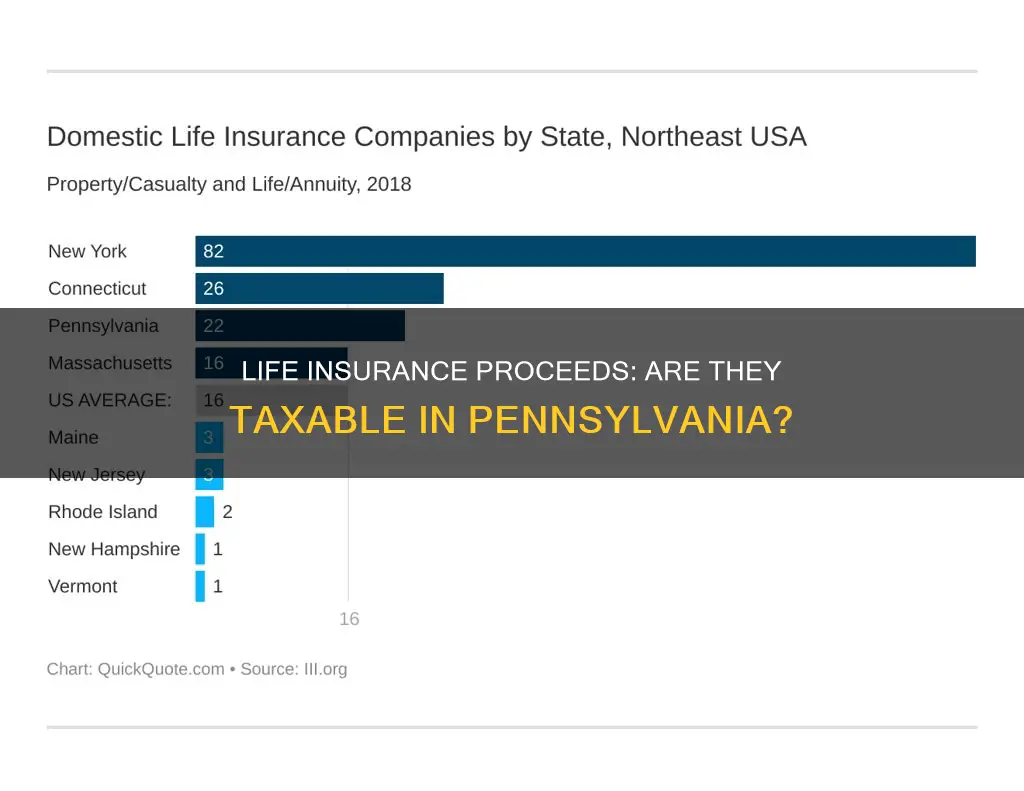

Life insurance is a crucial financial safety net for many, but are the proceeds taxable in Pennsylvania? The answer is no, life insurance proceeds are not subject to state income tax or PA inheritance tax, provided it is not an annuity. However, there are certain scenarios where taxes may apply. For example, if you receive interest on the policy, you will need to pay taxes on that interest, and if the policy matures and pays out a cash value, this may be taxed as ordinary income. Understanding the tax implications of life insurance is essential for beneficiaries and policyholders in Pennsylvania, ensuring that they are aware of any potential taxes they may owe and can plan their finances accordingly.

What You'll Learn

- Life insurance proceeds are not taxable in Pennsylvania

- Interest received on life insurance is taxable

- Cash value of life insurance policies is taxable under certain conditions

- Life insurance is included in the estate of the deceased

- Pennsylvania inheritance tax must be paid within nine months of the decedent's death

Life insurance proceeds are not taxable in Pennsylvania

In addition, if you are the owner of a life insurance policy and you receive a payout because you have reached the maturity age specified in the policy, this payout may be taxed as ordinary income on the amount that exceeds your cost basis (the sum of your after-tax premiums). This amount would then become part of your estate and may be subject to further taxation upon your death.

It's worth noting that, if a policy is owned by an irrevocable trust, the trust is responsible for any tax owed, and the proceeds would not become part of the insured's estate if the insured had no incidents of ownership.

Pennsylvania has an inheritance tax, which is a tax on property at the time of someone's death, imposed on the transfer of that property. The death benefit of life insurance is exempt from this inheritance tax. There is no tax on assets going to a spouse, but children and grandchildren pay 4.5%, siblings pay 12%, and everyone else pays 15%.

Who Gets Your Life Insurance Money: Contingent Beneficiaries Explained

You may want to see also

Interest received on life insurance is taxable

In Pennsylvania, life insurance proceeds are not taxable in the estate of the decedent, provided it is not an annuity. However, interest received on life insurance is taxable.

If you receive interest on a life insurance policy, you are required to pay taxes on this interest. This is reported on federal tax forms and Pennsylvania tax forms under the "Interest" section. This is separate from the death benefit, which is typically not taxable. It's important to note that the death benefit of life insurance is exempt from Pennsylvania inheritance tax.

Cash Surrender Value

The cash value of a life insurance policy is taxable only if the amount received exceeds the amount paid in premiums. In this case, the insurance company will provide you with a Form 1099-R. On federal taxes, you must list this gain under "Pensions and annuities," while on the Pennsylvania tax form, it is listed under "Interest."

Borrowing from a Life Insurance Policy

When you borrow from a life insurance policy, neither federal nor Pennsylvania state income tax is applicable. However, if you surrender the policy or let it lapse with an outstanding loan, and the loan amount plus the amount received is more than the premiums paid, you may be subject to taxation. Both federal and state authorities consider the loan amount as income received at the time of surrender.

Life Insurance in the Estate of the Deceased

Life insurance is included in the estate of the deceased if they owned the policy. For 2011 and 2012, the federal government provided a $5 million exclusion for all estates. This means that if the total value of the estate, including life insurance, is less than $5 million, there is no federal estate tax.

Life Insurance Proceeds: Florida's Tax Laws Explained

You may want to see also

Cash value of life insurance policies is taxable under certain conditions

In Pennsylvania, life insurance proceeds are generally not taxable. However, the cash value of life insurance policies can be taxable under certain conditions. This is separate from any death benefit, which is typically not taxed.

The cash value of a life insurance policy may be paid out to the policy owner if they outlive the maturity age specified in the policy, often 95 or 100 years old. This payout may be taxed as ordinary income on the amount that exceeds the owner's cost basis (the sum of after-tax premiums paid). This means that if the cash value payout is more than the total amount of premiums paid, the excess amount may be taxable.

Additionally, if you borrow against your life insurance policy and subsequently surrender it or let it lapse, you may have to pay taxes on the loan amount if the total payout, including the loan, is more than the total amount of premiums paid. In this case, both the federal government and Pennsylvania consider the loan amount as income received at the time of surrender.

It's important to note that the tax implications of life insurance policies can be complex and may vary depending on individual circumstances. Consulting with a tax professional or financial advisor is always recommended to understand the specific tax consequences of your life insurance policy.

To avoid unexpected tax burdens, policyowners can consider a maturity extension rider, which allows the policy to continue until the death of the insured, or opt for newer policies with higher maturity ages or indefinite periods.

Term Life Insurance: Exclusion Decision Factors

You may want to see also

Life insurance is included in the estate of the deceased

Life Insurance and Its Inclusion in the Estate of the Deceased in Pennsylvania

In Pennsylvania, the proceeds from a life insurance policy are generally not subject to income tax at the state or federal level. However, it is important to understand that life insurance is considered part of the deceased's estate and may be subject to estate taxes, depending on the size of the estate and the specific laws in Pennsylvania.

When an individual passes away, their estate includes all their assets, such as real estate, personal property, investments, and life insurance. The value of the estate is important, as it determines whether estate taxes will be owed to the state and federal governments. In Pennsylvania, life insurance proceeds are generally included in the value of the estate, which can increase the overall value and potentially push it into a taxable range.

The inclusion of life insurance in the estate can have significant tax implications, especially for larger policies. While there is currently no estate tax at the federal level, Pennsylvania does have an estate tax with a relatively low exemption threshold. This means that if the value of the estate, including life insurance proceeds, exceeds this threshold, the estate may owe taxes to the state.

It is important for individuals to consider the potential tax implications when planning their estate and designating life insurance beneficiaries. Strategies such as establishing a trust or naming beneficiaries other than the estate can help minimize the tax burden on beneficiaries and ensure that the proceeds are distributed according to the individual's wishes.

Life Insurance and Subrogation: What's the Verdict?

You may want to see also

Pennsylvania inheritance tax must be paid within nine months of the decedent's death

In Pennsylvania, inheritance tax returns are due within nine calendar months of a person's death. The individual responsible for filing the return and paying the tax is the person named in the will as the executor. If the person dies without a will, the individual who is approved as administrator by the register of wills after a petition is filed will be responsible. If no executor or administrator is named, and there is property or transfers involved, then the person receiving the property is required to file a return and pay the tax.

The Pennsylvania inheritance tax rate varies depending on the relationship of the beneficiary to the deceased. Transfers to direct descendants (lineal heirs) are taxed at 4.5%, transfers to siblings are taxed at 12%, and transfers to other heirs are taxed at 15%. Property owned jointly between a husband and wife is exempt from inheritance tax, and property inherited from a spouse or from a child aged 21 or younger by a parent is taxed at a rate of 0%.

It is important to note that life insurance proceeds are generally not subject to Pennsylvania inheritance tax, as long as they are not in the form of an annuity. Additionally, the proceeds are not taxable according to state income tax laws. However, if the beneficiary receives interest on the life insurance proceeds, they may be required to pay taxes on that interest, reporting it as "Interest" on both federal and Pennsylvania tax forms.

To ensure compliance with Pennsylvania inheritance tax laws, it is recommended to consult official sources, such as the Pennsylvania Department of Revenue, for the most up-to-date information.

Fibromyalgia's Impact: Life Insurance Considerations and Challenges

You may want to see also

Frequently asked questions

No, life insurance proceeds are not taxable in Pennsylvania.

Yes, if the deceased owned the policy, life insurance is included in their estate.

No, the death benefit from life insurance is exempt from Pennsylvania inheritance tax.

Yes, if the amount you receive is more than the amount you paid in premiums, you will have to pay taxes on the cash value.

No, you don't have to pay tax on a loan from a life insurance policy. However, if you surrender the policy later or let it lapse and it has a loan, you might have to pay tax if the loan amount plus the amount you receive is more than you paid in premiums.