Life insurance is a significant step in one's life, and it's natural to have questions about it. One of the most important questions is whether the payout on your life insurance is taxed and if your beneficiaries will need to pay taxes on it. The answer is that while the payout from a life insurance plan is typically tax-free, there are circumstances in which it can be subject to inheritance tax. This tax is usually payable on all assets that are part of your estate, and the threshold for paying this tax is an essential consideration when setting up a life insurance plan.

What You'll Learn

Life insurance payouts are usually tax-free

In the UK, the inheritance tax threshold is currently £325,000 per person. So, if the total value of the estate, including the life insurance payout, is more than £325,000, then any amount above this threshold may be taxed at 40%. For example, if the insured person's estate is worth £300,000 and they have a life insurance policy worth £200,000, the total value of the estate is £500,000. This exceeds the tax-free threshold by £175,000. The beneficiary would have to pay inheritance tax on this amount, resulting in a tax bill of £70,000.

To avoid paying inheritance tax on a life insurance payout, you can set up a trust. Placing a life insurance policy under trust separates the payout from the rest of the estate, and it is not subject to inheritance tax. This also ensures that the money goes directly to the intended beneficiaries and can provide quicker access to the funds as it avoids the probate process. However, setting up a trust can be complex, and it is recommended to seek advice from a solicitor or independent financial adviser.

It is important to consider the potential tax implications when taking out a life insurance policy. While the payout is usually tax-free, there may be circumstances where inheritance tax becomes a factor. By understanding these tax implications, individuals can make informed decisions and ensure that their loved ones receive the maximum benefit from the life insurance payout.

FEMA: Flood Insurance and Life-of-Loan Monitoring Explained

You may want to see also

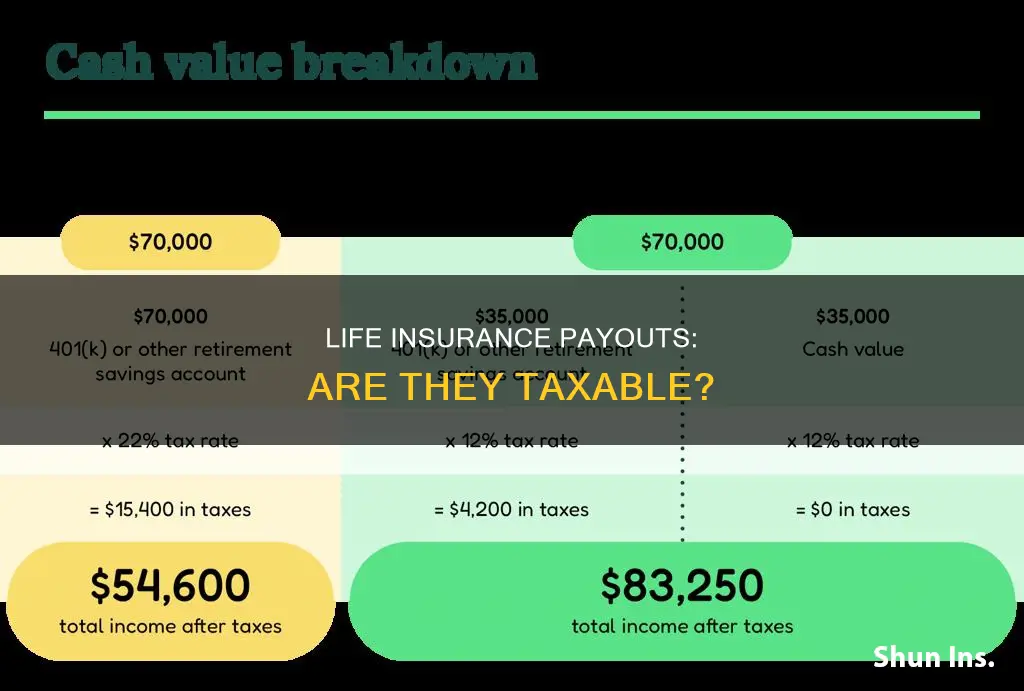

Payouts can be taxed as income

While life insurance payouts are typically tax-free, certain circumstances can lead to these payouts being taxed as income. This typically occurs when the payout is subject to inheritance tax, which is a tax levied on assets that form part of an individual's estate. If the combined value of the life insurance payout and the existing estate exceeds the threshold for paying inheritance tax, then the amount exceeding the threshold becomes liable for taxation.

In the UK, the inheritance tax threshold is currently set at £325,000 per person. Therefore, if the total value of an individual's estate, including the life insurance payout, surpasses this amount, the excess may be taxed at a rate of 40%. For example, if a person has an estate worth £300,000 and receives a life insurance payout of £50,000, the total value becomes £350,000, which is £25,000 over the threshold. As a result, the beneficiaries might have to pay £10,000 in inheritance tax.

To mitigate this tax liability, individuals can place their life insurance policies under a trust. By doing so, the payout is separated from the estate and is typically exempt from inheritance tax. This approach also ensures that the intended beneficiaries receive the correct amount promptly, without having to wait for probate. However, it is important to note that placing a life insurance policy in trust can be complex, and it is recommended to seek advice from a solicitor or an independent financial adviser before proceeding.

It is worth noting that the rules and thresholds for inheritance tax may vary depending on the country or region. Additionally, there are specific conditions and exemptions, such as the ability to leave the primary property to a spouse without tax implications in the UK. Therefore, it is always advisable to consult with a financial professional to understand the specific tax implications based on your circumstances.

While income tax is generally not applicable to life insurance payouts, certain scenarios can lead to taxation. For instance, if the life insurance policy is considered an investment or if the payout is particularly large, it may be subject to income tax. Additionally, if the payout is made to a beneficiary who is not a dependent or spouse of the deceased, it could be taxed as income.

Primerica Life Insurance: Does It Pay Out?

You may want to see also

Inheritance tax may apply to the payout

Life insurance payouts are usually exempt from tax. However, in certain circumstances, they can be subject to inheritance tax. This is typically payable on all assets that form part of the deceased's estate, which may include any potential life insurance payout.

If the payout and the existing estate value push the estate over the threshold for paying inheritance tax, then any amount over the threshold would be liable for inheritance tax. This is a significant amount, currently at 40%. Therefore, careful planning is required to ensure that your beneficiaries receive the maximum benefit from your policy.

One way to mitigate this tax liability is to place a life insurance policy under a trust. A trust will usually separate the payout from your estate, and it will not be subject to inheritance tax. This can be done by completing a trust form, which ensures that the life insurance policy payout is handled separately from your other assets. By assigning a trustee, the beneficiaries you choose will receive the money directly, bypassing potential inheritance taxes and speeding up access to the funds.

It is important to note that setting up a trust can be a complex issue, and it is recommended to seek advice from a solicitor or independent financial adviser before proceeding. Additionally, it should not be done at the last moment as late changes to avoid tax will not be allowed.

How to Increase Your Term Life Insurance Coverage

You may want to see also

Placing a policy in trust can mitigate tax

Placing a life insurance policy under trust is a way to mitigate tax liability. A trust separates the payout from your estate, meaning it is not subject to inheritance tax. Inheritance tax is usually payable on all assets that form part of your estate, which may include any potential life insurance payout. By placing your policy in trust, you can ensure that the money from your policy goes directly to your chosen beneficiaries, bypassing potential inheritance taxes. This arrangement also facilitates quicker access to the funds since it avoids the probate process.

To place your life insurance policy in trust, you will need to complete a trust form. This is a straightforward process that can be done for free through some insurance companies, such as Caspian Insurance. They will have standard trust wordings and will guide you through the process step by step. You can also seek advice from an independent financial advisor to find a solution that works best for your specific circumstances.

It is important to note that if you are diagnosed with a terminal illness, you cannot make last-minute changes to your policy to avoid tax. Additionally, the transfer of the life insurance policy into trust may be considered a gift and could use up a portion of your gift tax exemptions, so it is advisable to work with an attorney and tax advisor.

By placing your life insurance policy in trust, you can ensure that your loved ones receive the maximum benefit from the policy and avoid the additional burden of taxes during an already difficult time.

GSK Retirement Benefits: Life Insurance Coverage Explained

You may want to see also

Tax implications vary for qualifying and non-qualifying policies

The tax implications of a life insurance payout depend on whether the policy is a qualifying or non-qualifying one. For tax purposes, this is the most important distinction.

Qualifying policies

Qualifying policies generally have a minimum term of 10 years, with fairly even premiums payable at regular intervals such as weekly, monthly or annually. If the policy was taken out on or after 21 March 2012, or taken out before that date and varied afterwards, the premiums payable in any 12-month period by any beneficiary for all such policies must be less than £3,600 per year.

Qualifying policies generally do not give rise to chargeable event gains. If your insurer has sent you a chargeable gains certificate, it could be because the policy has been surrendered or premiums have ceased within the first 10 years of the policy, the £3,600 premium limit has been breached, or a statement to this effect has not been made to the insurer, or the policy has been purchased from a third party.

Non-qualifying policies

Non-qualifying policies are all policies that are not qualifying policies. Often these will be single premium life insurance policies, although additional premiums may be allowed. Non-qualifying policies often give rise to gains.

Inheritance tax

The main form of tax that can affect the payout of a life insurance policy is inheritance tax. This tax is usually payable on all assets that form part of your estate, which may include any potential life insurance payout. If you hope to mitigate tax liability, consider placing a life insurance policy under trust. A trust will usually separate the payout from your estate and will not be subjected to inheritance tax.

Life Insurance and FDIC: What's Covered?

You may want to see also

Frequently asked questions

Life insurance payouts are usually exempt from tax. However, in certain circumstances, they can be subject to inheritance tax.

Inheritance tax is a tax on the estate of the person who passed away, which may include any potential life insurance payout. The current rate of inheritance tax is 40%.

You can avoid paying inheritance tax by placing your life insurance policy under a trust. A trust will separate the payout from your estate, meaning it won't be subject to inheritance tax.

Setting up a trust for your life insurance policy can be complex, so it's recommended that you seek advice from a solicitor or independent financial adviser. They will be able to guide you through the process and ensure that your trust is set up correctly.