If you have been diagnosed with lymphoma, it is possible to find life insurance approval, but it may be challenging. People with a history of cancer may find it more difficult to get life insurance, and insurers have strict guidelines for pre-existing medical conditions. The type of cancer, the stage it is at, and the treatments used are all factors that insurers consider when assessing applications. Life insurance approval is more likely if the individual has been in remission or cancer-free for several years. The waiting period varies among insurers and depends on several factors, including the diagnosis, prognosis, stage, grade, age, and overall health of the individual.

What You'll Learn

Life insurance approval for Hodgkin's and Non-Hodgkin's Lymphoma patients

Yes, it is possible to get life insurance approval if you have been diagnosed with Hodgkin's Lymphoma or Non-Hodgkin's Lymphoma. However, life insurance companies have strict guidelines for pre-existing medical conditions, and you will automatically be declined traditional coverage if you are still receiving treatment.

The rating factors or information required by an insurer may include:

- Date and details of the initial diagnosis

- Date of final treatment and the manner in which the cancer was treated

- The stage and/or subcategory of the type of cancer diagnosed

- Whether there has been any recurrence and applicable details

- Medications and any other types of treatment that were used

- Evidence of appropriate follow-up exams

- Any other health issues

For Hodgkin's Lymphoma, early-stage cancer may be insurable as soon as 1 year after successful treatment. For other Lymphomas, you will only be considered for a life insurance policy if you are in remission or have been cancer-free for 3 or more years.

The waiting period will vary from insurer to insurer and will depend on the diagnosis and prognosis of the disease, the stage and grade of the cancer, along with your age and overall health.

Some insurers may add a surcharge or flat rate on top of your premium for an indeterminate period if you apply near or have just completed the required waiting period. The longer you have been cancer-free, the better the rating. However, the best you can hope for, even under optimum conditions, is a "standard" rating.

You can find affordable life insurance approval with lymphoma by going through an independent insurance agent. They will have access to multiple life insurance companies and will know which ones are more liberal when it comes to issuing a policy for someone with a health condition. An experienced agent can help you find the best offer by negotiating between carriers that specialize in underwriting this particular type of risk.

Life Insurance: Credit Rating Impact and You

You may want to see also

Factors that affect life insurance approval for cancer patients

Being diagnosed with cancer can be life-changing, and it's natural to start thinking about your future and your family's financial stability. If you're wondering about life insurance options as a cancer patient or survivor, several factors will determine your eligibility and the cost of coverage.

Type and Stage of Cancer

The type and stage of cancer play a significant role in your life insurance options. Insurers classify cancers based on their aggressiveness and severity, as some types have higher survival rates than others. For instance, early-stage breast cancer is viewed differently from early-stage pancreatic cancer due to differences in treatment success rates.

Treatment History and Response

Your treatment history and response are crucial factors. Insurers will want to know about the treatments you've undergone, such as chemotherapy, radiation therapy, surgery, or immunotherapy, and how your body has responded to them. Positive responses to treatment may result in lower premiums.

Time Since Diagnosis and Remission

The duration since your cancer diagnosis and the length of your remission period are essential considerations. Many insurers require cancer survivors to be in remission for a certain period, typically ranging from one to five years, before offering coverage. The longer you've been cancer-free, the better your chances of securing affordable coverage.

Age and Overall Health

Your age and overall health are fundamental factors in life insurance approval. Other health complications or pre-existing conditions can impact your eligibility and premiums. Insurers will also consider your family medical history, especially if certain types of cancer have a strong hereditary pattern.

Type of Life Insurance

The type of life insurance policy you're seeking also matters. Traditional term and whole life insurance policies are typically designed for individuals in good health, so active cancer patients may find these options prohibitively expensive or even inaccessible.

On the other hand, cancer patients may find alternative options like guaranteed issue life insurance, burial insurance, or group life insurance more accessible. These policies often don't require medical exams and can provide coverage for final expenses and funeral costs.

Cancer-Specific Details

Insurers will also consider cancer-specific details when evaluating your application:

- The type of cancer and its stage

- Date of diagnosis and treatment

- Treatment methods and response

- Whether the cancer has metastasized

- History of cancer recurrence

- Oncologist's assessments and medical reports

Foresters Life Insurance: AM Best Rating and What It Means

You may want to see also

Life insurance after a cancer diagnosis

A cancer diagnosis can be emotionally distressing for patients and their families. The stress of treatment and keeping track of health expenses can be overwhelming. This is why life insurance for people with cancer can be particularly helpful, especially if you are the main source of income for your dependents.

Yes, it is possible to get life insurance after a cancer diagnosis, but it may not be easy. Since cancer patients are considered high risk, life insurance policies may be more expensive.

Several factors determine the availability and cost of life insurance for cancer patients. These include the type and stage of cancer, treatment methods, and time since the last treatment.

The National Cancer Institute's SEER database, which provides information on survival rates and life expectancy based on diagnosis and stage, is often consulted by insurance companies. Less treatable forms of cancer, such as pancreatic cancer, may result in significantly higher premiums.

Additionally, insurance companies may require details about the initial diagnosis, treatment methods, recurrence, medications, follow-up exams, and other health issues.

There are a few options for life insurance for cancer patients:

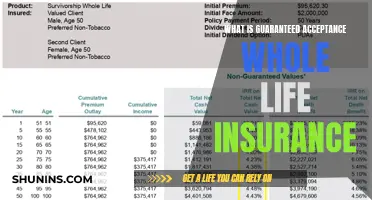

- Guaranteed issue life insurance: This type of policy does not deny coverage based on pre-existing conditions and usually does not require medical questions or history. However, premiums may be higher to balance out the risk.

- Group life insurance: This can be accessed through your employer and often comes in the form of guaranteed issue, meaning you are less likely to be penalized for your cancer diagnosis.

- Term life insurance: This type of policy lasts for a set number of years and may be more affordable, but it can be difficult to qualify for.

- Whole life insurance: This policy has no end date but may also be challenging to qualify for and typically comes with higher premiums.

- Specialist insurers: If you are unable to obtain life insurance through standard insurers, there are specialist companies that cater specifically to cancer patients and survivors.

It is important to be honest with your insurance provider about your health to increase the chances of your claims being accepted. Additionally, if you have existing insurance policies, it is essential to review them to understand how your cancer diagnosis may impact your coverage.

Furthermore, cancer patients may also want to consider critical illness cover, income protection, and travel insurance, which can be obtained through specialist insurers if necessary.

Lymphoma and Life Insurance

For those specifically diagnosed with lymphoma, it is important to know that Hodgkin's Lymphoma and Non-Hodgkin's Lymphoma are both forms of cancer that affect the lymphatic system. Life insurance companies will consider the specifics of your diagnosis, treatment, and prognosis when determining your eligibility and rates.

While it may be challenging to obtain traditional coverage if you are currently undergoing treatment, there are guaranteed issue life insurance policies available that do not consider health status. However, these policies are typically recommended for individuals with a life expectancy of at least two years.

For early-stage Hodgkin's Lymphoma, you may be insurable as soon as one year after successful treatment. For other types of lymphoma, you will generally need to be in remission or cancer-free for three or more years to be considered for a life insurance policy.

The waiting period and rating will depend on various factors, including the diagnosis, stage, grade of cancer, age, and overall health. Insurers may also add a surcharge or flat rate on top of your premium if you apply near or have just completed the required waiting period.

Seeking Expert Advice

Given the complexity of life insurance options for cancer patients, it is advisable to consult independent insurance agents or specialist high-risk insurance advisers. They can guide you through the process, help you navigate the requirements of different insurance companies, and find the most suitable policy for your specific circumstances.

Sony's Life Insurance Offering: Should You Buy It?

You may want to see also

Life insurance and critical illness cover

If you have been diagnosed with lymphoma, it is important to check your existing life insurance policy or ensure that a new policy suits your needs. Life insurance is useful for paying off debts, such as a mortgage, and providing financial support for your family after you die. Some life insurance policies include terminal illness cover, which allows you to make a claim if you are diagnosed with a terminal illness and have less than 12 months to live. The insurer will pay out immediately, and you can keep the payout even if you live longer. Check with your insurer to see if this is included in your policy.

Life Insurance After Lymphoma

Getting life insurance after a lymphoma diagnosis can be challenging and may affect the type of policy you can apply for. If your diagnosis occurred recently, you may find that your rates are significantly higher for traditional term and whole life insurance policies, or your application may be rejected. However, there are guaranteed issue life insurance policies that do not require a medical examination and may still be an option for you. It is important to note that your life expectancy should be at least two years for these policies to be a viable option.

Waiting Periods

The waiting period for life insurance after lymphoma varies from insurer to insurer and depends on several factors, including the diagnosis, prognosis, stage, and grade of the cancer, as well as your age and overall health. For Early Hodgkin's Lymphoma, you may be insurable as soon as one year after successful treatment. For other types of lymphoma, you will typically need to be in remission or cancer-free for three or more years before being considered for a life insurance policy.

Non-Standard Rates

If your lymphoma and/or treatment ended recently, or if the staging and grading of the tumour were of high severity, you may be offered life insurance at non-standard rates. This means that your premiums will be increased compared to someone who has not had lymphoma. Over time, as the period since your lymphoma diagnosis increases, the insurer is likely to reduce the increased premium.

Critical Illness Cover

Critical Illness Cover may be available from some insurers once you are a few years past your last treatment for lymphoma. The insurer will ask for a report from your doctor to establish the full extent of your condition, including the staging and grading of the tumour, treatments undertaken, lasting complications, and the time since you were given the all-clear. It is likely that a cancer exclusion will be placed on your policy, which means that claims relating to cancer will not be covered. While this may not seem ideal, it is important to note that the Critical Illness policy typically covers many other serious conditions, such as heart attack, stroke, Parkinson's disease, and multiple sclerosis.

Specialist Insurers

If your lymphoma was of a high grading or staging, Critical Illness Cover may not be available from standard market insurers. However, there are specialist insurers that you can arrange Critical Illness insurance through to ensure you have the cover you need.

Life Insurance: When It's Not Worth the Cost and Commitment

You may want to see also

Income protection for cancer patients

Cancer patients may be able to secure income protection, but this depends on several factors. Firstly, it is important to understand the financial impact of cancer. Cancer treatment is often complex and expensive, leading to high healthcare costs and financial hardship for patients and their families. This is especially true for individuals with limited incomes, who experience significantly higher healthcare expenditures than those without a cancer diagnosis.

Sources of Income Protection

For cancer patients who are unable to work due to their illness, there are a few options for income protection:

- Supplemental Security Income (SSI): This program is designed to help people who cannot work due to disabilities, which includes cancer patients under the Americans with Disabilities Act (ADA).

- Social Security Disability Insurance (SSDI): Cancer patients may qualify for SSDI if they are unable to work due to their illness.

- Temporary Assistance for Needy Families (TANF): TANF is a grant program that provides monthly payments to help with basic needs, including food, housing, utilities, and medical supplies not covered by Medicaid.

- Specialist Income Protection Policies: Some insurance companies offer specialist income protection policies for individuals with cancer, although the acceptance criteria can be strict and may not suit everyone.

Factors Affecting Income Protection

When applying for income protection, cancer patients will need to provide details such as the staging and grading of the cancer, treatments undertaken, and the time since the last treatment. The availability and cost of income protection can vary depending on these factors:

- Staging and grading of cancer: Low staging cancer with a good amount of time since treatment may result in standard terms for income protection. Higher staging cancer or more recent treatment may lead to higher premiums or a cancer exclusion on the policy.

- Treatment details: The types of treatment received, such as chemotherapy or radiotherapy, can impact the availability and cost of income protection.

- Time since treatment: Most income protection policies require a certain amount of time to have passed since the last treatment, usually a number of years. The longer the time since treatment, the better the rating and the lower the premium.

Additional Support

In addition to income protection, cancer patients may be able to access other forms of support to help with the financial burden of their illness:

- Housing assistance: The American Cancer Society Hope Lodge® offers free housing for families receiving cancer treatment far from home. Other organizations, such as Extended Stay America and the Healthcare Hospitality Network, offer discounted or low-cost housing options.

- Transportation assistance: The American Cancer Society's Road To Recovery program provides transportation to treatment centers through trained volunteers. Other organizations, such as the Leukemia & Lymphoma Society and Mercy Medical Angels, also offer transportation assistance or cost coverage.

- Food assistance: Government programs such as the Supplemental Nutrition Assistance Program (SNAP) and Meals on Wheels can provide food or food costs assistance for low-income individuals and families affected by cancer.

- Dental care assistance: NeedyMeds and the US Department of Health and Human Services provide resources to help cancer patients access free or reduced-cost dental care.

- Other expenses: Church groups, community organizations, and social workers can often provide information and support for other expenses, such as internet access, caregiver expenses, and mortgage payments.

It is important to note that the availability and specifics of income protection and support services may vary depending on the patient's location and individual circumstances. Seeking advice from a financial specialist or cancer support organization can help cancer patients understand their options and apply for the most suitable income protection and support services.

Understanding MEC: Life Insurance's Essential Clause

You may want to see also

Frequently asked questions

Yes, it is possible to get life insurance approval if you have had lymphoma. However, life insurance companies have strict guidelines if you have had any pre-existing medical conditions.

You can get life insurance by going through an independent insurance agent. They will have access to multiple life insurance companies and will know which ones are more liberal when issuing a policy for someone with lymphoma.

The rating factors or information required by an insurer may include:

- Date and details of the initial diagnosis

- Date of final treatment and the manner in which the cancer was treated

- The stage and/or subcategory of the type of cancer diagnosed

- Whether there has been any recurrence and applicable details

- Medications and any other types of treatment that were used

- Evidence of appropriate follow-up exams

- Any other health issues