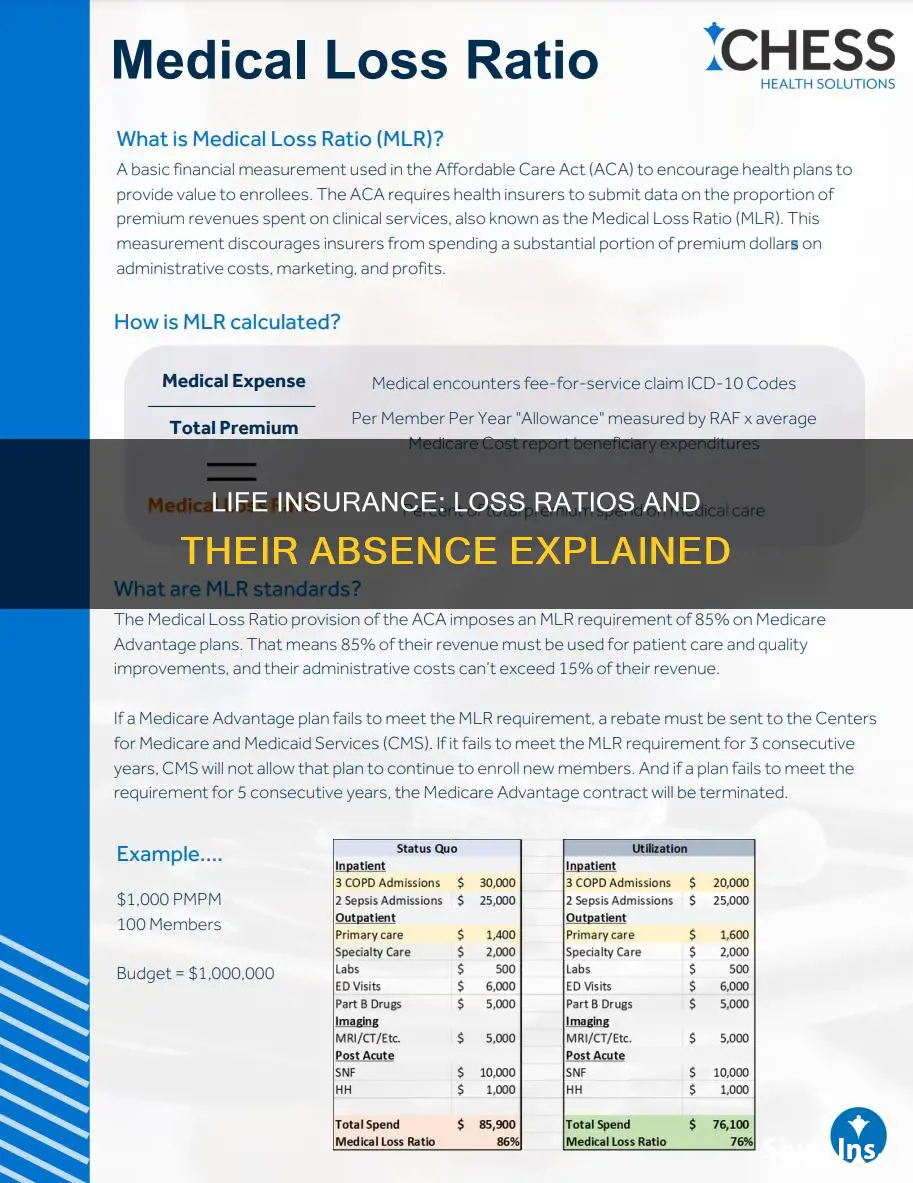

The loss ratio is a metric used in the insurance industry to assess the financial health of an insurance company. It represents the ratio of losses incurred by an insurer due to paid claims and adjustment expenses to the total premiums earned. While a high loss ratio can indicate financial distress, especially for property or casualty insurance companies, a low loss ratio may suggest that the insurer is not taking on enough risk. As the loss ratio varies depending on the type of insurance, there is no one-size-fits-all interpretation of a good or bad loss ratio. In the context of life insurance, the absence of a specific loss ratio benchmark allows insurers to assess their financial performance and make informed decisions about pricing, risk exposure, and policy renewals.

| Characteristics | Values |

|---|---|

| Definition | Loss ratio is a value used in the insurance industry to indicate the ratio of losses to premiums earned. |

| Formula | Loss ratio = ((insurance claims paid + loss adjustment expenses) / total premiums earned) x 100 |

| Interpretation | A high loss ratio can be an indicator of financial distress, especially for property or casualty insurance companies. A low loss ratio does not necessarily mean that the insurer is doing well as it could also mean that the insurer is not taking on enough risk. |

| Variation | The type of insurance, the size of the book of business, and the classification of claims payments, reserves, and expenses can all affect the loss ratio calculation. |

| Comparison | Loss ratios are compared across different insurers to evaluate performance. A high ratio is best for consumers as it indicates that the insurer is returning most of the premium in claim payouts and not overcharging customers. |

| Usage | Loss ratios are used by regulators to monitor the insurance industry and to ensure that insurers are not taking on too much risk. Loss ratios are also used by investors, lenders, and rating agencies to assess insurers' financial health. |

| Action | If loss ratios become excessive, an insurance provider may raise premiums or choose not to renew a policy. |

What You'll Learn

Life insurance companies adjust premiums according to risk factors

Life insurance companies adjust premiums according to several risk factors. Firstly, age is a significant determinant of life insurance premiums. The younger someone is, the less likely they are to die, which translates to lower premiums. Life expectancy, which is influenced by factors like gender and health, also plays a role. Women, for instance, generally live longer than men and thus attract lower rates.

Health is another critical factor. Applicants with certain health conditions are considered riskier to insure because they are more likely to claim insurance payouts sooner. Family medical history, including heart disease and cancer, is also assessed, as it predisposes individuals to these ailments. Lifestyle choices, such as smoking, drinking, drug use, and risky hobbies like racing cars or rock climbing, can also lead to higher premiums.

Other factors that influence life insurance premiums include occupation, with some companies charging more for dangerous professions like police officers or miners. Credit scores and driving records can also impact an individual's premiums or result in outright denial of coverage.

It is worth noting that loss ratios, which represent the ratio of losses to premiums earned, are not commonly discussed in the context of life insurance. This may be because loss ratios are more relevant for insurance types with frequent claims, such as health and auto insurance.

Ispa Insurance: Do They Offer Life Insurance Policies?

You may want to see also

A high loss ratio can indicate financial distress

A high loss ratio can be caused by a number of factors, including a large number of small and medium-sized losses or a few very large "shock" losses. It is important to understand the raw data used in the calculation of the loss ratio, as well as the mix of business included in the analysis. For instance, health and auto insurance tend to have higher loss ratios due to frequent claims, while property and specialty insurance often have lower loss ratios.

If a company has a high loss ratio, it may need to adjust its pricing, tighten its underwriting standards, or reassess its risk exposure. A high loss ratio can also lead to an increase in premiums for the insured or a decision by the insurer not to renew the policy.

While a high loss ratio can be indicative of financial distress, it is important to consider it in conjunction with the combined ratio, which includes both claims and operating expenses. A high combined ratio with a healthy loss ratio may indicate that the problem lies in operational inefficiencies rather than claim payouts.

In summary, a high loss ratio can be a cause for concern for a business, indicating that it may be in financial distress. However, it is important to consider the broader context and potential underlying causes when interpreting a high loss ratio.

Life Insurance Annual Charges: What You Need to Know

You may want to see also

Insurers need to balance risk with premium collection

A high loss ratio, typically above 100%, indicates that an insurer is paying out more in claims than they are collecting in premiums. This can be a sign of financial distress, especially for property and casualty insurance companies, as it may lead to insolvency. In such cases, insurers may need to increase premiums or choose not to renew policies to mitigate their risk and improve their financial position.

On the other hand, a low loss ratio may suggest that the insurer is not taking on enough risk. This could be due to conservative underwriting practices or a cautious approach to risk assessment. While a low loss ratio may indicate financial stability, it does not necessarily mean that the insurer is performing well. To improve their loss ratio, insurers may need to reassess their risk exposure and potentially take on more risk.

The acceptable loss ratio varies depending on the type of insurance and market conditions. For example, health and auto insurance tend to have higher loss ratios due to frequent claims, while property and specialty insurance often have lower loss ratios. Additionally, the size of the business, classification of claims payments, and expenses can impact the loss ratio calculation.

Insurers use the loss ratio as a tool to assess their financial performance and make management decisions. By comparing the costs of claims and adjustments to the premiums earned, insurers can evaluate their profitability and sustainability. However, the loss ratio should be considered alongside other financial metrics, such as the expense ratio, to gain a comprehensive understanding of an insurer's financial health.

Explore the Life Insurance Universe: Types and Differences

You may want to see also

Loss ratios help assess the health and profitability of an insurance company

Loss ratios are an important metric for insurance companies as they help assess their financial health and profitability. The loss ratio is calculated by dividing the sum of insurance claims paid and loss adjustment expenses by the total premiums earned. Expressed as a percentage, the loss ratio indicates the proportion of premiums paid out in claims and adjustments. For example, a loss ratio of 50% means that for every $160 in collected premiums, the insurer pays out $80 in claims and adjustments.

While a high loss ratio can indicate financial distress, especially for property or casualty insurance companies, a low loss ratio may not necessarily mean the insurer is doing well. It could indicate that the insurer is not taking on enough risk or is being too selective with its policies. Therefore, insurers need to balance the amount of risk they take with the amount of premiums they collect to remain profitable.

In the insurance industry, loss ratios are used to compare the financial performance of different insurers and evaluate if consumers are getting a good deal. A high loss ratio is generally beneficial for consumers as it suggests that the insurer is returning most of the premium in claim payouts and not overcharging customers. Conversely, a low loss ratio may indicate that the insurer is not paying out enough in claims relative to the premiums collected.

It is important to note that the loss ratio is not the sole indicator of an insurance company's financial health. It should be used in conjunction with other metrics such as the expense ratio, which considers additional expenses like agent's commissions, salaries, and marketing costs. By using both the loss ratio and the expense ratio together, a more comprehensive understanding of the insurer's financial performance can be achieved.

Additionally, the acceptable range for a loss ratio varies depending on the type of insurance and market conditions. For example, health and auto insurance tend to have higher loss ratios due to frequent claims, while property and specialty insurance often have lower loss ratios. Therefore, when comparing loss ratios across insurers, it is crucial to consider the specific context and business mix included in the analysis.

Weed and Life Insurance: What UK Smokers Need to Know

You may want to see also

The type of insurance affects the acceptable loss ratio

The loss ratio is a metric used in the insurance industry to evaluate the financial health and profitability of an insurance company. It is calculated by dividing the insurance claims paid and adjustment expenses by the total earned premiums. This ratio is used by both insurers and external parties, such as regulators and consumer advocates, to monitor and assess the performance of insurance companies.

The type of insurance does affect the acceptable loss ratio. For example, health insurance tends to have a higher loss ratio compared to property and casualty insurance due to frequent claims. In mid-2024, the average loss ratio for health insurance was about 87-88%, while for property and casualty insurance, it ranged from 54% to 68%. Health insurance providers are mandated to allocate a significant portion of premiums to claims and activities that improve healthcare quality, which results in higher loss ratios.

On the other hand, property and casualty insurance companies typically have lower loss ratios. A high loss ratio in these sectors may indicate financial distress. For instance, a homeowners' insurance company maintaining a loss ratio of 60% is considered strong underwriting performance.

Auto insurance is another type of insurance that can impact loss ratios. Unlike health and homeowners insurance, auto insurance providers can adjust premiums based on submitted claims and the insured's history. If an insured has a brief tenure with the insurer, the company may decide that the risk is unacceptable and choose not to renew the policy, impacting their loss ratio.

Each sector in the insurance industry has a different definition of an acceptable loss ratio. Accelerating claims processing, investing in underwriting excellence, and increasing client satisfaction can help improve loss ratios. Insurers use loss ratios to make management decisions, such as adjusting pricing or reassessing risk exposure.

Adding Senior Mom to Your Life Insurance Policy

You may want to see also

Frequently asked questions

The loss ratio is the ratio of losses to premiums earned. It is calculated by dividing the total incurred losses by the total collected insurance premiums. The loss ratio is used to measure the profitability of an insurance company.

The loss ratio varies depending on the type of insurance. While health and auto insurance tends to have higher loss ratios, property and casualty insurance often has lower loss ratios. Life insurance is not mentioned in the same breath as health, auto, property, or casualty insurance, and therefore, it can be inferred that life insurance does not have an associated loss ratio.

A loss ratio below 100% indicates that an insurance company is making an underwriting profit, while a ratio above 100% means that it is paying out more money in claims than it is receiving from premiums. A high loss ratio can be an indicator of financial distress, potentially leading to the insurer becoming insolvent.