Colonial Life Insurance policyholders can cancel their coverage, but they must do so in writing to the attention of Employee Benefits during annual open enrollment. Policyholders can also contact Colonial Life Insurance's customer support for assistance with their plans. To request a cancellation, policyholders can submit a Request for Service Form or call customer support at 800-325-4368.

| Characteristics | Values |

|---|---|

| How to cancel Colonial Life Insurance | To cancel Colonial Life Insurance, you must submit a written request to the attention of Employee Benefits during annual open enrollment. |

| Customer Service Contact | For questions about plan coverage, premium changes, or any other queries, contact Colonial Life Insurance Customer Service at 1-800-325-4368. |

| Online Support | Policyholders can access their accounts and get support through the Colonial Life for Policyholders portal, available 24/7 on any device. |

| Request for Service Form | You can use this form to update policy details or maintain your policy if premiums are no longer being deducted from your paycheck. |

What You'll Learn

- Cancelling a Colonial Life insurance policy requires a written request

- Contact Colonial Life Insurance Customer Service with any questions

- Policyholders can access claims and benefits resources online

- To keep your policy, complete a Request for Service Form

- You can request a cancellation of your life policy using Form #73712

Cancelling a Colonial Life insurance policy requires a written request

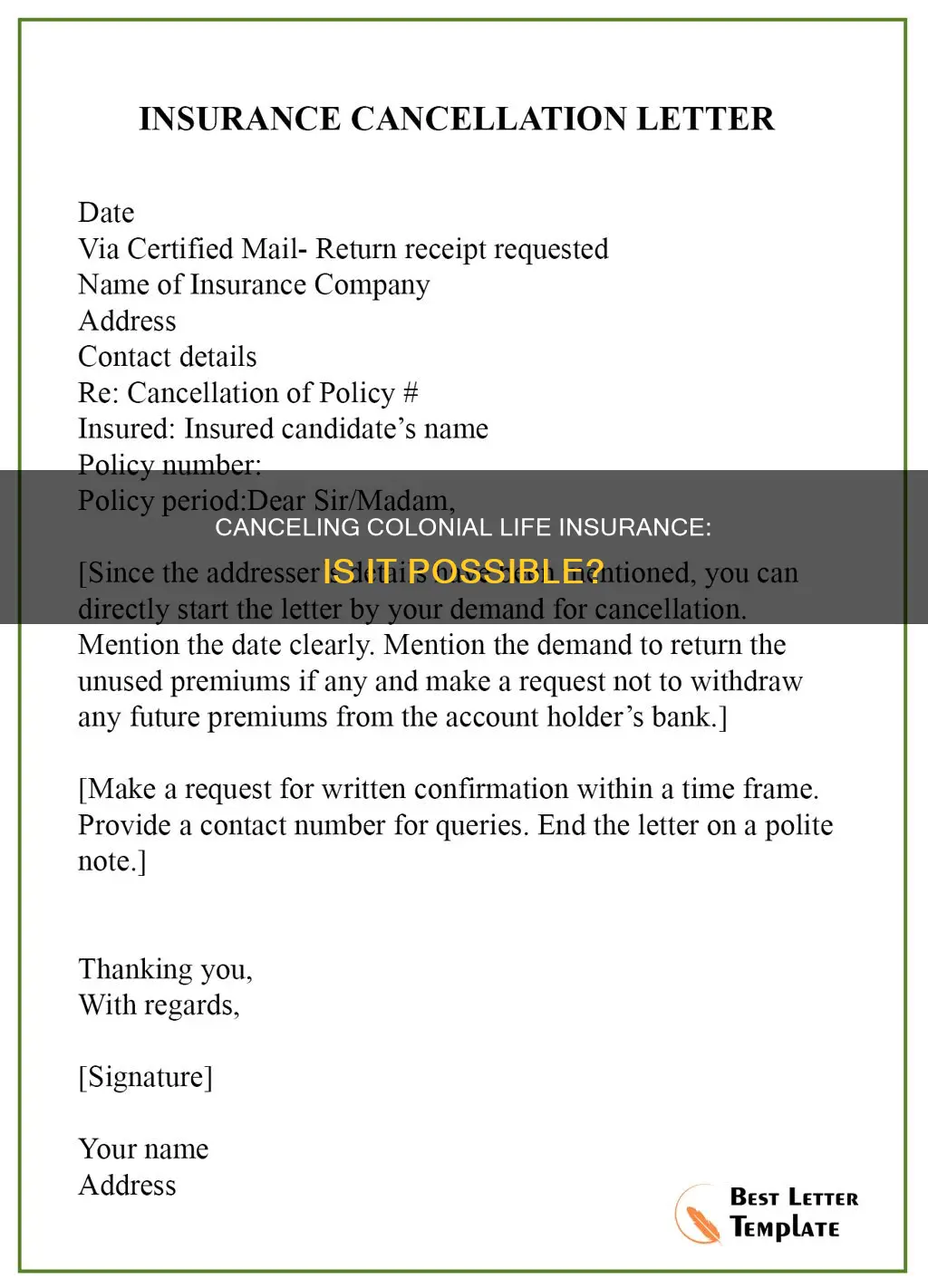

Cancelling a Colonial Life insurance policy is a straightforward process, but it does require a written request. This is in line with industry standards and ensures the security and protection of policyholders. Here are the steps to follow to cancel your Colonial Life insurance policy:

Initiating the Cancellation Process

To initiate the cancellation process, you must submit a written request to the attention of Employee Benefits. This request should be made during the annual open enrollment period. Your written request is a formal expression of your intention to cancel your insurance policy and is the first step in the process.

Contacting Customer Service

After submitting your written request, you should contact Colonial Life Insurance Customer Service at 1-800-325-4368. Their customer support team is available Monday through Friday, 8 a.m. to 8 p.m. ET, and can provide you with any necessary guidance or answer any questions you may have about the cancellation process.

Completing the Request for Service Form

To complete the cancellation of your Colonial Life insurance policy, you will need to fill out a Request for Service Form. This form can be found on the Colonial Life website or by contacting customer support. The form allows you to request changes to your personal data and exercise policy provisions, including cancellations.

Additional Information

It's important to note that, as per Colonial Life's guidelines, you can only make changes to your existing policy; you cannot increase your coverage or enrol in a new policy. Additionally, your ability to maintain coverage after cancelling your policy may depend on your specific policy guidelines and administrative regulations.

Remember to carefully review your policy and understand the implications of cancelling your Colonial Life insurance. If you have any doubts or concerns, don't hesitate to reach out to their customer support team for clarification.

Term Life Insurance: Outliving Your Policy

You may want to see also

Contact Colonial Life Insurance Customer Service with any questions

If you have any questions about your Colonial Life Insurance policy, there are several ways to contact customer support. The company offers a 24/7 policyholder portal that can be accessed from any device. Here, you can access policy details and coverage information, file claims, check claim status, and receive updates via text or email.

You can also call customer support at 1-800-325-4368, Monday through Friday, 8 a.m. to 8 p.m. ET. This line has live chat support and Spanish-speaking representatives. Additionally, you can fax claims information to 800-880-9325 or mail them to:

Colonial Life & Accident Insurance Company

P.O. Box 1365

Columbia, SC 29202-1365.

For those who prefer to manage their policies online, the ColonialLife.com website offers a range of self-service options. These include registering for an account, enrolling in coverage, filing a claim, making payments, viewing claim and policy status, and keeping your policies if your employer is no longer deducting premiums.

If you are an employee with coverage through Colonial Life Insurance and wish to cancel or drop your coverage, you must do so in writing to the attention of Employee Benefits during annual open enrollment. Be sure to contact Colonial Life Insurance Customer Service with any questions or concerns about your plan coverage, premium changes, or other matters.

Withholding Tax: Does It Affect Your Life Insurance?

You may want to see also

Policyholders can access claims and benefits resources online

Colonial Life offers a range of benefits and resources to its policyholders, making it easy and convenient for them to access their claims and benefits information online.

The Colonial Life for Policyholders portal is a one-stop shop that provides 24/7 access to policyholders' benefits and claims information from any device. Policyholders can log in to their personalized dashboard to view their benefits, file claims, check the status of their claims, and update their communication and payment preferences. The portal offers a quick and intuitive way to manage benefits and claims, saving time and providing a simplified experience.

Filing a claim online is a straightforward and user-friendly process. Policyholders can log in, access the Claims Center, and click the "File an Online Claim" button to initiate the process. Various types of claims can be filed online, including wellness, doctor's office visits, accidents, pregnancy, sickness, and vision claims. Policyholders can also download claim forms and find answers to their claims-related questions.

Additionally, the Colonial Life website offers educational resources, such as custom websites, digital benefit booklets, and digital postcards, catering to different learning styles. These resources empower policyholders to make the most of their benefits and make informed decisions.

For those who cannot file their claims online, Colonial Life provides alternative options. Policyholders can fax their claims information to the company and utilize the available service forms to update policy details or maintain their policies if premiums are no longer being deducted.

Colonial Life's online platform streamlines the process of accessing claims and benefits information, providing policyholders with convenience, efficiency, and a user-friendly experience.

Who Can Be Your Life Insurance Nominee?

You may want to see also

To keep your policy, complete a Request for Service Form

To keep your Colonial Life Insurance policy, it is recommended that you complete a Request for Service Form and send it to the Colonial Life Insurance office for processing. This form can be used to request changes to personal data or to exercise policy provisions. You can also use this form to update your payment method and continue your coverage if premiums are no longer being deducted from your paycheck. For example, if you are on a leave of absence and your employer will not be sending your premiums to Colonial Life, you will need to complete this form to change your policy to be paid on an individual payment basis.

The Request for Service Form can be found on the Colonial Life website. You can also access policy details, coverage information, and file claims by logging into your online account. If you have not viewed your policy recently, it may be archived, in which case you should wait a few minutes and try again. You can also call customer support at 800-325-4368, Monday through Friday, 8 a.m. to 8 p.m. ET, or fax claims information to 800-880-9325.

It is important to note that your ability to maintain coverage after your employer stops deductions is determined by your policy and/or administrative guidelines. If you are on a leave of absence, your ability to continue coverage is addressed in the policy and/or guidelines as well. In some cases, no action is necessary to continue coverage during a leave of absence, but if your leave is three months or less and your employer will not be sending premiums, you will need to send your premium payment directly to Colonial Life.

Remember, if you wish to cancel your Colonial Life Insurance coverage, you must do so in writing to the attention of Employee Benefits during annual open enrollment.

Life Insurance Endowments: Taxable or Not?

You may want to see also

You can request a cancellation of your life policy using Form #73712

If you want to cancel your Colonial Life Insurance policy, you must do so in writing. You can request a cancellation of your life policy using Form #73712, which is a Request for Service – Life form. This form can be used to request a loan, withdrawal, or cancellation/surrender of your life policy. To obtain this form, you can contact Colonial Life Insurance Customer Service at 1-800-325-4368. They are available Monday through Friday, from 8 a.m. to 8 p.m. ET.

Additionally, it is important to note that employees who want to cancel their coverage must do so during annual open enrollment. This means that there is a specific time frame each year within which you can submit your cancellation request.

When you contact customer service, you can inquire about the specific process for submitting Form #73712, including any additional requirements or steps that may be necessary. You can also clarify any questions regarding your plan coverage, premium changes, or other related topics.

Remember to carefully review the terms and conditions of your policy before initiating the cancellation process, as there may be specific provisions or consequences associated with ending your coverage.

Life Insurance Beneficiary: Understanding the Certificate

You may want to see also

Frequently asked questions

You can cancel/drop your coverage by submitting a written request to the attention of Employee Benefits during annual open enrollment.

Yes, you can contact Colonial Life Insurance Customer Service at 1-800-325-4368 for any questions related to your plan coverage, premium changes, or any other queries.

Yes, you can use the Request for Service Form to request changes to your personal data or to exercise policy provisions, including cancellations/surrender of your life policy.