Health Maintenance Organization (HMO) insurance is a popular option on the Health Insurance Marketplace. HMO plans are known for their affordability, with lower premiums and out-of-pocket costs than other insurance plans. However, this affordability comes with some restrictions. HMO members must choose a primary care physician (PCP) from a network of in-network providers, and they need a referral from their PCP to see a specialist. HMO plans do not cover out-of-network care unless it is an emergency, in which case the HMO will cover the cost of care even if provided by an out-of-network doctor. In terms of billing, HMO members typically pay a copayment for each clinical visit, test, or prescription, and doctors in the HMO network can only bill members for copayments, not for the full cost of covered services.

| Characteristics | Values |

|---|---|

| Cost | HMO plans are more affordable than other types of health insurance plans. |

| Coverage | HMO plans only cover the cost of medical services involving an in-network doctor or hospital, except for emergency care. |

| Choice of doctors | HMO plans limit the number of providers and hospitals you can visit. |

| Referrals | HMO plans require a referral from your primary care doctor if you need to see a specialist. |

| Billing | HMO members usually don't have to file claims or wait for reimbursement. |

| Out-of-pocket costs | HMO plans have lower out-of-pocket costs compared to other types of health insurance plans. |

What You'll Learn

- HMO subscribers must pay a monthly or annual premium to access medical services

- HMO plans require a referral from a primary care physician to see a specialist

- HMO plans do not cover out-of-network care unless it's an emergency

- HMO plans have lower premiums than other health insurance plans

- HMO plans have lower out-of-pocket costs than other health insurance plans

HMO subscribers must pay a monthly or annual premium to access medical services

HMO subscribers pay a monthly or annual premium to access medical services. This is a fixed fee that subscribers pay to participate in the HMO. The premium is usually paid monthly, but some plans may offer the option to pay annually.

The cost of HMO premiums depends on several factors, including the subscriber's age, whether they are enrolling as an individual or as a family, and the plan tier (e.g., Bronze, Silver, Gold, or Platinum). On average, the monthly cost of an HMO plan for a single person is $390, but this can increase depending on the subscriber's age. For example, the average monthly cost for a 60-year-old is $930.

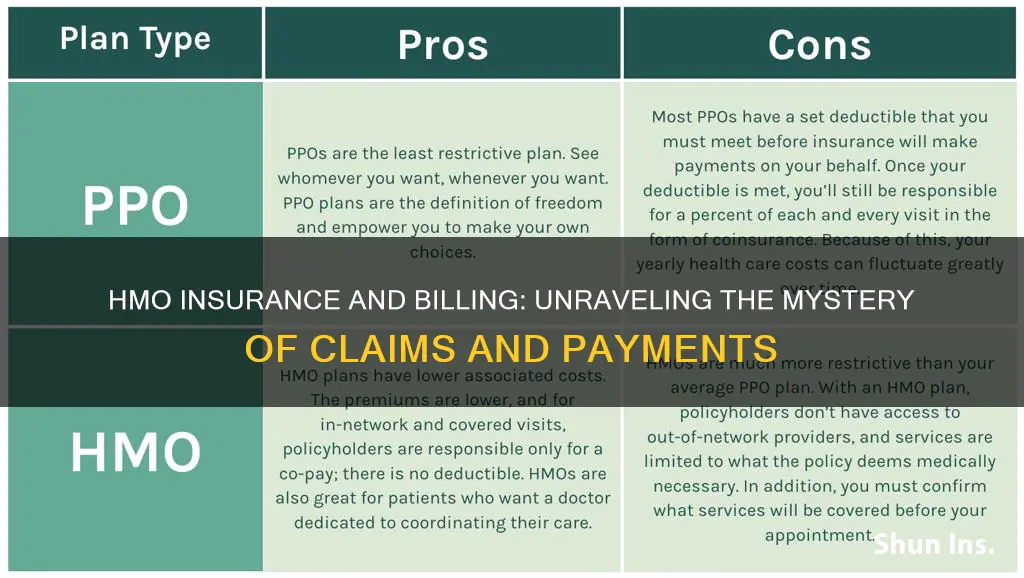

HMO premiums are typically lower than those of other insurance plans, such as Preferred Provider Organization (PPO) plans. This is because HMO plans have a network of contracted health care providers who have agreed to accept a certain level of payment for their services. This arrangement helps to keep costs low for HMO members.

In addition to the premium, HMO subscribers may also have to pay copayments and deductibles. Copayments, or copays, are fees that subscribers pay each time they receive a covered health service, such as a doctor's visit or filling a prescription. Deductibles are the amount that subscribers must pay out-of-pocket before their health plan starts paying for covered services.

It is important to note that HMO plans generally do not cover out-of-network care, except in cases of emergency or urgent care. Therefore, HMO subscribers are limited to receiving their care from doctors and hospitals within the HMO's network.

Understanding the Fine Print: Unraveling the Mystery of Margin Clauses in Insurance Policies

You may want to see also

HMO plans require a referral from a primary care physician to see a specialist

HMO stands for Health Maintenance Organization. With an HMO plan, you must select a primary care physician (PCP) who will be your first point of contact for all health-related issues. This means that you cannot see a specialist without first receiving a referral from your PCP.

The referral process usually involves the following steps:

- You visit your PCP with a health concern.

- Your PCP examines you and determines that you need to see a specialist.

- Your PCP refers you to a specialist within the HMO's network. The referral can be made electronically, on paper, or over the phone.

- You make an appointment with the specialist.

It is important to note that getting a referral does not guarantee that your HMO plan will cover all the costs associated with seeing the specialist. You may still have to pay a copay, meet your deductible, or pay for things your plan doesn't cover. However, without a referral, you will likely have to pay more or all of the costs yourself.

Some modern HMOs have relaxed these rules, and members can visit specialists within the plan's network without a referral from their PCP. Additionally, in emergency situations, you can usually see a specialist without a referral.

- Referrals usually have an expiration date, typically between 90 days to one year from the date of issue.

- If you change your PCP while seeing a specialist, your new PCP may need to issue a new referral.

- In some cases, your HMO plan may not cover care provided by doctors without a referral.

Understanding how referrals work can help you avoid unexpected bills and ensure that your HMO plan covers the cost of your medical care.

The Surprising Link Between Cavities and Insurance: Understanding the Unexpected Connection

You may want to see also

HMO plans do not cover out-of-network care unless it's an emergency

Health Maintenance Organizations (HMOs) are a type of health insurance that provides coverage through a network of physicians. HMO plans require members to seek care from doctors, hospitals, and other healthcare providers within their network. This allows HMOs to offer lower premiums and out-of-pocket costs compared to other insurance plans. However, this also means that HMO plans generally do not cover out-of-network care unless it is an emergency or urgent care situation.

In an emergency, HMO plans will cover out-of-network care as if it were in-network. This means that your deductible and coinsurance for out-of-network emergency care will not be higher than the regular in-network amounts. Federal law, including the Affordable Care Act and the No Surprises Act, protects individuals from receiving surprise or balance bills for emergency care received out-of-network.

There may be other situations where HMO plans will cover out-of-network care. For example, if there are no in-network providers available, such as when travelling out of the plan's service area, your HMO may cover your treatment as if it were in-network. Additionally, if you are in the middle of a complex treatment and your provider suddenly becomes out-of-network, your HMO may temporarily continue to cover your care at in-network rates. In some cases, HMO plans may also allow for out-of-network services at a higher copayment or coinsurance rate.

It is important to note that HMO plans typically require members to choose a primary care physician (PCP) who coordinates their care. This PCP is the first point of contact for all health-related issues and referrals to specialists must usually be made through them.

Unraveling the Web of Deceit: Insurance Fraud Treatment Centers Exposed

You may want to see also

HMO plans have lower premiums than other health insurance plans

Health Maintenance Organization (HMO) plans are known for having lower premiums than other health insurance plans. This is because HMO plans have contracts with a network of physicians, hospitals, and medical specialists, who agree to accept a certain level of payment for their services. This arrangement helps to keep the cost of premiums low for HMO members.

The average monthly cost of an HMO plan is $480, which is nearly $100 cheaper than a Preferred Provider Organization (PPO) plan. HMO plans also tend to have lower out-of-pocket costs, such as deductibles, copays, and coinsurance. This means that individuals with an HMO plan will often pay less when they need medical care.

In addition to lower premiums and out-of-pocket costs, HMO plans also offer the benefit of coordinated medical care. Individuals with an HMO plan will have a primary care provider who coordinates their care and makes referrals to specialists when needed. This can streamline treatment and take the guesswork out of finding reputable specialists.

However, it is important to note that HMO plans have more restrictions than other health insurance plans. HMO members must use in-network providers for their medical care and must usually obtain a referral from their primary care physician to see a specialist. Out-of-network coverage is typically not provided by HMO plans, except in the case of emergencies.

The Ultimate Guide to Purchasing Colonial Short-Term Insurance

You may want to see also

HMO plans have lower out-of-pocket costs than other health insurance plans

Health Maintenance Organizations (HMOs) are known for their lower out-of-pocket costs compared to other health insurance plans. This is due to several factors, including their structure, provider networks, and emphasis on preventive care.

Firstly, HMOs have a different structure from other plans, such as Preferred Provider Organizations (PPOs) and Exclusive Provider Organizations (EPOs). HMOs require individuals to choose a primary care physician (PCP) from their network, who coordinates their healthcare and provides referrals to specialists. This managed care approach helps control costs by directing individuals to network providers with negotiated rates.

Secondly, HMOs prioritize preventive care and wellness visits, encouraging members to attend annual check-ups and covering preventive services at little to no cost. This focus on prevention can lead to early detection of health issues and lower healthcare costs over time.

Thirdly, the HMO's provider network plays a significant role in keeping out-of-pocket costs low. HMOs contract with a network of physicians, hospitals, and medical specialists, who agree to accept a certain payment for their services. As a result, HMO premiums and out-of-pocket expenses, such as deductibles, copays, and coinsurance, are typically lower than those of other plans.

Additionally, HMOs have a less complicated billing process with less paperwork and fewer billing problems. This simplifies the overall healthcare experience for members.

While HMOs offer lower out-of-pocket costs, it is important to consider their limitations. HMOs are restrictive, requiring individuals to stay within their provider network for maximum coverage. Out-of-network services are usually not covered unless it is an emergency or urgent care situation.

In conclusion, HMOs have lower out-of-pocket costs than other health insurance plans due to their structured approach, emphasis on preventive care, provider networks with negotiated rates, and simplified billing processes. However, these cost savings come with the trade-off of limited provider flexibility.

Risk Mitigation: Strategies for Hazard Elimination in Insurance Policies

You may want to see also

Frequently asked questions

No, they cannot. However, they can bill you for copayments or coinsurance as outlined in your contract. You may also be billed for non-covered services if you agreed to pay for them in advance.

Yes, HMO members are required to work with a primary care provider that is in-network. They are responsible for coordinating your care and providing referrals if you need to see a specialist.

Yes, if you have an HMO plan, you must visit your primary care provider to get a referral before seeing a specialist. There are some exceptions, for example, females do not need a referral to see an obstetrician or gynecologist.

HMO stands for Health Maintenance Organization. It is a type of health insurance plan that contracts with a network of physicians, hospitals, and medical specialists. HMO plans typically have lower premiums than traditional health insurance but offer less flexibility.

Typically, no. HMO plans only cover the cost of medical services involving an in-network doctor or hospital, except in cases of emergency care. If you choose to see an out-of-network doctor or visit a hospital that isn't in the HMO's provider network, you are usually responsible for the full medical bill.