its efficient claims settlement process and deep understanding of its customers' needs. The company offers a range of life insurance plans, including term plans, investment plans, and money-back policies, providing tailored solutions to meet the diverse needs of its policyholders. LIC's long-standing presence in the insurance sector has allowed it to build trust and reliability, making it a preferred choice for individuals seeking financial security for themselves and their loved ones.

LIC's high claim settlement ratio is a crucial factor in choosing a life insurance provider. It ensures peace of mind and guarantees that LIC will be there to support its policyholders and their beneficiaries in times of need. LIC's impressive performance in settling claims reinforces its position as a leading and trusted life insurance provider in India.

Life Insurance: Bequests and Your Legacy

You may want to see also

LIC provides financial protection and safeguards for families

LIC (Life Insurance Corporation of India) is a trusted and leading insurance company in India, with a wide range of life insurance products. LIC's policies are designed to be flexible and dynamic, catering to the unique needs of its customers.

LIC provides comprehensive financial protection and safeguards for families in several ways. Firstly, LIC offers a range of life insurance plans, including term plans, retirement plans, endowment plans, and ULIP plans. These plans provide financial assistance to the insured person's family in the event of their untimely demise. The LIC Jeevan Amar plan, for instance, is a pure term plan that offers financial support to the family, helping them maintain a stable and secure life.

Secondly, LIC's policies often come with survival benefits, providing a lump sum amount to the policyholder if they survive the entire premium payment tenure. This feature ensures financial security for the family, even if the primary breadwinner passes away unexpectedly. The LIC Jeevan Umang plan is a notable example, offering a combination of income and protection for the insured and their family.

Thirdly, LIC also provides investment options within its insurance plans, allowing policyholders to build a financial cushion for their families. The New Children Money Back Plan is one such example, where LIC pays the basic sum assured when the insured child reaches certain milestones, such as 18, 20, and 22 years of age. This plan helps families secure their children's future financially.

Furthermore, LIC offers additional riders to enhance the financial protection provided to families. These include the Accidental Death and Disability Rider, the New Term Assurance Rider, and the Critical Illness Rider. These riders provide extra coverage in case of accidental death, critical illnesses, or other unforeseen events, ensuring that families have the financial resources they need during difficult times.

Lastly, LIC's strong financial position and high claim settlement ratio of around 98% inspire confidence in its ability to safeguard families financially. During the Fiscal Year 2022-2023, LIC settled claims totaling Rs. 18,398 Crores, demonstrating its commitment to meeting policyholders' obligations. LIC's impressive solvency ratio of 187% in the same year further highlights its financial stability and ability to pay potential liabilities.

Understanding Tax Implications of Life Insurance Payouts

You may want to see also

LIC offers flexible and dynamic plans

LIC offers a wide range of flexible and dynamic plans that cater to the diverse needs of its customers. LIC's plans are designed to provide financial protection and security to individuals and their families, even in unforeseen circumstances. Here are some key features that make LIC's plans flexible and dynamic:

Customisable Coverage: LIC understands that each individual has unique insurance needs. Their plans offer customisable coverage options to suit varying requirements. For example, the LIC Jeevan Amar Plan has two categories: Smoker and Non-Smoker, with premium amounts determined by medical test results. Similarly, the LIC Jeevan Umang plan, a 100-year whole-life plan, offers a minimum sum assured of INR 2 lakh and has no limit on the maximum sum assured, allowing policyholders to choose a sum that fits their needs.

Flexible Payment Options: LIC provides flexible premium payment options, allowing policyholders to choose a payment method that aligns with their financial situation. LIC's plans offer the convenience of paying premiums in instalments or as a lump sum at the outset of the policy. This flexibility ensures that customers can maintain their policies without financial strain.

Riders and Add-ons: LIC offers a range of riders and add-ons that can be attached to the base plan, providing additional benefits and customisation. These riders include the LIC Accidental Death and Disability Rider, the LIC Accidental Rider, the LIC New Term Assurance Rider, the LIC New Critical Illness Rider, and the LIC Premium Waiver Benefit. These riders enhance the coverage of the base plan, providing extra protection in case of unforeseen events, such as critical illness or accidental death.

Online and Offline Purchase: LIC makes it convenient for customers to purchase or invest in their plans through both online and offline channels. This flexibility allows customers to choose the mode of purchase that is most accessible and convenient for them.

Loan Facility: LIC's plans often include a loan facility, allowing policyholders to avail loans against their policies. This feature provides financial flexibility and support to customers, especially in times of unexpected financial needs.

Tax Benefits: LIC's insurance plans offer tax advantages under the Income Tax Act. Policyholders can claim up to INR 1.5 lakh annually under Section 80C, helping individuals save money and providing an additional financial incentive to invest in LIC's plans.

LIC's flexible and dynamic plans demonstrate their commitment to meeting the diverse needs of their customers. By offering customisable coverage, flexible payment options, and additional benefits through riders, LIC ensures that individuals can find a plan that suits their unique circumstances and provides financial security for themselves and their loved ones.

Extending Life Insurance Coverage: Pre-existing Conditions and Options

You may want to see also

Frequently asked questions

LIC has a strong background as it is an Indian statutory insurance and investment corporation that is undertaken by the Ministry of Finance, Government of India. It has been in force since 1956 and was created by the merger of over 245 insurance companies and provident societies. LIC has a customer base of over 250 million in India and offers a wide range of life insurance products. LIC's Insurance Plans are policies that cater to individuals' unique needs and give them the most suitable options.

LIC's Insurance Plans offer dynamic and flexible plans that are designed in a customer-friendly manner, keeping in mind the needs of the consumers. LIC's plans offer financial protection and safeguard you and your family, even in your absence. LIC's plans also offer tax benefits under the Income Tax Act.

LIC's Insurance Plans offer survival benefits, death benefits, and survival benefits every year under the plan. LIC also offers loan facilities against the policy. LIC has a high claim settlement ratio of 98.52% in the FY22-23, showcasing its ability to settle most of the claims it receives.