Colonial Life Insurance Company is one of the leading voluntary benefits providers in the US, offering a range of insurance products, including short-term disability insurance. The company has been in business for over 80 years and has built a strong reputation for financial stability and customer satisfaction.

Colonial Life's short-term disability insurance provides financial support and peace of mind for individuals who are unable to work due to illness or injury. The benefits can be used to cover everyday expenses such as rent, utilities, and medical bills, and are payable directly to the insured individual on a monthly basis.

To purchase Colonial short-term insurance, individuals can enrol through their employer if it is offered as part of their benefits package. Alternatively, they can contact Colonial Life directly or work with an independent insurance agent to find the best coverage option for their needs.

| Characteristics | Values |

|---|---|

| Types of Insurance Offered | Critical illness insurance, disability insurance, hospital confinement indemnity insurance, life insurance (term, universal, and whole) |

| Company Ratings | "A" (excellent) rating by A.M. Best, "A+" (excellent) rating by Better Business Bureau (BBB) |

| Customer Service | Online claims reporting, fax claims reporting, snail mail contact options, general contact inquiries form, customer service hotline |

| Payment Options | Payroll deduction, direct billing if you leave the job |

| Customer Satisfaction | Mixed reviews, with some praising prompt settlements and others complaining about delays and miscommunication |

| Financial Stability | Strong financial stability, rated "A" (excellent) by AM Best |

What You'll Learn

Colonial Life's short-term disability insurance

Colonial Life has been in the insurance business for over 80 years, providing benefits to employees for life's unexpected moments. The company offers short-term disability insurance to individuals and groups, which can provide income protection and peace of mind during difficult times. Here are some key features and instructions on how to purchase Colonial Life's short-term disability insurance:

Key Features of Colonial Life's Short-Term Disability Insurance:

- Income Protection: Colonial Life's short-term disability insurance can help replace a portion of your income if you are unable to work due to an illness, injury, or other covered conditions.

- Coverage for Common Conditions: The insurance covers common conditions such as pregnancy and childbirth, back and joint disorders, accidents and fractures, and heart attacks and strokes.

- Financial Safety Net: By providing income protection, the insurance helps reduce financial anxiety and allows individuals to focus on their health and recovery.

- Monthly Benefit Payments: Benefits are payable on a monthly basis directly to the policyholder and can be used for various expenses such as rent, house payments, utilities, and more.

- Customizable Benefit Amount: You can choose the appropriate benefit amount based on your needs and customize the elimination period, which is the waiting period before benefits begin.

- Portable Policies: Some policies allow individuals to keep their coverage even if they change jobs, providing flexibility and continuity.

- Optional Provisions: Colonial Life offers optional provisions to cover psychiatric and psychological conditions and hospital admission.

How to Purchase Colonial Life's Short-Term Disability Insurance:

- Contact a Colonial Life Representative: Reach out to your local Colonial Life representative to discuss the specific disability insurance options available to you. They can guide you through the different plans and help you choose the most suitable coverage.

- Understand the Plan Options: Colonial Life offers both individual and group plans. Individual plans are owned by the employee, portable across jobs, and have stable rates. Group plans, on the other hand, are owned by the employer and offer flexible underwriting and rate flexibility.

- Calculate Your Needed Coverage: It is recommended to have enough disability insurance to cover approximately 60% of your after-tax income. Consider your monthly living expenses and other factors when determining the appropriate coverage amount.

- Enrol Through Your Employer: If your employer offers Colonial Life insurance as a benefit, you can enrol through them. Contact your company's human resources department to get started.

- Consult a Broker or Agent: If you are an employer considering Colonial Life insurance for your employees, you can partner with a broker or independent insurance agent to set up a benefits package that includes Colonial Life's short-term disability insurance.

Understanding the Complexities of Extended Term Insurance Calculations

You may want to see also

Online claims reporting

Colonial Life Insurance Company offers online claims reporting, allowing customers to file claims through their website at any time. This digital platform provides a quick and intuitive way for policyholders to manage their benefits and file claims from the convenience of their homes.

To initiate the online claims reporting process, policyholders can log in to their secure My Account portal on the Colonial Life website. From their personalized dashboard, they can access a range of features, including filing new claims, checking the status of existing claims, and updating their communication and payment preferences. This user-friendly interface simplifies the claims process, making it more accessible and efficient for customers.

For those who prefer digital interactions, online claims reporting offers a seamless and expeditious option. Policyholders can easily navigate the claims process without having to make phone calls or send physical mail. This digital approach is particularly appealing to those who are comfortable with technology and prefer a paperless experience.

However, it is important to note that Colonial Life does not provide a specific claims response time frame promise. While customers can file claims online at any time, they may experience a delay in receiving a response or update on their claim status. Therefore, it is recommended to contact their insurance agent or customer service for more immediate assistance if needed.

In addition to online claims reporting, Colonial Life also offers other methods for filing claims, such as fax and snail mail options, ensuring that customers have multiple avenues to choose from based on their preferences and convenience.

Understanding Convertible Term Insurance: Flexibility for Changing Needs

You may want to see also

Colonial Life's financial stability

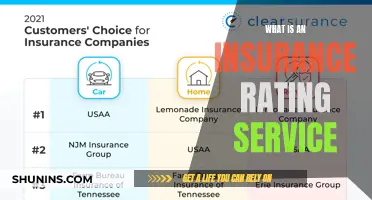

Colonial Life Insurance Company, founded in 1937, is a subsidiary of the Unum Group. It has consistently demonstrated strong financial stability, with an "A" (Excellent) rating from AM Best, an "A+" from the Better Business Bureau (BBB), an "A3" (Good) rating from Moody's Investors Service, and an "A-" (Strong) rating from Fitch. The company has over $1.5 billion in premiums and serves over 3.7 million policyholders from more than 90,000 client organizations.

Colonial Life has a long tradition of consistent and profitable financial performance, staying true to its mission and commitment to its customers. The company has a strong financial foundation and a history of timely payments to policyholders, which has earned it high ratings from insurer rating agencies.

In addition to its financial stability, Colonial Life offers a wide range of insurance products, including life insurance, accident insurance, cancer insurance, critical illness insurance, and disability insurance. The company also provides voluntary benefits and promotes wellness through health and medical perks.

With its strong financial performance, high credit ratings, and diverse insurance offerings, Colonial Life has established itself as a stable and reliable insurance provider.

Understanding the Insurance Coverage of Short-Term Bonds

You may want to see also

Colonial Life's customer service

Colonial Life has a range of customer service options available. The company provides a 24/7 automated service line, as well as a customer service hotline with restricted hours. The main customer service number is 1-800-325-4368, and is available Monday to Friday, 8 am to 8 pm ET. Spanish-speaking representatives are also available during these hours.

For those who prefer not to call, there is a live chat function on the website, as well as a general contact inquiry form. Customers can also send mail to the following address:

Colonial Life & Accident Insurance Company

P.O. Box 1365

Columbia, SC

29202-1365

Fax and email are also available.

Colonial Life also has a social media presence on Facebook, Twitter, and LinkedIn, making the company more accessible to customers.

The company provides a range of online resources, including a Policyholder Support portal, where customers can access their policies, file and view claims, and manage their benefits. This can be accessed 24/7 on any device.

Colonial Life also offers a range of educational resources, such as custom websites, digital booklets, and digital postcards, to help employees understand their benefits.

For those wishing to purchase short-term insurance, Colonial Life offers short-term disability benefits, which can provide financial support for up to two years. To purchase this insurance, customers should speak with their HR department about coverage options, as most products are sold in the workplace.

Exploring Short-Term Insurance Options with Horizon

You may want to see also

Colonial Life's insurance coverage

Colonial Life Insurance is a subsidiary of the Unum Group, founded in 1937 under the name Mutual Accident Company. The company has since expanded its network to more than 10,000 independent insurance agencies and brokerages and has over 1,000 home insurance office professionals. Colonial Life has over three million policyholders and $1.5 billion of insurance in force.

Colonial Life offers a range of insurance products, including:

- Life insurance (term, universal, and whole)

- Critical illness insurance

- Disability insurance (short-term only)

- Hospital confinement indemnity insurance

Colonial Life's insurance products are available as voluntary employee benefits, meaning they are offered through employers as part of an optional package. The company does not offer insurance products for individual purchase.

Colonial Life's life insurance policies are portable, meaning employees can continue their coverage even if they change jobs. The company also offers short-term disability insurance, which provides monthly payouts for up to two years in the event of an accident or illness.

In terms of purchasing Colonial Life's short-term insurance, individuals would need to enrol through their employer. The company offers multiple enrolment options, including in-person, virtual, telephonic, and online self-service. Colonial Life also provides educational resources to help employees understand their benefits and make informed decisions.

Overall, Colonial Life has established itself as a respected name in the insurance market, particularly in the area of life insurance. The company has received high ratings from A.M. Best and the Better Business Bureau (BBB), indicating strong financial stability. However, it is important to note that Colonial Life is not BBB accredited and has received a concerning volume of complaints through the BBB.

Haven Insurance: Understanding the Fine Print

You may want to see also

Frequently asked questions

Colonial offers a range of insurance products, including critical illness insurance, disability insurance, hospital confinement indemnity insurance, and life insurance (term, universal, and whole).

You can purchase Colonial short-term insurance through your employer if they offer Colonial insurance as part of your benefits package. You can also purchase insurance directly from Colonial by contacting their customer service team or through an independent insurance agent.

Colonial has a strong financial stability rating from A.M. Best, indicating that they are capable of offering secure coverage. They also offer customizable coverage, including the ability to add spouses and children to your policy, and portable policies that can be taken with you if you change jobs.