Term life insurance is a temporary product that offers coverage for a set period, such as 10, 20, or 30 years. It is generally more affordable than whole life insurance, as it does not offer a refund on premiums paid unless you add an additional benefit known as a rider. Riders can be added free of cost or for a one-time fee, and they ensure that all premiums are refunded if the policy term is outlived. If you outlive your term life insurance, you will only get a refund if you purchase a return of premium rider.

| Characteristics | Values |

|---|---|

| Do you get your money back at the end of a term life insurance policy? | No, unless you have a return of premium rider. |

| What happens when a term life insurance policy matures? | Your coverage ends, and you stop paying premiums. |

| Can you extend term life insurance? | Yes, some insurance carriers allow you to extend your coverage. |

| Can you get permanent life insurance after term life insurance expires? | Yes, but it will be more expensive. |

What You'll Learn

Getting a refund on term life insurance premiums

Term life insurance is a type of insurance that provides coverage for a specific period, typically ranging from 10 to 30 years. It is generally more affordable than whole life insurance, as most people outlive their terms and are in good health when they purchase the insurance, making it less risky for insurance companies to cover them. However, after the term ends, you might wonder if you can get any of your money back.

In most cases, you will not get any money back after your term life insurance policy expires. This is because term life insurance premiums are almost never refunded, even if you cancel your policy. The reason for this is that insurance companies are able to keep term life premiums lower by not refunding premiums.

However, there are a few instances when you may be able to get a refund on your term life insurance premiums:

- By law, if you cancel a term life insurance policy within 30 days of purchasing it, the company must refund any money you paid.

- If you pay some of your premiums ahead of schedule and then cancel your policy, the company should return those early pre-payments.

- Some term life insurance policies offer a "return-of-premium" feature, which allows you to get a refund of your premium payments if you outlive the policy term. This type of policy is typically much more expensive than traditional term life insurance.

- Some insurance companies allow you to add a "return-of-premium rider" to your policy for a one-time fee. This rider will ensure that all of your premiums are refunded to you after your term expires, even if you cancel your policy before the term ends. However, it is important to note that you will only be refunded your regular premium payments, not the actual death benefit of your policy.

In summary, while it is generally uncommon to get a refund on term life insurance premiums, there are a few specific circumstances in which you may be able to get a refund. It is important to carefully review the terms and conditions of your policy to understand your options for getting a refund.

Life Insurance: A Must-Have for Small Business Owners?

You may want to see also

Converting term life insurance to permanent life insurance

Understanding the Conversion Process

To convert your term life insurance policy to a permanent one, start by reviewing the terms of your current policy. Check if your policy includes a conversion option and identify the conversion period or deadline. Some policies allow conversion at any time during the term, while others may limit it to a specific duration, such as the first 10 years. Contact your insurance agent or company to initiate the conversion process and fill out the necessary paperwork. You won't need to undergo a medical exam or underwriting process again.

Cost of Conversion

There are generally no fees associated with converting a term policy to a permanent one. However, your insurance premiums will increase. The amount of increase depends on factors such as your age at the time of conversion, the type of permanent policy you choose, and the amount of coverage you opt for. You may have the option to convert only a portion of your term policy to permanent coverage to manage the cost.

Reasons for Conversion

There are several scenarios where converting your term life insurance to permanent life insurance can be advantageous:

- Change in Health: If your health has deteriorated, converting to a permanent policy allows you to extend your coverage without undergoing a new medical evaluation or facing higher premiums due to health issues.

- Budget Changes: If your financial situation has improved, and you can now afford higher premiums, converting to a permanent policy can be a good idea if you want lifelong coverage or additional benefits.

- Accumulating Cash Value: Permanent life insurance policies offer a cash value component that grows over time. This can be beneficial for retirement planning or accessing tax-free cash during your lifetime.

- Leaving a Legacy: If you want to leave an inheritance for your children but also want to spend liberally during retirement, converting to a permanent policy ensures your beneficiaries receive a death benefit regardless of when you pass away.

- Final Expenses: Converting a portion of your term policy to permanent coverage can help cover funeral expenses and prevent your loved ones from bearing these costs.

- Change in Family or Business Obligations: If you have new dependents, extended loan periods, or unexpected business obligations, permanent life insurance can provide the extended coverage you need.

- Long-term Financial Planning: As your financial goals evolve, permanent life insurance can offer a basic level of coverage and support long-term planning, especially for final expenses, supporting a surviving spouse, or leaving a legacy.

Factors to Consider Before Converting

Before making the decision to convert, consider the following:

- Goals and Affordability: Understand your objectives for converting and ensure you can afford the higher premiums, both now and in the long term, especially during retirement.

- Available Permanent Policies: Different insurers offer different permanent policy options for conversion. Understand the specific permanent policies available to you and their features, as they may have restrictions or limitations.

- Long-Term Care Benefits: If you're considering converting due to long-term care benefits, check if your insurer offers this option and on which type of permanent policy.

- Rising Death Benefit: If you want a higher death benefit, you may need to undergo the underwriting process again, unless your insurer offers a permanent policy with a rising death benefit.

Life Insurance and Inflation: Are Your Investments Protected?

You may want to see also

Extending term life insurance coverage

Term life insurance provides coverage for a specific period, typically between 10 and 30 years. While some term life insurance policies do not expire until the policyholder reaches 90-95 years old, others can be extended through policy renewals or conversions.

There are several options for extending term life insurance coverage:

- Renewing the policy: Most term life insurance policies can be renewed for a limited number of years without requiring evidence of insurability. This means coverage can be extended even if the policyholder's health has changed. However, the premium will increase with each renewal, making this option viable for only a few years.

- Converting the policy to permanent life insurance: Many term life policies contain a conversion option or rider, allowing conversion to a permanent policy without a new medical exam. However, the premium will increase, and there may be a deadline for conversion.

- Purchasing a new term life insurance policy: For those in good health, purchasing a new term life insurance policy may be the most cost-effective option. However, a medical exam is usually required, and the premium will be higher due to increased age.

- Purchasing a permanent life insurance policy: Permanent life insurance policies, such as whole life insurance, are more expensive than term life insurance but offer lifelong coverage and include a cash value component. This option may be beneficial for those with special needs dependents or those who want protection they can't outlive.

Factors to Consider When Extending Term Life Insurance Coverage

When considering extending term life insurance coverage, it is essential to assess your current financial situation and future needs. Ask yourself the following questions:

- Do I have dependents who rely on my income?

- Do I have significant debts, such as a mortgage or car loans?

- Do I have business obligations, such as business succession planning or key person coverage?

- Do I have enough assets to cover end-of-life expenses?

- Am I in good health, or have my health circumstances changed?

By evaluating these factors, you can make an informed decision about extending your term life insurance coverage and choose the option that best suits your needs.

Senior Life Insurance: Is It Possible to Get Covered?

You may want to see also

Buying a new term life insurance policy

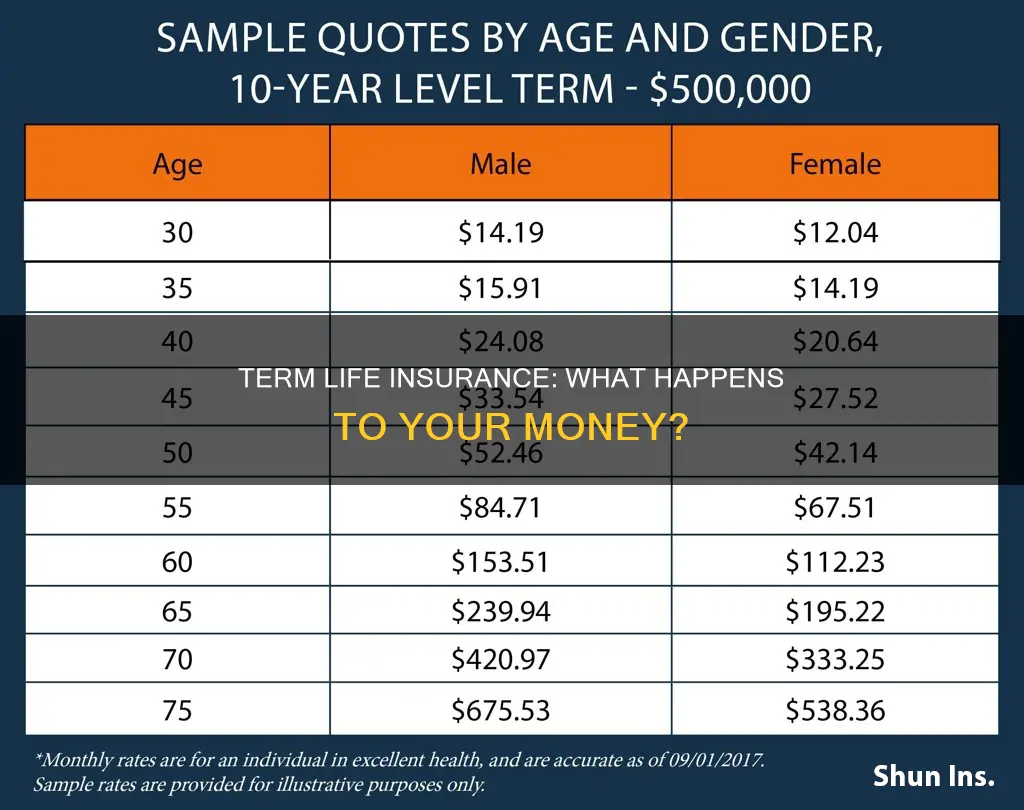

If you outlive your term life insurance policy, you can choose to purchase a new one. However, it is important to note that the cost of a new policy will be higher due to age-related risk increases. Additionally, a medical exam will likely be required as part of the underwriting process, and any new health issues will further increase the rate.

- Age and health: Older individuals typically face higher premiums due to potential health concerns. Being transparent about your health during the application process is crucial for ensuring your loved ones don't face issues when making a claim.

- Policy term: Consider how long you will need coverage. If you're still supporting dependents or have outstanding debts, you may want to opt for a longer-term policy.

- Coverage amount: Evaluate your current financial situation and future needs to determine the appropriate coverage amount.

- Riders: Consider adding riders such as critical illness or accidental death and disability coverage for additional protection.

- Cost: Compare quotes from multiple insurers to find the most affordable option.

- Company reputation: Research the insurance company's claim settlement ratio, customer satisfaction ratings, and financial strength to ensure they are reliable and will be able to pay out claims.

- Payment options: Choose a policy that offers flexible payment options to fit your budget and preferences.

- Tax benefits: Look for policies that offer tax advantages to help reduce your overall cost.

Remember to carefully review the terms and conditions of the policy before purchasing and seek advice from a financial advisor or licensed insurance professional if needed.

Divorced Parents: Joint Life Insurance Beneficiaries?

You may want to see also

Getting permanent life insurance

Permanent life insurance provides coverage for the full lifetime of the insured person. It is more expensive than term life insurance but comes with a death benefit and a savings component that earns interest on a tax-deferred basis.

The two primary types of permanent life insurance are whole life and universal life. The cash value of whole life insurance grows at a guaranteed rate, whereas universal life insurance features more flexible premium options and its earnings are based on market interest rates.

Variable life and variable universal life provide expanded options to invest the cash value in mutual funds and other financial instruments.

Permanent life insurance policies have much higher premiums than term life insurance policies, which lack a savings component. However, permanent life insurance policies enjoy favourable tax treatment. Cash value generally grows on a tax-deferred basis, which means the policyholder pays no taxes on earnings as long as the money stays in the policy.

Some money can also be withdrawn from the policy without taxation. Generally, withdrawals up to the total of premiums paid are not taxed.

Taking cash value out of a permanent policy through a withdrawal or outstanding loan will reduce the future death benefit for heirs.

Many term life insurance policies offer the option to convert the coverage to permanent life insurance before the term expires. This can be appealing for someone with medical issues that could make a new policy prohibitively expensive, or for those with chronic conditions that might eventually require them to draw ongoing expenses from the savings portion.

Advantages and disadvantages of permanent life insurance

If you can afford the higher premiums, permanent life insurance allows you to provide a death benefit to your beneficiaries without the limitations of term life insurance. A permanent life insurance policy allows you to build savings in an account with tax advantages. You can also borrow from or withdraw those funds during the lifetime of the policy.

The downsides to purchasing a permanent life insurance policy are the high costs of premiums, the risk of not being able to afford to keep up with payments, and that taking out the policy's cash value reduces the death benefit.

Life Insurance: Haven's Easy Sign-In Process

You may want to see also

Frequently asked questions

No, you don't get your money back after your term life insurance ends. However, if you have purchased a basic term insurance plan, you will not get any money back. In contrast, under a money-back term plan, you get assured returns at the end of the policy tenure.

A rider is an additional benefit to your insurance policy that you can usually add for free or purchase for a one-time fee. A return-of-premium rider ensures that all your premiums are refunded to you after your term expires. If you cancel your policy before your term ends, this rider also allows you to recover a percentage of the premiums you paid.

Yes, if you cancel the insurance policy within 15 days or less, you can get your money back within the free-look period.