People with multiple sclerosis (MS) can get life insurance, but they may need to shop around and their premiums will likely be higher. When applying for life insurance, it is important to be upfront about your condition, as lying on your application could result in being denied coverage.

| Characteristics | Values |

|---|---|

| Do I have to disclose MS for life insurance? | Yes, you must disclose your MS diagnosis when applying for life insurance. |

| Will I be able to get life insurance if I have MS? | Yes, it is possible to get life insurance if you have MS, but your options and costs will depend on the progression of your MS, your age, and other factors. |

| What type of life insurance can I get if I have MS? | You may be able to get traditional life insurance, such as term or whole life insurance, or alternative options like guaranteed issue life insurance. |

| Will my life insurance rates be higher if I have MS? | Rates may be higher if you have MS, and you will likely need to undergo a medical exam as part of the application process. |

| What information will I need to provide when applying for life insurance with MS? | You will need to disclose information about your MS, including frequency of symptoms, progression of the disease, current treatments, medications, and impact on daily activities. |

What You'll Learn

Do I need to disclose MS when applying for life insurance?

Yes, you need to disclose if you have multiple sclerosis (MS) when applying for life insurance. Failing to do so could result in your claim being denied, or your application being rejected.

When you apply for life insurance, the insurance company evaluates your risk of death and assigns a cost to the policy accordingly. The younger and healthier you are, the lower the premiums will be. Most life insurance policies require that you answer medical questions and submit to a medical exam.

If you have MS, you will most likely need to get a medical exam. During the exam, a paramedical will record your medical history, including any prescription medications you are taking, and ask about your family's medical history. They will also take your blood pressure, listen to your heartbeat, and check your height and weight.

It is important to be honest during the application process. If the company discovers you lied about a health condition, they may deny your application or increase your insurance premium. Additionally, your beneficiaries may be denied the death benefit if you are untruthful on your application.

While it may be more challenging and expensive to obtain life insurance with MS, it is still possible. The cost of your premiums will depend on the progression of your MS, your current age, the age you were when first diagnosed, and other factors. Some insurance companies may be more accommodating to those with MS, so it is worth shopping around and comparing quotes from multiple providers.

Life Insurance Cash Out: Is It Worth It?

You may want to see also

What happens if I don't disclose my MS?

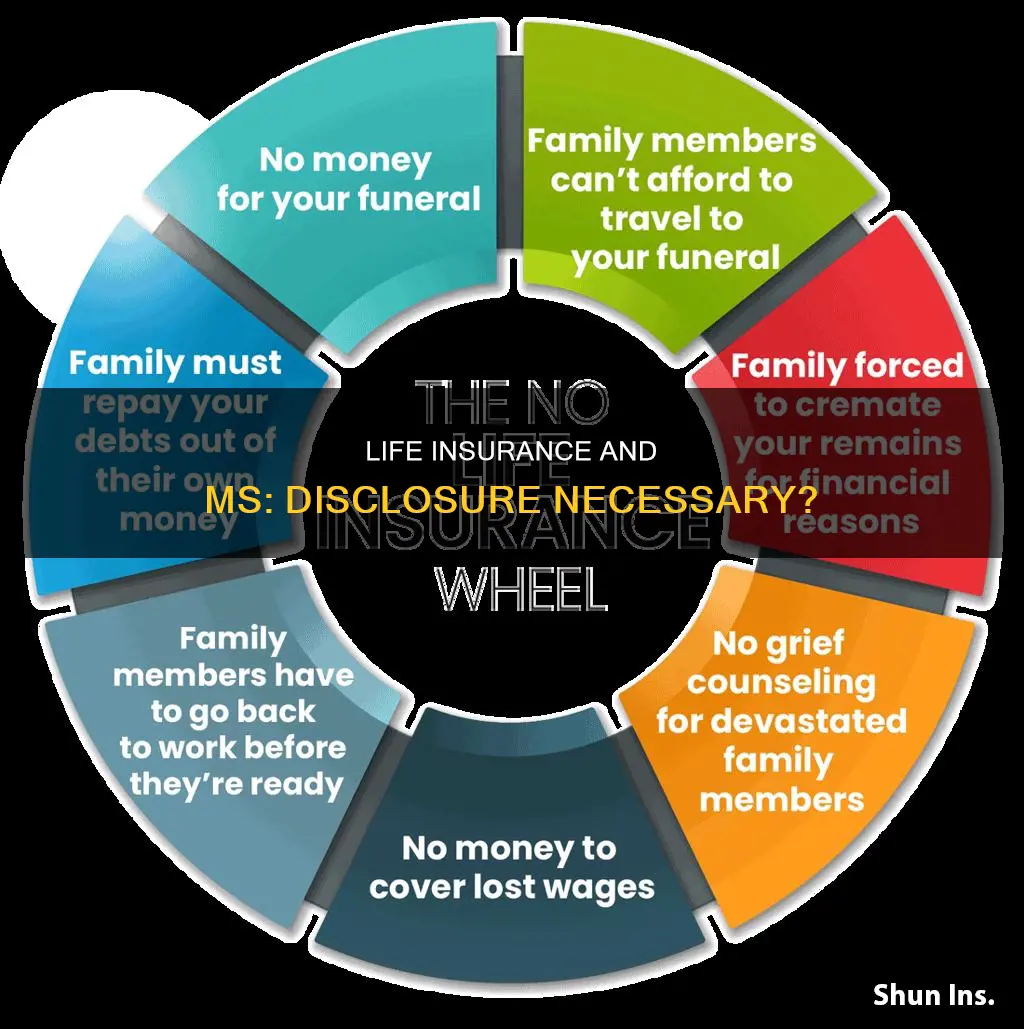

If you don't disclose your MS when applying for life insurance, you risk invalidating your policy and it not paying out in the future. Not being honest also undermines the peace of mind that comes with having cover in place. If you took out the cover knowing you had the condition but didn't tell the insurer, they are unlikely to pay out on claims that come from having MS.

If you are diagnosed with MS after taking out an insurance policy, you don't always have to tell your insurer unless you are making a claim, or the policy states that you have to. If you are unsure, you can ask your insurer about what you have to tell them.

If you are diagnosed with MS in the 'on risk' period (the time between applying for your policy and when it starts), you must tell your insurer. The information you gave in your application would have been correct at the time, but you must inform them of this change until the policy is in force.

If you don't update the insurer and you have to make a claim, you might not be covered.

Gerber Life Insurance: Cash Value and Policy Benefits Explained

You may want to see also

What are the best life insurance companies for people with MS?

Yes, it is possible to get traditional life insurance if you have multiple sclerosis (MS). However, you may have to shop around, and your coverage options and premium costs will depend on the progression of your condition, your current age, the age you were when first diagnosed, and other factors.

Transamerica

Transamerica is one of the oldest and largest life insurance companies, with over 12 million active accounts. It offers affordable rates for almost every age group, and you may not even need a medical exam if you fall under a certain age or coverage amount. Transamerica has more flexible guidelines than other insurers for people with MS. For example, the company can consider you for coverage if you have moderate or relapsing-remitting MS, as long as you were diagnosed over two years ago.

Lincoln Financial

Lincoln Financial offers a diverse array of life insurance policies, including competitive no-medical-exam and high-net-worth options. The insurer can consider you for up to standard rates if you have mild MS, while other insurers may only consider table-rated health classifications instead. Lincoln Financial is also a good option for people with other existing health conditions, such as depression, stroke, and heart conditions, as well as marijuana users.

Prudential

Prudential has nearly four million policyholders and 150 years of experience. It offers competitive coverage options for seniors and people with some of the most common medical conditions, including asthma, depression, and fibromyalgia. Prudential has more flexible guidelines for a number of health conditions, including MS. If you have mild, moderate, or relapsing-remitting MS, Prudential may be more likely to offer you coverage than other insurers. Prudential is also a good option for those with more flexible income requirements and various immigration statuses (visas and green cards). However, younger applicants will likely find better prices elsewhere.

American General

American General is another insurance company that views MS favourably.

Banner Life

Banner Life is also considered to view MS favourably.

MetLife

MetLife is considered to view MS favourably and will offer competitive rates for life insurance for MS patients.

Mutual of Omaha

Mutual of Omaha is considered to view MS favourably and will offer competitive rates for life insurance for MS patients.

Protective

Protective is considered to view MS favourably and will offer competitive rates for life insurance for MS patients.

Primerica Life Insurance: Changing Your Beneficiary Simplified

You may want to see also

How much does life insurance cost if you have MS?

People with multiple sclerosis (MS) can get life insurance, but it may be more expensive and require more research to find the right policy. The cost of life insurance for people with MS depends on several factors, including the type and stage of MS, age, gender, and overall health profile.

- A 40-year-old non-smoking female with mild MS could pay less than $56 for a 20-year term life insurance policy with a $500,000 payout.

- A 40-year-old non-smoking male with mild MS can expect to pay less than $72 for the same coverage.

- A 50-year-old non-smoking female with relapsing-remitting MS (RRMS) can expect to pay less than $222 for a 20-year term life insurance policy with a $500,000 payout.

- A 50-year-old non-smoking male with RRMS can expect to pay less than $300 for the same coverage.

These rates are based on specific health classifications, which are determined by factors such as age, health conditions, and family history. People with MS may fall under the Standard or Table 2 health classification, which represent average and higher-than-average rates, respectively.

When applying for life insurance, individuals with MS will need to disclose information such as frequency of symptoms, progression of the disease, current treatments, medications, and their ability to perform daily activities.

It is recommended to shop around and compare rates from different insurance companies, as some companies may offer more competitive rates for individuals with MS. Additionally, term life insurance policies may be easier to obtain and more affordable than whole life policies for people with MS.

How to Get Life Insurance for Your Relatives

You may want to see also

What are the different types of life insurance available to people with MS?

People with Multiple Sclerosis (MS) can usually get life insurance, but the options available to them will depend on the progression of their condition, their age, the age at which they were first diagnosed, and other factors. Here are some of the different types of life insurance available to people with MS:

Term Life Insurance

Term life insurance is a simple and low-cost policy that replaces the insured person's income when they die. It is typically sold in lengths of one, five, 10, 15, 20, 25, or 30 years, with coverage amounts varying depending on the policy. Most people buy term life insurance for a length of time long enough to cover their prime working years, so that if they die early, their beneficiaries can meet short-term financial needs such as paying off a mortgage or supporting children through college. Term life insurance is generally the cheapest type of life insurance and is sufficient for most people. However, if the insured person outlives the policy, their beneficiaries will not receive a payout.

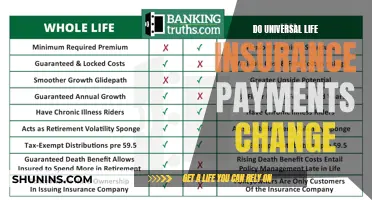

Whole Life Insurance

Whole life insurance typically lasts for the insured person's entire life, as long as they keep up with the premiums. It usually has the same premiums, a guaranteed rate of return on the policy's cash value, and a fixed death benefit amount. Whole life insurance is more expensive than term life insurance, but it is a good option for those who want a straightforward permanent policy and can afford the higher premiums.

Universal Life Insurance

Universal life insurance allows the insured person to adjust their premiums within limits and has a cash value component that grows based on market interest rates. Premiums typically increase over time, and the policyholder must either increase their premium payments or cover rising costs by subtracting from their cash value account or death benefit. Universal life insurance is less expensive than whole life insurance and can adapt to the insured person's changing needs. However, the death benefit and cash value growth are not guaranteed.

Variable Life Insurance

Variable life insurance is tied to investment accounts such as bonds and mutual funds. The premiums are typically fixed, and the death benefit is guaranteed, regardless of how the market performs. Variable life insurance offers the potential for considerable gains if the insured person's investment choices do well, but it requires them to be hands-on in managing their policy because the cash value can change daily based on the market.

Burial Insurance or Final Expense Insurance

Also known as final expense insurance, burial insurance is a small whole life insurance policy that helps the insured person's family pay for their funeral, burial, and other end-of-life expenses after their death. A medical exam is usually not required for this type of insurance, making it more accessible to seniors with pre-existing health conditions. However, coverage is capped at low amounts, typically ranging from $5,000 to $25,000. If the insured person dies within two or three years of taking out the policy, the insurer may not pay the full death benefit.

People with MS may also want to consider supplementing their life insurance policy with living benefits, which allow them to access a portion of their death benefit while they are still alive if they meet certain criteria, such as being diagnosed with a qualifying terminal illness.

Retirement Funds for Life Insurance: A Smart Move?

You may want to see also

Frequently asked questions

Yes, you must be upfront about your condition when applying for insurance. If you took out the cover knowing you had the condition but didn't disclose it, the insurer is unlikely to pay out on claims that are a result of having MS.

When applying for life insurance, you'll need to share all diagnoses, treatments, surgeries, and medications that you're currently taking. You'll also have to provide specific information about your MS, including the frequency of symptoms, progression of the disease, current treatments and how you're responding to them, any medications you're taking, and your ability to perform activities of daily living (ADLs).

It is possible to get life insurance with MS, but your chances of automatic approval are slim, and the rating class can be very unpredictable and subjective. Your coverage options and how much you pay for your policy will depend on the progression of your condition, your current age, the age you were when first diagnosed, and other factors.