Whole life insurance is a long-term financial commitment that offers a range of benefits, making it an attractive option for those seeking a secure and reliable financial plan. One of the key advantages of whole life insurance is the ability to build cash value over time, which can be borrowed against or withdrawn as needed. This feature makes it a valuable tool for financial planning, especially when considering the long-term financial goals of an individual or family. By putting a lump sum into whole life insurance, you can take advantage of this cash value growth, ensuring that your investment not only provides coverage but also grows tax-free, offering a secure financial cushion for the future.

What You'll Learn

- Long-Term Savings: Whole life insurance builds cash value, offering a guaranteed savings plan over time

- Fixed Premiums: You pay the same amount each year, providing financial predictability and stability

- Death Benefit: A lump sum payout upon death, ensuring financial security for beneficiaries

- Tax-Advantaged Growth: Cash value grows tax-free, allowing compound interest to work in your favor

- Lifetime Coverage: Provides insurance for life, ensuring protection for your loved ones regardless of age

Long-Term Savings: Whole life insurance builds cash value, offering a guaranteed savings plan over time

Whole life insurance is a powerful financial tool that provides long-term savings and security, making it an attractive option for those seeking a guaranteed savings plan. Unlike term life insurance, which only covers a specific period, whole life insurance offers permanent coverage, ensuring financial protection for your entire life. This type of insurance is particularly beneficial for those looking to build substantial savings over time.

The key feature that sets whole life insurance apart is its ability to accumulate cash value. With each premium payment, a portion goes towards covering the policy's expenses, while the remaining amount is invested. This investment component grows over time, generating interest and building a substantial cash reserve. As a result, the policyholder not only receives death benefit protection but also owns a valuable asset in the form of the cash value. This cash value can be borrowed against or withdrawn, providing financial flexibility and a means to access funds when needed.

One of the advantages of whole life insurance for long-term savings is its predictability. The insurance company guarantees the accumulation of cash value, ensuring a steady growth rate. This predictability allows individuals to plan their financial future with confidence, knowing that their savings will grow consistently over the years. Unlike other investment vehicles, whole life insurance offers a stable and secure environment for long-term wealth accumulation.

Additionally, the cash value in whole life insurance can be a valuable resource during the policyholder's lifetime. It can be used to pay for various expenses, such as education costs, business ventures, or even as an emergency fund. The ability to access this cash value provides financial flexibility and peace of mind, knowing that your savings are readily available when required. This aspect of whole life insurance is particularly appealing to those who want to ensure they have a financial safety net for unexpected events.

In summary, whole life insurance is an excellent strategy for long-term savings and financial security. By building cash value, it offers a guaranteed savings plan that can grow over time, providing a substantial financial asset. The predictability and flexibility of accessing this cash value make it a valuable tool for individuals seeking to secure their financial future and manage their money effectively. Considering the potential benefits, it is worth exploring how whole life insurance can be utilized as a lump sum investment to build wealth and protect against financial risks.

Chubb Life Insurance: What You Need to Know

You may want to see also

Fixed Premiums: You pay the same amount each year, providing financial predictability and stability

When considering whole life insurance, one of the most appealing aspects is the predictability and stability it offers in terms of premium payments. Unlike some other insurance policies, whole life insurance provides a fixed premium structure, meaning you pay the same amount each year without any increases. This predictability is a significant advantage for several reasons.

Firstly, it allows you to plan your finances more effectively. Knowing exactly how much you will pay annually for insurance coverage helps in budgeting and financial management. This predictability is especially beneficial for long-term financial planning, as you can allocate your resources accordingly without the worry of sudden premium hikes. With a fixed premium, you can ensure that your insurance costs remain stable over the policy's duration, providing a sense of financial control and security.

The stability of fixed premiums is particularly advantageous for those with long-term financial goals. For instance, if you are saving for your child's education or planning for retirement, a consistent insurance premium can be a valuable part of your overall financial strategy. You can calculate your future expenses more accurately and make informed decisions about savings and investments, knowing that your insurance costs will not unexpectedly rise.

Moreover, the predictability of whole life insurance premiums encourages policyholders to maintain their payments. With a fixed amount due each year, it becomes easier to stay on track with the payments, ensuring that the insurance coverage remains active. This consistency in payments also contributes to the overall financial health of the insurance company, as they can rely on a steady income stream from policyholders.

In summary, the fixed premium structure of whole life insurance offers financial predictability and stability, which are essential for effective long-term planning. It provides peace of mind, knowing that your insurance costs will remain consistent, and allows you to manage your finances with greater confidence. This aspect of whole life insurance is a key reason why many individuals choose to invest a lump sum in this type of policy, ensuring a reliable and secure financial future.

Pacific Life Insurance: Mail Payment Reminders?

You may want to see also

Death Benefit: A lump sum payout upon death, ensuring financial security for beneficiaries

When considering whole life insurance, one of the key benefits is the death benefit, which is a crucial aspect to ensure financial security for your loved ones. This feature guarantees a lump sum payout upon your passing, providing a substantial financial cushion for your beneficiaries. The death benefit is a fixed amount that the insurance company agrees to pay out to the designated recipients when the insured individual dies. This financial safety net can be a powerful tool to protect your family and loved ones, especially during challenging times.

The lump sum payout offers several advantages. Firstly, it provides immediate financial support to cover essential expenses, such as funeral costs, outstanding debts, or daily living expenses for the beneficiaries. This immediate financial assistance can alleviate the financial burden and stress that often accompany the loss of a loved one. Moreover, the lump sum can be used to cover long-term needs, such as education expenses for children or the maintenance of a mortgage or rent. By providing a one-time, substantial payment, the death benefit allows beneficiaries to make significant financial decisions and plan for the future with a sense of security.

In the context of whole life insurance, the death benefit is typically guaranteed, meaning it is assured to be paid out as long as the premiums are up to date. This guarantee provides peace of mind, knowing that your family will receive the intended financial support regardless of market fluctuations or other insurance company changes. Additionally, the death benefit is often tax-free, ensuring that the entire amount goes directly to the beneficiaries without being subject to income tax. This feature makes the lump sum payout even more valuable, as it can be utilized for various purposes without the worry of immediate taxation.

Furthermore, the death benefit can be a strategic tool for wealth transfer. By utilizing the lump sum payout, beneficiaries can make significant investments or business decisions, potentially growing the funds over time. This aspect of whole life insurance can be particularly beneficial for those who want to ensure their family's long-term financial well-being and provide an inheritance for future generations. The guaranteed and tax-free nature of the death benefit makes it an attractive option for those seeking to secure their family's financial future.

In summary, the death benefit with a lump sum payout is a critical feature of whole life insurance, offering financial security and peace of mind. It provides a substantial financial cushion for beneficiaries, ensuring they can cover essential expenses and make important financial decisions during challenging times. With the guaranteed and tax-free nature of the payout, whole life insurance becomes an effective tool for wealth transfer and long-term financial planning, allowing individuals to leave a lasting legacy for their loved ones.

Life Insurance: Estate Planning Essentials

You may want to see also

Tax-Advantaged Growth: Cash value grows tax-free, allowing compound interest to work in your favor

When considering whole life insurance, one of the most compelling reasons to invest a lump sum is the potential for tax-advantaged growth. Unlike traditional savings accounts or investments, the cash value within a whole life policy grows tax-free. This means that the interest earned on your initial investment is not subject to annual taxes, allowing your money to grow faster over time.

The power of compound interest is a key factor here. With each passing year, the interest earned is added to the policy's cash value, and the subsequent year's interest is calculated on this new, larger amount. This compounding effect can significantly boost your savings. For instance, if you invest $10,000 in a whole life policy with a 5% annual interest rate, after the first year, you'll have $10,500. In the second year, the interest is calculated on this new total, resulting in $11,025. This process continues, and over time, your investment can grow exponentially.

The tax-free nature of this growth is a significant advantage. In a typical savings account, the interest earned is taxable income, reducing the overall return. However, with whole life insurance, the cash value accumulation is shielded from annual taxes, allowing your money to grow uninterrupted. This is particularly beneficial for long-term financial goals, as it ensures that your savings are not eroded by taxes over time.

Additionally, the tax-advantaged nature of whole life insurance can be especially advantageous for those in higher tax brackets. By investing in a whole life policy, you can potentially save on taxes that would otherwise be paid on other investment earnings. This makes whole life insurance an attractive option for those seeking to maximize their after-tax returns.

In summary, the tax-advantaged growth of cash value in whole life insurance is a powerful incentive for lump-sum investments. It allows your money to grow faster due to compound interest, all while being protected from annual taxes. This feature makes whole life insurance an excellent choice for those looking to build a substantial financial cushion over time, providing both security and the potential for significant returns.

MetLife Insurance: Covering Spouses, Understanding the Policy

You may want to see also

Lifetime Coverage: Provides insurance for life, ensuring protection for your loved ones regardless of age

Lifetime coverage is a fundamental aspect of whole life insurance, offering a comprehensive solution to ensure financial security for your loved ones throughout their lives. This type of insurance provides a constant and reliable source of protection, which is particularly valuable as it guarantees coverage for the entire duration of the policyholder's life. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers a permanent safety net, ensuring that your family is protected even if your circumstances change over time.

The beauty of lifetime coverage lies in its ability to provide peace of mind. With this type of insurance, you can rest assured that your loved ones will have the financial support they need, regardless of age-related factors. As your loved ones' needs may evolve over the years, from raising a family to supporting aging parents, whole life insurance with lifetime coverage adapts to these changes, offering consistent protection. This is especially crucial in ensuring that your family can maintain their standard of living and cover essential expenses, such as mortgage payments, education costs, or medical bills, even if the primary breadwinner passes away.

One of the key advantages of whole life insurance with lifetime coverage is its flexibility. Policyholders can customize their plans to suit their specific needs. This includes choosing the amount of coverage required, which can be adjusted over time as financial goals and responsibilities change. Additionally, the policy can be tailored to include various riders and benefits, such as critical illness coverage or long-term care insurance, further enhancing the protection offered. This flexibility ensures that the insurance policy remains relevant and effective throughout the policyholder's life.

Furthermore, the cash value component of whole life insurance is a significant benefit. This feature allows the policy to accumulate cash value over time, which can be borrowed against or withdrawn, providing additional financial flexibility. The cash value can be used for various purposes, such as funding education expenses, starting a business, or even providing a retirement nest egg. This aspect of whole life insurance ensures that the policy not only provides protection but also serves as a valuable financial tool, offering both insurance and investment benefits.

In summary, whole life insurance with lifetime coverage is a powerful financial tool that ensures your loved ones' well-being and financial security. It provides a consistent and reliable safety net, adapting to the changing needs of your family over time. With its flexibility, customization options, and the potential for cash value accumulation, this type of insurance offers a comprehensive solution for long-term financial protection. By investing in whole life insurance, you are making a wise decision to safeguard your loved ones' future and provide them with the peace of mind that comes with knowing they are protected.

Florida Government Workers: Lifetime Health Insurance Benefits?

You may want to see also

Frequently asked questions

Paying a lump sum for whole life insurance can be a strategic financial move. It allows you to build cash value faster, which can be borrowed against or withdrawn in the future. This can be beneficial for long-term financial goals and provide a financial safety net.

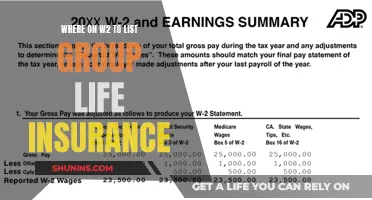

When you pay a lump sum, the insurance company invests the funds into an investment account. Over time, this investment grows, and the cash value of your policy increases. This cash value can be borrowed against, providing a tax-free loan, or it can be used to pay future premiums, ensuring the policy remains in force.

Yes, there can be tax advantages. The cash value growth in a whole life policy is typically tax-deferred, meaning it grows free of annual income tax. Additionally, any dividends received can be tax-free if reinvested in the policy. This can be an attractive feature for long-term savings.

Yes, one of the key benefits of whole life insurance with a lump sum payment is the ability to access your money. You can take out loans or withdrawals from the cash value, providing financial flexibility. These withdrawals are typically tax-free, and the policy remains in force, ensuring continuous coverage.

While whole life insurance with a lump sum can be advantageous, it's important to consider the risks. The investment aspect may not perform as expected, and market fluctuations can impact the cash value. Additionally, if you need to access the funds early, there may be penalties or taxes to consider. It's crucial to understand the policy's terms and consult a financial advisor.