There are many reasons why you might want to cancel your auto insurance policy, such as switching to a new provider, moving to a different state, or selling your car. If you're wondering what happens when you cancel your existing policy, here's what you need to know. In general, you can cancel your auto insurance at any time, but it's important to look into your provider's cancellation policy to avoid unnecessary fees and to ensure you receive any refunds you're entitled to. Giving proper notice is crucial, which means informing your provider of your intention to cancel rather than simply stopping payment. It's also important to note that having a lapse in coverage may result in fines and higher premiums when you purchase a new policy, as insurance companies will consider you a high-risk customer.

| Characteristics | Values |

|---|---|

| Can you cancel your auto insurance at any time? | Yes, but you should look into your provider's cancellation policy to avoid paying unnecessary fees and missing out on refunds. |

| What happens if you cancel insurance early? | You will need to give proper notice, i.e., informing your provider that you're canceling the policy rather than simply stopping payment. Some companies ask you to give 15 or 30 days' notice when you cancel. |

| Will your rates increase after canceling your auto insurance? | Yes, insurance companies will consider you a high-risk driver and your premiums will increase. |

| What happens if you don't give proper notice? | You may incur high fees if you cancel your auto insurance soon after buying the policy. |

| What happens if you don't cancel and stop paying your premiums? | Your provider will cancel your policy, but it will harm your credit score. |

What You'll Learn

Lapses in coverage

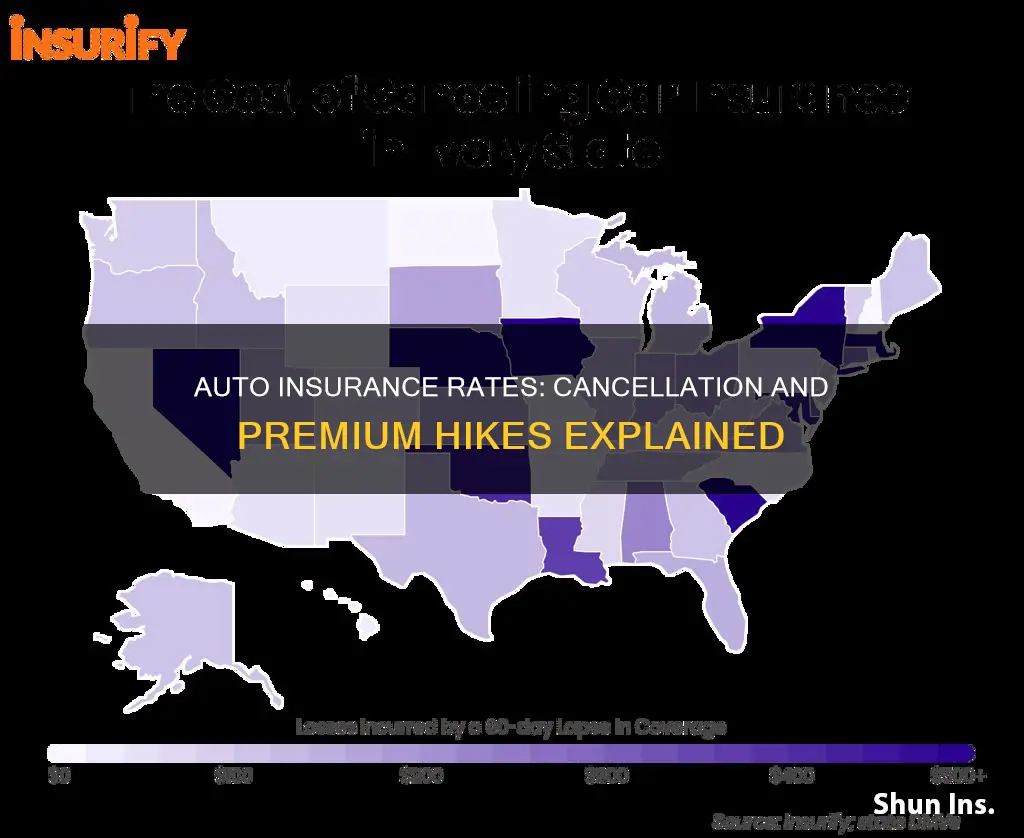

Having a lapse in coverage can result in fines and is considered driving without insurance, which is illegal in most states. A lapse in coverage may also result in an increase in your premiums when you purchase a new policy, as insurance companies will consider you a high-risk customer.

To avoid a lapse in coverage, it is recommended that you purchase a new policy before cancelling your old one. This ensures there is no gap in coverage and can help prevent an increase in your insurance rates.

If you are temporarily not driving, some insurance companies will allow you to suspend your car insurance and put your vehicle on a storage plan, rather than cancelling your policy altogether. This can help you avoid a lapse in coverage and the associated consequences.

It is important to carefully consider the reasons for cancelling your auto insurance and the potential impact on your coverage and rates. Speaking with a licensed insurance agent can help you understand the specific implications of a lapse in coverage for your situation.

Stated Value Auto Insurance: How Does It Work?

You may want to see also

High-risk drivers

- At-fault or no-fault accidents on your motor vehicle report

- Traffic violations, including DUI or DWI

- Multiple comprehensive claims

- Lack of driving experience

- No history of auto insurance

- Bad credit

- A driving violation in the last five years

- A lapse in coverage

If you are a high-risk driver, you can expect to pay higher insurance rates compared to low-risk drivers. The average cost of high-risk auto insurance is $1,589 per year for minimum coverage and $4,374 per year for full coverage. However, the cost will depend on your unique driver profile. For example, young drivers between the ages of 16 and 25 are considered high-risk due to their lack of driving experience, and they are charged much higher insurance premiums than older drivers. Additionally, having bad credit can also increase insurance rates for high-risk drivers, except in California, Hawaii, Massachusetts, and Michigan, where insurers are prohibited from using credit scores to set rates.

If you are a high-risk driver, there are still ways to get cheaper insurance rates. One way is to only purchase the minimum coverage required by your state. You can also increase your deductible, which will lower your rate but will result in higher out-of-pocket costs if you need to make a claim. Taking advantage of discounts offered by insurance companies, such as multi-policy or safe driver discounts, can also help reduce your insurance rates. Shopping around and comparing quotes from different insurance providers is another effective way to find cheaper high-risk auto insurance.

Turo Auto Insurance: What's Covered and What's Not?

You may want to see also

Accident forgiveness

It's important to note that accident forgiveness only applies to your first accident. Subsequent accidents will not qualify for accident forgiveness, and your insurance rate may increase as a result.

Canceling Your Infinity Auto Insurance Policy: A Step-by-Step Guide

You may want to see also

Insurance contract violations

An auto insurance contract is a legally binding agreement between the policyholder and the insurance company. It outlines the rights and duties of both parties, including the coverage provided, the premiums to be paid, and the procedures for making changes or cancellations. While policyholders have some flexibility to modify their coverage, certain insurance contract violations can occur that may result in penalties or consequences.

Violating Minimum Coverage Requirements

Most states have mandatory minimum auto insurance requirements, which typically include bodily injury liability coverage and property damage liability coverage. Failing to meet these requirements can result in legal penalties such as license suspension, fines, or even jail time for repeat offenses.

Non-Renewal or Cancellation of Policy

Auto insurance policies are typically renewed periodically, usually every six or twelve months. Policyholders have the right to choose not to renew their policy at the end of the term. However, cancelling a policy before its expiration date may result in cancellation fees, and a lapse in coverage can lead to higher rates or difficulties in obtaining a new policy.

Misrepresentation or Fraud

Providing false or misleading information to the insurance company during the application or claims process can be considered a breach of contract. This includes misrepresenting facts about the vehicle, driving history, or other relevant details. In some cases, this may result in the denial or cancellation of a claim or even the termination of the policy.

Failure to Pay Premiums

Policyholders are responsible for paying their premiums on time to maintain their coverage. Non-payment of premiums can result in the insurance company cancelling the policy for non-compliance with the contract terms.

Violating Policy Exclusions

Insurance policies typically have exclusions outlined in the contract, specifying certain perils, persons, property, or locations that are not covered. Engaging in activities or incurring losses that fall under these exclusions can result in the denial of a claim.

Unauthorized Modifications or Changes

Making significant modifications to the insured vehicle without informing the insurance company can be considered a violation of the contract. Additionally, adding or removing drivers, changing vehicle usage, or modifying coverage limits may require approval from the insurance company and may result in adjustments to the premium.

Auto Insurance: Understanding Your Policy Number and Costs

You may want to see also

Insurance refunds

If you cancel your auto insurance policy before the end of the term, you may be entitled to a refund for the remaining time on your policy. However, this depends on several factors, including whether you or your insurance company cancelled the policy, the reason for cancellation, and the company's rules about refunds.

Reasons for Cancellation

Common reasons for cancelling an auto insurance policy include finding a better rate elsewhere, selling your car, or moving to another state. Other reasons include removing a vehicle or a driver from your policy, or reducing your coverage.

How Much Refund You Get

The amount of refund you receive depends on how much time is left on your policy and whether you paid your premium in full upfront or in monthly instalments. If you paid in full upfront, you will typically get a refund for the remaining time on your policy. If you pay monthly, you may or may not get a refund, depending on when you cancel. For example, if you cancel in the middle of the month or billing cycle, you may get a refund for the rest of that month.

Cancellation Fees

Some insurance companies charge a cancellation fee, which is taken out of your refund. This could be a flat fee or a short-rate fee, which is a percentage (usually 10%) of the unearned premium.

How to Get a Refund

To get a refund, contact your insurance company to ask about their rules regarding cancellations and refunds. You may need to pay a cancellation fee and give a certain amount of notice. Your insurance company will then inform you about how and when you will receive your refund.

Impact on Future Rates

Cancelling your auto insurance policy can lead to higher rates in the future if you do not have another policy in effect. This is because insurance companies may consider you a high-risk driver if there are gaps in your insurance coverage. Therefore, it is recommended to purchase a new policy before cancelling your old one.

Auto Claim Insurance: When to Call

You may want to see also

Frequently asked questions

If you allow your auto insurance coverage to lapse, your rates may increase because insurance companies will consider you a high-risk customer. However, if you switch to a new provider and they cancel your previous insurance for you, you can avoid a lapse in coverage and therefore won't be subject to increased rates.

You can usually cancel your auto insurance by contacting your insurance agent. Some companies require written notice, so check with your provider to ensure you follow the correct cancellation process.

Most insurance companies allow you to cancel your policy at any time, regardless of where you are in the billing cycle. However, you will need to give proper notice and may have to pay a cancellation fee. If you paid premiums in advance, your provider should refund them to you.