Life insurance is a financial tool that can be used to protect your loved ones and provide them with financial support after you pass away. It is a contract between a policyholder and an insurance company, where the insurer pays out a death benefit to the beneficiaries when the insured person dies. While the primary purpose of life insurance is to provide a financial safety net for dependents, it can also be used as a financial asset during the policyholder's lifetime.

There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, such as 10, 15, 20, or 30 years, and is generally more affordable. On the other hand, permanent life insurance offers lifetime coverage and includes a cash value component that grows over time. This cash value can be accessed by the policyholder during their lifetime through loans or withdrawals.

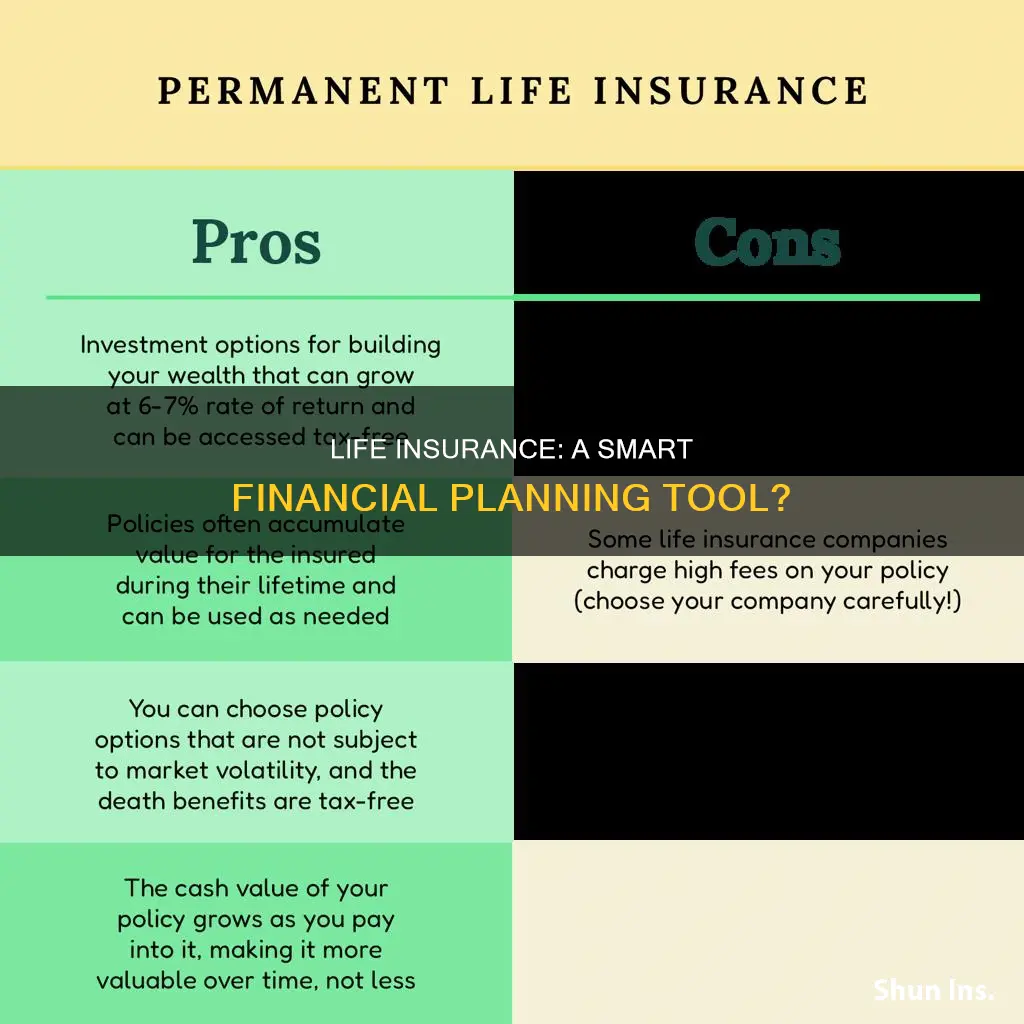

Permanent life insurance policies, such as whole life and universal life insurance, can serve as a financial asset similar to an IRA or mutual fund. Policyholders can borrow against the cash value, use it as collateral for loans, or withdraw funds. Additionally, permanent life insurance offers tax advantages, such as tax-deferred growth of cash value and tax-free dividends.

When considering life insurance as a financial tool, it is important to weigh the benefits against potential disadvantages. Life insurance policies may have higher premiums compared to other investment options, and the investment returns on cash value policies might be lower than expected. It is crucial to carefully review the terms and conditions of the policy to understand the associated risks and benefits fully.

| Characteristics | Values |

|---|---|

| Type | Term life insurance, permanent life insurance (whole life insurance, universal life insurance) |

| Purpose | Income replacement for survivors, investment/forced savings, reduced income and transfer tax liability, funding of small business buy/sell agreements, financial asset during the lifetime of the insured |

| Advantages | Death benefit, cash value/savings, tax advantages, loan collateral, loan, withdrawal, "accelerated" benefits, cash out |

| Disadvantages | Overpriced, poor investment returns, lack of tax advantages, unethical insurance agent, emotional factors |

What You'll Learn

- Life insurance as a financial tool for income replacement for survivors

- Life insurance as an investment/forced savings for the insured

- Life insurance as a way to reduce income and transfer tax liability

- Life insurance as a source of cash for small business buy/sell agreements

- Life insurance as a financial tool for retirement income

Life insurance as a financial tool for income replacement for survivors

Life insurance is a financial tool that can be used to replace lost income and support survivors in the event of the policyholder's death. It ensures that the deceased's loved ones can maintain their standard of living and meet immediate needs and long-term financial goals. Here's how life insurance works as a financial tool for income replacement:

Determining the Coverage Amount

The income replacement approach is a method used to calculate the appropriate amount of life insurance coverage. It considers the future earnings stream of the insured breadwinner, taking into account factors such as age, current income, anticipated salary growth, inflation, and the number of years of income to be replaced. This calculation provides an estimate of the insurance needs, ensuring that the coverage amount is sufficient to replace the lost income.

Types of Life Insurance

There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance covers a specific period, such as 10, 20, or 30 years, and is typically more affordable. Permanent life insurance, on the other hand, remains in effect for the insured's entire life, provided premiums are paid. It is more expensive but offers additional benefits, such as accumulating cash value over time.

Benefits of Life Insurance for Income Replacement

Life insurance provides financial stability for survivors by replacing the income of the deceased. It helps cover essential expenses, such as mortgage payments, utility bills, and daily living costs, and education expenses. Life insurance can also supplement other benefits, such as Social Security or worker's compensation, ensuring that survivors have sufficient funds to maintain their standard of living.

Considerations for Income Replacement

When considering life insurance as a financial tool for income replacement, it is important to assess your needs and situation. Factors such as age, health, lifestyle, and income level will impact the cost and coverage of the policy. Additionally, it is crucial to understand the different types of policies, coverage amounts, waiting periods, and potential drawbacks, such as high premium costs or lengthy waiting periods. Seeking advice from a financial planner or insurance advisor can help individuals make informed decisions about their life insurance choices.

Life Insurance at 70: Is It Possible?

You may want to see also

Life insurance as an investment/forced savings for the insured

Life insurance can be used as a financial tool, offering benefits not only when you pass away but also during your lifetime. Permanent life insurance policies, such as whole life insurance and universal life insurance, can serve as valuable financial assets. These policies allow you to build cash value over time, providing access to funds through withdrawals, loans, or by cashing out the policy. Here's how life insurance can be an investment or forced savings for the insured:

Life Insurance as an Investment

Life insurance, particularly permanent life insurance, can be utilised as an investment tool to achieve long-term financial goals. Here's how:

- Diversifying your portfolio: Including permanent life insurance with a cash value component in your investment portfolio helps spread financial risks across different types of investments. It offers a backup plan if your other investments underperform.

- Limiting financial risk: The death benefit and tax-deferred advantages of life insurance policies provide a unique form of risk management not offered by other investments. They are attractive to conservative investors seeking steady growth over time.

- Long-term financial goals: Integrating life insurance into your comprehensive investment plan can enhance long-term financial stability. The cash value component grows over time and could serve as an additional income stream during retirement.

- Tax advantages: The cash value in your policy grows tax-deferred, and you only pay taxes when you make withdrawals. Additionally, death benefits are typically income-tax-free for beneficiaries.

- Asset protection: In several states, permanent life insurance policies are safeguarded from creditors, making them valuable for asset protection strategies, especially for business owners or professionals facing liability issues.

- Potential income streams: A well-managed life insurance policy can provide a steady income stream during retirement through policy loans and withdrawals, resembling a pension plan.

Life Insurance as Forced Savings

Life insurance, specifically whole life insurance, is sometimes promoted as a "forced savings" vehicle. Here's how it works:

- Saving through premiums: When you purchase a whole life insurance policy, you are compelled to put money into a savings account by paying premiums. A portion of these premiums contributes to the cash value of the policy.

- Guaranteed minimum growth: Whole life insurance policies offer a guaranteed minimum growth rate for your cash value. This feature makes it a "safe" investment, as your savings are assured to grow over time.

- Long-term benefit: After consistently paying premiums for several years, you will accumulate a substantial asset. You can utilise this asset to fund retirement or other financial goals.

However, it's important to note that whole life insurance may not be the best option for everyone. The fees associated with whole life insurance policies can be high, and many people end up surrendering their policies due to the financial burden of premium payments. Additionally, the cash value in the early years of the policy is relatively low, and surrender charges may apply if you cancel the policy early. Therefore, it's crucial to carefully consider your financial situation and goals before deciding if whole life insurance aligns with your needs.

Life Insurance: A Legal Obligation or Personal Choice?

You may want to see also

Life insurance as a way to reduce income and transfer tax liability

Life insurance can be used as a financial tool to reduce income and transfer tax liability. Here are some ways in which this can be achieved:

Ownership Transfer:

- Transferring ownership of a life insurance policy to another person or entity can help avoid federal taxation on the proceeds. This requires choosing a competent adult or entity as the new owner and obtaining the proper assignment forms from the insurance company.

- The new owner will be responsible for paying the premiums, but the previous owner can gift them money to cover these payments without incurring gift taxes.

- It is important to note the three-year rule, which states that gifts of life insurance policies made within three years of death are still subject to federal estate tax.

Irrevocable Life Insurance Trusts (ILIT):

- Creating an ILIT is another way to remove life insurance proceeds from your taxable estate. The trust purchases the insurance policy directly, and the proceeds are not included in the estate.

- This option provides more control over the policy and ensures that premiums are paid promptly. It is also useful when the beneficiaries are minor children from a previous marriage, as it allows for the appointment of a trusted family member as trustee.

Choosing the Right Policy:

- Term life insurance policies, which are generally less expensive and valid for a set number of years, do not offer tax benefits.

- Permanent life insurance policies, such as whole life insurance and universal life insurance, can serve as financial assets and provide tax advantages.

- Whole life insurance allows the policyholder to accumulate cash value, similar to a savings account, which can be accessed tax-free while the insured is alive.

- Universal life insurance offers flexible premiums and the ability to invest earnings into accounts of the policyholder's choosing, providing the potential for higher returns.

Tax-Free Death Benefits:

- The death benefit of a life insurance policy is usually tax-free for the beneficiaries, providing a more tax-effective inheritance compared to other financial accounts such as IRAs or qualified retirement plans.

- However, the death benefit may be subject to estate taxes, especially for larger estates.

Tax-Deferred Growth:

- The cash value of permanent life insurance policies grows tax-deferred. Policyholders can withdraw up to their premium payments tax-free.

- Loans against the policy can also be taken out tax-free, helping to keep the policyholder in a lower tax bracket in retirement and prevent taxes on Social Security.

Investment Tax Benefits:

- Permanent life insurance policies offer investment options, such as fixed-interest rates or investing in mutual funds or exchange-traded funds (ETFs).

- Reallocations within the policy and investment gains are not taxable, providing tax-deferred growth for the policyholder.

By utilizing these strategies, individuals can effectively reduce their income and transfer tax liability through the use of life insurance as a financial tool.

Fafsa and Life Insurance: What You Need to Know

You may want to see also

Life insurance as a source of cash for small business buy/sell agreements

Life insurance can be used as a financial tool, and permanent life insurance can be used as a financial asset. Whole life insurance and universal life insurance are the two main types of permanent life insurance that can be used as an asset.

Life insurance-backed buy-sell agreements can help ensure that stable ownership of a business continues even if one of the business owners passes away. A buy-sell agreement is a contract created by business owners to ensure that if one of the members passes away, their ownership interest will be sold to the remaining partners or the company. A life insurance buy-sell agreement requires each owner to take out a life insurance policy that benefits the other members or the business. That way, the proceeds of the policy can be used to pay for the deceased member's ownership interest.

There are two main types of buy-sell agreements: redemption agreements and cross-purchase agreements. In a redemption agreement, the company buys back the ownership interest of the exiting owner. In a cross-purchase agreement, the remaining owners purchase the exiting owner's share. A hybrid agreement provides flexibility in terms of who purchases the exiting owner's share.

Life insurance is often used to fund buy-sell agreements. Each business owner must take out a life insurance policy with the other members or the company as the beneficiary. The face amount of the policy is equal to the value of that member's ownership interest. Should a member die, the policy pays out to the company or remaining owners, providing the funds they need to purchase the deceased member's share.

Life insurance can be a valuable tool for small businesses, helping to ensure stable ownership and providing liquidity for the business and the deceased owner's family.

Life Insurance: Credit Rating Impact and You

You may want to see also

Life insurance as a financial tool for retirement income

Life insurance is primarily a means of providing financial support to your loved ones after you're gone. However, certain types of life insurance can also serve as a financial tool for retirement income. Permanent life insurance policies, including whole life, universal, and variable life insurance, can help you accumulate a source of funds for retirement.

Accumulating Retirement Funds

Permanent life insurance policies allow policyholders to build up a "cash value" over time as they make premium payments. This cash value grows over time and can be a source of retirement income. Withdrawing from the cash value is typically tax-free up to the amount you've paid in premiums.

Borrowing Against the Policy

You can borrow money from the cash value of your permanent life insurance policy. This can be useful if you need funds during retirement, but it will accrue interest and reduce the death benefit paid out to your family.

Paying Premiums with the Policy

If you're a permanent life policyholder, you may be able to use the cash value to pay upcoming policy premiums. This can be helpful if you're on a fixed income during retirement and need to manage your expenses carefully.

Pension Maximization

Married pensioners can choose to accept their full pension and use a portion of the money to purchase life insurance to benefit their spouse. This strategy, known as pension maximization, can provide additional financial security for the surviving spouse.

Supplemental Retirement Income

Life insurance can serve as a valuable source of supplemental retirement income, especially during market downturns. Withdrawing from the cash value of a life insurance policy can help you avoid selling investments at a loss during a bear market.

Tax Advantages

Life insurance offers certain tax advantages that can benefit retirees. The cash value growth within a policy is tax-deferred, and withdrawals up to the amount of premiums paid are typically tax-free. Additionally, permanent life insurance policies provide tax-free death benefits to beneficiaries.

While life insurance can be a useful financial tool for retirement income, it's important to consider the potential drawbacks. The cost of permanent life insurance can be high, and it may not be the most efficient way to save for retirement. It's essential to weigh the benefits against alternatives such as investing in a 401(k) or IRA, which may offer better long-term returns.

Understanding Life Insurance Units: A Comprehensive Guide

You may want to see also