Landlords often face financial risks and uncertainties, and life insurance can provide a crucial safety net. It ensures that their tenants' rent payments continue to be made even if the landlord passes away, preventing potential financial strain on the estate and the need to find a replacement tenant. Additionally, life insurance can cover the costs associated with maintaining the property, such as repairs and maintenance, which might otherwise be difficult to manage without a steady income stream. This financial protection is essential for landlords to safeguard their investments and provide stability for their tenants, especially in the long term.

What You'll Learn

- Financial Security: Landlords need insurance to protect their financial interests and ensure tenants' well-being

- Mortgage Coverage: Life insurance can pay off the mortgage if the landlord dies, preventing foreclosure

- Income Replacement: It provides income replacement for the landlord if they can no longer manage the property

- Tenant Stability: Insurance ensures tenants can remain in the property, preventing displacement

- Estate Planning: Life insurance is a tool for landlords to plan their estate and leave assets to heirs

Financial Security: Landlords need insurance to protect their financial interests and ensure tenants' well-being

Landlords often overlook the importance of life insurance, but it is a crucial aspect of responsible property management. The primary reason landlords should consider life insurance is to safeguard their financial interests and ensure the well-being of their tenants. Here's a detailed breakdown of why this insurance is essential:

Protecting Financial Assets: Landlords invest significant capital in purchasing rental properties. These properties are often their most valuable asset. In the event of an untimely death, life insurance can provide a financial safety net. The policy's death benefit can be used to cover various expenses, including outstanding mortgage payments, property taxes, maintenance costs, and legal fees associated with selling the property. By having this insurance, landlords can ensure that their investment remains protected and that any financial gaps are filled, preventing potential financial strain on the landlord or the need to abruptly increase rent to cover these costs.

Tenant Stability: A landlord's primary goal is to provide a stable and safe living environment for tenants. Life insurance can contribute to this by ensuring that tenants' rights and the property's maintenance are not compromised in the event of the landlord's death. The insurance proceeds can be used to cover any outstanding rent, property management fees, or necessary repairs, ensuring that tenants continue to have a comfortable and secure home. This stability is crucial, especially during the transition period after the landlord's passing, allowing tenants to focus on their well-being without the added stress of financial uncertainty.

Long-Term Financial Planning: Life insurance encourages landlords to plan for the long term. It provides an opportunity to consider the future of the rental property and the tenants' needs. With the right insurance policy, landlords can ensure that the property remains in good condition and that any necessary upgrades or repairs are funded. This proactive approach can lead to better tenant satisfaction and retention, as well-maintained properties are more attractive to renters. Additionally, the insurance can be structured to provide financial support for the landlord's family, ensuring their financial security and the potential for future investments in other properties.

Legal and Ethical Responsibility: Landlords have a legal and ethical duty to act in the best interest of their tenants. Life insurance is a tool to fulfill this responsibility. In the event of a landlord's death, the insurance proceeds can be used to cover any legal fees and ensure a smooth transition of property management. This includes providing tenants with the necessary support and documentation to continue their tenancy without disruption. By taking this step, landlords demonstrate their commitment to tenant welfare and maintain a positive reputation in the rental market.

In summary, life insurance is a vital consideration for landlords to protect their financial investments, ensure tenant stability, and fulfill their legal and ethical obligations. It provides a safety net that allows landlords to focus on their other responsibilities, knowing that their tenants and property are secure. This insurance is a long-term strategy that benefits both the landlord and the tenants, creating a more sustainable and harmonious rental environment.

Unveiling New York Life Insurance: A Comprehensive Business Overview

You may want to see also

Mortgage Coverage: Life insurance can pay off the mortgage if the landlord dies, preventing foreclosure

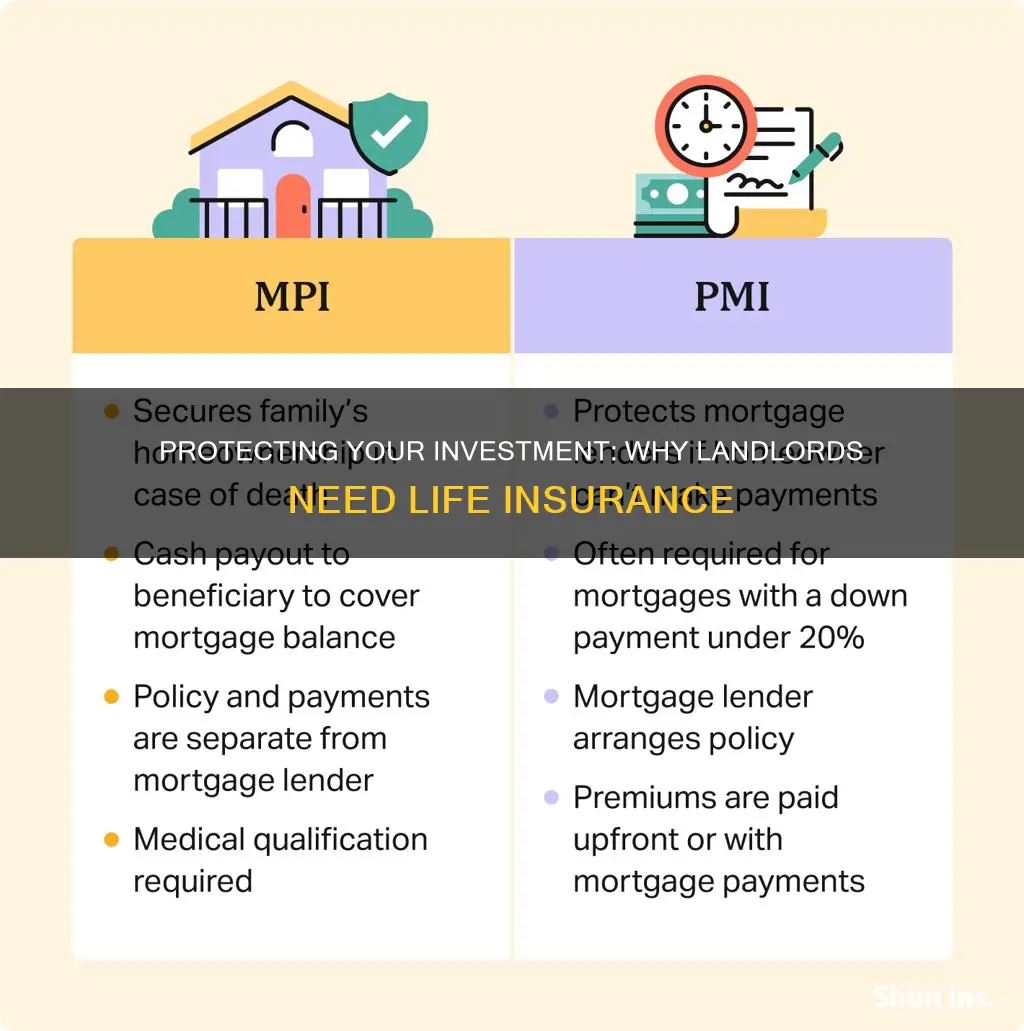

Life insurance can be a crucial financial tool for landlords, especially those who own rental properties and have taken out a mortgage to finance their purchase. The primary purpose of life insurance in this context is to provide financial security and peace of mind, ensuring that the landlord's family and their investment in the property are protected in the event of their untimely death.

When a landlord takes out a mortgage, they are essentially borrowing money to purchase the property, and the lender has a vested interest in the property's value and the landlord's ability to repay the loan. If the landlord were to pass away, the mortgage would need to be settled, and without adequate financial resources, the lender could initiate foreclosure proceedings, potentially leading to the loss of the property. This is where life insurance steps in as a safeguard.

Mortgage coverage life insurance is designed to address this specific concern. It is a type of policy that provides a death benefit, which can be used to pay off the outstanding mortgage balance in the event of the landlord's death. By having this insurance, the landlord's family can ensure that the mortgage is settled, and the property remains in their possession, even if the landlord is no longer around to manage it. This coverage is particularly important for landlords who have significant financial investments tied up in their rental properties and want to protect their assets.

The process typically involves the landlord naming the mortgage lender as a beneficiary of the life insurance policy. Upon the landlord's death, the insurance company pays out the death benefit directly to the lender, who then uses the funds to clear the mortgage debt. This prevents the lender from taking legal action to recover the remaining balance, thus safeguarding the property and providing financial relief to the surviving family members.

In summary, life insurance with mortgage coverage is a strategic decision for landlords to protect their financial interests and the value of their rental properties. It ensures that the mortgage remains satisfied, even in the face of tragedy, allowing the landlord's family to maintain their investment and avoid the complications and potential loss associated with foreclosure. This type of insurance is a valuable consideration for anyone in the landlord business, providing a safety net that can offer long-term financial security.

Heir's Dilemma: Rejecting Life Insurance Proceeds

You may want to see also

Income Replacement: It provides income replacement for the landlord if they can no longer manage the property

Landlords often face the challenge of managing rental properties, and unexpected events like death can significantly impact their ability to do so. Life insurance can be a valuable tool for landlords to ensure their financial stability and the smooth operation of their rental business in the event of their passing. Here's how it provides income replacement:

When a landlord purchases life insurance, they essentially create a financial safety net for their rental enterprise. The policy's death benefit, a lump sum amount, can be designated to the landlord's estate or a trust. In the unfortunate event of their death, this benefit is paid out, providing a crucial source of income replacement. This financial cushion allows the landlord's family or designated beneficiaries to cover various expenses and maintain the property's management.

The primary purpose of this insurance is to ensure that the landlord's family is financially protected while also securing the long-term viability of the rental property. Without this insurance, the sudden loss of the landlord's income could lead to significant challenges. The death benefit can be used to cover immediate expenses, such as funeral costs and outstanding debts, providing peace of mind during a difficult time. Moreover, it ensures that the landlord's family is taken care of, allowing them to focus on the emotional aspects of grieving rather than worrying about financial matters.

For the rental property itself, the income replacement aspect is vital. The death benefit can be utilized to cover ongoing expenses, such as property taxes, maintenance, and repairs. This financial support enables the landlord's family to continue paying for essential services, keeping the property in good condition and potentially avoiding any penalties or disruptions in utility services. Additionally, it provides the means to maintain the property's marketability, ensuring tenants can continue to find a suitable home.

In summary, life insurance for landlords serves as a critical tool for income replacement, offering financial security for both the landlord's family and the rental property. It ensures that the landlord's passing does not result in a sudden halt to the property's management and maintenance. By providing a financial safety net, this insurance allows the landlord's family to grieve and plan for the future while also safeguarding the long-term stability of the rental business.

Life Insurance: Can You Opt-Out of Your Employer's Plan?

You may want to see also

Tenant Stability: Insurance ensures tenants can remain in the property, preventing displacement

When landlords consider life insurance, it's often with the primary goal of protecting their financial interests. However, the benefits of this coverage extend far beyond the landlord's perspective, particularly in terms of tenant stability. Life insurance can play a crucial role in ensuring that tenants remain in their homes, preventing sudden displacement and providing a sense of security.

The primary reason for this is the financial security it offers. When a landlord has life insurance, it means they have a financial safety net in place. This safety net can be utilized to cover various expenses related to the property, including rent. In the event of the landlord's death, the insurance payout can be used to continue paying the rent for the property, especially if the landlord was the sole provider of financial support for the tenant. This financial stability is vital for tenants, as it ensures they don't lose their home due to unforeseen circumstances.

Moreover, life insurance can provide tenants with peace of mind. Knowing that their landlord has a financial backup plan can reduce anxiety and uncertainty. Tenants may feel more secure in their tenancy, especially if they are aware of the landlord's proactive approach to financial planning. This sense of security can foster a positive landlord-tenant relationship and encourage tenants to maintain the property, as they are more likely to respect the home when they feel valued and protected.

In addition, life insurance can be a powerful tool to prevent displacement, especially in cases where the landlord's death would otherwise lead to a sudden change in the rental agreement. With the insurance payout, the landlord's estate can continue to cover the rent, allowing the tenant to remain in the property until a new rental arrangement can be made. This is particularly important for long-term tenants who have established a strong connection to the community and may struggle to find alternative accommodation quickly.

For landlords, considering life insurance is a responsible step that demonstrates a commitment to the well-being of their tenants. It shows a proactive approach to managing the property and a willingness to ensure the long-term stability of the tenancy. By providing this financial security, landlords can build trust with their tenants, creating a more harmonious and secure living environment for everyone involved.

Life Insurance Agents: Annuity Sales and Beyond

You may want to see also

Estate Planning: Life insurance is a tool for landlords to plan their estate and leave assets to heirs

Life insurance can be an essential component of estate planning for landlords, offering a strategic approach to managing and protecting their assets. When a landlord owns rental properties, their estate becomes a valuable asset, and life insurance can be a powerful tool to ensure the smooth transition of these assets to beneficiaries. Here's how life insurance fits into the realm of estate planning for landlords:

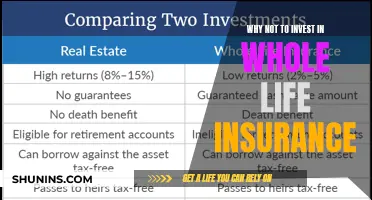

Asset Protection and Transfer: Landlords often have substantial wealth tied up in their rental properties. Life insurance can provide a means to safeguard these assets. By taking out a life insurance policy, landlords can ensure that their estate is protected. The death benefit from the insurance policy can be designated to cover any outstanding debts or mortgages associated with the rental properties, thus preventing the risk of the estate being burdened with financial liabilities. Moreover, life insurance allows landlords to transfer ownership of their properties to heirs or beneficiaries in a tax-efficient manner. This strategic planning can help minimize the impact of inheritance taxes, ensuring that the majority of the estate's value is passed on to the intended recipients.

Income Replacement for Dependents: Landlords, especially those with multiple rental properties, often rely on the income generated from these rentals to sustain their lifestyle. In the event of their passing, life insurance can provide a financial safety net for their dependents. The death benefit can be structured to replace the lost rental income, ensuring that the landlord's family is financially secure. This aspect of life insurance is particularly crucial for landlords with a large number of tenants, as it guarantees that the rental income stream continues, providing stability for the landlord's family and the tenants' peace of mind.

Estate Valuation and Distribution: Estate planning involves considering the overall value of one's estate and how it will be distributed. Life insurance can significantly impact the valuation of an estate. A substantial death benefit from a life insurance policy can increase the overall value of the estate, potentially leading to a higher inheritance tax liability. However, with careful planning, landlords can structure their insurance policies to minimize tax implications. This might include choosing a policy with a lower death benefit or utilizing specific tax-efficient strategies to ensure that the majority of the estate's value remains intact for the intended heirs.

Long-Term Financial Security: Beyond the immediate benefits, life insurance provides long-term financial security for landlords. It allows them to plan for the future, ensuring that their heirs are protected and that the rental properties remain in the family for generations. By incorporating life insurance into their estate plan, landlords can create a legacy, providing financial stability and peace of mind for their loved ones. This strategic approach to estate planning can be particularly valuable for landlords with a long-term vision for their business and family.

In summary, life insurance is a versatile tool for landlords to manage their estate and secure the future of their rental properties. It offers a way to protect assets, ensure financial stability for dependents, and provide a structured approach to estate distribution. By integrating life insurance into their estate planning, landlords can achieve their financial goals and leave a lasting legacy.

Life Insurance and Veteran Benefits: What's the Connection?

You may want to see also

Frequently asked questions

Landlords often have financial obligations and responsibilities that extend beyond their own lives. Life insurance can provide financial security and peace of mind, ensuring that their beneficiaries or heirs are protected in the event of their death. This is especially important if the landlord has tenants who rely on the rental income or if there are outstanding debts or mortgages associated with the property.

Life insurance can offer several advantages to landlords. Firstly, it can cover any outstanding debts or mortgages, preventing the landlord's estate from being burdened with financial liabilities. Secondly, the death benefit can be used to pay for any necessary repairs or maintenance, ensuring the property remains in good condition. Additionally, the policy can provide income replacement for the landlord's family, especially if they were relying on the rental income.

Even if a landlord has no immediate dependents, life insurance can still be beneficial. It can help with funeral expenses and provide a financial cushion for any unexpected costs that may arise. Moreover, if the landlord has a business partner or a family member who relies on their income, life insurance can ensure their financial stability.

Yes, life insurance can be a valuable tool for landlords to manage potential future risks. For instance, if a landlord owns multiple properties and has a significant amount of rental income, life insurance can provide a safety net in case of unexpected death. It can also be used to cover potential future losses, such as the cost of finding and managing new tenants or any other associated expenses.

Absolutely. Landlords can choose from various life insurance policies, such as term life insurance, which provides coverage for a specific period, or permanent life insurance, which offers lifelong coverage. The choice depends on the landlord's financial goals, the value of their assets, and the level of coverage they require. Consulting with a financial advisor can help determine the most suitable type of policy.