Life insurance is a critical component of a comprehensive financial plan, offering a safety net for your loved ones in the event of your passing. However, it is possible to be denied life insurance due to various reasons, including health conditions, high-risk occupations or hobbies, lifestyle factors, financial considerations, and age or life expectancy. If you are denied life insurance, there are still options available to you, such as mortgage life insurance.

Mortgage life insurance is a special type of insurance policy offered by banks affiliated with lenders and independent insurance companies. It is designed to pay off the remaining balance on your mortgage in the event of your death, providing financial protection for your loved ones. While it can be a valuable tool, mortgage life insurance also has some limitations and may not be the best option for everyone.

In the following paragraphs, we will explore the topic of being denied life insurance and discuss the alternative option of mortgage life insurance in more detail. We will also highlight the pros and cons of mortgage life insurance to help you make an informed decision about whether it is the right choice for your needs.

| Characteristics | Values |

|---|---|

| Purpose | To ensure your home is paid off if you die with an outstanding balance on the loan |

| Who gets paid? | Lender, not your chosen beneficiaries |

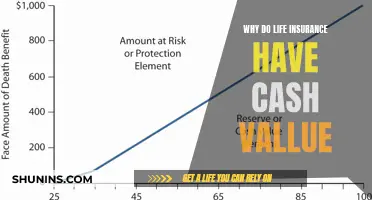

| Payout | Decreases as you pay off your mortgage |

| Premiums | Stay the same |

| Medical exam required? | No |

| Flexibility | Low |

| Cost | Higher than term life insurance |

What You'll Learn

High-risk activities and occupations

Certain occupations or activities with inherently high risks may lead to a declined risk assessment and, consequently, the denial of a mortgage life insurance policy. Examples include jobs involving high altitudes, such as aviation or construction work, extreme sports, hazardous materials, or dangerous environments. Insurance companies may deem these occupations or activities too risky to offer coverage.

If you work in a high-risk occupation, you may find it challenging to obtain mortgage life insurance. Occupations that fall into this category include construction workers, aviators, and those who work with hazardous materials or in dangerous environments. It is important to note that the definition of "high-risk" may vary among insurance providers, and some companies may have more stringent criteria than others.

Additionally, individuals who engage in extreme sports or activities, such as skydiving, auto racing, or scuba diving, may also face difficulties in obtaining mortgage life insurance. These activities are considered high-risk due to the increased likelihood of injury or death.

If you are unsure whether your occupation or activities fall into the high-risk category, it is advisable to consult with insurance providers or brokers directly. They can provide specific guidance based on their underwriting guidelines and help you understand your options for obtaining mortgage life insurance.

It is worth noting that, in some cases, individuals who work in high-risk occupations or engage in high-risk activities may still be able to obtain mortgage life insurance. However, the insurance company may charge higher premiums to compensate for the increased risk. Alternatively, they may offer coverage with certain exclusions or limitations related to the high-risk nature of the occupation or activity.

H&R Block: Life Insurance for Employees?

You may want to see also

Health conditions

Mortgage life insurance may be a good option for those who don't qualify for term life insurance due to poor health. This is because mortgage life insurance is typically sold without underwriting and does not require a medical exam. However, it is important to note that mortgage life insurance policies are often more expensive than term life insurance policies, even for those in good health.

When applying for mortgage life insurance, the insured will be required to answer a series of health questions. These questions are often convoluted and difficult to understand, and answering incorrectly could result in the insurance company denying coverage. The company may deny the application on the basis of misrepresentation, claiming that they would not have issued coverage if they had known about the health condition in question. In some cases, the insured may have answered honestly, but the insurance company may still deny coverage.

If you have been denied mortgage life insurance due to a health condition, it is important to seek quotes from multiple companies and compare their financial strength ratings. You may also want to consider alternative options, such as term life insurance, which offers more flexibility and control over the payout. Additionally, if you are a homeowner with underlying health conditions, you may want to consider the peace of mind that an MPI policy can provide, ensuring that your mortgage payments will be covered in the event of your death or disability.

Who Gets Life Insurance Benefits After a Divorce?

You may want to see also

Financial instability

Insurers and lenders evaluate your financial situation to determine the level of risk they would undertake by offering you a policy. They may deny your application if they deem the risk to be too high. This financial assessment is part of the underwriting process, which also includes a detailed evaluation of your health, lifestyle, and occupation.

If you are denied mortgage life insurance due to financial considerations, you can take steps to improve your financial stability. This may involve improving your credit score, stabilising your income, or consulting a financial advisor for personalised advice.

It is important to note that mortgage life insurance is not the same as mortgage insurance or landlord insurance. Mortgage life insurance provides financial support to your family in the event of your death, while mortgage insurance protects the lender if you default on your loan, and landlord insurance includes specific coverage for buildings and liability that is not related to the policyholder's death.

Life Insurance Options for Basal Cell Skin Cancer Survivors

You may want to see also

Age and life expectancy

Age and health are the primary factors in determining whether mortgage life insurance is the right policy for you.

Mortgage life insurance is a type of insurance policy offered by banks affiliated with lenders and by independent insurance companies. It is designed to pay off a mortgage when the borrower dies as long as the loan still exists. The beneficiary of the policy is the mortgage lender, not the borrower's family, and the death benefit typically decreases as the mortgage is paid off.

Mortgage life insurance is often marketed to those with health issues who don't qualify for traditional term life insurance. It is usually more expensive than term life insurance and lacks flexibility, as the death benefit can only be used to pay off the mortgage. For this reason, mortgage life insurance is generally considered ill-advised for healthy individuals, who can get a better deal with traditional life insurance.

While mortgage life insurance may be a good option for older individuals with serious health conditions, age can also be a limiting factor when it comes to the availability of mortgage life insurance. Some insurers offer 30-year mortgage life insurance to applicants 45 or younger and only offer 15-year policies to those 60 or younger.

VFW Life Insurance: What You Need to Know

You may want to see also

Lifestyle choices

While mortgage life insurance is not mandatory, it is a good idea to consider protecting such a large asset. However, there are several reasons why you might be denied mortgage life insurance based on your lifestyle choices.

Firstly, mortgage life insurance is often sold without underwriting, making it an option for people who don't qualify for traditional life insurance due to their lifestyle choices. But this also means that the insurance company can review your application after your death to determine if you qualify for coverage. If they find any contradictions or misrepresentations, they reserve the right to deny the claim, leaving your family in financial distress.

Secondly, mortgage life insurance applications typically involve answering a few medical questions, and in some cases, you may be denied coverage if you answer "yes" to any of these questions. This means that certain lifestyle choices, such as smoking or excessive alcohol consumption, can negatively impact your chances of qualifying for mortgage life insurance. These behaviours are linked to health issues that could lead to higher insurance premiums or outright denial.

Thirdly, mortgage life insurance is generally more expensive than traditional life insurance, especially if you are in good health. This is because mortgage life insurance does not take health into account when determining pricing, and the lack of underwriting means the insurance company is taking on more risk. As a result, you may end up paying higher premiums for less coverage.

Finally, mortgage life insurance offers little flexibility. Most policies only allow you to choose the amount of coverage based on your mortgage balance, and you cannot add riders or convert the policy to permanent insurance. This means that if your financial needs change, you may not have the option to adjust your coverage accordingly.

In conclusion, while mortgage life insurance can provide peace of mind and protect your loved ones in the event of your death, it is important to carefully consider the limitations and potential drawbacks of this type of insurance. Lifestyle choices that negatively impact your health or increase your risk profile may result in higher premiums or denial of coverage. It is always a good idea to compare different insurance options and seek advice from a licensed insurance agent to find the best coverage for your needs.

How Beneficiaries Can Change Your Life Insurance Policy

You may want to see also

Frequently asked questions

Yes, you can be denied mortgage life insurance. However, mortgage life insurance is often a guaranteed acceptance policy, meaning you can't be denied based on your health condition. Mortgage life insurance companies may deny you coverage based on your age, as older home buyers are more likely to receive a payout than younger ones.

The pros of mortgage life insurance are guaranteed policy acceptance, no underwriting required, and peace of mind for your family. The cons are an extra monthly payment, limited payout options, and the possibility that alternative policies may work better.

Alternatives to mortgage life insurance include self-funding, employer-sponsored life insurance, guaranteed coverage plans, and simplified issue (no medical) life insurance.