When considering life insurance for a loved one, it's important to understand the right time and reasons to do so. Life insurance can provide financial security and peace of mind for the beneficiaries, ensuring that their financial obligations and goals are met in the event of the insured's passing. This can be especially crucial for those with dependents, such as children or a spouse, who rely on the insured's income. Additionally, it can help cover funeral expenses, outstanding debts, and other final costs, allowing the family to grieve without the added stress of financial burdens. However, it's essential to assess the insured's overall health and financial situation to ensure the policy is appropriate and beneficial for all involved.

What You'll Learn

- Benefits for Dependents: Life insurance provides financial security for family members who rely on the insured person's income

- Debt Management: It helps cover debts, ensuring financial stability for the deceased's loved ones

- Income Replacement: Life insurance can replace lost income, supporting family members' living expenses

- Education Funding: Policies can be used to fund children's education, ensuring their future

- Final Expenses: Covers funeral costs and other end-of-life expenses, easing financial burdens on survivors

Benefits for Dependents: Life insurance provides financial security for family members who rely on the insured person's income

Life insurance is a crucial financial tool that offers numerous benefits, especially for dependents who rely on the income of the insured individual. When someone's income is a primary source of financial support for their family, ensuring that this income is protected in the event of their untimely death is essential. This is where life insurance steps in as a vital safety net.

For dependents, the primary advantage of life insurance is the financial security it provides. Dependents often include spouses, children, and other family members who depend on the insured person's income for their daily needs, education, and overall well-being. In the unfortunate event of the insured's death, life insurance proceeds can be a lifeline for these dependents, ensuring they have the financial resources to maintain their standard of living. This is particularly important if the insured person is the primary breadwinner, as their death could leave a significant financial gap that the family might struggle to fill.

The benefits of life insurance for dependents are twofold. Firstly, it provides immediate financial support to cover essential expenses such as mortgage payments, rent, utilities, and daily living costs. This ensures that the family can continue to live in their home, maintain their lifestyle, and cover basic necessities without the added stress of financial instability. Secondly, life insurance can also be used to fund the education of dependent children, ensuring they have the means to pursue their academic goals and secure their future.

Moreover, life insurance can provide peace of mind, knowing that your loved ones will be taken care of in your absence. It allows you to plan for the future and ensure that your dependents have the financial resources to make important life decisions, such as purchasing a home, starting a business, or investing in their future. This financial security can also reduce the emotional burden on dependents, allowing them to grieve and adjust to life changes without the added worry of financial strain.

In summary, life insurance is a powerful tool for protecting the financial well-being of dependents. It ensures that the income of the insured person is replaced, providing a safety net for the family's financial stability and overall quality of life. By considering the needs of your dependents and the potential impact of your death on their financial situation, you can make an informed decision about when and how to obtain life insurance on someone else.

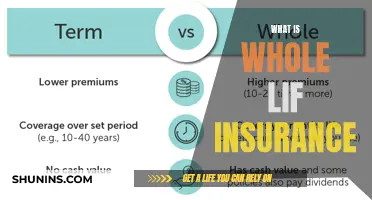

Cash Value Life Insurance: Benefits and Their Trade-Offs

You may want to see also

Debt Management: It helps cover debts, ensuring financial stability for the deceased's loved ones

Life insurance can be a crucial tool for managing and covering debts, especially when it comes to providing financial stability for the loved ones of a deceased individual. When someone passes away, their family and dependents often face a sudden and overwhelming financial burden, particularly if the deceased had accumulated significant debts. This is where life insurance can step in and provide much-needed relief.

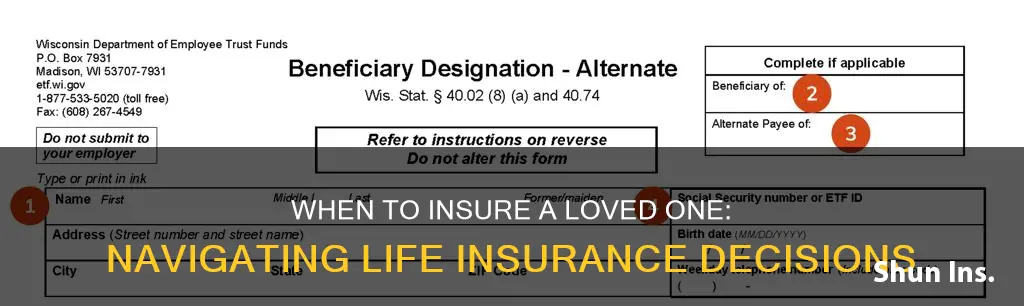

The primary purpose of life insurance is to provide financial security and peace of mind to the insured and their beneficiaries. When you take out a life insurance policy on someone else, such as a spouse, parent, or child, you are essentially creating a safety net for their financial future. In the event of the insured's death, the life insurance policy will pay out a lump sum or regular income to the designated beneficiaries. This financial support can be used to cover various expenses, including outstanding debts.

Managing debts is a critical aspect of financial planning, and life insurance can play a pivotal role in this process. Here's how it works: When a person dies, their estate may include various liabilities, such as mortgages, car loans, credit card debt, or personal loans. These debts can be challenging for the deceased's loved ones to manage, especially if they are left with limited financial resources. By taking out a life insurance policy, you can ensure that the proceeds from the policy are used to settle these debts promptly. This prevents the debts from becoming a long-term burden on the family and allows them to move forward with their financial plans.

The financial stability provided by life insurance can be a significant advantage for the deceased's family. It ensures that the loved ones are not left with the added stress of managing debts while dealing with the emotional aftermath of a loss. Moreover, it provides a sense of security, knowing that the family's financial obligations are covered. This can be particularly important for families with children, as it ensures that the children's education, healthcare, and overall well-being are protected.

In summary, life insurance is a valuable tool for debt management and financial stability. By taking out a policy on someone else, you can provide a safety net for their loved ones, ensuring that debts are covered and financial obligations are met. This proactive approach to financial planning can offer peace of mind and security, knowing that the family's financial future is protected, even in the face of tragedy. It is a thoughtful and responsible step that can significantly impact the lives of those left behind.

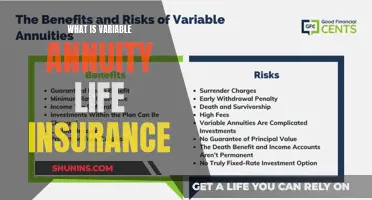

Whole Life Insurance: An Asset or a Liability?

You may want to see also

Income Replacement: Life insurance can replace lost income, supporting family members' living expenses

Life insurance is a crucial financial tool that can provide much-needed support and security for your loved ones, especially when it comes to replacing lost income. This type of insurance is designed to ensure that your family can maintain their standard of living and cover essential expenses even if you are no longer around. Here's how it works and why it's essential to consider:

Understanding Income Replacement: When you purchase life insurance, you essentially agree to pay a premium to an insurance company. In return, the company promises to pay out a lump sum or regular payments to your beneficiaries (usually your spouse, children, or other dependents) upon your death. The primary purpose of this payout is to act as a financial safety net, replacing the income that you would have contributed to the household. This is particularly important if you are the primary breadwinner or if your income significantly contributes to the family's overall financial stability.

Supporting Family Expenses: Life insurance proceeds can cover a wide range of living expenses, ensuring that your family's financial situation remains stable during a challenging time. These expenses may include mortgage or rent payments, utility bills, groceries, transportation costs, and even educational fees for your children. By providing this financial support, life insurance allows your loved ones to maintain their current lifestyle and avoid the financial strain that could result from your sudden absence. For example, if you were the primary earner in a family with a substantial mortgage, life insurance could ensure that the mortgage payments are covered, preventing the family from losing their home.

Tailored Coverage: The amount of coverage you need will depend on your family's unique circumstances. It's essential to assess your family's financial obligations and future goals. Consider factors such as the number of dependents, their ages, and the overall cost of living in your area. A financial advisor can help you calculate the appropriate coverage amount, ensuring that your family's needs are met. For instance, if you have a young family with a mortgage, college funds for children, and regular living expenses, a substantial life insurance policy could provide the necessary financial cushion.

Long-Term Financial Security: Income replacement through life insurance offers long-term financial security. It ensures that your family can plan for the future, make significant purchases, or even start a new business without worrying about financial constraints. This peace of mind allows your loved ones to focus on healing and adjusting to life changes rather than worrying about financial stability. Moreover, the proceeds can be used to pay off any debts you may have left behind, further protecting your family's financial well-being.

In summary, life insurance with an income replacement focus is a powerful tool to safeguard your family's financial future. It provides the means to cover essential expenses, maintain a comfortable lifestyle, and plan for the long term. By carefully considering your family's needs and seeking professional advice, you can ensure that your loved ones are protected and that your legacy of financial security lives on.

Cancer and Life Insurance: Can You Get Covered?

You may want to see also

Education Funding: Policies can be used to fund children's education, ensuring their future

Education funding is a critical aspect of ensuring a child's future success and well-being. It involves implementing policies and strategies to provide financial support for their education, which can have long-lasting benefits. Here are some key points to consider:

Government Grants and Scholarships: One of the most common methods of funding education is through government initiatives. Governments often offer grants, scholarships, and financial aid programs specifically designed to support students from diverse backgrounds. These programs aim to reduce financial barriers and promote equal opportunities. For instance, many countries provide need-based grants to students, ensuring that financial constraints do not hinder their academic pursuits.

Tax-Funded Education Systems: Many countries have established comprehensive education systems funded through taxation. This approach ensures that all citizens have access to a basic education. Tax-funded schools provide a structured learning environment, and the government's investment in education infrastructure and teacher training contributes to a skilled workforce in the future. This policy is a long-term investment in the nation's human capital.

Private Education Funding: In addition to government support, private funding sources can also play a significant role. Wealthy individuals, foundations, and charitable organizations often contribute to education funds. These funds can provide scholarships, grants, or financial aid to students who might not otherwise afford private education. Private funding can also support specialized educational programs, research initiatives, and extracurricular activities that enhance the overall learning experience.

Education Savings Accounts: Implementing education savings accounts is another effective strategy. These accounts allow parents or guardians to set aside funds specifically for their child's education. The money can be invested, and the accumulated savings can be used to cover various educational expenses, including tuition fees, books, and other educational resources. This approach empowers families to take control of their children's educational finances.

Policy Recommendations: To ensure a robust education funding system, policymakers should consider the following: First, allocate a significant portion of the national budget to education, ensuring that funding is stable and predictable. Second, establish transparent and fair scholarship and grant programs that consider financial need, academic merit, and other relevant factors. Finally, provide tax incentives for individuals and businesses to contribute to education funds, encouraging private sector involvement.

By implementing these policies and strategies, societies can create a supportive environment for children's education, fostering a skilled and educated future generation. Education funding is a powerful tool to break the cycle of poverty, promote social mobility, and build a prosperous and equitable society.

Life Insurance: Preferred Category Membership Benefits

You may want to see also

Final Expenses: Covers funeral costs and other end-of-life expenses, easing financial burdens on survivors

When considering life insurance for someone else, it's important to understand the specific context and needs of the individual you are insuring. One crucial aspect to consider is the purpose of the insurance, particularly in relation to 'Final Expenses'. Final Expenses insurance is a type of policy designed to cover the costs associated with an individual's final arrangements, including funeral expenses, burial or cremation costs, and any other related end-of-life expenditures. This type of coverage can provide significant financial relief to the survivors, ensuring that the deceased's wishes are honored without placing a heavy financial burden on their loved ones.

The decision to purchase Final Expenses insurance for someone else should be based on several key factors. Firstly, it is essential to consider the financial situation and stability of the individual you are insuring. If they have a substantial amount of debt or financial obligations, the insurance can help cover these costs, providing peace of mind for the survivors. Additionally, evaluating the individual's health and age is crucial. As with any insurance policy, the risk and premium associated with the coverage will depend on the insured's overall health and age. Older individuals may face higher premiums, but the coverage can still be a valuable investment for their long-term financial security.

Another important consideration is the relationship between the insured and the policyholder. If the individual is a family member or a close relative, the insurance can ensure that their final wishes are respected and that the surviving family members are not left with overwhelming financial responsibilities. For example, if a parent or grandparent has always been a source of financial support, this type of insurance can provide a safety net for the family, allowing them to focus on grieving rather than financial worries.

Furthermore, Final Expenses insurance can be a thoughtful and considerate gesture, especially when the insured has expressed specific wishes regarding their funeral arrangements. By honoring their preferences and covering the associated costs, the policy ensures that the deceased's final wishes are fulfilled without causing financial strain on the survivors. This aspect of the insurance can be particularly meaningful for those who want to provide a dignified send-off for their loved ones.

In summary, Final Expenses insurance is a specialized form of life insurance that caters to the specific needs of covering end-of-life expenses. It is a thoughtful consideration for family members or close associates, ensuring that the financial burden of funeral costs and other related expenses is alleviated. By providing this coverage, you can offer both financial security and emotional support to the survivors during a difficult time.

Understanding the Role of IRR in Life Insurance

You may want to see also

Frequently asked questions

It's generally recommended to consider life insurance for a loved one when there are financial dependencies or obligations involved. This could be when you have young children who are financially dependent, a spouse or partner relying on your income, or significant financial commitments like a mortgage or business that would be impacted by your passing. The key is to ensure that your loved ones are protected financially in the event of your untimely death.

You should consider getting life insurance on someone else's life if their death would result in financial loss or hardship for you or your family. This could be due to various reasons such as providing financial support, covering daily expenses, paying for their children's education, or contributing to their retirement plans. It's a way to ensure that your loved ones are taken care of and their financial future is secure.

Yes, there are certain life events and circumstances that make getting life insurance on a family member even more crucial. For instance, if you are the primary breadwinner in your family, or if your spouse or partner relies on your income for their livelihood, then life insurance becomes essential. Additionally, if you have a large debt or a substantial financial obligation that your family would struggle to manage without your income, life insurance can provide the necessary financial protection.

Getting life insurance on your spouse or partner can offer several advantages. Firstly, it provides financial security for your partner in the event of your death, ensuring they have the means to maintain their standard of living. This can include covering daily expenses, paying for their housing, and providing for their long-term financial goals. Secondly, it can help with estate planning, allowing you to leave a financial legacy for your spouse or partner. Lastly, it can also provide coverage for dependent children, ensuring their financial well-being in the future.